Enterprise Caiying Group to provide U.S. companies / Singapore companies / Japanese companies / Thai companies / Malaysian companies / Canadian companies / Mexican companies / Brazilian companies / British companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Vietnamese companies / Indonesian companies / Dubai companies and other foreign companies registered in the relevant business and taxation services, but also to provide the Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic company registration of corporate services, company annual audit audit / bookkeeping and tax returns / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252).

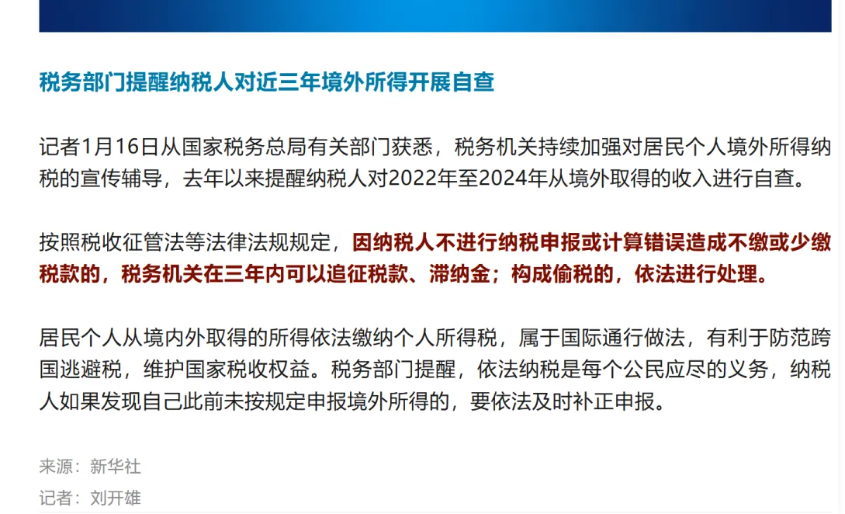

Authoritatively released by Xinhua News Agency, the General Administration of Taxation (GAT) officially launched a special reminder for foreign income.

It is reported that recently, according to media reports, the relevant departments of the State Administration of Taxation have once again made their attitude clear: the tax authorities are continuing to strengthen the publicity and counseling on the taxation of overseas income of resident individuals, and all China's tax residents are required to carry out a self-examination of their overseas income from 2022 to 2024 to make up for their reports.

This is not the first time that the State Administration of Taxation (SAT) has issued a self-examination reminder. As early as last year, the tax authorities reminded taxpayers to conduct self-examinations of their incomes obtained from abroad in the three years from 2022 to 2024, in order to guide taxpayers to fulfill their declaration obligations proactively, and to investigate and resolve potential tax-related risks accumulated due to a lack of understanding of the policy in advance.

According to the Individual Income Tax Law and its implementing regulations, individuals who have a residence in China or who do not have a residence but have resided in China for 183 days in a taxable year are required to pay individual income tax on all income derived from within and outside China in accordance with the law.

In other words, all Chinese tax residents, regardless of their status, must pay individual income tax in accordance with the law as long as they have offshore income from 2022 to 2024.

In terms of the types of overseas income that are taxable, according to the announcement issued by the Ministry of Finance and the State Administration of Taxation of the PRC in 2020, they mainly include income derived from the provision of labor services outside of the PRC, income from the transfer of overseas immovable property, income from the leasing of overseas property, and dividends and bonuses received from overseas enterprises.

It is worth noting that, in accordance with the Tax Administration Law and other relevant provisions, if the taxpayer fails to declare or miscalculation, resulting in unpaid taxes, underpayment of taxes, the tax authorities can be within three years to recover the tax, late fees; only be characterized as "tax evasion" behavior, will be dealt with in accordance with the more stringent provisions.

This clear caliber, breaking the previous market rumors circulating in the "retroactive tax back to 2017" and other false rumors, the focus of the current self-examination and rectification is clearly framed in the last three tax years.

For cross-border e-commerce practitioners, this "policy call" is of far-reaching significance.

As a core group with overseas income, the compliance declaration of sellers is not only a legal obligation, but also the basis for realizing long-term operation. Taking the initiative to sort out the overseas income of the last three years and completing the compliance declaration has become an inevitable trend in the industry.

Photo courtesy of Xinhua News Agency

If you have income from sales overseas on platforms such as Amazon, eBay, and Sizzle, or hold equity in overseas companies or receive income from offshore investments, then this is news you must pay attention to!

On January 16, the relevant departments of the State Administration of Taxation (SAT) officially issued an important reminder: tax authorities have continued to strengthen the publicity and counseling on the taxation of resident individuals' income from abroad, and since 2024, they have begun to remind taxpayers to carry out a self-examination of their income derived from abroad during the three-year period from 2022 to 2024.

This is not simply a routine reminder, but a clear policy signal!

01 How serious are the legal consequences of not filing

According to the Tax Administration Law and other laws and regulations, it is clearly stipulated that: the period of recovery: if the taxpayer fails to make a tax declaration or makes a calculation error resulting in non-payment or underpayment of tax, the tax authorities can recover the tax and late payment within three years.

Tax evasion penalties: If this constitutes tax evasion, it will be dealt with in accordance with the law, which may involve fines or even criminal liability.

Many cross-border sellers may think that "overseas income cannot be checked by tax authorities", but with the improvement of CRS (Common Reporting Standard) and international tax information exchange mechanism, your overseas account information and income data are becoming more and more transparent! Why do we need to tax offshore income?

There may be sellers who will ask: "Why should I pay tax at home when I earn money abroad?" Here we need to clarify an internationally accepted tax principle: it is a common international practice for resident individuals to pay individual income tax on income earned from inside and outside the country in accordance with the law.

The core logic is that you are a tax resident of China (usually defined as having a domicile in China, or not having a domicile but having lived in China for 183 days). China applies the principle of "global taxation", i.e. Chinese tax residents are required to file tax returns in China for all global income.

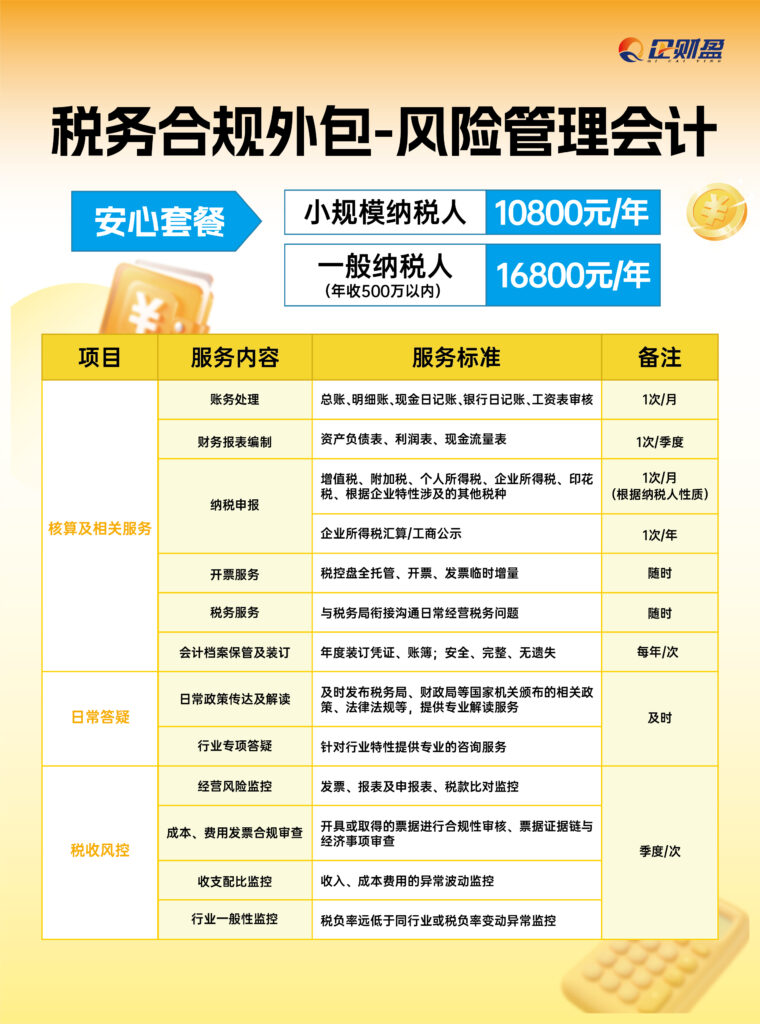

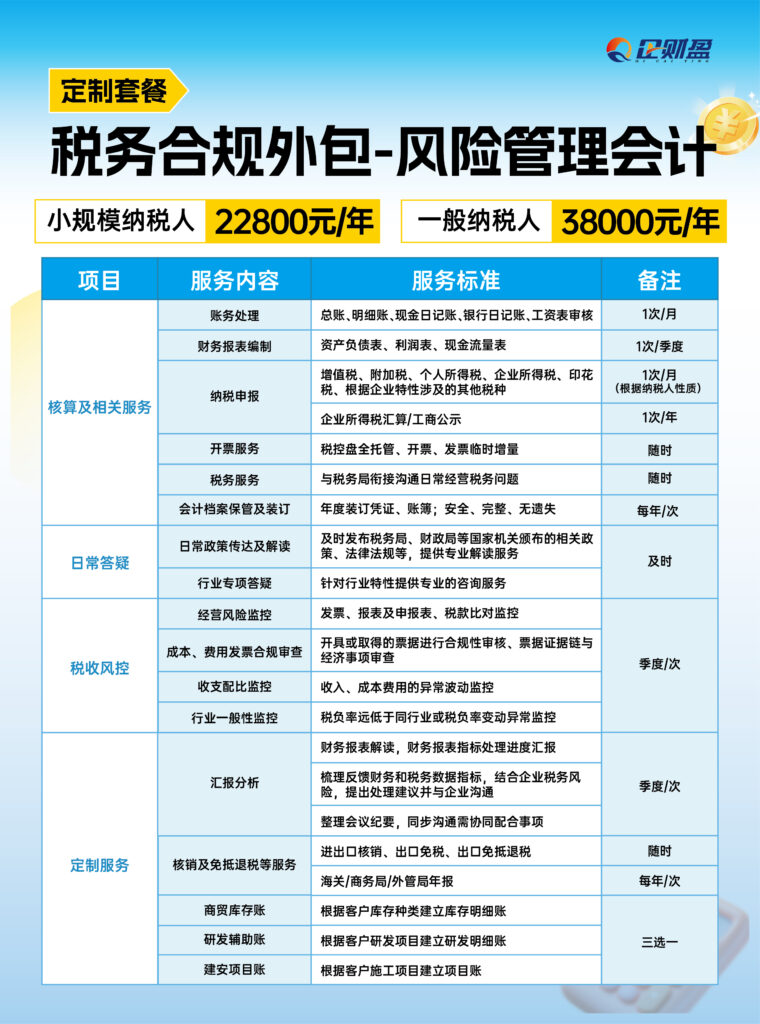

This is conducive to the prevention of cross-border tax evasion, the maintenance of national tax rights and interests, but also the embodiment of international tax fairness. If you encounter corporate tax compliance issues, you can refer to the Enterprise Caiying Group's tax compliance product package one to solve tax compliance or difficult account processing, etc., you can consult at any time (WeChat the same number: 13045886252)▼▼▼▼

02 Which cross-border sellers need special attention?

If you have any of the following, it is important to take it seriously:

✅ Open a store on overseas e-commerce platforms such as Amazon, eBay, Shopee, etc. with sales revenue.

✅ Holding equity in an overseas company and receiving dividends or gains from equity transfers.

✅ Have investment and financial management outside the country and receive interest, dividends and other investment income.

✅ Receiving remuneration for services or labor performed overseas.

✅ Holding overseas properties with rental income or sale proceeds.

✅ Having other business income outside the country.

Self-examination focus: three years of foreign income from 2022-2024 The period of self-examination for which the tax department is clearly reminding is three full years: 2022, 2023 and 2024.

The self-study includes, but is not limited to.

(1) Whether the revenue from sales on offshore e-commerce platforms is fully declared.

(2) Whether or not to declare income from dividends and equity transfers from overseas companies.

(3) Whether or not the income from foreign investments (interest, dividends, property leases, etc.) is declared.

(4) Whether remuneration for overseas labor, royalties, etc. are declared.

5) Whether the credit is correctly taken for foreign taxes paid.

If you encounter more difficult corporate tax compliance issues, you can refer to Enterprise Finance Group's Tax Compliance Product Package II to solve them, and you can consult with us at any time (WeChat same number: 13045886252)▼▼▼

03 How to correctly file a return

The tax authorities have made it clear that taxpayers who find that they have not previously declared their foreign income in accordance with the regulations should make timely corrections to their declarations in accordance with the law.

For your information, here are the proper steps to take to correct your filing:

Step 1: Sorting out offshore income

Organize all offshore revenue details for 2022-2024. Collect relevant bank flows and platform settlement documents. Prepare offshore tax paid tax clearance documents.

Step 2: Calculate the taxable amount

Calculate the amount of tax payable in accordance with the provisions of the Individual Income Tax Law. Note that the tax paid abroad can be credited (proof of tax payment is required).

It is recommended to consult a professional tax organization Enterprise Caiying Group, if you need, you can drop me at any time, phone and WeChat consulting: 13045886252, to avoid calculation errors.

Step 3: Proactive corrective declarations

You can do this through the Personal Income Tax App or the tax lobby. Select "Annual Self-Declaration of Comprehensive Income" or "Corrective Declaration". Pay back the tax and the corresponding late fee.

Step 4: Keep complete vouchers

Retain all records of filing and proof of payment. Keep relevant information for at least 5 years. Use the overseas tax credit policy well. Many cross-border sellers are worried about the problem of "double taxation". In fact, China's tax law has already taken this into consideration: taxes paid abroad can be credited!

Specific rules: Individual income tax already paid abroad can be credited against the tax payable. The credit limit is the taxable amount of the income calculated in accordance with Chinese tax law. Any amount exceeding the credit limit can be carried forward in the next five years.

For example: Suppose you earn $100,000 in income from sales on the Amazon platform in the U.S. and have paid $20,000 in taxes in the U.S.. When you return to your home country to file your return, if you calculate the taxable amount of $25,000 according to the Chinese tax law, then:

(1) Creditable foreign taxes: $20,000

(2) Actual retroactive payment also required in China: 0.5 million dollars

Now is the best processing window. From the tax department's statement, the current "reminder self-examination" stage is a window of grace for taxpayers. It is the duty of every citizen to pay taxes according to the law. Instead of worrying about being investigated, it is better to take the initiative to comply with the law, so as to give your cross-border business a solid tax foundation.

This formal reminder from the SAT is not a bad thing for the majority of cross-border sellers, but a necessary step for the industry to become standardized and professionalized. Early compliance, early peace of mind, focus on business expansion, rather than worrying about tax risks.

If you are experiencing a particularly difficult corporate tax compliance issue, you can refer to Enterprise Finance Group's Tax Compliance Product Package III for a solution.

If your company is in need of tax compliance or more difficult accounts processing, etc., you can always consult (WeChat with number: 13045886252)▼▼▼

04 Cross-Border Tax Compliance: 2026 Survival Guide for Cross-Border Sellers

1) Supply chain reshaping: from price-oriented to tax-health-oriented

The financial director of a cross-border apparel company in Guangzhou has made a calculation: if you only consider the purchase unit price and ignore the tax compliance of the supplier, you may not be able to obtain a compliant input invoice and pay more VAT, and the actual cost will be higher by 3-5 percentage points.

After 2026, supplier selection criteria will have to be weighted towards "tax compliance". Sellers are advised to initiate supplier screening immediately to ensure that all purchases can be invoiced with VAT compliance.

2) Pricing strategy adjustment: tax costs must be internalized

Hangzhou, a home furnishing category hypermarket has adjusted its pricing model in advance: "We have fully internalized the cost of VAT into our product pricing, which may affect competitiveness in the short term, but avoids tax risks in the long term."

With the new law in place, price wars will have to consider tax compliance costs. Business models that appear to be low-priced but fail to provide tax compliance credentials will be unsustainable.

3) Overseas warehouse tax treatment needs to be clarified to avoid double taxation

Mr. W, a seller on the European site, shared his experience, "We have re-planned our logistic path to ensure that the tax treatment in each step meets the requirements of the new law. Especially the movement of goods in overseas warehouses now requires clearer documentation on tax handling."

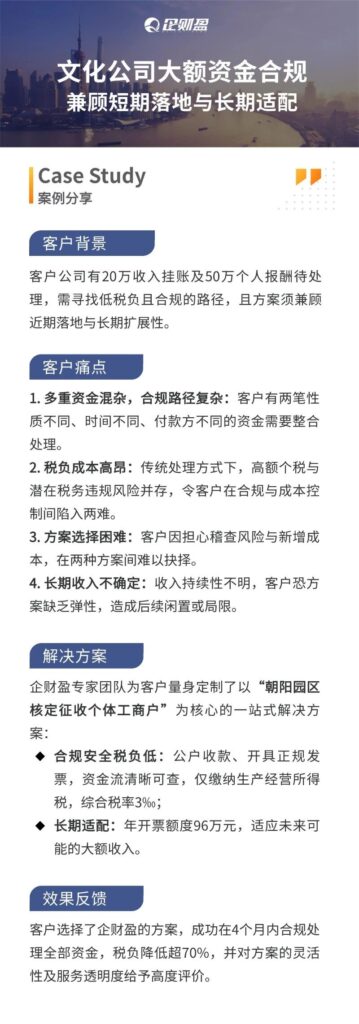

There is also a children's clothing e-commerce enterprise that moved to Guangzhou from a mainland city, which is a real customer case of our Enterprise Caiying, selling through Amazon and TIKTOK platforms, with an annual turnover in the order of ten million dollars.

Although the enterprise is profitable, there are hidden problems in fiscal compliance for a long time - the store operates as a domestic individual household, borrowing the name of another person to register, and it is difficult for the actual operator to dock the tax verification, while there is a large number of lack of cost tickets in the business, and the tax risk is increasingly prominent.

Despite the busy business and cross-regional operations, the core decision makers of the enterprise have a clear understanding of compliance and tax security.

They are eager to systematically avoid risks and control the tax burden, and look forward to a professional and efficient team to help cope with all kinds of unexpected financial and tax problems, so they find us to cooperate with Enterprise Caiying.

This cooperation not only solves the momentary needs, but also reflects the deeper needs of cross-border e-commerce enterprises for professional financial and tax accompaniment in the new economic environment - what they need is not only the program, but also the reliable experts and the support that can be landed, which is exactly the value of the service that we, Enterprise Caiyin Group, continue to build.

If you plan to register a U.S. company/Singapore company/Japanese company/Thailand company/Malaysia company/Canada company/Mexico company/Brazil company/Britain company/France company/New Zealand company/Japanese company/Singapore company/Vietnamese company/Indonesia company/Dubai company and other foreign companies registered in the relevant business and financial services, or plan to register a Hong Kong company/Shenzhen company/ Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓ ↓

05 The compliance dilemma: where are the profits after regulation?

These three pain points stack up to create a harsh reality:Once tax compliance is strictly enforced, many e-commerce companies will have to pay high taxes on the portion of their profits that is "not their true profit".

Let's take an e-commerce company with a pure store model as an example of a short account:

Assume that its merchandise gross margin is only 15% (which is not uncommon in competitive platform e-commerce).

- value-added tax (VAT): At the rate of 13%, if there is a significant shortfall in input votes, VAT will be payable on almost 13% of sales.

- surplus after tax: 15% of gross profit, after deducting 13% of VAT, leaves only 2%.

- corporate income taxThe "gross profit" of $2% has to be deducted from operating expenses (of which a large number of non-billable expenses and over-limit advertising costs are not deductible), and the final book profit may be minimal or even negative, but after tax adjustments, the taxable income may still be very high.

Therefore, e-commerce tax compliance is not as simple as simply making the accounts "beautiful" and importing the water into the bookkeeping software. Rough "standardization" may lead to an embarrassing end: the account is standardized, but the company has lost its ability to survive due to excessive tax burden.

This is particularly fatal for owners of store clusters where margins are already thin and turnover is based on scale.

Corporate High Risks and Response Strategies

1) Three major high-risks (e-commerce / anchor focus on vigilance)

| Type of risk | group of people | Risk consequences |

| split operation | Multi-store enterprise | Consolidated Tax Trigger Exceeded, Back Tax at 13% |

| Replacement of business entities | Cross-border e-commerce, anchor | Tax and penalty costs spike when historical data is combined and exceeded |

| Concealment and misreporting of income | Ticketless income-based e-commerce/anchor | After being audited by Big Data, rehydrated at 13% + fines |

typical exampleAn e-commerce company's sales in April 2026 had exceeded 5 million, but because of the delay in pushing data from the platform (on a quarterly basis), the overrun was only discovered in July: it was necessary to correct the VAT declaration for April-June and pay three months of additional tax at 13% instead of the original small-sized 1%, and the profit margins were seriously compressed.

2) Corporate Response StrategiesCore Portfolio:Internal finance team (focusing on internal bookkeeping) + external year-round tax consultant (professional guidance, regular compliance checks, training for finance staff).Necessity:Under the escalation of levy, it is difficult for a single in-house finance team to cover the full dimensions of compliance needs, and external consultants can make up for the shortcomings of specialization, which is the most economical compliance solution.

06 Breakthrough Ideas: Finding a Balance Between Compliance and Survival

Since tax-related information reporting is a major trend and the road to compliance must be traveled, the key is:How do you find a solution that meets regulatory requirements while allowing e-commerce businesses to pay taxes and retain profits?

This requires planning and optimization at an integrated level of business model, tax structure and financial management:

1)Business Re-engineering and Supply Chain Sorting::

Revisit the upstream supply chain to find a new balance between price and compliance. Gradually replace key suppliers with partners who can provide compliant tickets, even if the cost of purchasing goes up slightly, but obtaining deductible input tickets can recover from the overall tax burden.

2) Main design and tax planning::

According to the segmentation of business segments (e.g. cross-border platforms, store groups, live streaming with goods, offline sourcing, etc.), rationally utilize the tax policies of different market players (e.g. preferential policies for small and micro enterprises, individual businessmen and women), and carry out a conglomerate or matrix layout. For segments with high non-invoiced expenses such as Darren Carrying Goods, explore modes such as settlement through compliant platforms to convert labor remuneration into purchasing costs that can be invoiced.

3) Accurate accounting and account management::

Establish a financial accounting system that is highly compatible with the e-commerce business. Especially for the characteristic items such as return, promotion fee, platform fee, etc., carry out refined account processing and tax preparation to ensure the data is accurate and avoid overpayment of unjust tax.

4) Policy Research and Compliance Innovation::

Pay close attention to and study tax policies and local financial support policies for new businesses such as e-commerce and live broadcasting. Under the premise of legal compliance, make good use of various tax incentives and approved levies and other tools.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business tax services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / French company / New Zealand company / Japanese company / / Singapore company / Thai company / Vietnamese company / Malaysian company, and other foreign companies Company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop services, etc. can be found in the enterprise CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant with you in detail! Communication ↓↓↓

07 A real case of tax compliance for the Enterprise Finance Group

08 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Guide

- Corporate Tax Compliance

- tax planning

- Tax Compliance Optimization

- Tax Compliance

- tax inspection