U.S. company registration full strategy: from the selection of state strategy, bank account opening to tax compliance, cross-border enterprises must see to avoid the pit guide!

The latest data from the U.S. Department of Commerce shows that the number of new business registrations across the U.S. in the first half of 2025 exceeded2.8 million homes, up 121 TP3T year-over-year, a record high. Among them, the number of Chinese companies setting up subsidiaries or offshore companies in the U.S. increased from the same period in 202435%(math.) genusCross-border e-commerce, technology research and development and brands going overseas have become the three main tracks.

Relying on the world's largest consumer market, sound legal system, diversified financing channels and business rules in line with the world, the U.S. has become a core destination for Chinese enterprises to go overseas for layout and brand upgrading. From U.S. company registration and bank account opening to later tax compliance and cross-border flow of funds, there are clear procedures and compliance requirements for each step. In this article, we have compiled the latest full-process practical points in 2026 to help you take the wrong path!

If you have a U.S. company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance and other needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

01.Advantages of a U.S. Company

First, the market advantage: direct hit 330 million consumer groups, radiation global market

- The world's largest consumer marketThe United States, with a per capita GDP of more than $70,000 and total retail sales of consumer goods exceeding $7 trillion (source: U.S. Department of Commerce), is a core target market for cross-border e-commerce and manufacturing enterprises. For example, a 3C brand in Shenzhen, by registering a U.S. company and directly laying out the local market, annual sales increased from 200 million yuan to 800 million yuan, with a profit margin of 18%.

- Brand Globalization SpringboardU.S. brands are highly recognized globally, and registration of a U.S. company provides quick access to the local distribution system.Into Amazon, Walmartand other mainstream e-commerce platforms, while enhancing the brand's international credibility and helping to develop markets in Europe and the rest of the Americas.

Second, tax advantages: multi-state policy differentiation, rational planning tax burden

- Dual Federal + State Tax System, Flexibility to choose state tax savingsThe federal corporate income tax rate is 21% (fixed rate), and state taxes vary from state to state: Delaware has no sales tax and no personal property tax, which is suitable for holding companies; Nevada is exempt from corporate and personal income tax, which is suitable for brick-and-mortar businesses; and California has a higher tax rate, but has a strong market radiance, which is suitable for businesses that need to be deeply rooted in the local area.

- Abundant tax incentivesR&D companies are eligible for R&D expense credits (up to 10% of federal tax); exporting companies can avoid some cross-border tariffs by re-exporting through a U.S. company; and some states offer job incentives for newly registered businesses and tax rebates for job creation.

Legal and Financing Advantages: Compliance Guarantee + Diversified Financing

- sound legal systemThe U.S. has a common law system with strong enforcement of commercial contracts, double tax agreements with more than 60 countries around the world, and investment disputes can be efficiently resolved through international arbitration.

- Diversified Financing ChannelsThe U.S. has the most developed capital market in the world, and registered U.S. companies can directly connect to NASDAQ, NYSE and other listing platforms, as well as conveniently obtain financing support from Silicon Valley venture capitalists, bank loans and other financing support, with financing costs 2-3% lower than those on the mainland.

Fourth, capital and operational advantages: free flow + flexible management

- Freedom of funds in and out of the country, no foreign exchange controlThe U.S. has no foreign exchange control policy, the U.S. dollar as the global reserve currency, the funds are convenient for cross-border transfers, the enterprise can freely exchange multi-currency to avoid the risk of exchange rate fluctuations, especially suitable for frequent cross-border receipts and payments of foreign trade enterprises.

- Flexible registration and operationSimple registration process, no field office (can provide dependent address), no statelessness restrictions on shareholders and directors, no paid-in registered capital; later maintenance costs are controllable, and the annual review process is simple in some states, suitable for start-ups and small and medium-sized enterprises.

If you have a U.S. company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance and other needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

02.U.S. company registration core: state selection + information process

2026 U.S. company registration has realized the whole process of electronic, without the need to come to the United States, the fastest registration can be completed in 3 working days, the efficiency of registration in different states varies slightly (such as Delaware, Nevada electronic registration through the rate of 98%)

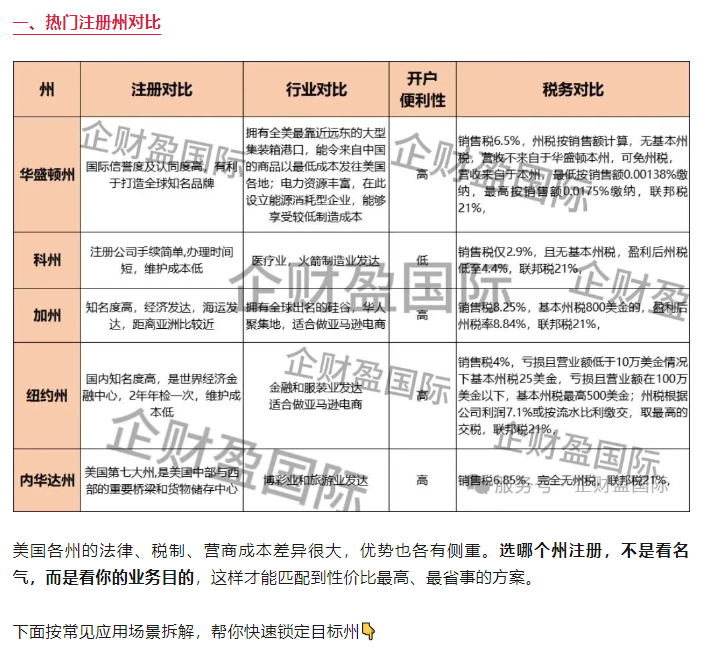

The laws, tax systems, and cost of doing business vary greatly from state to state in the U.S., and each state has its own advantages.Choosing which state to register in is not about name recognition, it's about the purpose of your business, so as to match the most cost-effective and hassle-free program.

Here's a breakdown by common application scenarios to help you quickly target states 👇

1️⃣ For Packaging US Brands - Low Cost International Image Enhancement

If your intention is only toIncorporate a U.S. company to enhance brand image and publicityIf it is not about opening a local account in the U.S., actually doing business, or optimizing the tax burden, then the cost of registration and ease of maintenance are the primary considerations.

Proposed Program: Colorado (Colorado) Inc.

- ✅ Low registration fees - the total processing price is even cheaper than a round-trip airfare to the United States;

- ✅ Fast registration - 5-7 working days to get your license;

- ✅ Simple maintenance - no complicated annual audit requirements, suitable for "shell company" style brand packaging;

📌 Suitable for: cross-border e-commerce sellers, foreign trade companies, entrepreneurs who need to show the identity of "U.S. companies" in overseas exhibitions or official websites.

.

2️⃣ Doing e-commerce platforms like Amazon - compliant operations + tax advantages

Doing cross-border e-commerce like Amazon and Walmart will involveU.S. Tax Returnsand applicationsEIN Federal Tax Identification NumberThe EIN must be applied for through a U.S. company, so a U.S. company must be registered for formal operation.

Proposed Program: Delaware (Delaware) Corporation

- ✅ sales tax exemption--More friendly to e-commerce sellers' cash flow;

- ✅ Entrepreneurial friendly policies - Mature legal system and efficient court handling of commercial disputes;

- ✅ High visibility - familiar to global investors for subsequent financing or brand endorsement;

📌 Suitable for: cross-border e-commerce, B2C platform sellers, companies planning to expand offline channels in the U.S. in the future.

.

3️⃣ Starting a business in the US, on the ground - combined cost and resource optimization solutions

If you are going to operate in the U.S. on the ground, you have to consider bothCustomer convenience, staff recruitment, tax cost, bank account opening and later tax preparationand other factors, the advantages vary significantly from state to state.

① Employment and staffing priority → California Corporation (California)

- ✅ Low language and cultural communication barriers in the state with the largest Chinese population in the United States;

- ✅ The closest straight-line distance from China, with easy access to and from the city;

- ✅ Sufficient talent pool and low recruitment difficulty;

📌 For: Organizations that require a lot of Chinese and American team synergy and value local employee services.

② Cost preference for bookkeeping and tax preparation → Washington State Corporation (Washington)

- ✅ No state income tax--Significantly reduce business operating costs;

- ✅ Stable business environment for long-term holding and operation;

📌 For: Technology or trading companies that focus on after-tax profits and plan to grow in the U.S. over the long term.

③ Company reputation and financial resources are preferred → New York State Corporation (New York)

- ✅ High brand recognition as a financial center in the United States and globally;

- ✅ Well-established commercial package with easy access to banks, investors and high-end clients;

- ✅ Biennialization--Save half the cost of an annual audit compared to most states' annual audits;

📌 For: Financial, consulting, and high-end service industries, as well as companies looking to leverage New York's prestige to expand internationally.

💡 Tip.: U.S. company registration may seem like just picking a state, but behind the scenes it'sBusiness model, team layout, tax planningof comprehensive decision making. It is advisable to define your core needs and then match them with the right state in order to save both money and hassle!

If you have a U.S. company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance and other needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

Second, the United States company registration information process

- Determine the area of incorporation of the U.S. company;

- Provide the full English name of the company;Ends in INC, LTD, LLC, LLP, etc.

- Determination of shareholders and directors

- Scope of Operation:Most U.S. company profiles do not reflect the scope of business

- registered capital: Customizable as appropriate

Delaware, Nevada registered capital standard shares of 5,000 shares, each share 15USD, the total registered capital does not exceed 75,000 U.S. dollars, such asFranchise tax is payable in excess of standard shares

Delaware has a franchise tax, a minimum of $175 per year that needs to be paid along with the annual inspection, and the exact amount of the franchise tax is related to the registered shares and registered capital.

Delaware Franchise Tax Algorithm:

Under 5,000 shares and under $150,000, $175 in franchise tax

5,000-10,000 shares and less than $150,000, $250 in franchise tax

For each additional 10,000 shares and up to 10,000 shares over 10,000 shares, an additional tax of $75 will be applied, up to a maximum of $180,000.

Franchise Tax Tax Submission:Annual inspection to the state registry, but if the registered capital is more than $150,000, you also need to pay additional taxes when registering.

Nevada registered capital cannot exceed75000US dollarThe number of shares cannot exceed 75,000 or there is a tax on registration and annual audits, payable to the state registrar, similar to the Delaware franchise tax.

The number of registered shares or capital exceeds the outgoing tax submission:Registration and annual inspections are due to the state registrar's office.

If you need to apply in the U.S.L1For visas, the registered capital needs to be physically present, with a minimum requirement of15WUS dollar

.

03.U.S. Corporate Bank Account Opening

I. United States Bank of America

Most U.S. companies choose to open an account with the U.S. Bank of East West, because the account is faster.

U.S. Wal-Mart Bank's Public Account Advantage:

● Access to mainstream U.S. banks::East West Bank is one of the few U.S.-listed banks that supports remote video account opening for Chinese beneficial owners, and is protected by the FDIC for high credibility and stable access.

● account opening thresholdlower (one's head)::There is no need to travel to the U.S. in person, the entire process is online, efficient and convenient.

● Free flow of funds::The Huamei account supports unlimited transfers (you can apply to upgrade your internet banking privileges) and is suitable for large cross-border transactions.

● costThe advantages are obvious::Enrollment Fee: 0$, Minimum Account Balance: $500, Daily Transfer Limit: No Limit (Internet Banking Limit can be applied according to individual circumstances)

U.S. Wal-Mart Bank Open AccountRequired information:

:: Company registration documents + tax identification number

:: Personal documents of directors and shareholders (ID card + passport)

:: KYC completion

:: (If available) Photographs of associated company licenses + 1-2 business contracts of associated companies

:: The account opening company may not provide a business contract if an affiliate business contract is provided

● If there is no affiliated company, provide the contract of intent of the account opening company (overseas) + the legal person's last 3 months of water flow.

:: KYC template provided by our company

.

Second, the United States Hopewell Bank ✅ United States Hopewell Bank account opening advantages:

⭕ Account opening 0 checking fee ⭕ Support ZELLE+ACH function ⭕ Remote video witnessing! ⭕ Support cross-border e-commerce! Many cross-border e-commerce bosses, under the name of the company is not affiliated If the cross-border e-commerce industry of the U.S. company to open an account No affiliated companies can also open, just need to provide store links + shareholders personal water The shortcomings of U.S. Hopscotch, like those of JPMorgan Chase, are twofold: 1, only accept the U.S. company's account, not accept Hong Kong companies, Singapore companies and other non-U.S. companies account opening requirements; 2, the account default is the U.S. dollar single-currency, not Hong Kong banks, Singapore banks as multi-currency. However, the U.S. banks are more "noble", basically single-currency U.S. dollars, Hua Mei, JPMorgan is also so.

U.S. Hershey Bank opens its accounts to the publicRequired information:

:: U.S. Company Incorporation Package + EIN

- ID + Passport

- Fill in the account opening KYC form documents

- Affiliated company license photo + last 3 months water flow (if any)

- If unaffiliated provide links to the account company's website or e-commerce store (1-2 business contracts for the account company)

Account opening cycle: company registration is completed → submit information → video witnessing → account opening:About 4 weeks or so

Fees associated with the United States Hopitality Bank account:

- Monthly management fee:$0

- Internet Banking Wire Transfer Monthly Service Fee: $29

- International Wire Transfer: Outgoing Charge: $32; Incoming Charge: $16

- Inward wire transfer: Outward fee: $16; Inward fee: $16

- Zelle Transfer Limit: Daily Limit: $1500 / $3000; Monthly Limit: $15,000

- Account Transfer Limit: Daily Transfer Limit / Monthly Limit Unlimited

- Check Deposit: Support

If you have a U.S. company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance and other needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

04.U.S. Corporate Tax Returns

Once a U.S. corporation is formed, it is not "one and done," but needs to beCompleting annual audits and tax returns on time, or face the risk of fines, account freezes or even forced write-offs by the government. Many cross-border enterprises neglect maintenance at the initial stage, and as a result, they get stuck when financing or expanding their business, and the loss far exceeds the cost of maintenance

I. Annual Review of U.S. Companies - Key Actions to Maintain Legal Existence

The annual audit is equivalent to the annual business inspection in China, the purpose of which is to update the basic information of the company to the state government and pay the annual Franchise Tax.

⚠️ take note of::

- Annual audits ≠ tax returns, both of which are separate obligations and must be completed separately;

- Annual audit late fines accrue on a daily basis, with some states (e.g. California) penalizing $250 for 1 month late, and up to $2,000+ for 3 months;

- Failure to have an annual audit for a number of years in a row will result in the company being flagged as aInactive/DissolvedThe bank account and the validity of the contract are affected.

2. Operational points of the annual review

- Update the company's registered address and director/shareholder information (if there is any change);

- Payment of franchise tax for the year;

- Engage a registered agent to file an Annual Report with the state;

- Retain annual review receipts for checking bank or investor due diligence

.

Second, the United States company tax declaration - federal + state double obligations

The U.S. tax system isFederal + state taxes in parallelThe tables and deadlines are different for different types of companies and sources of income.

Key reminders::

- Even if the company is not operating in the current year, it is required to file a"Zero return" tax form, otherwise the IRS will consider it to be non-compliant;

- U.S. corporations with foreign shareholders or foreign holdings are also required to submitForm 5472(Disclosure of Shareholder Information and Connected Transactions), with a fine for omission as high as $25,000 per occurrence.

2. State tax returns

- States with state income tax(e.g., CA 8.84%, NY 6.5%): a separate state corporate income tax return is required;

- States with no state income tax(e.g., Texas, Florida, Washington, Nevada): only state sales tax (if there is a retail business) or other specialized taxes need to be reported;

- Note to e-commerce platforms: some states requireSales Tax Licenseand file sales tax returns on a monthly/quarterly basis.

3. Attention to non-operating company declarations

Many cross-border business owners mistakenly believe that "if you don't operate in the U.S., you don't have to file a tax return," which is a misconception:

- No operating LLCs still need to be submittedFederal Individual Tax Form + Schedule C Zero Filing.;

- C-Corp has no operations to submitForm 1120 Zero Declaration.;

- Having a bank flow but not filing a tax return is highly likely to trigger an IRS audit.

.

Third, common pitfalls and mine guide

- Confusing the timing of annual audits and tax returns → Suggested a dual calendar reminder with annual audits based on state notification and tax returns based on IRS fiscal year end;

- Ignore Form 5472 → mandatory reporting for foreign holding companies, omission = high fines;

- Filing Taxes with an Individual SSN Instead of an EIN → If found, it may be recognized as illegal employment or tax evasion;

- Operating across state lines without a state tax ID number → May be subject to sales tax recovery + penalties in the state in which they operate;

- Zero declaration of bank accounts for long periods of time → Banks will suspect money laundering risks and may freeze accounts

.

Fourth, our hosting services - so that maintenance saves compliance

🔥 "AFSL Compliance Manager Annual PackageDesigned for cross-border businesses:

✅ Annual Audit Chargé d'affaires: File your Annual Report + pay your taxes on time according to state policy to eliminate late penalties;

✅ All-inclusive tax filing: Federal + state tax form filing, Form 5472 compliance disclosures, zero return processing;

✅ Quarterly combing of accounts: Automatically generate income statement/balance sheet to detect tax risks in advance;

✅ Bank statement monitoring: Alerts on unusual transactions to avoid account windfalls.

💰 Average daily cost ≈ ¥ 15, much lower than a full-time accountant or a local US firm's quote, allowing you to focus on your business and stay out of the compliance minefield!

If you have a U.S. company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance and other needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

- U.S. Company Registration Process

- external trade

- U.S. Company Registration

- cross-border e-commerce