According to Invest Hong Kong, the number of start-ups in Hong Kong will reach 4,694 in 2024, an increase of 10% from 2023. The total number of employees of these start-ups will be close to 18,000 in 2024, representing a year-on-year increase of 7%, which is an all-time high in terms of both the number of start-ups and the number of employees.

And Hong Kong's business vitality continues to climb in 2025, the latest official figures show.By the end of September 2025, the total number of registered local companies in Hong Kong had reached 1,519,103, an increase of nearly 58,600 from the end of 2024, another record high.This series of figures fully confirms the strong attraction of Hong Kong's excellent business environment to global enterprises.

What is more noteworthy is that Hong Kong has continued to consolidate its advantages in doing business in 2025. Not only has Hong Kong been crowned the world's freest economy for the second consecutive year, it has also launched a number of policies to optimize the business environment during the year, includingThe Companies (Amendment) Ordinance 2025, which came into effect in April, promotes paperless corporate communications, and the company relocation system, which was introduced in May, provides non-Hong Kong corporations with a convenient way to relocate their companies.

Relying on the advantages of liberal foreign exchange control, comprehensive financial system, favorable tax policies and a system that is globally compatible, Hong Kong has become a core hub for enterprises to expand their international business. From registering a Hong Kong company, opening a public account, to subsequent compliance maintenance, each step has a clear process and compliance requirements. This article organizes the whole process of practical points to help you take the road less traveled.

.

.

01 Hong Kong's Irreplaceable Advantage in Going to Sea

I. Doing business: the world's top three free economies

1. "Zero tariff" policy dividend

Hong Kong has no tariffs on imported and exported goods (except for a very few commodities such as tobacco and alcohol), and enterprises save an average of 8-15% in cross-border costs (Source: Hong Kong Customs and Excise Department)

For example, a 3C enterprise in Shenzhen exported through Hong Kong transit, logistics costs reduced 22%.

For specifics on Hong Kong companies doing re-export trade you can read this article:

2. Efficient customs clearance system

The port is the second most efficient in the world (World Bank's Logistics Performance Index), with an average cargo clearance time of only 1.5 hours, 40% faster than Singapore.I. Doing business: the world's top three free economies

.

.

Second, tax advantages: fewer taxes, lower tax rates

1. Corporate income tax rate of only 8.25% (Mainland 25%, Singapore 17%)

Hong Kong applies the territorial source principle of taxation, which means that only profits derived from Hong Kong are subject to profits tax. Currently, the profits tax rate is 8.251 TP3T (for the first HK$2 million of profits) and 16.51 TP3T (for the portion exceeding HK$2 million). In addition, if a Hong Kong company does not conduct substantial local business activities in Hong Kong, it may have the opportunity to apply for an offshore tax exemption to further reduce its tax liability. For exampleAn enterprise with an annual profit of HK$50 million pays about HK$8 million less in tax in Hong Kong than in the Mainland.

2. Zero VAT/excise tax

Cross-border fund dispatching, cargo transit without VAT, avoiding the risk of European 20% + VAT rate

.

III. International network: 1-hour coverage of a market of 3 billion people

1. Radiating power of geographic location

Covering major economies in Asia-Pacific (Japan, Korea, Southeast Asia, Australia) within 4 hours' flight, a Hong Kong-incorporated company can quickly enter the RCEP regional market.

2. Global financial hub status

- Hong Kong is home to more than 1,000 regional headquarters of multinational organizations and has the largest number of foreign banks in Asia.

- Enterprises' financing costs through Hong Kong are 1.5-2 percentage points lower than those in the Mainland (HKMA 2023)

.

IV. Legal safeguards: common law system to escort maritime security

1. High international recognition

Hong Kong has signed double taxation agreements with 42 jurisdictions around the world, and international arbitration rules apply to investment disputes.

Case: A new energy enterprise had a contract dispute with a European customer and recovered the payment through the Hong Kong International Arbitration Center (HKIAC), which took only 1/3 of the time in the Mainland.

2. Intellectual Property Protection

Hong Kong is the first in the world to implement the "original grant patent" system, whereby international patent applications can be granted in as fast as 6 months (50% shorter than that of the Mainland).

.

V. Freedom of funds in and out of the country, not subject to foreign exchange controls

In Hong Kong, funds are free to enter and exit the territory without foreign exchange control, and various currencies can be freely exchanged and mobilized. This is undoubtedly a great convenience for overseas enterprises that need to frequently receive and pay across the border. The bank account of a Hong Kong company can easily handle international transactions, accelerate capital turnover and reduce exchange rate risks.

.

Low cost of establishment and operation

Hong Kong company registration process is simple and fast, free to take the name, no capital verification, relatively low maintenance costs, and only need to declare tax once a year. This undoubtedly lowers the threshold for the pursuit of efficient, low-cost operation of small foreign trade enterprises or start-up companies.

.

VII. Market positioning for brand image

Due to its international reputation and mature business environment, a Hong Kong company can often bring a higher degree of trust to customers, especially when dealing with overseas customers, the international image of a Hong Kong company can add points to the enterprise, which is conducive to the development of the international market and enhance the competitiveness of mainland companies

Hong Kong company registration, annual audit, audit, accounting and tax, Hong Kong identity application, Hong Kong identity renewal, e-commerce tax compliance, difficult to cancel, qualification licenses and other issues have questions Sweeping code to add our online customer service (cell phone WeChat the same number: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

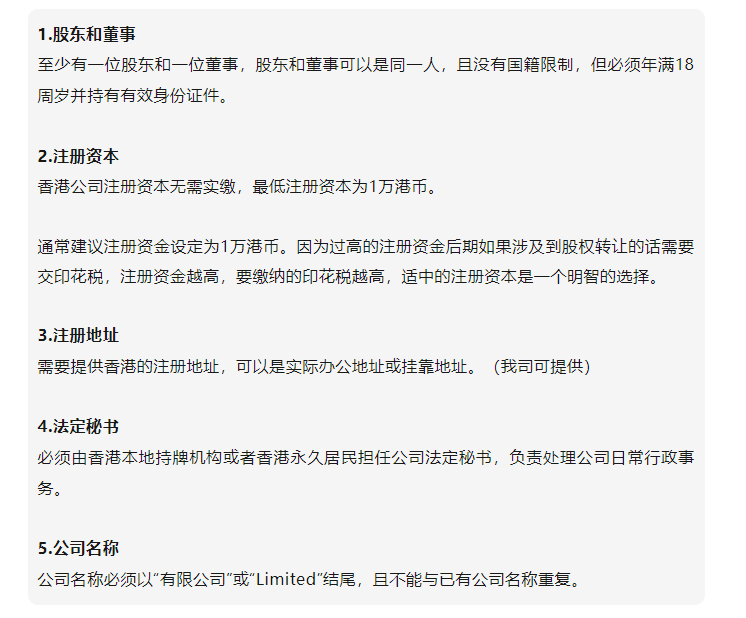

02 Information flow of registering a Hong Kong company

2025 Hong Kong company registration has been fully electronic, the whole process can be handled online, no need to come to Hong Kong, the fastest 1 working day out of the preliminary results of the audit, 7 days to complete the whole process to get a full set of documents.

According to the Hong Kong Companies Registry, new company registrations have grown significantly since 2025, with a total of 151,226 new local companies formed in the first three quarters alone.An average of 629 new rooms per day.The percentage of registration applications submitted electronically reaches 72%, and the processing efficiency is greatly improved

Note: Hong Kong company business industry is not restricted, but for some special industries still need a franchise license, the following industries need qualification:.

(1) travel agencies: Hong Kong tourism industry developed tourism companies, it is necessary to apply for a license.

(2) financial category: like BANK, funds, securities, insurance have to go to the Hong Kong Monetary Authority to apply for a license, each application corresponds to a different management department.

(3) Education: Those who wish to develop education business in Hong Kong need to apply for relevant licenses and permits.

(4) Catering industry: If you want to engage in the food industry in Hong Kong, you must go to the Food and Environmental Hygiene Department to apply for a license, and obtain a catering license before you can operate

Hong Kong company registration, annual audit, audit, accounting and tax, Hong Kong identity application, Hong Kong identity renewal, e-commerce tax compliance, difficult to cancel, qualification licenses and other issues have questions Sweeping code to add our online customer service (cell phone WeChat the same number: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

03 Hong Kong company registration after the bank account how to choose

With more and more of your company's business flow, trade transactions more frequently, when the bank account flow of a large amount of money or money is not clear, the bank will require you to provide a series of customs declaration documents, contracts and business description, such as the provision of untimely or unclear explanations, or to receive sensitive countries may lead to the closure of the account. Therefore, we recommend that you open a Hong Kong bank for backup.

In Hong Kong, a company can open multiple bank accounts with no limit on the number.

There are several options for opening a Hong Kong company account:

1、With a mainland company + Hong Kong company

There are more options available in this case because the existence of a mainland company and proof of assets indicates that the director-shareholder is more secure in terms of the company's operating funds, and it also indicates that the director-shareholder has more experience in the field.

Can open Hong Kong local bank accounts, such as Hong Kong HSBC, Standard Chartered, Citibank, Hang Seng, East Asia, Daxin, etc., are required to Hong Kong companies have affiliates, but there is no affiliate, there are a number of banks can be opened, depending on what banks, when their Hong Kong company is registered, which qualifications, the better the qualification, the simpler it will be.

Newly registered Hong Kong companies and those with associated companies for more than one year, direct charge to HSBC

.

There are generally two ways to open a Hong Kong HSBC public account:

1. Inside ground signing open HSBC 1+1

Hong Kong company to open Hong Kong HSBC public account + domestic affiliates to open mainland HSBC general account

The account holder or the company's directors and shareholders do not have to come to Hong Kong in person to open an account, they can choose HSBC's branches in the Mainland for video witnessing, for customers who do not have the convenience of crossing the border in Hong Kong.

Witness account opening points: Shenzhen, Guangzhou, Shanghai, Beijing branch witnessing

2. Visiting Hong Kong in person for a visa interview

.

2、No mainland company, but a Hong Kong company

Here again, there are two scenarios.

1. Hong Kong company has been operating for quite a long time

In this case, it is also possible to open a local bank account in Hong Kong, for example, the Bank of East Asia in Hong Kong, Hong Kong Hang Seng Bank, this is suitable for foreign trade enterprises, e-commerce industry and other companies

2. Hong Kong company has just been established for a short period of time

In this case the choice is much less, but there is also a choice, physical banks can consider the Bank of East Asia, Hong Kong, Hong Kong Hang Seng Bank, Hong Kong Construction Bank, etc., you can also consider digital banks; let's say: panpay panpay bank, rich Hong Kong CBI bank.

That's about it, it's just a matter of what you choose for yourself. Different choices have their own good and bad points.

.

Hong Kong Company Account Opening Information (Generic Version)

Opening a Hong Kong local bank's correspondent account will generally require matching relevant domestic/foreign trade evidence, for example:

1. Information of associated domestic/foreign companies (business license, sales and purchase contracts, bank flows, VAT invoices, etc.);

2. Auxiliary evidence: domestic/foreign company websites, store photos, directors' personal water flow in the last three months, etc;

3. Other information: e.g. running water of Hong Kong accounts that have been closed, evidence of trade, etc.

* Specific account opening requirements and fees can contact us to give you a program. Different Hong Kong bank account opening process may vary in detail, specific can be private letter ~ provide free advice ~ picture

Hong Kong company registration, annual audit, audit, accounting and tax, Hong Kong identity application, Hong Kong identity renewal, e-commerce tax compliance, difficult to cancel, qualification licenses and other issues have questions Sweeping code to add our online customer service (cell phone WeChat the same number: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

.04 Post-registration maintenance of Hong Kong companies

I. Annual Audit of Hong Kong Companies

The annual audit of a Hong Kong company is similar to the annual industrial and commercial inspection of a mainland company, which is conducted once a year.

When a Hong Kong company reaches the anniversary of its incorporation, it is required to undergo an annual audit, which is divided into two parts:

①Annual Return

②Business Registration Certificate

NAR1 Annual Return

It needs to be completed within 42 days after the anniversary date of incorporation. Every year thereafter, it is necessary to report the latest information of the company to the Hong Kong Companies Registry and submit a new Annual Return (NAR1), which includes basic company registration information such as directors and shareholders, legal secretary, address, etc., and to renew the Certificate of Incorporation (CI).

BR Business Registration Certificate

You need to renew the Business Registration Certificate within one month after its expiry. Hong Kong company's business registration certificate is normally valid for one year, so once a year, you need to get a new business registration certificate within the specified time, and pay the registration fee, and the registration certificate is also one of the necessary documents for tax payment, tax saving and tax exemption.

Note: There are two parts to the annual audit: the annual return + the business registration certificate. You can't just do one part of it, both parts have to be done for a complete annual audit. If you only do one part, you will face a fine in the second year of the annual audit.

.

Second, the Hong Kong company to do the audit of the accounts and tax returns

A Hong Kong company audit is a review of the company's financial situation in the previous year, in which an independent licensed accountant assesses the safety, reasonableness and legality of the company's finances. Generally, a professional secretarial company or accounting firm in Hong Kong will be commissioned to complete the audit to ensure the accuracy and validity of the audit results. The audit report is also a mandatory document for tax declaration and shareholders' meeting of a Hong Kong company.

An audit is generally divided into three parts: (1) bookkeeping; (2) auditing; and (3) tax preparation.

settle accounts

After 1 year of operation, a Hong Kong company will certainly generate bank flows, business documents, merchandise entry and exit details, transportation vouchers and other commercial documents and accounting information, and bookkeeping is to match commercial documents and accounting information one by one, so that it can accurately reflect the business entity's operation in the past year.

audits

Once the account documents have been reconciled with the business documents, a certified public accountant (practicing) in Hong Kong will reconcile each transaction activity to confirm that there are no misconnections or spurious transactions, and express an opinion on these, which is known as an audit.

-Unqualified opinion - Opinion

-Qualifiedopinion

-Disclaimer of opinion

-Adverse opinion

declare dutiable goods (at customs)

After the auditor's report is issued by the accountant, the profitability of the business entity and the amount of tax payable will be calculated on the basis of the relevant data in the financial statements and the profits tax return issued by the Inland Revenue Department (IRD) will be filled out. According to the year-end date and within the time limit set by the Inland Revenue Department, the completed Profits Tax Return with supporting documents (audit report, financial statements, etc.) will be submitted to the Inland Revenue Department of Hong Kong for tax filing compliance.

.

PS: There are two types of tax returns for Hong Kong companies.

No operations:

No operation of the Hong Kong company tax returns need to submit no operation of the audit report, and do the tax form zero declaration (since 2023.4.1 from the implementation of no operation of the Hong Kong company must also provide no operation of the audit report, can not be as before only separate tax form zero declaration.

There are operations:

Hong Kong companies with operations need to provide real bank water and business documents, etc., by the Hong Kong CPA licensed accountants to do the audit, submit the audit report signed by the directors and shareholders of the Hong Kong company to confirm the audit report, and submit the real data of the profits tax return.

Determine the financial year-end date:

When a Hong Kong company makes its first audit and tax return, it has to confirm the company's year-end date. The first time for a newly established Hong Kong company to file tax return is within 18 months from the date of establishment, which can be chosen at any time, and then every 12 months to do an audit tax return; the time for a non-newly established Hong Kong company to file tax return is in accordance with the company's chosen year-end date of the previous year. Different year-end date can apply for an extension of time to file tax returns are not consistent.

Most Hong Kong companies will choose the accounting year from April 1 to March 31 of the following year, which is the same as the financial (tax) year in Hong Kong, or from January 1 to December 31, to be able to apply for a longer period of time to postpone the filing of tax returns, but also conducive to accounting firms in the annual audit of the accounting statements to avoid too much concentration in time, so that the work of the whole year is more balanced, in order to ensure the quality of the audit.

.

III. Quarterly accounting services: professional and worry-free auditing

For Hong Kong companies, daily accounts sorting is the foundation of compliance maintenance and the key to subsequent audits and tax returns. In order to help business owners save time and effort, we have launched "Quarterly Accounts Handling Service for Hong Kong Companies" with the following core advantages:

Accurate report output: 4 core reports are automatically generated every quarter, which shows the details of income and expenditure, asset status at a glance, and the account situation is clear and controllable;

Real-time risk warning: Real-time monitoring of abnormal transactions, timely alerts for duplicate payments, sudden expenditures and other issues to avoid the risk of funds;

Efficient audit connection: systematically organize the annual accounts in advance, and submit complete information directly during subsequent audits, significantly saving audit preparation time;

Full assistance in tax: Professional team assists in the whole process of tax declaration, accurately controlling the deadline of declaration to avoid late penalty.

The service is extremely cost-effective, spending less than 10 dollars a day, you can have the exclusive services of a professional Hong Kong accountant, the cost is only equivalent to the level of part-time accountant. The accounts are clear and standardized throughout the year, completely solving the audit headache problem. Bosses in need, you can directly leave a message in the background to consult!

.

IV. Other maintenance: timely registration of changes in information + update of the register of significant controllers

Information change registration: Changes in company name, shareholders, directors, registered address, business scope and other information need to be submitted to the Hong Kong Registry within 15-30 days (the time limit varies for different changes) to submit an application for change, with a fine of HK$10,000-50,000 for late payment.

Register of significant controllers: The company is required to keep a register of significant controllers at the registered address to record the details of shareholders, directors and de facto controllers, which should be updated at least once a year and made available at all times for government verification, and a fine of HK$25,000 will be imposed for failing to keep the register or update it as required.

Hong Kong company registration, annual audit, audit, accounting and tax, Hong Kong identity application, Hong Kong identity renewal, e-commerce tax compliance, difficult to cancel, qualification licenses and other issues have questions Sweeping code to add our online customer service (cell phone WeChat the same number: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

05.ODI Filing: A Passport to Compliance for Funds Entering and Leaving the Country

Chinese enterprises investing in Hong Kong companies are required to complete the Mainland's "Outbound Investment Record (ODI)", otherwise funds cannot be legally remitted and profits cannot be repatriated to the Mainland (tighter verification by the OFAC in 2025, and remittance of funds without a record will be intercepted).

I. 5 types of core scenarios for which ODI records must be filed

As long as the operation and capital flow of the Hong Kong company is related to the cross-border investment of the mainland entities (enterprises/individuals), and the following circumstances are met, it is necessary to complete the ODI filing according to the regulations, and one of them is indispensable:

- Mainland enterprises holding / injection of Hong Kong companies (shareholding ≥ 10%)

This is the most common filing scenario. According to the Foreign Exchange Management Regulations and Shunyi.com December 2025 data, if a Mainland enterprise (including individual or partnership) holds, directly or indirectly, 10% and above equity interest in a Hong Kong company as a shareholder, or injects start-up capital or shareholder loans (regardless of the amount) into a Hong Kong company, it must apply for an ODI filing.

Example: A trading company in Shenzhen invested 500,000 Hong Kong dollars to hold a Hong Kong company (shareholding 60%), for the expansion of trade in Southeast Asia, the need to complete the ODI record in the Shenzhen Development and Reform Commission, the Commerce Bureau, otherwise the bank will refuse to remit funds.

- Hong Kong companies as "springboards" for offshore investments

If a Hong Kong company does not operate locally only, but acts as an "offshore platform" for Mainland enterprises to invest in other countries/regions (e.g. the US, the EU, Southeast Asia), regardless of whether it is in the form of a "new company" or an "acquisition of assets", an ODI filing is required. Merger and Acquisition of Assets", ODI filing is required.

Specific scenarios include:

Hong Kong company opens new factory in Vietnam;

Hong Kong company acquires 51% shares in a German technology company

Hong Kong companies transfer funds to overseas subsidiaries for project construction.

Core logic: Such behavior is essentially "indirect exit of mainland funds through Hong Kong", which needs to be included in the scope of ODI regulation to ensure that the investment is in line with the national industrial policy (e.g. not involving sensitive industries such as real estate and entertainment).

- Hong Kong company profits need to be repatriated to the mainland parent company

If a Hong Kong company makes a profit and plans to distribute dividends or transfer shares to its parent company in the Mainland, or repatriate funds to the Mainland by way of "shareholder loan repayment", it must first complete an ODI filing.2025 The new SAT regulations are clear:

Repatriation of overseas profits that have not been filed will be subject to back tax at the mainland enterprise income tax rate of 25% (far exceeding Hong Kong's profits tax rate of 16.5%) and will not be eligible for the "tax credit" benefit;

Banks will be mandatory to provide the "Enterprise Overseas Investment Certificate" when settling foreign exchange, without the record, the funds can not enter the country, and long-term stay outside the country may be recognized as "foreign exchange evasion".

- Involving "return investment" (Hong Kong companies investing back into the Mainland)

If a Hong Kong company plans to invest in the Mainland (e.g. setting up a WFOE in Shenzhen, merging and acquiring a factory in the Mainland), which is in the category of "return investment", it needs to apply for an ODI filing, and then apply for a Certificate of Approval for Foreign Invested Enterprises (FIEs) with the filing document from the Mainland's commerce department.

Risk Warning: A return investment that has not been filed may be recognized as "false foreign investment" and face project call-off, fines (up to 30% of the investment amount), or even criminal liability (Foreign Exchange Management Regulations).

- Significant changes to Hong Kong companies (updated filing required)

If the following "material changes" occur to a Hong Kong company that has already filed an ODI record, it is required to update the ODI record within 30 days:

Increase or decrease in investment entities (e.g. transfer of equity interests in Hong Kong companies by Mainland parent companies to other Mainland enterprises);

20% of the change in investment amount over the original filed amount (e.g., originally filed at $1 million, now increased to $1.3 million);

Change of investment destination (e.g. from "Hong Kong → Singapore" to "Hong Kong → Malaysia");

Adjustment of business scope to sensitive industries (e.g., addition of real estate development).

Note: Non-substantive changes (e.g., change of company name, change of currency of capital contribution) only need to be filed with the Ministry of Commerce, and do not need to repeat the NDRC process.

Enterprise Caiying ODI filing part of the case

Core conditions and materials for ODI filing

Record conditions: net assets of mainland enterprises ≥ investment amount, no major violations of the record in the past three years, investment projects in line with national industrial policy (prohibit investment in gambling, pornography and other industries).

Required materials:

Basic corporate documents: business license, articles of incorporation, financial statements (audit report) for the past year;

Investment decision documents: shareholders' meeting resolution (agreeing to invest in the Hong Kong company), investment plan (stating the amount of investment, its purpose, and expected return);

Hong Kong company documents: Certificate of Incorporation, Business Registration Certificate, Articles of Association (notarization required);

Other documents: ODI application form (NDRC + MOFCOM version), proof of source of funds (e.g. bank deposit certificate).

.

ODI Filing Process (Simplified 2025)

Filing with NDRC: submit materials to the provincial NDRC, with a review cycle of 5-7 working days, and receive the "Notice of Filing of Overseas Investment Projects" after approval.

Recorded by the Ministry of Commerce: Apply to the provincial department of commerce with the notification letter from NDRC, the review cycle will take 3-5 working days, and you will receive the Certificate of Enterprise Overseas Investment after approval.

Filing with the Foreign Exchange Bureau: Submit the filing to the Foreign Exchange Bureau where the enterprise is located to obtain the Foreign Exchange Registration Certificate for Overseas Direct Investment, after which the funds can be remitted at the bank (the remitted amount should be the same as the filed amount).

Note: If the investment amount exceeds 30 million US dollars, it needs to be submitted to the National Development and Reform Commission (NDRC)/Ministry of Commerce (MOFCOM) for approval (period of 15-20 working days); after the ODI filing, the remittance of funds needs to be completed within 6 months, or a new application will be required after that time.

Hong Kong company registration, annual audit, audit, accounting and tax, Hong Kong identity application, Hong Kong identity renewal, e-commerce tax compliance, difficult to cancel, qualification licenses and other issues have questions Sweeping code to add our online customer service (cell phone WeChat the same number: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

- Hong Kong Company Registration

- Hong Kong Tax Returns

- Hong Kong company accounts

- Hong Kong company

- cross-border e-commerce