Hello! I'm Wendy from Enterprise Caiying, providing Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company /Hong Kong companyDomestic company registration and other related business services, but also to provide the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company / Vietnamese company / Malaysian company and other foreign company registration and related business services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252 ).

More and more mainland enterprises are registering their companies in Hong Kong, according to the latest disclosure of the Hong Kong Commerce and Economic Development Bureau, as of the end of October 2025, the total number of local companies in Hong Kong amounted to 1,530,000+, an increase of about 4.7% compared to the same period last year, respectively, and the number of new registrations of local companies in Hong Kong in the first half of 2025 alone was as high as 84,300, the total number of companies exceeded the historical peak, with nearly 465 new companies being born on average every day. 465 new companies were born every day, this "Hong Kong company fever" is not only the entrepreneurs on the efficiency, freedom of capital and tax optimization of the collective pursuit, but also a large number of people considering the renewal of Hong Kong status of the talent choice.

However, the completion of the Hong Kong company registration is not the end, can not realize the real business and build a substantial contribution is the key, after all, only with the commercial substance of the Hong Kong company, in order to play the leverage of the business to the sea, so that you can successfully get the Hong Kong tax residency status, compliance to enjoy the Hong Kong low-tax policy, to make the enterprise to reduce the tax burden.

01 Real Customer Cases of Enterprise Caiying Group

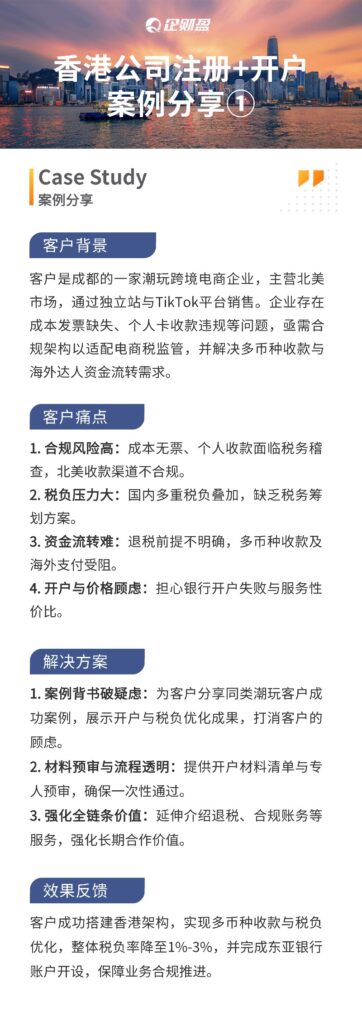

Today we share a case of Hong Kong company registration + account opening of Enterprise Caiying Group. This customer is a tide play cross-border e-commerce business owner in Chengdu, the main business in the North American market, the customer mainly faced these difficulties:

1) High compliance risk: costs without tickets, personal collections facing tax audits, and non-compliant collection channels in North America.

(2) High tax burden pressure: multiple domestic tax burdens overlap and lack of tax planning programs.

(3) Difficulty in capital flow: unclear prerequisites for tax rebates, and obstacles to multi-currency collections and overseas payments.

(4) Account opening and price concerns: fear of bank account opening failure and cost-effective service.

Solutions provided by the Enterprise Cai Ying team:

(1) Case endorsement to break the doubt: share the successful cases of similar tide play customers for customers, show the results of account opening and tax burden optimization to dispel the customer's concerns.

(2) Material pre-approval and process transparency: provide a list of account opening materials and specialized pre-approval to ensure a one-time pass.

3) Strengthening the value of the whole chain: Extending the introduction of tax refund, compliance accounts and other services to strengthen the value of long-term cooperation. Through the assistance of the Enterprise Caiying team, the company not only handled tax compliance and reduced tax through reasonable tax planning, but also made the flow of funds back to Hong Kong and home country smoother.

If you need to register a Shenzhen company/Guangzhou company/Shanghai company/Hangzhou company/Beijing company/Hong Kong companyDomestic company registration related business services, but also provides U.S. companies / Canadian companies / Mexican companies / British companies / New Zealand / Singapore companies / Vietnamese companies / Malaysian companies and other foreign companies registered in the relevant business services, the company's annual review / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add me! WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

02 What Hong Kong tax advantages can I enjoy with my Hong Kong status?

At the same time, that cross-border e-commerce business owners or executives, in fact, can also layout to apply for Hong Kong identity, tax can also be more advantageous. So, Hong Kong identity can enjoy what Hong Kong tax advantages? Mainland China and Hong Kong implement the policy of one country, two systems, the tax system adopted is different, which also caused the two places to pay tax differentiation, you can visualize the difference between Hong Kong and the mainland tax system through this chart:

03 What benefits can I enjoy under Hong Kong tax status?

Hong Kong's tax burden is almost the lowest in the world, so many high net worth individuals apply for Hong Kong status for this reason, so how low is the tax rate in Hong Kong? What are the advantages of the Hong Kong tax system?

① Enjoy a low tax regime when working or starting a business in Hong KongThe low tax regime for Hong Kong residents can generally be enjoyed by working in Hong Kong or opening a company.

Working in Hong Kong: It is no secret that jobs in Hong Kong offer high salaries and low taxes. If you are an elite talent, the difference in the amount of tax paid between working in Hong Kong and working in the Mainland is huge, from an annual income of $500,000 to an annual income of $10 million, the difference in the amount of tax paid ranges from a few tens of thousands to a few million. For example, with an annual income of $1 million, the Mainland needs to pay $212,800 in tax, while Hong Kong only needs to pay $60,500 in tax, a difference of $152,300, and the higher the income, the bigger the difference.

Open a company in Hong Kong: and if you have a Hong Kong company, the amount of corporate tax to be paid and the amount of corporate income tax paid by mainland companies is even greater, Hong Kong involves corporate tax is mainly profits tax, the standard tax rate of 16.5%, the first 2 million profits tax rate of only 8.25%, personal income tax rate of 2% ~ 17%, the highest personal tax rate of only 17%.

If your company has an annual turnover of $10 million and a net profit of about $1.5 million (calculated at an annual interest rate of 15%), the amount of tax payable in Hong Kong is $123,800,000, whereas the amount of tax payable in the Mainland is about $675,000, a difference of more than half a million dollars.

② Double Taxation Avoidance Agreements:Hong Kong has signed Double Taxation Avoidance Agreements (DTAs) with 49 tax jurisdictions to ensure that the income of tax residents will not be subject to double taxation in the two jurisdictions and that they will be able to enjoy certain preferential tax rates.

Example: A Hong Kong company is taxed at 51 TP3T on dividends from mainland sources, 71 TP3T on interest and royalties, and 101 TP3T on all the above three general tax rates for a Hong Kong company that does not qualify for the agreement, and 201 TP3T for a mainland resident enterprise.

③ Tax incentives for Hong Kong business start-up policy:The Hong Kong government introduces tax incentives and financial support policies every year. For the year of assessment 2024/25, Hong Kong enterprises are entitled to a profits tax relief of 100%, capped at HK$1,500.

The profits tax deduction ceiling for 2025-26 will be substantially increased from HK$1,500 to HK$10,000 (the exact percentage of deduction will be announced after the scrutiny of the Legislative Council). The tax deduction for R&D expenditure of qualified technology ventures (companies incorporated in Hong Kong or with their principal place of business in Hong Kong) has been increased to 150%, with priority given to biotechnology, artificial intelligence and other areas.

Example: If an enterprise invests HK$1,000,000 in R&D expenses, it can deduct HK$1,500,000 from its taxable profits, which directly reduces its tax burden.

④ Hong Kong investment income:The tax saved can make money, no matter you are a personal income or business income, the amount of tax saved is not small, if the money saved is used for investment, such as buying a property in Hong Kong, doing a small business, etc., the return on investment is not low.

Moreover, the more tax saved by Hong Kong residents, the more willing these talents are to make investments and spend money to boost the local economy. Hong Kong is China, and with better economic development, Hong Kong will contribute more to the country.

Assuming that you save tax by taking a Hong Kong identity, employment or entrepreneurship in Hong Kong is 300,000, with this 300,000 to make investments in the principal, do a small business and so on, according to the reinvestment of the annualized return of 3.5% to calculate the 1 year time can earn back 10,500,000, 10 years will be able to earn back 642,600,000, 30 years can earn back 7,028,800,000.

What if the annual rate of return was a bit higher? For example, 6%, then the money earned back would be even more, and maybe in 10, 20, or 30 years you could be earning hundreds or tens of millions of dollars back on that tax savings alone to invest.

If you have not yet applied for Hong Kong identity but have plans to do so, you can call or WeChat: 13045886252 to assess whether you can apply for the High Talent Pass Scheme/other talent policies ↓↓↓

04 Services offered by Enterprise Finance Group

Founded in 2015, Enterprise Caiying has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industrial, commercial, taxation and business services for enterprises and individuals, covering domestic and international industrial and commercial qualifications/tax and equity/overseas identity and asset allocation/cross-border e-commerce, and other core businesses.

Details of the services provided by the Enterprise Finance Group:

Enterprise Caiying Group Strength:

Core strengths of the Enterprise Caiying Group:

The company has nearly 400 employees, and the core team consists of senior lawyers, accountants, tax experts and business consultants. At present, Enterprise Caiying has set up branches in North, Guangzhou and Shenzhen, Hong Kong, Southeast Asia and the United States. So far, it has provided services for 300,000 small and medium-sized enterprises, with more than 50,000 long-term cooperative customers.

If you plan to register a Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, but also to provide the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company / Vietnam company / Malaysian company and other foreign company registration related business services, the company annual review / bookkeeping and tax returns / payment of MPF / change of Information / bank account opening / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop services, etc. can be found in the Enterprise Caiying Group to handle.Welcome to consult me (WeChat No.: 13045886252), or [scan the QR code below] to match your needs, there will be a professional tax consultant to communicate with you in detail ↓ ↓↓↓

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Application for Hong Kong Identity

- Customer Cases

- Tax advantages

- Hong Kong Identity

- Register Hong Kong Company