Amazon four people small team annual income of 5 million, the main body is a general taxpayer but did not do the tax rebate, withdrawals to the boss's private card, so now what, want to develop more products, if say the collection is $20 million or more, how do you collect in compliance to do this fiscal compliance?

At present, many Amazon sellers take the territory of the company to register an account, with a personal account to collect money or a third-party payment platform, after the collection of money, it is cleared to the domestic personal account, and some of the company's annual income of more than a hundred million dollars in the flow of water is also done.

Excessive personal card payments can lead to tax audits.This situation is well known to everyone, are not compliant. Want to make money, you have to comply with the collection; that to solve the problem of financial and tax compliance, the first thing you need to sort out your business flow, capital flow, logistics compliance.

This year, in particular, the National Revenue Service has undertaken a series of reformsGolden Tax Phase IV on-line pilot + big data for tax administration.E-commerce platforms and tax bureaus have long been interconnected, and all the transaction data and revenue behavior of merchants on the platform have long been mastered by the tax authorities.

The launch of Golden Tax IV means that tax supervision will be more comprehensive, intelligent and transparent. It will cover the entire business process of enterprises and utilize big data technology to comprehensively monitor taxpayers' transaction behaviors. With the help of big data, previously unnoticeable violations will be more easily detected and the transparency of assets will increase.

01 cross-border e-commerce how to achieve fiscal compliance

01 Financial compliance

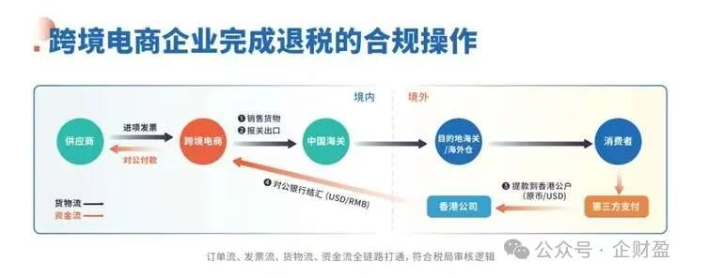

In cross-border e-commerce capital supervision, the principle of "real business background" is of paramount importance. This means that the business itself must be real and the relevant processes and documents must be complete.

What about money flow, based on the authenticity of the business, generally speaking for those who do Amazon, there are these three ways to be compliant with money flow:

The first type: with the domestic company as the main body of the store, the Amazon store funds can be transferred back to the account of the domestic company through Amazon Global Collections or a third-party collection platform.

The second type: localized stores, where store income is paid back directly to the account of the offshore enterprise, and the account of the offshore enterprise can be paid back to the domestic enterprise in the form of payment for goods if it has trade transactions with the domestic enterprise.

Third: Receiving money by way of entrepot trade, using an offshore company, and then paying it back to the public account in the territory in the form of trade transactions in goods.

02 How are other cross-border e-commerce companies responding?

1、Small and medium-sized sellers who have started soon.

The company's pre-development period, dry million do not zero declaration, more or less to report some tax, and then the social security to the corresponding company to ensure the normal operation of the domestic. At the same time, apply for Hong Kong offshore companies, as well as offshore accounts. Ensure that the foreign exchange funds receive and pay problems.

2、It has begun to scale, want to finance the loan of medium and large sellers:.

Improve the statistics, procurement, invoice procurement, export tax rebates, clear order flow, this stage, the focus is on good financial aspects of the statement, back to the public account, the four streams of the problem.

3. Super sellers who are ready to go public :)

Do an asset inventory, adjust the liability structure and equity structure, and do the VAT filing in the country of operation.

Many cross-border e-commerce businesses think that compliance means losing money. It's actually a misconception; in fact, compliance is what makes a business better in the long run!

With the transparency of the international affairs environment, the future of tax planning needs to spend more effort to create a holistic program, after all, the money earned, safe and compliant business can be a long time to come ~

Cross-border e-commerce there are many ways to plan, organized a detailed cross-border e-commerce tax compliance manual PDF, if there is a need for the boss can find me to receive free ~

Cross-border e-commerce tax compliance pain points

1、 Two sets of accounts: the internal accounts are chaotic and lead to difficult assessment, while the external accounts are difficult to file tax returns due to tax evasion and tax evasion;

2. Low income from external accounts, difficulties in financing, investment, mergers and acquisitions and IPOs;

3, no ticket purchases, personal accounts in and out of large sums of money, suspected of money laundering, tax evasion boss sleepless nights;

Compliant Overseas and Domestic Equity Structures for Cross-Border Enterprises

1、Build a good in-country structure, that is, tax-saving and compliance

2, must set up a Hong Kong company as well as good positioning

3、Use of Hong Kong company offshore tax exemption policy

4. How is the store company built?

5、Why do we need to do offshore investment filing?

Cross-border e-commerce fiscal and capital rational planning

1. Normative design for procurement without and with tickets

2. Reasonable pricing of goods exported from Hong Kong companies to achieve both tax savings and compliance

3, the company structure flow, goods flow, financial flow, tax flow, capital flow, contract flow, bill flow reasonable planning management

4、 How to make cross-border e-commerce enterprises and bosses' income legal? How to plan for shareholders' dividends?

5. Need to share the cost of payroll for in-country employees

6、 Must do cross-border service tax-free record

If your business has registered Hong Kong companies and cross-border e-commerce tax compliance needs, you can contact our online customer service, for you to arrange the Commissioner Manager to answer questions and provide professional advice andFull one-on-one service

- Amazonian

- cross-border e-commerce