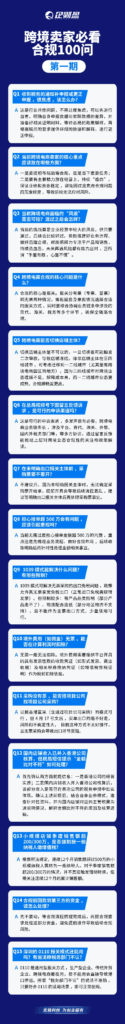

Recently, the national tax bureaus for cross-border e-commerce declaration difference reminders have been issued one after another, many sellers have received text messages, in the face of a series of complex issues such as platform information reporting, tax declaration, customs clearance mode switching, many sellers fall into the "how to verify the data? How to clear the risk? Compliance from where to start?" The predicament.

To this end, we have systematically organized the recent sellers most concerned about the"100 Questions on Cross-border E-commerce ComplianceThe first issue of the series today is the 15 high-frequency questions. Today is the first installment of the series, selected 15 high-frequency issues, for all cross-border sellers to quickly control, clarify the risk, and layout as early as possible.

In conclusion, in the face of the increasingly tightened regulatory environment, it has become a must for sellers to gain insight into the risks in advance and master compliance strategies systematically. We hope this series of Q&A will provide you with immediate help.