The wave of global tax transparency has finally swept over cross-border e-commerce platforms

.

Amazon Officially Launches Tax-Related Information Reporting for Chinese Sellers

On October 13, Amazon officially released a heavy notice concerning all Chinese sellers - "Notice on the Requirements for Reporting Tax-Related Information of Platform Enterprises in China". This notice means that Amazon, a bridge connecting Chinese sellers and global consumers, will soon become a channel for tax data exchange.

The notice explicitly declares:Starting in October 2025, Amazon will report all Chinese sellers' relevant transaction information to Chinese tax authorities on a quarterly basis

.

At the same time, the platform will beBy October 31, 2025fulfillmentinauguralQuarterly information reporting coveringThird quarter of 2025 (July-September) All data for the period. Thereafter, reporting will become a regular quarterly exercise

.

This marks the first time that the business data of Chinese sellers on Amazon will be systematically and in bulk presented by the platform to the national tax authorities

.

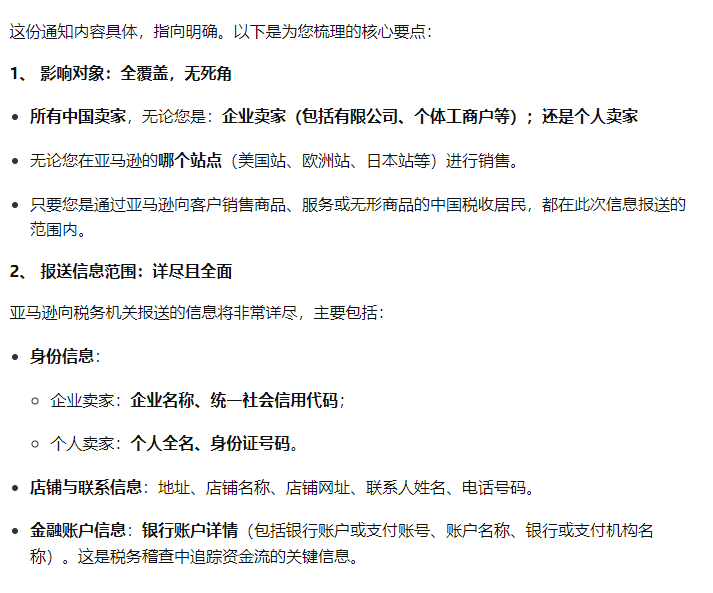

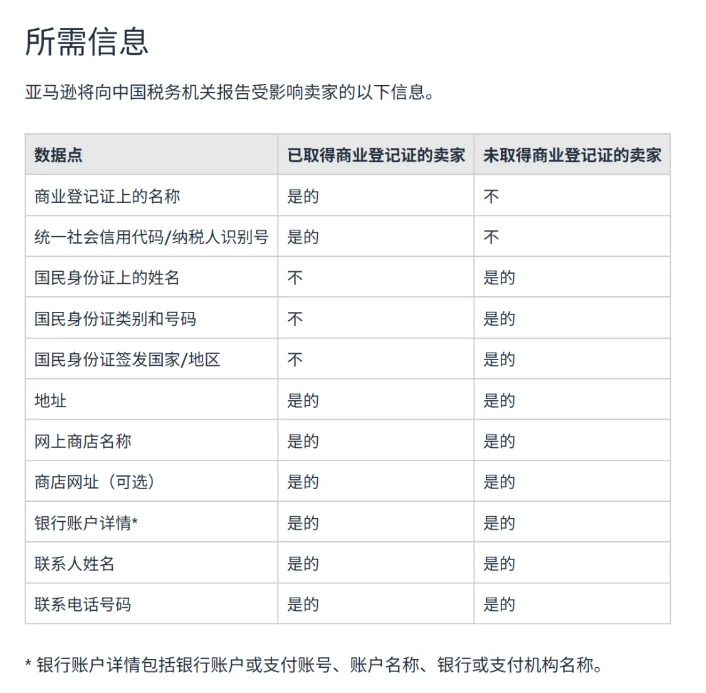

The core points of the notice are explained: it concerns every seller.

3. Timetable for initial submissions: the countdown has begun

- Deadline for first submission::By October 31, 2025

- Interval of first-time data submission::Third Quarter 2025 (July 1 - September 30)

This means that less than a year is left for sellers to check, rectify and prepare themselves

.

It is important to note that sellers do not need to take any action, Amazon will report the relevant information to the Chinese tax authorities on a quarterly basis

.

Several platforms, including Amazon, Walmart, SHEIN and others, have already posted informational messages about this.In response to the policy, relevant industry sources said that this policy adjustment may be aimed at fundamentally managing the current chaos, through multi-party data collection and analysis, and gradually guide the enterprise to actual e-commerce business identity declaration, which may be more in line with the future trend of standardized development of the industry. However, to achieve this goal, there is still a need to address the simplification of the customs filing process, cross-regional filing coordination, approved levy determination standards and efficiency and many other issues.

.

So it doesn't mean that as of October 1, theCorporate income tax will be collected on the basis of the amount declared for exportsThe

.

However, according to recent feedback from exchanges with a number of export sellers, theAs long as no prepayment of tax is involved, subsequent payment of income tax at the rate of 1% is not a major stress or problem for most companies

.

If your enterprise does not know how to comply with the solution of Amazon reporting tax-related information and other related issues, you can contact our online customer service, to provide you with a one-stop solution!

- Amazonian

- Amazon Onboarding

- Cross-border e-commerce platform

- Enterprises Going Overseas

- cross-border e-commerce