Under the impetus of the wave of globalized economy, more and more Shenzhen enterprises set their sights on overseas markets and actively carry out foreign investment and cooperation.2025 In the support policy for stabilizing foreign trade issued by Shenzhen, strong support is given to enterprises to carry out investment or contracting projects abroad, which injects a strong impetus for enterprises to "go out". Today, we will discuss in depth in the context of this policy, Shenzhen enterprises how to do a good job of ODI offshore investment filing, as well as why to do and what advantages after doing so.

Support of Shenzhen's Foreign Trade Stabilization Policies for Outbound Investments in 2025

In 2025, Shenzhen's support policy for stabilizing foreign trade clearly stipulates that enterprises shall be given support in accordance with 50% for the costs of legal, technical, commercial and investment and financing consulting services in the preliminary stage of carrying out investment or contracting projects outside China, the interest on bank loans, premiums for overseas investment insurance, and the costs of infrastructure construction of provincial-level overseas economic and trade cooperation zones, construction of public service platforms in the zones as well as the costs of organizing the zones' investment activities and promotion. The maximum subsidy is 20 million yuan. The introduction of this policy greatly reduces the cost pressure of enterprises investing abroad and encourages more enterprises to actively expand their overseas business and enhance their international competitiveness.

give an example::

- Cross-border e-commerce companies: Building warehouses in Vietnam and applying for logistics infrastructure subsidies

- Engineering contracting company: Construction of photovoltaic power plants in Saudi Arabia, application for subsidies for upfront consulting fees

- Manufacturing companies: Setting up a factory in Mexico and applying for subsidies for equipment purchases

Specific support content:

1. Up-front cost support projects

Front-end cost refers to the service cost of legal, technical, commercial and investment and financing consulting services provided by professional organizations with corresponding qualifications commissioned by domestic enterprises and their offshore holding companies for the purpose of obtaining or acquiring foreign-contracted engineering projects or offshore investment projects. The specific support contents are:

(1) Service fees for legal, technical, business and investment and financing advice;

(2) Costs for the preparation of project proposals, due diligence, feasibility study analysis, feasibility study report, investment environment analysis and project security assessment report;

(3) Purchase costs of project bids, technical data and other normative documents and materials;

(4) Translation costs of project bids, technical data and other normative documents.

Support of up to TP3T 501 for the above actually paid expenses (the actual expenditure on pre-project expenses shall not be higher than TP3T 61 of the total investment of the Chinese side of the project). A project can only enjoy the support once.

2. Loan Interest Subsidy Support Program

Loan interest refers to the bank loan interest expended by domestic enterprise entities and their overseas holding companies for foreign contracted engineering projects or overseas investment projects. It includes loans with expired or unexpired loan terms.

Subsidized interest rate for loans of one year and above (including one year). Among them:

(1) The interest rate for the RMB loan subsidy will not exceed the LPR interest rate for the corresponding loan period as of December 31, 2024, inclusive, as last announced for execution by the People's Bank of China. If the actual interest rate is higher than the LPR interest rate, it will be calculated according to the LPR interest rate; if the actual interest rate is lower than the LPR interest rate, it will be calculated according to the actual interest rate.

(2) The interest rate for foreign currency loan subsidy shall not exceed 3%. If the actual interest rate is higher than 3%, it shall be calculated according to 3%; if the actual interest rate is lower than 3%, it shall be calculated according to the actual interest rate.

Support up to TP3T 501 for the actual interest paid on the above. The time of project completion is based on the time of payment of bank interest bill. Projects that have been cumulatively supported for 3 years will no longer be given subsidized interest support.

3. Overseas Investment Insurance Premium Support Program

Overseas investment insurance refers to overseas investment (equity) insurance and overseas investment (debt) insurance purchased from policy insurance organizations by enterprises carrying out out foreign investment in order to reduce losses caused by expropriation, exchange restrictions, war and political riots, default and other political risks occurring in the host country faced by the overseas project. The actual premium paid will be supported up to 60%.

Specific details can be found in the Shenzhen Municipal Bureau of Commerce notice https://commerce.sz.gov.cn/

02 Advantages of Overseas Investment Filing for ODI by Enterprises Going Overseas

1. Free deployment of funds

- Foreign Exchange Line Application::After the filing, the enterprise can apply for foreign exchange registration with the bank with the Certificate of Enterprise Overseas Investment, remit the investment money legally, and realize the return of overseas profits. Enterprises can reasonably arrange the entry and exit of funds according to their own investment plans and operational needs, ensure the smooth implementation of overseas investment projects, and at the same time legally bring profits earned abroad back to the country, realizing the efficient use of funds.

- Pool management::Supporting the two-way flow of domestic and foreign capital and reducing exchange costs. Take a cross-border e-commerce enterprise as an example, it saves more than 2 million yuan in exchange costs annually after passing the ODI filing. Enterprises can more flexibly manage domestic and foreign capital pools, optimize capital allocation, improve capital use efficiency and enhance their financial competitiveness in the international market.

2. Policy support and resource orientation

- special subsidy::In addition to the previously mentioned offshore investment subsidies given by Shenzhen to enterprises of record, for qualified investment projects, enterprises may also receive special subsidies at the national level, such as offshore investment in some strategic emerging industries and key technology areas, the state will give key support to further reduce the investment cost of enterprises and increase the rate of return on investment.

- Financing facilitation::Enterprises of record are more likely to obtain preferential loans from policy banks (e.g., China Development Bank and Export-Import Bank), with interest rates lower than market levels. At the same time, commercial banks are also more willing to provide credit support for record enterprises, because the investment behavior of record enterprises is relatively more standardized and risk-controllable. This provides sufficient financial protection for the enterprises' overseas investment projects and helps them to develop and grow rapidly in the overseas market.

- Offshore tax credits::The filing enterprise can apply for the credit of tax paid abroad according to the Enterprise Income Tax Law to avoid double taxation. For example, a manufacturing enterprise saves more than RMB 3 million in tax annually after ODI filing, which greatly reduces the pressure of tax burden on the enterprise, increases the net profit of the enterprise, and improves the profitability and market competitiveness of the enterprise.

3、Compliance wind control

The filing requires enterprises to submit the "Overseas Investment Authenticity Commitment", forcing them to improve their overseas compliance system and reduce business risks. In the process of preparing the filing materials, enterprises need to conduct a comprehensive risk assessment of the investment project, including political risk, economic risk, legal risk, environmental risk, etc., and formulate corresponding risk response measures. This helps enterprises to fully understand the potential risks before investing, take precautions in advance, and safeguard the sound operation of investment projects. At the same time, through the establishment of a comprehensive compliance system, the enterprise can better comply with the laws and regulations of the investment destination countries and regions, avoid being penalized for irregularities, and maintain the good image and reputation of the enterprise.

4. Expanding business and strategic layout

Through the ODI filing, enterprises can more conveniently set up subsidiaries, merge and acquire existing enterprises or carry out other forms of investment activities abroad, so as to expand the scope of business and realize the strategic layout of globalization. Enterprises can utilize the advantages of resources, technologies and markets abroad to enhance their core competitiveness. For example, by setting up R&D centers overseas, some science and technology enterprises can better attract top talents from around the world, acquire cutting-edge technologies, and promote their technological innovation and product upgrading; and by setting up production bases overseas, some traditional manufacturing enterprises can reduce their production costs, avoid trade barriers, and improve the competitiveness of their products in the international market.

Shenzhen company for ODI overseas investment filing process

Shenzhen company for ODI filing of the preliminary preparations:

1. Pre-preparation:

Project evaluation and planning:Shenzhen companies need to make a comprehensive assessment of the offshore investment project, including market prospects, investment return rate, risk factors, etc.. At the same time, the amount and mode of investment (new company, merger and acquisition, etc.) as well as the investment path should be clarified.

2. Preparation of materials:

Usually, it is necessary to prepare copies of the business license, organization code certificate, tax registration certificate, articles of association, ID card of the legal representative and other documents of the domestic investment entity; financial statements of the domestic investment entity for the past month; contracts or agreements related to overseas investment; and materials of the relevant departments that permit the export of the products or technologies involved in the restriction on export.Specific material requirements may vary depending on the investment program.

Conditions for Shenzhen companies to apply for ODI overseas investment:

1. Meets the definition of "offshore investment":The act of a domestic enterprise owning a non-financial enterprise or acquiring ownership, control, management and other interests in a non-financial enterprise abroad through new establishment, merger and acquisition and other means.

2. Subject and time of establishment requirements:The subject needs to be an enterprise established in accordance with the law within the territory of China. However, enterprises that have been established for less than one year and are unable to provide complete audited financial statements are generally unable to pass the approval or filing with the approval authorities.

3. Shareholder background, source of funds, investment authenticity requirements:Those who are unable to specify the background of domestic shareholders or partners, the source of funds (e.g., own funds, bank loans, funds obtained in a compliant manner such as fund-raising, etc.), and the authenticity of the offshore investment project can hardly pass the examination.

4. Financial requirements:Audit reports issued by independent third-party accounting firms for the most recent year must not show a loss; return on net assets should preferably be higher than 5%, while gearing should preferably be lower than 70%.

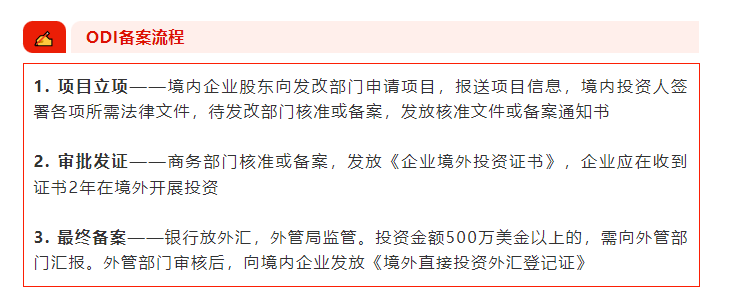

Application process for ODI offshore investments:

The whole process will take 2-3 months, involving complicated documents and processes, if there is no professional guidance to follow up, it is very time-consuming and laborious, and it is likely that due to the information involved in the submission of documents is not compliant, the industry involved in the more sensitive reasons can not pass the audit.

If your enterprise has the related ODI overseas investment filing needs, you can contact our online customer service, arrange professional manager to answer the doubts, provide professional advice andFull one-on-one service

- Shenzhen Company Registration

- odi filing application

- Enterprises Going Overseas

- ODI Filing