Enterprise Caiying Group provides the U.S. company / Singapore company / Japan company / Thailand company / Malaysia company / Canada company / Mexico company / Brazil company / UK company / France company / New Zealand company / Vietnam company / Indonesia company / Dubai company and other foreign companies registered in the relevant business and taxation services, but also to provide Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered corporate services, company annual audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied running Beijing company / Hainan company and other domestic companies registered corporate services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252 ).

这两天,电商圈炸了一个大雷!1月21日,上海税务局官宣:拼多多因未按规定报送涉税信息,被罚款10万元!

这可是头部平台首次因涉税信息报送问题被公开处罚。

很多跨境卖家可能觉得:”这是国内电商的事,跟我有什么关系?”错了!大错特错!这个案例背后,藏着一个所有平台卖家都必须警惕的税务合规信号:平台涉税信息报送制度,正在成为税务监管的”新杀手锏”。

01 拼多多到底做错了什么

此次处罚并非 “突然突袭”,而是税务机关对平台履行涉税信息报送义务的严格监管,整个流程清晰且具有警示性:2025 年《互联网平台企业涉税信息报送规定》实施后,拼多多未按要求报送 2025 年第三季度平台内经营者及从业人员的涉税信息。

税务机关 2025 年 11 月依法下达《责令限期改正通知书》,但拼多多虽启动整改却未在规定期限内完成,触发处罚条件。

根据《中华人民共和国电子商务法》及《互联网平台企业涉税信息报送规定》,逾期未改正的平台企业,可处 2 万元以上 10 万元以下罚款。此次 10 万元已达该档位上限,足见税务机关的监管力度。

这3个信号,跨境卖家必须读懂

平台是涉税信息报送的 “主体”,而卖家是 “信息源头”,平台数据一旦报送至税务机关,卖家的每一笔交易都将被精准溯源,这 3 个信号,决定了卖家后续的合规生死线。

信号1:税务监管进入”平台+卖家”双向穿透时代过去,税务机关主要盯着企业自己报税。

现在不一样了:平台必须报送卖家的涉税信息 → 税务机关掌握完整交易数据 → 卖家的每一笔收入都”透明化”,层层递进,环环相扣。这意味着什么?你在平台的销售额、提现记录、交易笔数,税务局都能看到。

平台数据 vs 你的申报数据,一旦对不上,立即触发预警。”少报收入””隐瞒利润”的操作空间,正在被技术手段压缩至零。

信号2:连拼多多都被罚,中小卖家更要小心中央财经大学樊勇院长的话说得很明白:”平台企业应依法履行信息报送义务,若违反规定要求,将面临相关法律风险,情节严重的,税务机关可对其从重处罚并依法责令停业整顿。”解读一下:拼多多这样的头部平台,罚10万只是”警示教育”。但对中小卖家来说,一旦平台数据与申报数据不符,可能面临:补缴税款 + 滞纳金、罚款(最高可达少缴税款5倍)、影响企业信用评级、严重的可能涉及刑事责任。

信号3:跨境电商税务合规,已进入”零容忍”阶段国家发改委研究员许生的评价一针见血:”税务机关依法依规对’拼多多’予以处罚,其警示教育意义远比罚款金额更为重大,对规范平台经济秩序、促进公平竞争具有重要意义。”翻译成大白话就是:这次处罚不是为了那10万块钱,而是给整个行业立规矩:税务合规,一个都不能少。

跨境电商同样在监管范围内,别抱侥幸心理。

If your company is in need of tax compliance or difficult account handling, etc., feel free to inquire (WeChat: 13045886252)▼▼▼

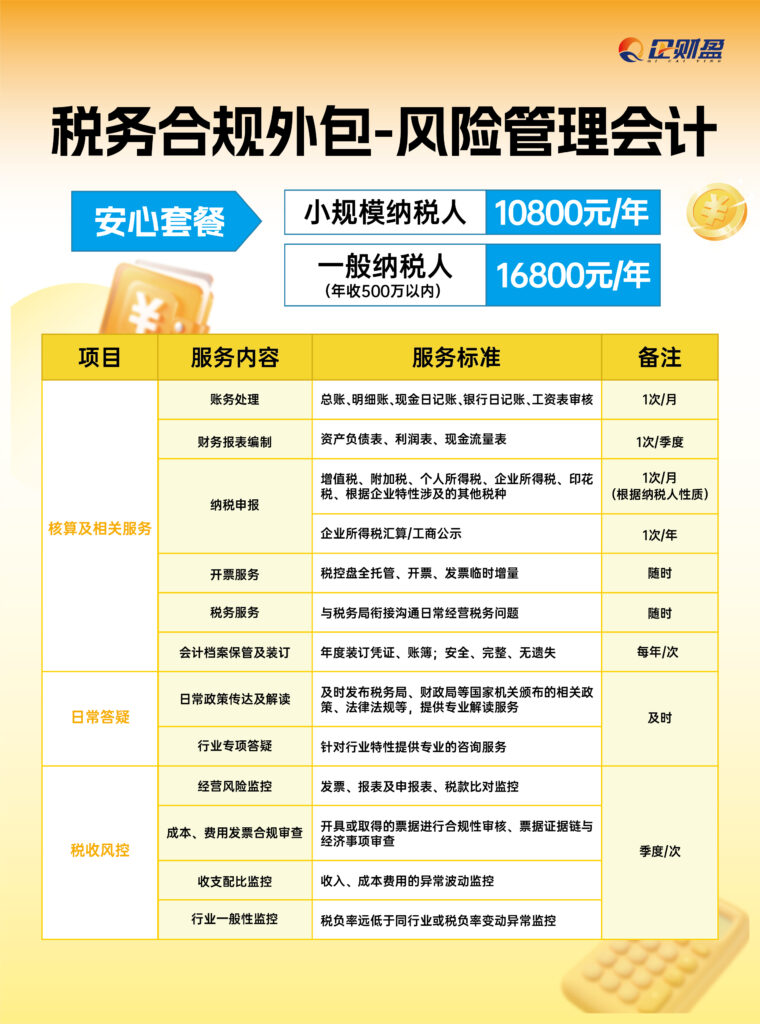

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package 1 for solutions.

02 跨境卖家必须关注的3个合规要点

1)平台会报送哪些涉税信息?

根据《互联网平台企业涉税信息报送规定》,平台需报送:经营者身份信息(姓名/企业名称、纳税人识别号)。

交易金额、笔数、频次。提现/结算记录。平台服务费、佣金等。

所以跨境卖家得注意,亚马逊、eBay、速卖通等平台,同样适用类似规则,欧美税务机关也在推进平台数据共享机制,更简单点说,你的跨境收入,正在变得透明。

2)如何确保申报数据与平台数据一致?

✅ 建立完整的财务记录体系每笔订单、退款、平台费用都要有据可查。使用专业的跨境电商财税软件,自动对账。

✅ 定期核对平台数据与账面数据每月核对销售额、提现金额。发现差异及时调整,避免年度汇算时”爆雷”。

✅ 聘请专业的跨境财税公司–如与企财盈集团合作跨境电商涉及增值税、企业所得税、个税多个税种。

还可能涉及出口退税、关税、海外VAT等。专业的事交给专业的人,省心又合规还放心。

3)哪些行为容易触发税务风险?

以下这些行为属于常见高危操作,看看你中了几条:用个人账户收款,不走公账。销售额与申报收入严重不符。长期零申报或低税负申报。频繁注销公司、更换主体。虚开发票、虚构成本。一旦被查,后果就是补税+滞纳金(每天万分之五)、罚款(0.5-5倍)、列入税务黑名单、影响贷款、招投标、出境等。

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Vietnamese company / Indonesian company / Dubai company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou Company / Beijing company / Hainan company and other domestic companies registered business services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

03 跨境电商财税合规的常见痛点

Pain point 1: Downstream can't get tickets, costs can't be deducted

This is by far the most prevalent and almost insoluble dilemma.

- status quo::The vast majority of suppliers, small factories and individual sellers are unable to provide compliant invoices, especially VAT invoices. In order to get the goods, e-commerce companies often need to accept "no invoice price".

- dilemma::

- Tax Points: You offer to take on the tax point to allow downstream invoicing, but this amounts to a tax burden shift and the cost is ultimately absorbed by you.

- For individual sellers: If the downstream is an individual, even if you are willing to bear the tax points, the other party can not issue an invoice. Unless the other party specifically goes to register an individual with an authorized levy, but this is usually only possible with a general invoice.Failure to address the core VAT input credit issue. The VAT chain is essentially broken here.

Pain point 2: High advertising and marketing costs, far exceeding pre-tax deduction limits

This is a permanent pain in the heart of platform e-commerce and store group model players.

- realism::In today's high cost of traffic, almost no e-commerce business with a sizable revenue can keep advertising costs (platform promotion, live stream casting, etc.) within 15% of revenue. Especially merchants who rely on the store group model to rush volume, paid traffic is the lifeline to maintain exposure.

- policy contradiction::The tax law stipulates that the advertising and business promotion expenses incurred by general enterprises are allowed to be deducted up to 15% of the sales (business) income of the year; the excess is allowed to be carried forward for deduction in the subsequent tax year. However, for e-commerce companies whose advertising expenses often account for 20%, 30% or even higher, theSignificant excess is not deductible in the current year, which directly pushes up the current taxable incomeThis is equivalent to paying an additional tax for "buying traffic" itself.

Pain point 3: High return rates erode revenue and complicated tax treatment

This is a characteristic challenge for consumer goods e-commerce, especially in industries such as apparel and footwear.

- industry practice: "seven days no reason to return" has become the standard, clothing and other categories of return rate as high as 30%-50% is not uncommon.

- Financial and tax implicationsA high return rate means that a large portion of the recognized revenue will eventually flow back. Although it can be handled by "sales return" in accounting and tax, frequent returns bring huge workload to the practical aspects such as invoicing, offsetting, cost transfer, etc., and if it is not handled in a timely manner or in a standardized manner, it will lead to a loss of revenue.Over-recognition of income and over-payment of tax in prior periodsThe funds are unreasonably tied up.

If your company is in need of tax compliance or difficult account handling, etc., feel free to inquire (WeChat: 13045886252)▼▼▼

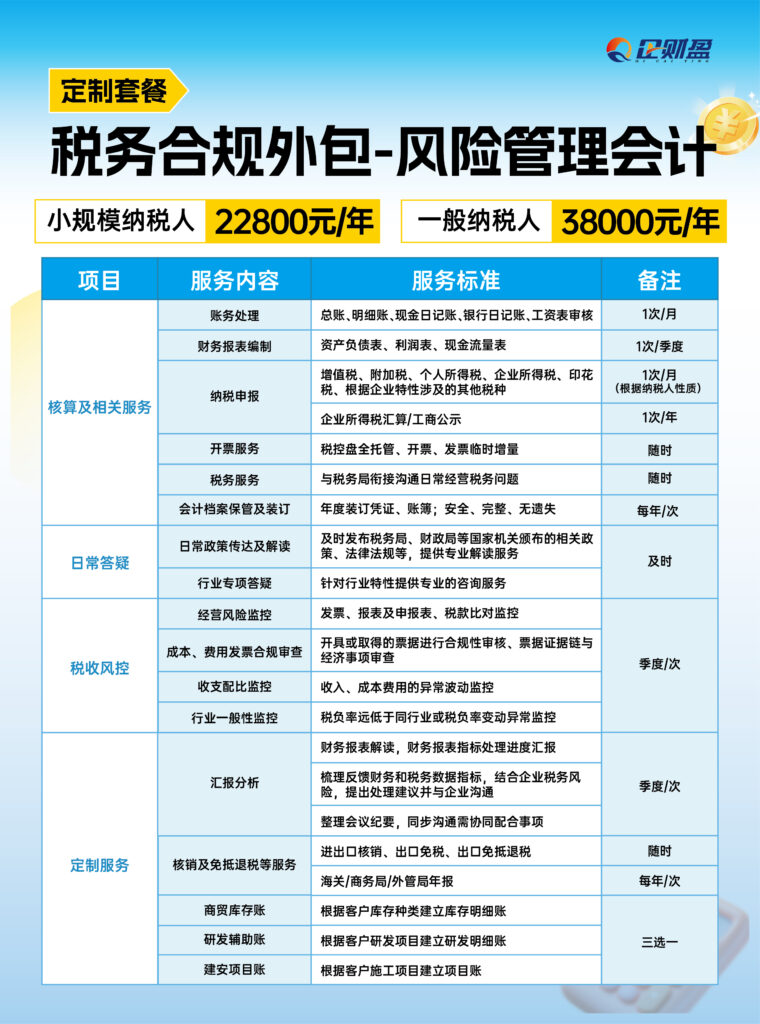

If you are experiencing more difficult corporate tax compliance issues, you can refer to Enterprise Finance Group's Tax Compliance Product Package II for solutions.

04 The Compliance Dilemma: Where are the Profits After Regulation?

These three pain points stack up to create a harsh reality:Once tax compliance is strictly enforced, many e-commerce companies will have to pay high taxes on the portion of their profits that is "not their true profit".

Let's take an e-commerce company with a pure store model as an example of a short account:

Assume that its merchandise gross margin is only 15% (which is not uncommon in competitive platform e-commerce).

- value-added tax (VAT): At the rate of 13%, if there is a significant shortfall in input votes, VAT will be payable on almost 13% of sales.

- surplus after tax: 15% of gross profit, after deducting 13% of VAT, leaves only 2%.

- corporate income taxThe "gross profit" of $2% has to be deducted from operating expenses (of which a large number of non-billable expenses and over-limit advertising costs are not deductible), and the final book profit may be minimal or even negative, but after tax adjustments, the taxable income may still be very high.

Therefore, e-commerce tax compliance is not as simple as simply making the accounts "beautiful" and importing the water into the bookkeeping software. Rough "standardization" may lead to an embarrassing end: the account is standardized, but the company has lost its ability to survive due to excessive tax burden.

This is particularly fatal for owners of store clusters where margins are already thin and turnover is based on scale.

Corporate High Risks and Response Strategies

1) Three major high-risks (e-commerce / anchor focus on vigilance)

| Type of risk | group of people | Risk consequences |

| split operation | Multi-store enterprise | Consolidated Tax Trigger Exceeded, Back Tax at 13% |

| Replacement of business entities | Cross-border e-commerce, anchor | Tax and penalty costs spike when historical data is combined and exceeded |

| Concealment and misreporting of income | Ticketless income-based e-commerce/anchor | After being audited by Big Data, rehydrated at 13% + fines |

typical exampleAn e-commerce company's sales in April 2026 had exceeded 5 million, but because of the delay in pushing data from the platform (on a quarterly basis), the overrun was only discovered in July: it was necessary to correct the VAT declaration for April-June and pay three months of additional tax at 13% instead of the original small-sized 1%, and the profit margins were seriously compressed.

2) Corporate Response StrategiesCore Portfolio:Internal finance team (focusing on internal bookkeeping) + external year-round tax consultant (professional guidance, regular compliance checks, training for finance staff).Necessity:Under the upgrading of tax administration, it is difficult for a single internal finance team to cover the full dimension of compliance needs, and external consultants can make up for the shortcomings of specialization, which is the most economical compliance solution. If your company needs tax compliance or more difficult account processing, etc., you can always consult (WeChat: 13045886252)▼▼▼▼

If you are experiencing a particularly difficult corporate tax compliance issue, you can refer to Enterprise Finance Group's Tax Compliance Product Package III for a solution.

05 Breakthrough Ideas: Finding a Balance Between Compliance and Survival

Since tax-related information reporting is a major trend and the road to compliance must be traveled, the key is:How do you find a solution that meets regulatory requirements while allowing e-commerce businesses to pay taxes and retain profits?

This requires planning and optimization at an integrated level of business model, tax structure and financial management:

1)Business Re-engineering and Supply Chain Sorting::

Revisit the upstream supply chain to find a new balance between price and compliance. Gradually replace key suppliers with partners who can provide compliant tickets, even if the cost of purchasing goes up slightly, but obtaining deductible input tickets can recover from the overall tax burden.

2) Main design and tax planning::

According to the segmentation of business segments (e.g. cross-border platforms, store groups, live streaming with goods, offline sourcing, etc.), rationally utilize the tax policies of different market players (e.g. preferential policies for small and micro enterprises, individual businessmen and women), and carry out a conglomerate or matrix layout. For segments with high non-invoiced expenses such as Darren Carrying Goods, explore modes such as settlement through compliant platforms to convert labor remuneration into purchasing costs that can be invoiced.

3) Accurate accounting and account management::

Establish a financial accounting system that is highly compatible with the e-commerce business. Especially for the characteristic items such as return, promotion fee, platform fee, etc., carry out refined account processing and tax preparation to ensure the data is accurate and avoid overpayment of unjust tax.

4) Policy Research and Compliance Innovation::

Pay close attention to and study tax policies and local financial support policies for new businesses such as e-commerce and live broadcasting. Under the premise of legal compliance, make good use of various tax incentives and approved levies and other tools.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business tax services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / French company / New Zealand company / Japanese company / / Singapore company / Thai company / Vietnamese company / Malaysian company, and other foreign companies Company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop services, etc. can be found in the enterprise CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant with you in detail! Communication ↓↓↓

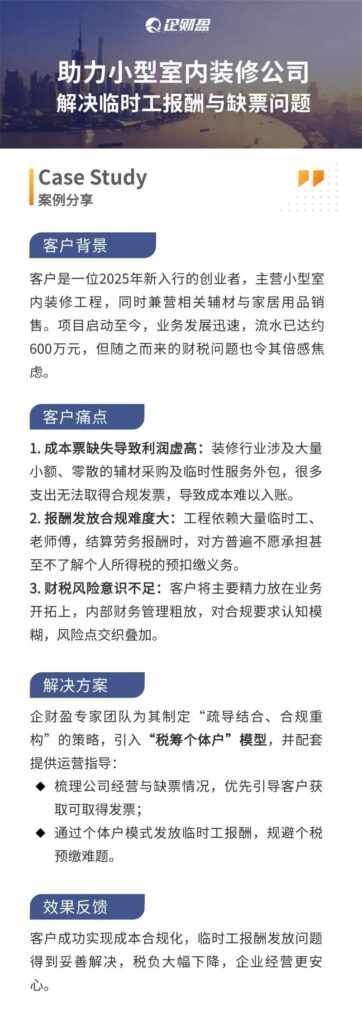

06 Real-life examples of tax compliance at Enterprise Finance Group

07 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Guide

- Tax Compliance Cases

- tax planning

- taxation services

- Tax Compliance Optimization

- Tax Compliance