Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, but also provides the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / France company / New Zealand company / Japan company / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign companies Registered related business services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

Brazil officially announced a visa-free policy for Chinese citizens.

The landing of this policy, marking the level of facilitation of personnel exchanges between China and Pakistan to achieve leapfrog improvement, but also for Chinese passport holders to travel the American continent opened up a more convenient channel.

For a long time, South American countries have been known for their cumbersome visa process and high threshold, with Brazil being a typical representative.

Previously, Brazilian visas not only required applicants to visit embassies and consulates for face-to-face interviews, but also did not recognize the exemption status of visas from third-party countries such as the U.S., which contrasted sharply with the entry facilitation policies of some South American countries for U.S. visa holders, and became an important bottleneck restricting China-Brazil people-to-people exchanges and cross-border exchanges.

Not long ago, the Brazilian government took the lead in launching an e-visa policy for Chinese citizens, significantly simplifying the application process, shortening the approval cycle, and reducing the difficulty of processing the originally complex visa to a "convenient and accessible" level, which triggered widespread concern and positive reactions in the market.

The official announcement of the visa-free policy is a further upgrade of the policy benefits on the basis of the electronic visa, completely breaking the last barrier for cross-border travel between China and Pakistan.

According to the details of the policy disclosed by the official, Chinese citizens holding valid ordinary passports to Brazil can enjoy the convenience of visa-free entry, applicable to business, tourism, visiting friends and relatives, exchange visits and transit and other purposes of travel, the maximum duration of a single stay of up to 30 days.

The implementation of this policy not only eliminates the cumbersome process and time cost of visa application, but also reduces the economic threshold of cross-border travel, allowing more Chinese citizens to have the opportunity to conveniently visit the natural wonders, humanistic heritage and diversified customs of this large South American country.

In fact, cooperation between China and Pakistan in the area of facilitating people-to-people exchanges has continued to deepen in recent years.

Previously, China has extended the unilateral visa-free policy for Brazilian citizens until December 31, 2026, and Brazil has been included in China's list of countries expanding the scope of visa-free access since June 2025. The gradual implementation of the two-way visa-free policy between the two sides has built up a good pattern of "two-way mutual exemption and convenient access".

The official implementation of Brazil's visa-free policy for China is an important initiative for China and Brazil to deepen humanistic exchanges and promote economic and trade cooperation, which will not only greatly stimulate the enthusiasm of Chinese citizens to travel to Brazil for tourism and business visits, but also inject new vitality into China-Brazil cooperation in trade, investment, culture and tourism, education and other fields.

Data show that in 2025, the bilateral trade volume between China and Pakistan will continue to maintain the growth trend, and the scale of people-to-people exchanges will be gradually restored to the pre-epidemic level, and the landing of the visa-free policy will further amplify the driving effect of "people-to-people exchanges" on "mutual promotion of trade and economic cooperation", and promote the development of the Sino-Brazilian comprehensive strategic partnership to a deeper level. The implementation of the visa-free policy will further magnify the driving effect of "people-to-people exchanges" on "economic and trade mutual promotion" and promote the development of China-Pakistan comprehensive strategic partnership to a deeper level.

Therefore, today, we are going to share Brazil's business environment, favorable policies, and the benefits of registering a Brazilian company, as well as the types of Brazilian companies and tax rates, in order to provide professional support for cross-border sellers who plan to register a Brazilian company, or those who already have a Brazilian company.

01 What is the business environment in Brazil?

What are the benefits of Brazil's foreign investment climate for registering a Brazilian company?

In recent years, the Brazilian government has taken a number of measures to improve the business environment and attract the inflow of foreign investment.

The Brazilian Investment Promotion Agency (Apex-Brasil) actively promotes the entry of foreign investors into the Brazilian market with various policy incentives, including tax incentives, simplified approval procedures, and investment subsidies.

However, despite the fact that Brazil shows great potential for investment in a number of areas, there are still a number of potential risks that foreign companies need to deal with when operating in the country.

First, Brazil has a complex tax system. Brazilian taxation involves three levels of federal, state and municipal taxes, and there are significant differences in tax rates and tax requirements between states and municipalities, resulting in higher compliance costs for companies.

Second, Brazil's laws and regulations are lengthy, with more administrative approvals and legal requirements, especially when it comes to environmental protection, labor regulations, and foreign exchange controls.

In addition, the Brazilian economy is highly cyclical, with high inflation and volatile financial markets.

Historically, Brazil's high inflation rate, currency devaluation and high interest rates have posed serious financial risks to foreign companies.

Although the Brazilian government has stabilized the economy to a certain extent in recent years through macroeconomic regulation policies, changes in the global economic situation may still have a greater impact on the Brazilian economy.

Finally, Brazil's infrastructure development, although gradually improving, is still inadequate in some areas. Especially in the interior, roads, ports, airports and other infrastructure are relatively poor, which may affect the efficiency of supply chains and logistics costs for enterprises.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign companies Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓

02 Brazil's favorable visa waiver policy for China

According to the official rules issued by the Brazilian Federal Government, the main favorable manifestations are the following:

1) Applicable objects:

Citizens holding Chinese ordinary passports (private passports) with a validity period of not less than six months, excluding holders of diplomatic passports, official passports and other special documents;

2) Purpose of entry:

It is limited to tourism, visiting relatives and friends, business negotiations, short-term exchange visits and transit, excluding employment, study, long-term residence and other matters that require special visas;

3) Duration of stay:

The maximum duration of stay for a single entry is 30 days, calculated from the day following entry into Brazil, with no application for extension or renewal of the visa, and the cumulative duration of stay within a 12-month period may not exceed 90 days;

4) Ports of entry:

It applies to all international airports, seaports and land crossings open to the public throughout Brazil, including major hubs such as São Paulo Guarulhos International Airport, Rio de Janeiro Galão International Airport and Brasilia International Airport;

5) Application materials:

No need to apply for a visa in advance, when entering the country, you need to present the following documents to the Brazilian Immigration Bureau (Federal Police): Chinese passport with a validity period of not less than 6 months, return air ticket or connecting air ticket to a third country, proof of hotel booking or letter of reception for lodging, proof of funds per capita per day of R$500 (about 700 yuan) (can be provided in the form of bank card, cash, credit card), in some cases it may be necessary to cooperate with the provision of a travel planning instructions. In some cases it may be necessary to provide an itinerary planner;

6) Policy validity period:

It will come into effect on February 1, 2026, with an initial validity period of 2 years, after which the extension will be evaluated based on the flow of people between China and Pakistan;

7) Special provisions:

Visa-free entrants are not allowed to engage in paid labor, academic research, or other activities beyond the scope of their authorization in Brazil, and in case of violation will be repatriated in accordance with the law and may be subject to restrictions on future admissions.

For cross-border travelers, this policy not only means simplified trip planning and lower costs, but also represents increased opportunities for cross-border exchanges and broadened horizons.

At a time when globalization continues to deepen, the implementation of the China-Pakistan visa-free policy will undoubtedly build a more convenient "friendship bridge" for the people of the two countries, and help China-Pakistan cooperation blossom into an even more brilliant luster in the new era.

03 Why incorporate a Brazilian company? What are the benefits?

Let's start with what are the benefits of registering a Brazilian company and why you need to register a local company to sail to Brazil.

1) Product Certification

Brazil has a strict certification system for imported products in order to maintain market order and protect consumer rights, and any uncertified products are at risk of being seized.

So what is the inevitable relationship between a Brazilian local company and product certification? Maybe you don't know, there is a mandatory condition before doing product certification, that is, you need a Brazilian company as a licensee in order to do the certification, so many sellers will be stuck in this step.

(2) Tax self-declaration

Brazil is a country with a complex and varied tax system, which has many types of taxes.

For companies, understanding and mastering tax filing is a key step to successfully entering Brazil.

Currently, Brazilian local companies are adopting the self-declaration model in terms of tax payment, which means that sellers can reduce their operating costs and increase their profit margins by reasonably planning their taxes, otherwise, it may give you a big headache in terms of the amount of tax payment.

3)No need to prove the flow of water in the store and be able to open full

If you are a new seller, only cross-border store, you must provide the relevant mainstream platform (single platform single store) in the past 6 months the average monthly water flow of more than 5000 U.S. dollars to prove in order to be stationed, this is a mandatory condition, otherwise you will not be able to carry out your business blueprint.

Secondly, having a local Brazilian company that can open full warehouses has two major advantages.

Product Flow:After opening the FULL warehouse, the product page will have a "green FULL mark", the traffic and ranking of the product link will be significantly improved, and the weight of the store will be higher. Especially during the promotion activities, FULL warehouse products will get more exposure.

Logistics:The use of FULL warehouse can reduce the tediousness of logistics operations, shipping directly from the official warehouse, and ensure that orders are processed within 24 hours, according to the buyer's address to control the product delivery in 1-3 working days.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign companies Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓

04 BrazilForms of incorporation of companies

Enterprises can choose from the following three forms of registration depending on their situation:

1) Local wholly owned company (simple and fast timeframe)

Registration time: usually about 3-4 weeks;

Registered capital: unlimited capital injection, no need for paid-in capital;

Advantages of registration: local account opening, simple process, speed;

Requirements for registration: Brazilian/permanent resident/blue card holder as legal representative and 100% shareholding.

2) Foreign holding company (compliance holding preferred)

Registration time: 1-3 months;

Advantage of registration: foreign enterprise control, platform entry is more compliant.

Registration Requirements: 99% foreign shareholding + 1% shareholding by Brazilian legal representative / 100% foreign shareholding;

Registered capital: unlimited registered capital, no need for paid-in. (Except for specific industries or the need to apply for import and export quota at a later stage)

3) Investment immigration companies (long-term layout, safe and controllable)

Registration time: about 3-7 months;

Advantage of registration: you can get permanent residence, the legal representative is your own person, compliance and security;

Registered Capital: Paid-up capital is required, with a minimum of R$150,000 paid-up capital (but with 10 registered Brazilian employees) or a one-time investment of more than R$500,000;

Registration requirements: first find a Brazilian to be the company's legal representative to register the company, then Chinese people for investment immigration visa, get the identity of the legal representative of the company changed to Brazil.

How to choose the type of company registration?

If you are initially testing the waters of the Brazilian market, you can choose a local wholly-owned company; if you need foreign control and emphasize compliance, it is recommended that you choose a foreign holding company; if you plan for long-term development and want the legal representative to take control of the company on his or her own, an investment immigration company is more appropriate and safer.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign companies Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓

05 How are Brazilian companies taxed?

How does a Brazilian company choose the method of tax calculation? There are currently three types of tax calculation methods.

(1) Simples Nacional (Simplified Taxation Act)

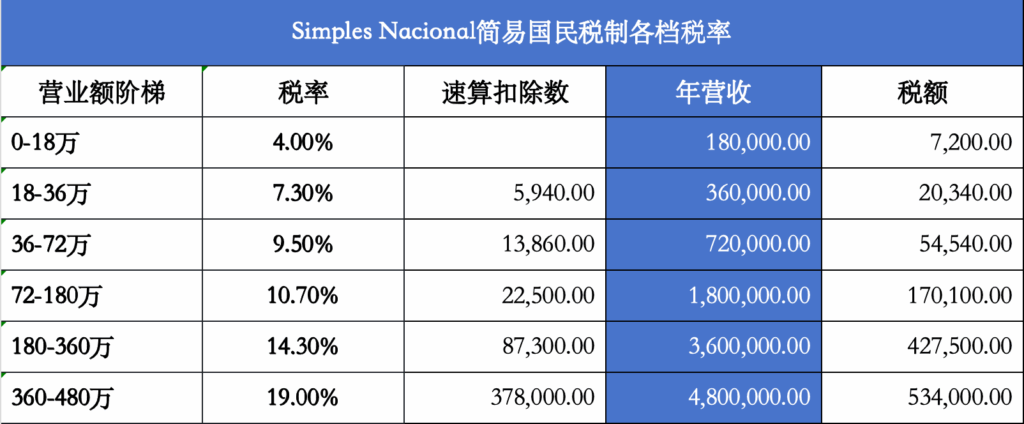

Created specifically for small and micro businesses with annual revenues up to $4.8 million, the tax system pays a single tax (DAS) based on the type of business, which includes federal, state and municipal taxes.

The simplified tax method uses a progressive form of taxation, taxed as a percentage of a business's gross receipts, usually between 4% and 19%, and is paid on a monthly basis.

Simplified tax system tax rate table / Image from the Internet

The tax system has certain limitations - it is not available to companies with annual revenues of more than R$4.8 million, to foreign companies, and to some companies belonging to specific industries (finance, transportation, electricity, importers of cars and motorcycles, etc.).

(2) Lucro Presumido (imputed profit method)

The tax system is based on corporate income and estimated profit margins to calculate taxable income, which is then used to calculate the income tax (IRPJ) and the net profit social contribution charge (CSLL).

In estimating profits, taxable income is 81 TP3T of the business's gross receipts from the sale of goods in the case of a business that sells goods, or 321 TP3T of service receipts in the case of a business that provides services.

In addition, companies that choose the imputed profits method of taxation are subject to income tax (PIS rate of 0.651 TP3T and COFINS rate of 31 TP3T), which is calculated on a cumulative basis, and the tax base for this method is gross business income, with no credit against the tax base for the company's related costs and expenses.

The imputed profits method is subject to certain limitations, such as the exclusion of companies with annual revenues exceeding R$78 million and financial institutions from the use of the tax system.

3) Lucro Real Profit Method

The tax regime applies to businesses with annual revenues exceeding R$78 million or those that want to keep precise records of income and expenses, detailed accounting of costs and expenses, and have requirements for completeness and accuracy of financial records.

The Actual Profit Method requires a business to accurately record revenues and expenses to calculate net profit, deduct tax-exempt income through actual profit, and add non-deductible income tax expenses to calculate the business's taxable income.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related corporate services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / French company / New Zealand company / Japanese company / / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign company Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce to accompany the operation of the enterprise one-stop service, etc. can be found in the enterprise CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant to communicate with you in detail ↓↓↓↓

06 Services offered by the Enterprise Finance Group

Founded in 2015, Enterprise Caiying has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industrial, commercial, taxation and business services for enterprises and individuals, covering domestic and international industrial and commercial qualifications/tax and equity/overseas identity and asset allocation/cross-border e-commerce, and other core businesses.

The company employs nearly 400 people, and its core team consists of senior lawyers, accountants, tax experts and business consultants. At present, Enterprise Caiying has set up branches in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia and the United States. So far, it has provided services for 300,000 small and medium-sized enterprises, with more than 50,000 long-term cooperative customers.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company / Vietnam company / Malaysian company and other foreign company registration related business services, the company's annual review / bookkeeping and tax returns / payment of mandatory contributions / change of Information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, etc. can be found in the enterprise Caiying Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax adviser to communicate with you in detail ↓↓↓↓

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Registration of Brazilian Companies

- Types of Brazilian company registration

- Brazilian company registration process

- Brazilian company

- Brazilian Company Registration