Enterprise Caiying Group to provide the United States / Singapore / Japan / Thailand / Malaysia / Canada / Mexico / Brazil / UK / France / New Zealand / Japan / Singapore / Vietnam / Indonesia / Malaysia and other foreign companies registered in the relevant business tax services, but also to provide Hong Kong companies / Shenzhen companies / Guangzhou companies / Shanghai companies / Hangzhou companies / Beijing companies / Hainan companies and other domestic companies registered corporate services, company annual audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / Hainan company Company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic company registration of corporate services, company annual audit audit / bookkeeping and tax returns / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252 ).

In today's accelerated integration of the global industrial chain, more and more enterprises are actively laying out overseas to seek new markets and new opportunities. However, the first step to go overseas - how to comply with the exit of funds? It often becomes the first "compliance threshold" faced by enterprises.

ODI filing is the "official passport" for Chinese enterprises to invest abroad. Without it, capital can't go out, projects are difficult to land, and profits are difficult to flow back.

01 What is an ODI filing?

With the ODI filing entering the new stage of "full-chain penetrating supervision + refined service", "filing first" has become an insurmountable red line for enterprises to go overseas. Many enterprises are unfamiliar with the new regulations, and either misjudged the suitability of the project and missed the opportunity, or the materials were rejected due to non-compliance.

ODI (Outbound Direct Investment) filing is a statutory pre-procedure for domestic enterprises to carry out overseas controlled investment before the NDRC, the Ministry of Commerce, and the OFAC to review and approve in collaboration with the three departments. The core logic of the current new regulations is "hierarchical control, penetrating verification", the three departments to establish a data-sharing mechanism, the equity structure, source of funds, business substance of the whole chain review, shell investment, irregularities in the sea and other behaviors are accurately controlled. Note: natural persons can not directly for ODI filing, must be a domestic enterprise legal person as the main body; not complete the filing or approval of the investment, will face a fine of 10%-30% investment amount, and 3 years prohibited cross-border investment and financing.

02 Which projects require ODI filing?

(1) The nature of the project: to clarify the boundaries of the three categories of "encouragement, restriction and prohibition".

Incentive programs:Including "Belt and Road" along the infrastructure, high-tech manufacturing, energy resources exploration, processing of agricultural products, etc., can enjoy the green channel, A-class enterprises under 10 million U.S. dollars of investment in the fastest 9 days to close.

Restricted/sensitive items:An authorization system, rather than a filing system, is required. Sensitive industries include key areas such as artificial intelligence infrastructure, 6G, strategic minerals, etc., and investments in real estate, studios, sports clubs, etc., are virtually impossible to pass; sensitive regions include non-federalized countries, sanctioned countries, and war-torn areas, and investments need to be additionally submitted with geopolitical risk assessment reports.

Prohibited items:Shell structure investment without real business, involving weapons and equipment, cross-border water resources development, etc., directly reject the filing application.

2) Subjects and finances:

Hard indicators are missing

Subject Requirements:The enterprise legal person (except the pilot industry of the free trade port) which has been established in China for one year according to the law, with the business scope containing the expression of "offshore investment", the actual controller without any major violation of laws and regulations, and the report of "Credit China" must be provided.

Financial indicators:No loss in the recent 1-year audit report, net assets not less than 2 times the investment amount, gearing ratio ≤ 70%; return on net assets higher than 5% is more likely to pass the audit, and C-level enterprises (high debt, violation records) will be suspended from filing eligibility for 1 year.

3) Authenticity of investments:

The core points of penetrating verification of the source of funds need to be legal and traceable, prohibit the use of bank loans, financial funds investment, own funds need to provide proof of running water, shareholder loans need notarized contracts; the project needs to have commercial substance, need to provide an offshore office address, proof of full-time employees, to avoid the nesting of multiple layers of equity, otherwise it will be recognized as a shell structure dismissed.

If you need to do ODI filing or go to overseas countries to start a business, you can always consult (WeChat same number: 13045886252)▼▼▼

Enterprise Caiying Group's ODI Filing Delivery Case

03 Which companies need ODI filing?

🌟 An ODI filing is required whenever your business does one of the following:

✅ New Establishment: the creation or acquisition of a new company abroad and the assumption of control;

✅ M&A participation: Acquisition/participation in a foreign company with effective control;

✅ Establishment of branches: establishment of offices, branches and other business entities outside the country;

✅ Financing support: internal and external loans for overseas subsidiaries, banks require ODI certificates;

✅ Additional investment: capital increase and capital injection in foreign subsidiaries;

✅ Return Investment: Overseas listed companies investing back to their home countries are required to issue ODI filing certificates.

✅ Applicable to:

:: Mainland enterprises intending to invest in the establishment of offshore companies (including offshore companies in Hong Kong, Singapore, BVI, Cayman, etc.).

:: Has registered an offshore entity with a Mainland company as a shareholder but has not yet applied for an ODI.

● Customers whose place of registration is in Shanghai, Chongqing, or other areas where ODI is not allowed.

● Applicable entities: Mainland-registered cross-border e-commerce enterprises (/companies are eligible).

04 Why cross-border e-commerce must do ODI?

2025-2026 regulatory context, with policy drivers being the main reason:

● Amazon has been reporting transaction, revenue, and bank account information of all Chinese sellers to Chinese tax authorities on a quarterly basis since October 2025 (covering 22 sites).

:: The IRD will identify hidden income through a four-source comparison of "platform data + bank flows + customs declarations + ODI filings".

● No ODI = no proof of linkage between offshore company and domestic entity = profit repatriation is treated as "individual splitting of foreign exchange purchases" or "clandestine money laundering".

💡 Conclusion: ODI is not a cost, it is a "tax compliance moat" for cross-border e-commerce.

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Japanese company / Singapore company / Vietnamese company / Indonesian company / Malaysian company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the↓ ↓ ↓

05 List of information required for ODI filing

(1) Business license of the domestic company (scanned copy, need to be stamped).

(2) The latest year's reported financial audit report of the domestic company (serious losses should be supplemented with financial statements of the last month).

(3) domestic company law, shareholders ID card copy (Note: If the shareholders are natural persons to provide a copy of the ID card; if the shareholders are companies to provide shareholders with the business license of the enterprise; legal person ID card to be stamped with the official seal).

4) Articles of Incorporation of the domestic company, Articles of Incorporation of the foreign company and a translation (if the foreign company already exists).

(5) Funding business plan, market research, etc. or investment environment analysis and evaluation of the outline (briefly explain the investment is out of consideration of what factors in the local, such as policy, market, etc.), the source of funds for the investment of the outline (briefly explain, for example, whether the funds are 100% derived from the parent company in the territory) (please provide an outline of the details of the refinement of our company's team of enterprise finance and earnings).

(6) Brief description of domestic and foreign products, award honors or certificates of qualification, etc., with pictures.

7) Company profile, link address of the company's official website (if any).

8) Cooperation agreements with overseas partners (if any).

9) Chart of the shareholding structure going back to the beneficial owner.

(10) Whether the overseas subsidiary is a joint venture with an overseas enterprise/natural person, if so, the natural person should provide identity documents (ID card or passport) and the enterprise should provide enterprise information; an agreement of intent to cooperate should also be provided (if any).

(11) In the case of mergers and acquisitions need to produce merger and acquisition-related contracts, agreements, statements.

(12) The M&A filing issues an asset valuation report issued by a third-party organization to assess the value of the subject of the M&A.

(13) to provide the original certificate of own funds issued by the bank (Requirements: ① Head: to the XX Municipal Commission of Commerce / to the XX Municipal Development and Reform Commission; ② the amount of deposits need to be greater than the amount of the investment filing) (the enterprise is not to be provided for the time being, the later information editing is completed we tell the enterprise to go to the bank to derive).

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Japanese company / Singapore company / Vietnamese company / Indonesian company / Malaysian company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the↓ ↓ ↓

06 ODI Filing Process

(i) Pre-preparation (3-7 days)

Clarify the investment destination and project details to avoid conflicting local policies (e.g., Uganda restricts foreign investment in small-scale retailing).

Prepare core materials: business license, audit report for the last 1 year, description of funding source, short version of feasibility study (10 pages or less is sufficient for non-sensitive projects), and commitment to authenticity.

(ii) Three sectoral declarations (20-30 days)

(1) Filing by NDRC: Log in to the National Online Approval and Supervision Platform for Investment Projects and obtain the Notice of Filing for Overseas Investment Projects in about 10 working days after submitting the materials, focusing on verifying the compliance of the project.

(2) Recorded by the Ministry of Commerce: Uploading materials through the Overseas Investment Management System and receiving the Certificate of Enterprise Overseas Investment in about 8 working days, noting that the certificate is valid for 2 years.

(3) Foreign exchange registration: docking with ODI-qualified banks, opening a special account, completing the registration can purchase foreign exchange remittance, the first capital contribution is not less than the total investment amount of 30%.

(iii) Follow-up compliance maintenance January-June each year

Submission of joint annual report on foreign investment, major changes (capital increase, stock transfer over 10%) need to be reported within 30 days.

Compliance certificates are retained for more than five years to avoid subsequent business being affected by a lack of post-investment management.

Common Funding Methods and Pitfall Avoidance Points

(1) Cash contribution is the mainstream method, which needs to be remitted through a dedicated account to avoid split remittance;

(2) In-kind contributions require an asset evaluation report, procurement contract and transportation documents;

(3) Equity, intangible assets need to complete the value assessment and ownership certificate, complex structure is recommended to consult a professional organization in advance, such as the Enterprise Caiying Group.

High-frequency dismissal reasons need to be avoided:

If the materials are not double-certified, the financial report is outdated, the localization commitment is not up to standard (e.g. the ratio of local employees is not clear in overseas projects), the source of funds is ambiguous, etc., it is recommended to adopt the dual-track pre-qualification of "China end + overseas end" to improve the passing rate.

The current ODI filing policy not only strengthens regulation, but also optimizes the process for compliant enterprises. Enterprises need to accurately judge the suitability of projects and plan capital and structure in advance before going overseas, in order to efficiently complete the filing and build a compliant foundation for offshore business.

If you need to do ODI filing or go to overseas countries to start a business, you can drop me at any time (WeChat the same number: 13045886252)▼▼▼

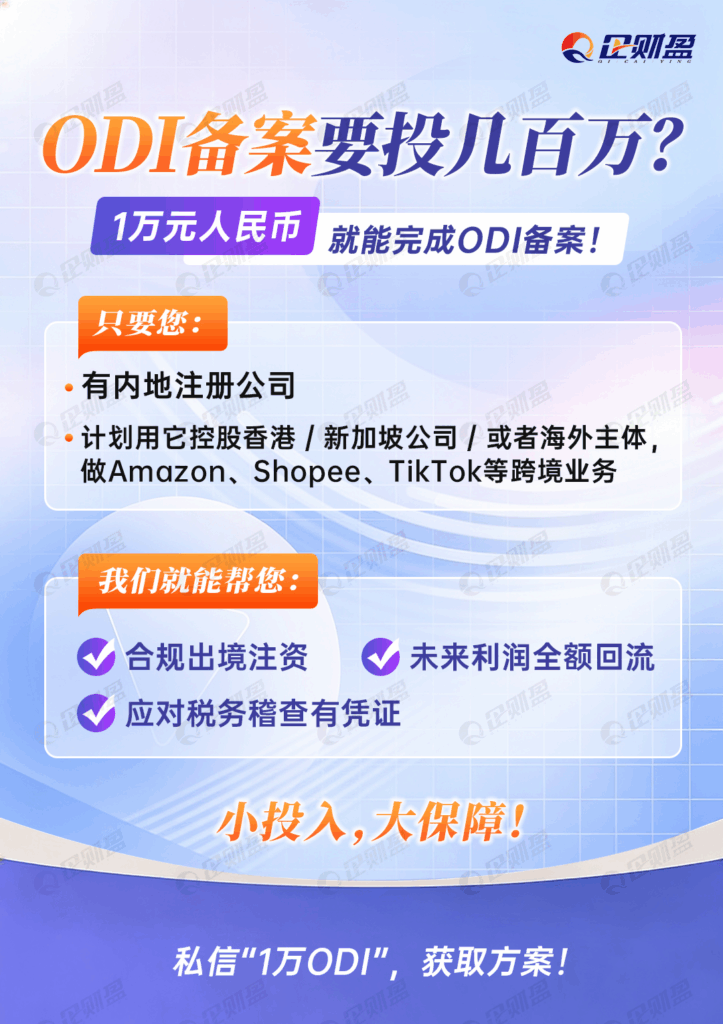

07 Enterprise Finance Group ODIProduct Packages(small amount friendly - fast delivery)

✅ Basic: [Cross-border departure ODI]

●Applicable to: first time overseas, small scale sellers, test period enterprises.

●Filing amount: less than 500,000 U.S. dollars (newly established), 10,000 RMB can be filed.

Services: Dual filing with NDRC + Ministry of Commerce.

○Simplified Business Plan

Explanation of source of funds (shareholders' loans/profit sharing available)

○Bank Foreign Exchange Registration Counseling

Combination price: ODI filing + Hong Kong company registration + BOC account opening reduced by $1200

● Discount offer: private message me phone with V: 13045886252 feel free to consult.

✅ Upgraded: [Compliance Closed Loop ODI]

●Applicable: have stabilized profitability, plan to operate for a long period of time, and have a need for return flow.

●Filing amount: $510,000 - $1,000,000 (newly established).

:: Additional services: Hong Kong company registration (if not already established).

○Bank of China account opening (search fee HK$150)

○Cross-border capital repatriation path design

Combination price: ODI filing + Hong Kong company registration + BOC account opening = $1,200 down

● Discount offer: private message me phone with V: 13045886252 feel free to consult.

The offer has expired, please consult the customer service phone with V: 13045886252 inquiry.

08 A partial collection of ODI filing delivery cases from Enterprise Finance Group

Recently, we, Enterprise Caiying Group, have assisted a number of enterprises in the fields of science and technology, manufacturing, trade, etc., to efficiently complete the ODI filing and successfully promote the landing of their overseas projects!

09 Services offered by Enterprise Finance Group

Founded in 2015, Enterprise Caiying has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industrial, commercial, taxation and business services for enterprises and individuals, covering domestic and international industrial and commercial qualifications/tax and equity/overseas identity and asset allocation/cross-border e-commerce, and other core businesses.

Details of the services provided by the Enterprise Finance Group:

Enterprise Caiying Group Strength:

Core strengths of the Enterprise Caiying Group:

The company employs nearly 400 people, and its core team consists of senior lawyers, accountants, tax experts and business consultants. At present, Enterprise Caiying has set up branches in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia and the United States. So far, it has provided services for 300,000 small and medium-sized enterprises, with more than 50,000 long-term cooperative customers.

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Japanese company / Singapore company / Vietnamese company / Indonesian company / Malaysian company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the↓ ↓ ↓

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- odi filing process

- ODI Filing Cases

- odi filing application

- ODI Filing

- ODI