Enterprise Caiying Group to provide the United States / Singapore / Japan / Thailand / Malaysia / Canada / Mexico / Brazil / UK / France / New Zealand / Japan / Singapore / Vietnam / Indonesia / Malaysia and other foreign companies registered in the relevant business tax services, but also to provide Hong Kong companies / Shenzhen companies / Guangzhou companies / Shanghai companies / Hangzhou companies / Beijing companies / Hainan companies and other domestic companies registered corporate services, company annual audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / Hainan company Company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic company registration of corporate services, company annual audit audit / bookkeeping and tax returns / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252 ).

For the majority of cross-border e-commerce sellers, tax compliance has recently become a difficult and focal point in their operations.

There are several core headaches that people commonly face, including compliance filings for multi-store models, difficult deductions for overseas platform expenses, purchases without invoices, and income tax cost expensing.

Tax compliance policies have progressed

Currently, progress on the core issues of concern to sellers is focused in three main directions:

1) In terms of a compliant way out of a multi-store operation:It is recommended that a "filing system" be adopted. Specifically, the information (such as tax identification numbers and store names) of multiple stores under the same business entity will be filed with the local tax authorities through a filing system, and eventually summarized in a core filing entity.

2) For overseas platform fees:It is recommended to adopt the "positive enumeration" method similar to that of stamp duty to clarify the items and proportion that can be expensed, including what kind of costs can be expensed, what kind of bills can be expensed, and what kind of vouchers can be expensed, etc., so as to help the sellers to make EIT declaration in a more reasonable manner.

3) In process optimization and voucher management:For those who get special invoices, tax refund will be made through intelligent and digital means in the future to speed up the timeliness of tax refund; for those who get ordinary invoices, the focus is to promote the standardization of cost expensing before enterprise income tax; for those who do not have invoices, the core of the business is to promote the sunshine and convenience of the operation of "tax exemption without invoices" and make it legally implementable through the on-line registration and other systematic solutions. The systematic program makes it legal.

Therefore, against the backdrop of tightening compliance regulations and normalization of tax audits, many companies are facing common problems such as missing cost tickets, social security non-compliance, and difficulties in handling large sums of money.

Recently, Enterprise Caiying Group has provided in-depth services to clients from different industries, such as automobile marketing, decoration engineering, culture and media, and successfully helped them to build a compliance structure, optimize tax costs and resolve potential risks. These typical cases reflect our deep insight into the real business scenarios of enterprises and our systematic solution capability.

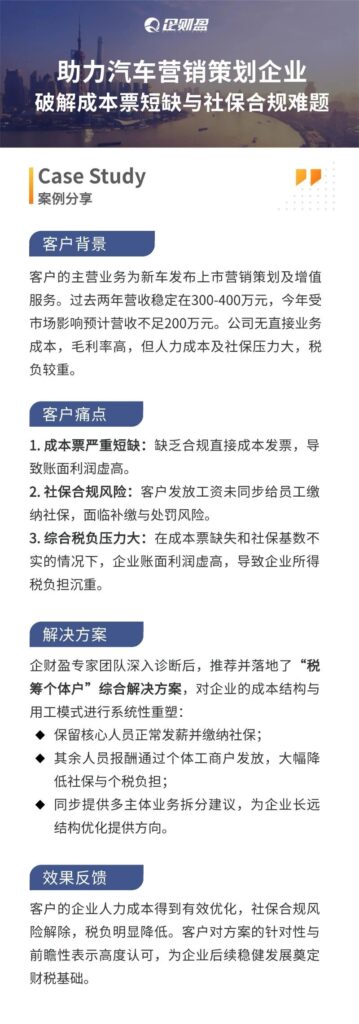

01 Enterprise Finance Group Real Customer Case 1

Today we share a [tax compliance] case study from Enterprise Finance Group.

The client's main business is marketing planning and value-added services for new car launches. Revenue has been stable at $3-4 million over the past two years and is expected to be less than $2 million this year due to market impact.

The company has no direct operating costs and high gross margins, but labor costs and social security pressures are high and the tax burden is heavy. Currently it is facing 3 main problems:

1) There is a severe shortage of cost tickets:Lack of compliant direct cost invoicing leads to inflated book profits.

2) Social Security Compliance Risks:Client pays wages without synchronizing social security contributions to employees, exposing them to the risk of retroactive contributions and penalties.

3) The combined tax burden is under pressure:In the absence of cost tickets and inaccurate social security bases, enterprises' book profits are inflated, resulting in a heavy corporate income tax burden.

Solutions provided by the Enterprise Cai Ying team:

After an in-depth understanding, our expert team recommended and implemented a comprehensive solution for "tax-financed self-employed", which systematically reshaped the cost structure and labor model of the enterprise.

(1) Retain core staff on regular payroll and social security contributions.

(2) The rest of the personnel compensation is paid through self-employed businessmen, which significantly reduces the burden of social security and personal tax.

(3) Simultaneously provide multi-principal business splitting suggestions to provide direction for long-term corporate structure optimization.

In the end, this client's enterprise manpower costs were effectively optimized, social security compliance risks were lifted, and the tax burden was significantly reduced. The client highly recognizes the relevance and foresight of this program, which lays a good financial and tax foundation for the subsequent sound development of the enterprise.

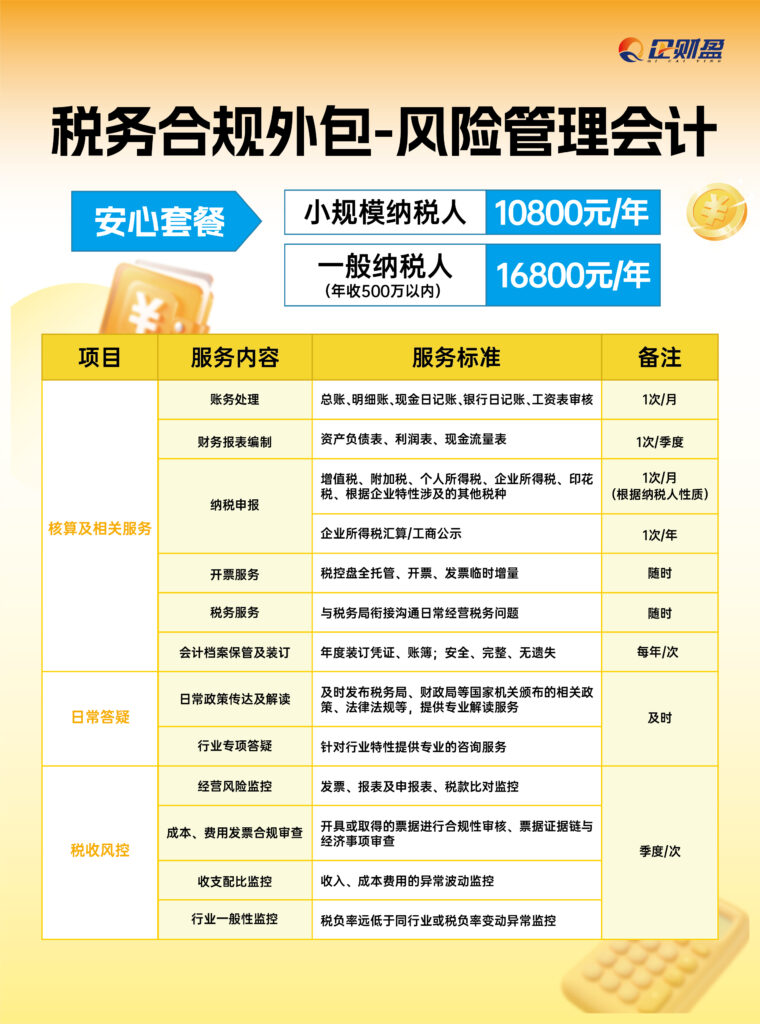

Enterprises CaiYing Group, also successively put forward the [tax compliance] service products 3 packages, the following is a package of service details, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package 1 for solutions.

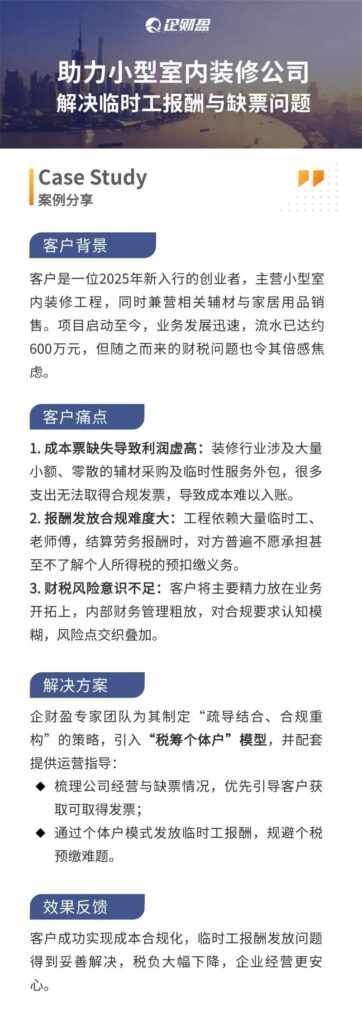

02 Enterprise Finance Group Real Client Case 2

Today, we share a [tax compliance] case study from Enterprise Finance Group2.

The client is a 2025 new entrepreneur who specializes in small interior remodeling projects and also sells related accessories and home furnishings.

Since the start of the project, the business has been developing rapidly, and the water flow has reached about 6 million yuan, but the ensuing financial and tax issues have also caused much anxiety, and the client was facing 3 major problems at that time:

1) Missing cost tickets lead to inflated profits:The decoration industry involves a large number of small and fragmented purchases of auxiliary materials and outsourcing of ad hoc services, and many of the expenditures are unable to obtain compliant invoices, making it difficult to account for the costs.

2) Compensation payments are difficult to comply with:The project relies on a large number of temporary workers and teachers, and when settling the labor compensation, the other party is generally unwilling to undertake or even do not understand the obligation to withhold personal income tax.

(3) Insufficient awareness of fiscal risks:The client focuses mainly on business development, with sloppy internal financial management, fuzzy perception of compliance requirements, and intertwined and overlapping risk points.

Solutions provided by the Enterprise Cai Ying team:

The expert team of Enterprise Caiying formulated the strategy of "combination of guidance and compliance reconstruction", introduced the model of "tax-financed self-employed", and provided supporting operational guidance:

(1) Sort out the company's operation and lack of invoices, and prioritize and guide customers to obtain obtainable invoices.

2) Payment of casual labor compensation through the self-employed model to avoid the challenge of tax prepayment.

The client successfully achieved cost compliance, the issue of payment of compensation for temporary workers was properly resolved, the tax burden was significantly reduced, and the business operated with greater peace of mind.

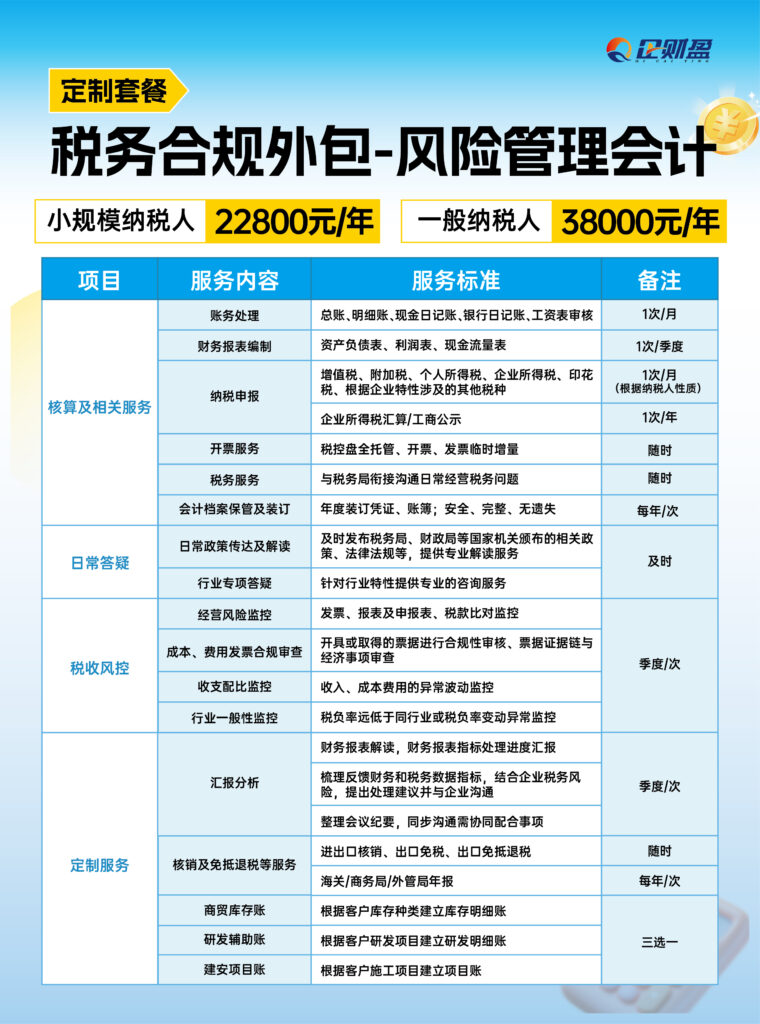

Enterprises CaiYing Group, also successively put forward the [tax compliance] service products 3 packages, the following is a package of service details, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package II for solutions.

Apart from Mainland renovation enterprises, many industries such as cross-border e-commerce enterprises also require tax compliance.

03 Enterprise Finance Group Real Client Case 3

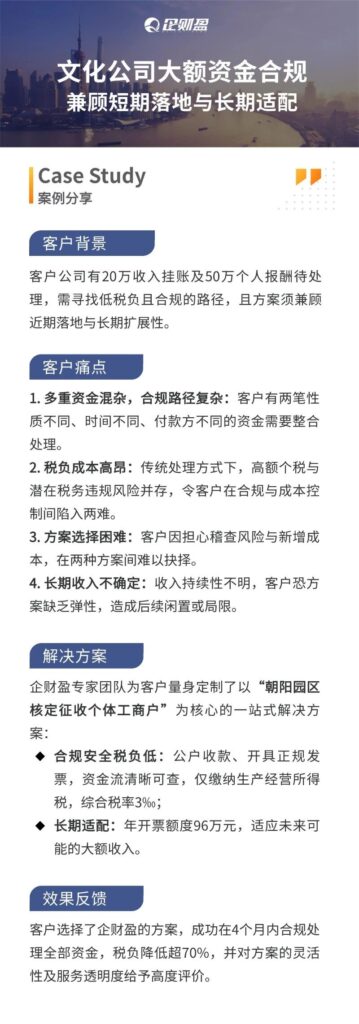

Today, we share a [tax compliance] case study from Enterprise Finance Group3.

The client had $200,000 in pending revenue and $500,000 in personal compensation, and needed to find a low-tax and compliant path that would be scalable for both the near term and the long term. As a result, the client was faced with 4 major challenges:

1) Multiple funds are mixed, and the compliance path is complex:The client has two funds of different nature, at different times and with different payers that need to be consolidated and processed.

2) The tax burden is costly:Under the traditional treatment, high personal tax and the risk of potential tax violations coexist, leaving clients in a dilemma between compliance and cost control.

3) Difficulty in program selection:Customers have a hard time choosing between the two options because of the risk of audits and the added costs.

4) Uncertainty of long-term income:Revenue continuity is unknown, and clients fear program inflexibility, resulting in subsequent inactivity or limitations.

Solutions provided by the Enterprise Cai Ying team:

Our team of experts has customized a one-stop solution for our clients with the core of "Individual Businesses with Approved Levy in Chaoyang Park".

1) Low tax burden for compliance security:Public account collection, formal invoices, clear and traceable flow of funds, only to pay income tax on production and business, the comprehensive tax rate of three thousandths of a percent.

2) Long-term adaptation:The annual billing limit of $960,000 accommodates potentially large future revenues.

The client chose Enterprise Caiying's solution and successfully disposed of all funds in compliance within 4 months, with a tax liability reduction of over 70%, and spoke highly of the flexibility of the solution and the transparency of the service.

Enterprises CaiYing Group, also successively put forward the [tax compliance] service products 3 packages, the following is a package of service details, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

If you are experiencing compliance issues with your corporate taxes, you can refer to Enterprise Finance Group's Tax Compliance Product Package III for solutions.

04 Breakthrough Ideas: Finding a Balance Between Compliance and Survival

Since tax-related information reporting is a major trend and the road to compliance must be traveled, the key is:How do you find a solution that meets regulatory requirements while allowing e-commerce businesses to pay taxes and retain profits?

This requires planning and optimization at an integrated level of business model, tax structure and financial management:

1)Business Re-engineering and Supply Chain Sorting::

Revisit the upstream supply chain to find a new balance between price and compliance. Gradually replace key suppliers with partners who can provide compliant tickets, even if the cost of purchasing goes up slightly, but obtaining deductible input tickets can recover from the overall tax burden.

2) Main design and tax planning::

According to the segmentation of business segments (e.g. cross-border platforms, store groups, live streaming with goods, offline sourcing, etc.), rationally utilize the tax policies of different market players (e.g. preferential policies for small and micro enterprises, individual businessmen and women), and carry out a conglomerate or matrix layout. For segments with high non-invoiced expenses such as Darren Carrying Goods, explore modes such as settlement through compliant platforms to convert labor remuneration into purchasing costs that can be invoiced.

3) Accurate accounting and account management::

Establish a financial accounting system that is highly compatible with the e-commerce business. Especially for the characteristic items such as return, promotion fee, platform fee, etc., carry out refined account processing and tax preparation to ensure the data is accurate and avoid overpayment of unjust tax.

4) Policy Research and Compliance Innovation::

Pay close attention to and study tax policies and local financial support policies for new businesses such as e-commerce and live broadcasting. Under the premise of legal compliance, make good use of various tax incentives and approved levies and other tools.

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Japanese company / Singapore company / Vietnamese company / Indonesian company / Malaysian company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the↓ ↓ ↓

05 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Cases

- Corporate Tax Compliance

- taxation services

- Tax Compliance Optimization

- Tax Compliance