In recent years, Vietnam's political stability and rapid economic development has become one of the choices for many enterprises to go overseas to Southeast Asia. Today to share some practical tips for enterprises to go overseas to build factories in Vietnam.

[Choice of investment path: direct investment vs. structured investment]

1. Direct investment: domestic companies invest directly in Vietnam

It refers to the model where a Chinese domestic company directly establishes a project company in Vietnam (100% shareholding or joint venture with other investors), or where a Chinese domestic company directly acquires all or part of the equity of a Vietnamese company, ultimately resulting in the formation of a Chinese domestic company-Vietnamese company.

2, set up structure investment (recommended): through the intermediate layer of formula shareholding in Vietnamese companies

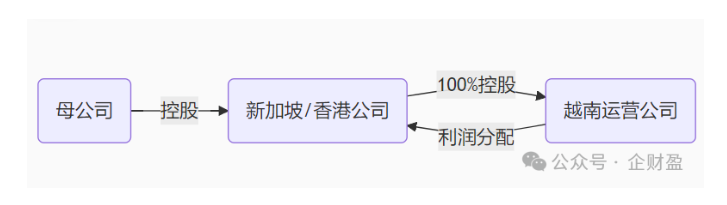

Using Hong Kong or Singapore as an intermediate layer to set up a Hong Kong company/Singaporean company first, and then the Hong Kong company/Singaporean company invests in Vietnam

It means that a company in China first sets up an intermediate company (Hong Kong or Singapore), and then invests in the establishment of a Vietnamese company, or acquires a stake in a Vietnamese company through the intermediate company. Under the middle tier structure, the final formation ofCompanies in China–Singapore Companies/Hong Kong company–The Vietnamese company model.

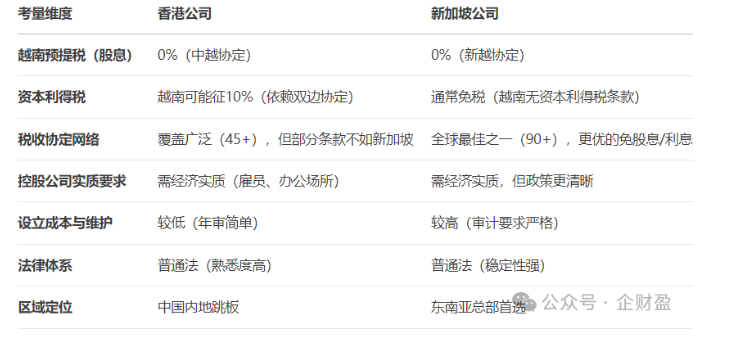

When investing in Vietnam, the choice of a Hong Kong company or a Singapore company as an intermediate tier holding structure needs to take into account factors such as tax efficiency, legal system, bilateral agreements, and business environment. Below are the key comparative analysis and recommendations:

- Core factor considerations:

Prioritize the Hong Kong scene:

- Greater China Connections: If there is a need to interface with supply chains or customers in Mainland China, Hong Kong has clear geographical and linguistic advantages.

- Cost-sensitive: Initial set-up and maintenance costs are lower, making it suitable for small and medium-sized investors.

- Short-term investment exit: Hong Kong's highly liquid capital market facilitates IPOs or resale of equity at a later stage.

Prioritize the Singapore scene:

- Long-term strategy for South-East Asia: If Vietnam is used as a base to radiate ASEAN (Indonesia, Thailand, etc.), Singapore is in a better position as a regional headquarters.

- Tax security: Singapore has better tax treaties (e.g. clear tax exemptions for dividends/interest) and more robust capital gains tax treatment.

- Financing facilitation: Singapore's mature capital market is suitable for issuing international bonds or attracting global capital.

- Technology/manufacturing investments: Singapore's S&T cooperation with Vietnam is strong, with good policy synergies.

Practical advice:

- Singapore Path::Suitable for profit reinvestment in Southeast Asia, utilizing Singapore-Vietnam Agreement relief.

- Hong Kong Path::Suitable for profit repatriation to the Mainland or Hong Kong capital market operations.

Substantive operations::- Leasing office in Singapore/Hong Kong, hiring local staff, holding board meetings.

- Avoid being recognized as a "letterbox company" (e.g. Singapore requires at least 1 local director).

In addition to considering tax planning, target market positioning, geopolitical stability, and potential risks, entrepreneurial identity planning should not be overlooked, as it not only facilitates identity for individuals and families, but also further optimizes tax planning to achieve tax savings for global businesses.

If the entrepreneur has plans to get Hong Kong/Singapore status, the path to self-employment renewal, application for permanent residence or investment immigration will be smoother through local middle tier companies.

Regardless of where you choose, be sure to complete your FDI capitalization through a local Vietnamese bank (to avoid third-party payments being investigated) and keep complete cross-border capital flow documentation (tax clearance certificates, audit reports) for compliance reviews.

Vietnam company registration fees, according to the industry (trade, production) domestic, foreign, different regions have different costs, our company provides overseas company registration, bank account opening, address dependency, tax compliance, identity application for a full set of services.

If your enterprise has the need to invest in Vietnam to build factories, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, to provide professional advice and the whole process of one-on-one service!

- Southeast Asia

- external trade

- Vietnam Company Registration

- cross-border e-commerce