Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related corporate services, also provides the United States company / Canadian company / Mexico company / Brazil company / British company / France company / New Zealand company / Japan company / Singapore company / Thailand company / Vietnam company / Indonesia company / Malaysia Companies and other foreign companies registered in the relevant business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, there is a need for or interested in any time to drop me (phone and WeChat consulting: 13045886252).

It is reported that Lazada Cross Border Store has issued an important announcement that according to the latest regulations of the Thai government, all imported goods with a value of not less than 1 baht (based on CIF value) will be subject to import tariffs on top of the original VAT as of 0:00 on January 14, 2026.

This means that cross-border sellers need to bear both tariffs and VAT, and the cost structure will change.

We would like to remind all sellers that they should recalculate the cost of goods and sales price according to the customs product classification and corresponding tax rate as soon as possible. In order to protect the profit margin and smooth transition, please update the tax-inclusive selling price through the seller's back office in a timely manner, and synchronize the adjustment of all kinds of marketing tools in the store (such as coupons, add-on discounts, set discounts, etc.).

Since January 14, the platform will directly deduct the relevant taxes from the seller's income of cross-border orders on the Thai site in accordance with the regulations. It is worth noting that this tax adjustment only applies to cross-border orders, local fulfillment orders are not affected.

Example of tax calculation for your reference

Assume that the CIF value of the commodity is 500 baht:

1) Import duty (for example, 10%): 500 × 10% = 50 baht (new at this time).

2) VAT (rate 7%): (500 + 50) × 7% = 38.50 baht (already levied since July 2024, adjusted accordingly due to tariff increase).

3) Total amount of order after taxes and fees: 500 + 50 + 38.50 = 588.50 Baht.

In addition to this, for items involved in the Global Plus campaign, sellers are required to edit and adjust the price through the product management page in the CSP merchant back office from January 9th to 14th; they can also choose to opt out of the campaign during this period, and then perform the price adjustment operation in the ASC merchant back office.

This policy adjustment was long overdue, as back in 2025, the Thai Customs Department had already issued an announcement stating that it would eliminate duty-free treatment for imports of less than 1,500 baht as of January 1, 2026, and instead levy customs duties and VAT on all goods valued at 1 baht and above, with a combined rate of generally not less than 171 TP3T.

Thai Customs has signed a memorandum of cooperation with platforms such as Lazada, Shopee, SHEIN, TikTok Shop, and TEMU, aiming to standardize taxes and promote local e-commerce. Under the new tax system, most low-value goods are categorized as fashion items, with tariffs on clothing and footwear at around 30%, bags at around 20%, and other goods mostly taxed between 10%-20%. This move indicates that Thailand is further strengthening tax control on imported goods, so sellers are requested to prepare for this in time.

If you need to register a Thai company or need a brother platform on behalf of the station, whether it is stationed Shopee, Lazada, SHEIN, TEMU or TikTok Shop such global giants, you can call or WeChat consulting: 13045886252, there are questions and answers.

01 Advantages of registering a Thai company

Located in the center of Southeast Asia, Thailand is an important ASEAN economy, with agriculture, manufacturing and tourism as its mainstays. The capital city of Bangkok is an international financial and logistics hub with excellent infrastructure. Thailand has an inclusive culture, open policies, a population of 70 million, and a strategic geographic location that provides access to global markets. The government has launched the "Thailand 4.0" strategy, focusing on the development of high-tech industries and providing tax breaks, industrial parks and other incentives to attract foreign investment. In addition, a vibrant consumer market, low labor costs and a continuously optimized business environment have made Thailand a popular destination for global investors.

✅ Government incentives: The Thai government has introduced a series of incentives that allow foreign-controlled companies to be able to enjoy incentives in many areas.

✅ Location Advantage: Thailand is a centerpiece within the Asian region and is strategically located, making it ideal for businesses that need to trade across borders, in addition to being a member of the ASEAN countries, which makes it easy to trade with other ASEAN countries.

✅ Advantage of Trade Freedom: Thailand is currently involved in free trade agreements including: ASEAN Comprehensive Investment Agreement, ASEAN Framework Agreement on Services, Australia-Thailand Free Trade Agreement, Japan-Thailand Economic Partnership Agreement, U.S.-Thailand Treaty of Friendship and Economic Relations, etc., which enables the company registered in Thailand to do business to conduct free trade in the international arena.

✅ Saving on tax costs: Thailand's low tax rate, pioneering single tax system and various capital relief programs are very beneficial to companies that are new to the market and in their formative years.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration of the relevant business services, but also provides the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company /Thai company/ Vietnam / Malaysia companies and other foreign companies registered in the relevant business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

02 Types of Thailand Company Registration

Before registering a Thai company, you need to know which type of Thai company is right for you.

1) Joint Venture

A. Scope of business is not required.

B. Registered capital is recommended to be at least 2 million baht without capital verification.

C. The registration of a joint venture company requires at least one Thai shareholder with a shareholding of 51% or more, with a maximum of 1-3 foreign shareholders, who can be legal persons or natural persons, and it is recommended to use two Thai shareholders in order to avoid risks.

2) Wholly Overseas Incorporated (BOI)

A. The business scope of the wholly foreign-owned company is restricted, and it is generally a large-scale production and manufacturing enterprise.

B. Registered capital needs to be 10 million - 200 million baht, and capital verification is required after account opening.

C. Shareholders may be foreign legal or natural persons.

D. Directors may be foreign natural persons.

3) Branch Office

A. The scope of business is not limited.

B. Registered capital of at least 3 million baht.

C. Shareholders may be foreign legal or natural persons.

D. Directors may be natural persons of Thai nationality.

Note: If it is a small investment is recommended to open a joint venture company, because the BOI company procedures are more cumbersome, and approval down at least more than 3 months, and then go through the process of submitting an application to receive the BOI certificate, and then submit a project application to the Board of Investment, but also need to apply for a "foreign business license", after the audit is passed before you can begin to After the approval, we can start the operation in Thailand.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration of the relevant business services, but also provides the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company /Thai company/ Vietnam / Malaysia companies and other foreign companies registered in the relevant business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

03 Requirements for registering a Thai company

a. Type of company:Sino-Thai Joint Venture Limited Liability Company.

b. Registered capital:Up to 5,000,000 baht is not required to be paid up, and it is recommended that it can be done for 2,000,000 baht.

c. Scope of business:The scope of business needs to be clearly listed in the Articles of Incorporation, with no limitations.

d. Shareholder and Director Requirements.Shareholders: At least 2 persons, of which at least 1 is Thai, and the proportion of foreign capital shall not be higher than 49% (the proposal is 3 Thai shareholders with a total of 51%, and the remaining 49% shall be foreign shareholders), and there is no restriction on the nationality of the foreign shareholders, who can be either natural persons or corporations. Director: at least 1 person, can only be a natural person, no nationality restriction.

e. Registered address: You must have a local address, and we can provide you with an address to register your company.

04 Required documents for registering a Thai company

A. Provide 1-3 company names in English, Chinese is not acceptable.

B. The first page and visa page of the passport of the company's legal representative (signature authority).

C. Shareholder information: Individual shareholders need to provide a scanned copy of the shareholder's passport.

D. Shareholding ratio of the company's shareholders (Foreign Shareholder A: MR. XXXX49%, Thai Shareholder A: 17%, Thai Shareholder B: 17%, Thai Shareholder C: 17%).

E. Information of Thai shareholders (to be provided by the customer, if necessary, we will provide additional fees).

F. Initial registered capital of the company (within 5,000,000 baht).

G. Company registered address (to be provided by the customer, if we need to provide another fee).

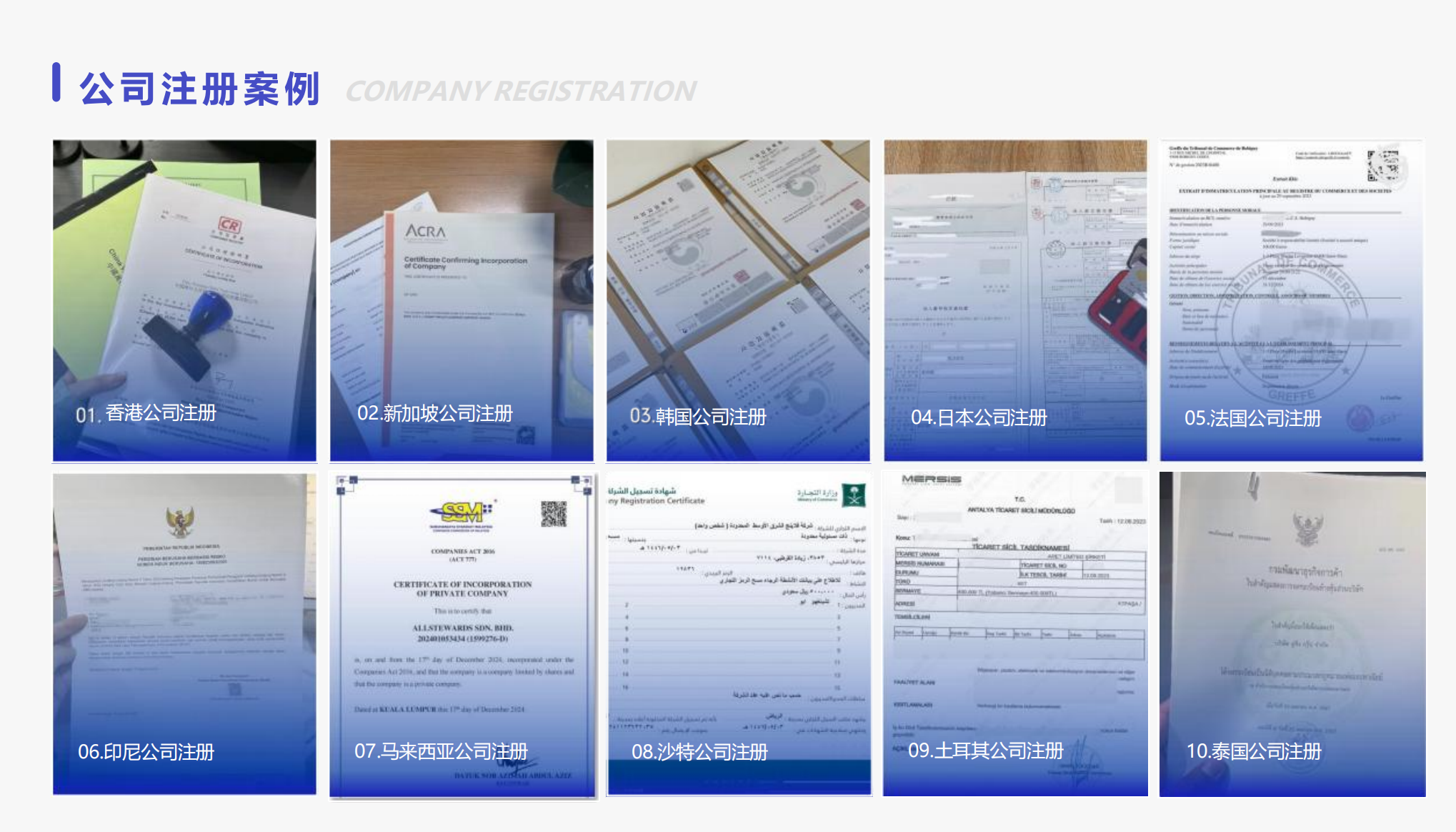

According to the above information, to our company enterprise financial surplus entrusted to deal with the registration of Thai companies, and then you can get the certificate of registration of Thai companies as above.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexico company / British company / New Zealand / Singapore company /Thai company/ Vietnam / Malaysia companies and other foreign companies registered in the relevant business services, company annual review / bookkeeping and tax / payment of MPF / change of information / bank account opening / ODI filing / cross-border e-commerce run on behalf of the operation of the enterprise one-stop services such as enterprises can look for enterprises Caiying Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scanning the following two-dimensional code] to match your needs. There will be a professional tax consultant to communicate with you in detail ↓↓↓↓

05 Process or steps to register a Thai company

To set up a Thai limited company, you need to follow specific steps to register according to the following guide:

Step 1: Company Name Reservation

When booking any company name, the name booking guidelines provided by the Department of Business Development (DBD), Ministry of Commerce, should be followed.

We usually ask our clients to provide at least 2-3 bookable company names in case the required name is already taken or unavailable.

Step 2: Identification of promoters, shareholders and directors

To form a Thai limited company, you need to have at least two promoters and shareholders and one director to register and form a company.

If the shareholders are both Thai and foreigners, or if the shareholders are all Thai but the director is a foreigner, a certificate of the Thai shareholder's bank statement issued by the Bank of Thailand is required to prove that the amount of funds in his/her bank account equals or exceeds the cost of the shares held by each Thai shareholder.

We usually ask for details of the promoters, shareholders and directors of the company such as passport or Thai ID number, age, address, occupation, contact details etc.

Step 3: Filing of Memorandum of Association

The Memorandum of Association (MOA) must be submitted to the Department of Business Development (DBD) of the Ministry of Commerce, which includes the name of the company that has been successfully booked, the province in which the company is located, the objectives of the business, the registered capital, and the names of the promoters.

While there is no minimum capital requirement, the amount of capital should be sufficient and reasonable to meet the needs of the anticipated business operations.

In addition, if you plan to hire a foreigner, you will need a minimum capital of 2 million baht (THB 2,000,000) per foreigner in order to obtain a non-immigrant "B" visa and a work permit for them to work in Thailand.

Step 4: Convene a statutory meeting

Following the determination of the company's share structure, the approval of the Memorandum and Articles of Association, the election of the Board of Directors and the appointment of the auditors, a statutory meeting is convened to make all appointments.

Step 5: Registration

The directors of a company must submit an application for incorporation and pay the company registration fee within three months from the date of the statutory meeting.

Step 6: Incorporation of the company for corporate income tax purposes

All companies in Thailand are required to register for tax purposes. Businesses that are liable to pay Corporate Income Tax (CIT) must obtain a tax card and company registration number from the Inland Revenue Authority of Thailand (IRAT) within 60 days of the company's establishment or commencement of business.

Business operators who are liable to pay Value Added Tax (VAT) are also required to register for a VAT ID within 30 days from the date of sales of 600,000 baht.

Step 7: Opening a company bank account

Company bank accounts and internet banking can be opened in Thailand once the company is officially registered.

Some of the details required to open a company bank account include the bank and branch where the account will be opened, the type of account the company needs and who will sign the relevant documents.

The registration process usually takes at least 9 days (mainly because the statutory meeting should be held at least 7 days before registration).

Both the company and the memorandum of association shall be registered with the Registrar of the Department of Business Development, Ministry of Commerce, in accordance with the prescribed format and conditions of the document.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexico company / British company / New Zealand / Singapore company /Thai company/ Vietnam / Malaysia companies and other foreign companies registered in the relevant business services, company annual review / bookkeeping and tax / payment of MPF / change of information / bank account opening / ODI filing / cross-border e-commerce run on behalf of the operation of the enterprise one-stop services such as enterprises can look for enterprises Caiying Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scanning the following two-dimensional code] to match your needs. There will be a professional tax consultant to communicate with you in detail ↓↓↓↓

06 Frequently Asked Questions about Registering a Thai Company

1) How many shareholders are required to register a Thai company?

According to the law, there can be as few as 2 shareholders, but in practice, it is more common to have 3 shareholders. The shareholder structure can be 1 Thai + 2 foreigners, or 2 Thai + 1 foreigner, but no matter what the combination is, one premise remains unchanged: the total shareholding of Thai shareholders is ≥ 51%, and the total shareholding of foreign shareholders is ≤ 49%.

An example:1 Thai + 2 foreigners, the 1 Thai must hold at least 51%, and the remaining 49% will be divided between the 2 foreigners, it is up to you to discuss.

2) Can a foreigner be the legal owner of a company?

Can. Simply put, a "legal person" is the person who signs the company's documents and who represents the company and assumes responsibility for the company to the outside world. This role can be played by a foreigner, no problem.

3) Are there any visa requirements for foreigners to be shareholders?

No. You can be on any visa. It is possible to become a shareholder of a company as a foreigner as long as you go through the proper process.

4) What is the typical amount of registered capital? Does it need to be paid up?

A common starting point is 2 million baht, which in most cases does not need to be paid immediately. The exact amount will depend on the type of industry, the size of the company's plans, and whether or not foreign employees are to be hired.

5) Are there any industry restrictions on the business scope of a Thai company?It has to be looked at in two ways:

A. Wholly foreign-owned companies:The industry is very restrictive and there is a whole list of negatives, and what you can or can't do depends on the specific category.

B. Thai-Foreign Joint Venture (Thai 51%+, Foreign 49%-) Companies:This is usually regarded as a "Thai company", industry restrictions are relatively small, very many industries can be done, and then according to the specific content of the business to apply for the corresponding industry license can be.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexico company / British company / New Zealand / Singapore company /Thai company/ Vietnam / Malaysia companies and other foreign companies registered in the relevant business services, company annual review / bookkeeping and tax / payment of MPF / change of information / bank account opening / ODI filing / cross-border e-commerce run on behalf of the operation of the enterprise one-stop services such as enterprises can look for enterprises Caiying Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scanning the following two-dimensional code] to match your needs. There will be a professional tax consultant to communicate with you in detail ↓↓↓↓

07 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Types of Thai Companies

- Registering a Thai Company

- Thailand Company Registration

- Thailand Company Registration Process

- Thai company