In recent years, the craze for Chinese enterprises to list abroad has continued to heat up. Authoritative data show thatA total of 63 Chinese companies will land on the U.S. stock market in the full year of 2025, up 7% from 59 in 2024;The performance of Hong Kong stock market is even brighter, only in 2025, there are 19 A-share listed companies through the "A + H" mode of landing in Hong Kong, raising a total of 139.993 billion Hong Kong dollars, accounting for nearly half of the total annual IPO of Hong Kong stocks.

Entering 2026, the boom continues, with 16 companies submitting forms to the HKEx in just 7 days at the start of the year, and several organizations predicting that the total IPO fundraising in Hong Kong in 2026 is expected to exceed HK$300 billion. For enterprises planning to go public overseas, structure construction is the first key link, of which red chip structure and VIE structure are the two most mainstream choices.

What exactly are these two architectures? What industries do they apply to? What are the risks to be avoided in the process? This article combines the latest regulatory policies and real cases to provide you with a comprehensive explanation and help you choose the right path for your overseas listing.

If you have a Hong Kong company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

01.Core Concept: What exactly are Red Silk and VIE structures?

Before dismantling the case, let's clarify the core definitions and essential differences between the two architectures to avoid confusion.

1. Red chip structures: the "direct route" to equity control

Red chip structure refers to the model whereby the founder of an enterprise in China establishes a special purpose vehicle (SPV) offshore, then uses that offshore company to reverse-acquire or control the domestic operating entity, and ultimately uses the offshore SPV as the main body to list in an overseas capital market. In brief.It is to "package" the interests of a domestic enterprise into an offshore company and realize offshore listing through direct equity control.

Its core feature is "equity control", clear structure, relatively clear compliance, as long as the completion of cross-border equity transactions for the record and approval, the legal risk is low.

2. The VIE structure: the "curved country rescue" of agreement control

VIE structure (Variable Interest Entities) is a mode of "agreement control", which is mainly used to circumvent the restrictions on foreign investment access in some industries in China. Specifically, the overseas listed entity does not directly hold the equity of the domestic operating entity, but through a series of agreements (e.g., exclusive business cooperation agreement, equity pledge agreement, profit transfer agreement, etc.), to achieve control over the operating activities and profit distribution of the domestic entity, so as to include the performance of the domestic entity in the statement of the overseas listed entity.

Its core features are"No direct equity relationship"The complexity of the agreement system, the need to continuously maintain the validity of the agreement, the relatively higher cost of legal and financial consulting, and the greater impact of policy and regulation

If you have a Hong Kong company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

02.Case Study: Practical Application and Compliance Points of Two Architectures

Beyond the theory, the actual application scenarios can better reflect the differences between the two architectures. Below are 3 real cases to show you the logic of architectural choices in different industries and policy environments.

Case 1: Red-chip structure - the utilization of the "policy window period" for new energy vehicle enterprises

[Corporate background]

A domestic new energy vehicle startup, whose core business is the research, development, production and sales of new energy passenger vehicles, plans to go public in Hong Kong to raise funds.

[Architecture selection logic]

Before 2022, China's traditional automobile manufacturing requirements for the Chinese side of the share ratio of not less than 50%, but from 2022 onwards passenger car manufacturing foreign capital share ratio restrictions are completely abolished; new energy vehicles as a policy to encourage the industry, is no share ratio restrictions, can be directly used red chip structure.

[Architecture building process]

- The founders set up a personal shareholding platform in BVI and then set up a listing entity in Cayman in conjunction with an investment organization;

- Setting up an intermediate holding company (SPV) in Hong Kong through a Cayman company;

- Reverse acquisition of a domestic new energy vehicle manufacturing entity by a Hong Kong SPV and completion of shareholding settlement;

- Completion of ODI (Outward Direct Investment) filing and FX 37 registration to ensure cross-border legal compliance of funds.

[Key highlights]

The enterprise seized the policy window period, after adopting the red chip structure, successfully introduced overseas strategic investors, clear shareholding structure, only 3 months to complete the structure and SFC filing, and finally successfully listed in the Hong Kong stock market, with a fund-raising amount of more than 5 billion Hong Kong dollars.

.

Case 2: VIE Structure - A "White List" Compliance Path for AI Companies

[Corporate background]

A domestic AI technology enterprise, whose core business is the research, development and application of artificial intelligence algorithms, plans to go public in the U.S. stock market, but its business involves part of the domestic data processing, and it needs to circumvent the restrictions on foreign investment access.

[Architecture selection logic]

In 2025, the SEC introduced the "VIE whitelisting system", clarifying that VIE structures can be used in encouraged industries such as internet technology, new energy, high-end manufacturing, etc., provided that they meet the requirement of "non-foreign material involvement". This AI company belongs to the Internet technology category and meets the whitelist entry requirements.

[Structuring and Compliance Points]

- The offshore listed entity (Cayman company) controls the domestic operating entity through an agreement to enter into a package of agreements including exclusive cooperation, profit transfer, and pledge of equity;

- Submit a shareholding penetration report to prove that the founders and core shareholders are all Chinese nationals with no foreign investment component;

- Registering core algorithm copyrights in the name of domestic entities to avoid the outflow of core technologies;

- Domestic lawyers issued a special legal opinion to prove the enforceability of the VIE agreement and supplemented with similar jurisprudence from domestic courts to enhance the persuasiveness.

[Key highlights]

The enterprise successfully bypassed foreign investment restrictions through compliant VIE structure design, while meeting the requirements of the new regulations in 2025, and finally successfully passed the SEC audit and realized the U.S. stock listing.

.

Case 3: Failure of VIE Structure - Map Company's Warning of "Industry No-Go" Zone

[Corporate background]

A domestic map service company, which plans to list in Hong Kong through a VIE structure, with its core business involving map surveying and mapping and geographic information services.

[Reason for failure]

Map surveying and mapping belongs to "data-sensitive industries", and the 2025 VIE white list explicitly excludes such industries and prohibits circumvention of foreign investment restrictions through VIE structures. The enterprise did not identify the industry's prohibited zone in advance and forcibly built a VIE structure, which was directly rejected in the filing process of the Securities and Futures Commission (SFC), with no room for rectification, and ultimately had to give up its plan to go public overseas.

[Warning Points]

Industry access is the "red line" for overseas listing, before choosing the structure, enterprises must first compare the "Negative List for Market Access" to clarify whether their own industry is allowed to be listed overseas and whether they can use VIE structure.

If you have a Hong Kong company registration, other overseas company registration, overseas structure building, cross-border e-commerce tax compliance needs, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

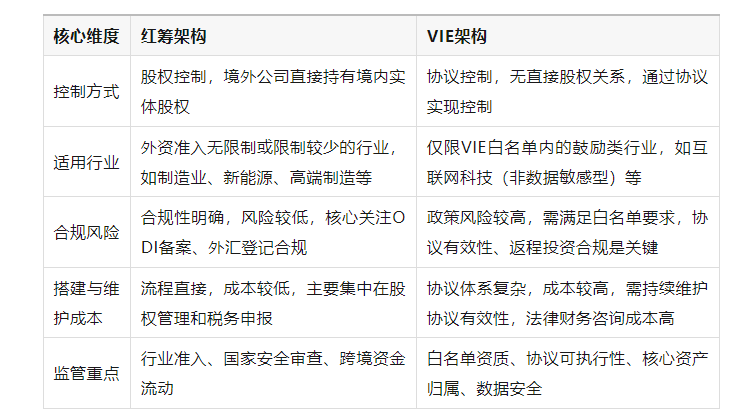

03.Red Chip VS VIE Structure: Core Dimension Comparison

.

04.2026 Core recommendations for architecture selection: compliance first, then landing

Combined with the latest regulatory policies and practical experience, enterprises need to grasp the following 3 core principles when choosing an overseas listing structure:

- Firstly, clarify the industry positioning: against the VIE white list and the negative list of market access, if it belongs to the encouraged category and no foreign investment restrictions, give priority to the red chip structure; if it is an encouraged industry with restricted foreign investment, then consider the compliant VIE structure; absolute prohibited industries (e.g., training for the compulsory education stage, news organizations) are prohibited from overseas listing.

- Completion of compliance filing in advance: red chip structure needs to focus on completing the ODI filing and FX 37 registration to avoid the historical legacy of capital compliance issues; VIE structure needs to pre-communicate with the SEC and the Office of the Internet Information Office in advance to ensure that it meets the whitelisting requirements and that the terms of the agreement are complete and effective.

- Make good use of regional policy dividends: Beijing, Shanghai FTZ and Hainan FTZ have exemptions for foreign investment in some industries, such as stem cells, gene diagnostics, clinical transformation links, companies can optimize the structure of the geographic layout to reduce the difficulty of compliance.

Overseas listing structure is a systematic project, involving law, tax, foreign exchange and other dimensions, a step wrong may lead to listing stagnation or even failure. If your company has an overseas listing plan, you need to clarify the structure of the choice, sorting out the path of compliance welcome to scan the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

- red chip structure

- shareholding structure

- Enterprises Going Overseas

- VIE structure