Three months 90,000 new residents, 1,000 people a day influx, the first quarter of property transactions exceeded 37.1 billion U.S. dollars ...... In the global economy shivering 2025, Dubai is staging a capital carnival. When the UK's 9,500 millionaires collectively "flee", when Indian tycoons and Chinese investors have smashed their money into skyscrapers in the desert, this city known as the "Pearl of the Middle East", in the end, what magic is hidden?

01 Who exactly is the global capital going crazy for Dubai real estate?

"For the price of one apartment in London, you can buy two villas with pools in Dubai." This is a phrase that has been circulating amongst the rich and powerful in the UK lately. 2024, British buyers suddenly took 15% of Dubai's property market share, and the trigger for this was the UK government's maneuvering to abolish the "foreigner's tax on house purchases" - an attempt to retain capital, only for the rich to suddenly find it:Houses in Dubai, so much fragrance!

But the Brits are just the new players. Indians have been on the Dubai property map for years: one in four homes are in the hands of Indian buyers, who are particularly fond of mid- to high-end homes and short-term rentals, relying on rental returns of 8%-9% to make a fortune.

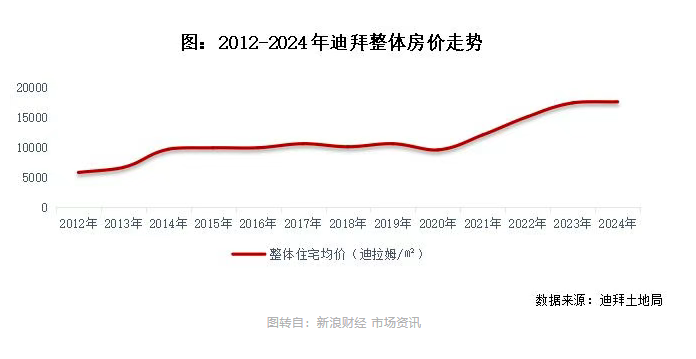

More noteworthy is the return of Chinese investors: the market share has exceeded 10%, which reminds people of 2009 Wenzhou speculation group of sad -- when they put together money to bet on Dubai mansions, but in the financial crisis suffered a property price cut. But history is always in turn: now Dubai "Dragon City" stores, from 200,000 yuan rose to more than 1 million, when the Chinese businessmen rushed in, has already earned a pot full of money.

02 What are the advantages of Dubai real estate?

At a time of high global inflation and geopolitical conflicts, Dubai has become the capital of the"Noah's Ark," by no means luck.

1. Political neutrality+ zero-tax paradise

This is Dubai's hardest bottom line.There is no personal income tax, no capital gains tax, no property tax, not even inheritance tax - the advantage of almost zero holding costs is irresistible to the world's wealthy.More critically, it is not on the CRS list and asset privacy is maximized.

2. Golden visa policy

Dh2 million (about 4 million yuan) to buy a suite, you can get 10 years of residency, the house does not sell can be permanently renewed. 2025 policy upgrades, even educators, electric campaigners can apply, directly attracting more than 100,000 high-net-worth people to settle in, high-end residential demand has been completely ignited.

The supply-demand imbalance has made investors even more frantic. 2024 Dubai's population surged by 169,000, a seven-year high, but there is a severe shortage of housing stock. Although developers are planning to build 300,000 new homes by 2029, the short-term pattern of "too few homes, too many people" has seen villas in the core area rise to 30.3% annually, and small apartments are being snapped up because of their impressive rental returns.

03 8 Hidden Benefits of Buying a Home in Dubai

Don't think that Dubai real estate is just a game for the rich and famous, it is far more friendly to the common man.

1. 400 Chinese Yuan (CNY) 10,000 = permanent residence + Assets:

Buy a suite can get a golden visa, the whole family can get the right of abode, children can go to international schools, no immigration supervision, 6 months activation.

2. Mortgage policies are too friendly:

Non-residents can borrow 50% at 3.5%-5.5% for up to 25 years, and can apply with proof of domestic income without checking current or social security.

3、Zero Public Amortization+ Hardcover delivery:

The house is priced according to the use of the area, balcony, parking space, free use of the pool, gym, buy directly after the turnkey move in.

4, Rental to sale ratio second to none in the country:

The city center can reach 4%, and even 5%-6% in the suburbs. A 5 million house in Shanghai rents for 100,000 per year, while a property of the same price in Dubai rents for more than 200,000 per year.

5. The king of cost-effective international education:

There are over 200 international schools with English, American and IB programs, and tuition fees range from 80,000 to 200,000 RMB, half the cost of domestic schools.

6. Safest city in the world:96.1% people dare to walk alone late at night, and the law and order is so good that the rich can show off their wealth without fear.

7, the purchase process foolproof:No identity verification, no proof of funds, the period of payment of 50% can be resold, the whole transparent closing.

8. The urban dividend continues to be released:Oil revenues account for only 5%, while tourism and commerce support 95% of the economy, with shopping centers, luxury stores, and world-class attractions bringing in a steady stream of people.

- Dubai

- Dubai Real Estate

- Buying a home in Dubai

- Investment in Dubai

- asset allocation

- Enterprises Going Overseas