Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Thai companies / Vietnamese companies Indonesia / Malaysia companies Foreign company registration and other related business tax services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

On December 25, 2024, the Thirteenth Meeting of the Standing Committee of the Fourteenth National People's Congress adopted the Value-Added Tax Law of the People's Republic of China, which came into effect on January 1, 2026.1 The Law was adopted by the Standing Committee of the Fourteenth National People's Congress at its Thirteenth Meeting.

The Regulations of the People's Republic of China on the Implementation of the Value-added Tax Law (the "Regulations") have been promulgated by Decree No. 826 signed by Premier Li Qiang of the State Council on December 25, 2025, and are expressly to come into force on January 1, 2026, while the original Provisional Regulations of the People's Republic of China on Value-added Tax are to be repealed at the same time.

As the first major tax in China, the introduction of the VAT law has realized the upgrading of the tax system under the rule of law, which not only maintains the basic stability of the tax system, but also absorbs the results of the reform practice.

01 The following is the original announcement

The screenshots were too blurry, so I just copied and pasted the original text, keeping the original format for your convenience.

If you need to go to the official website of the State Administration of Taxation to view the original article, you can click or copy and search the following link: https://fgk.chinatax.gov.cn/zcfgk/c100012/c5246538/content.html

Announcement of the State Administration of Taxation on Matters Relating to the Registration and Management of VAT General Taxpayers

State Administration of Taxation Announcement No. 2 of 2026

In accordance with the relevant provisions of the Value-added Tax Law of the People's Republic of China (hereinafter referred to as the VAT Law) and its implementing regulations, matters relating to the registration and management of general taxpayers of value-added tax (hereinafter referred to as the general taxpayers) are hereby announced as follows:

I. A value-added taxpayer (hereinafter referred to as the taxpayer) whose annual assessable value-added tax (VAT) sales exceed the standard for small-scale taxpayers stipulated in the VAT Law (hereinafter referred to as the stipulated standard) shall apply for registration as a general taxpayer, except for the following two types of cases.

(i) Non-enterprise units that do not regularly engage in taxable transactions and whose main business does not fall within the scope of taxable transactions, and that elect to be taxed as small-scale taxpayers (hereinafter referred to as electing to be taxed as small-scale taxpayers);

(ii) Natural persons.

Other cases that should be registered as general taxpayers shall be implemented in accordance with the relevant provisions of the State Administration of Taxation.

II. Taxpayers whose annual assessable value-added tax sales do not exceed the prescribed standards, whose accounting is sound and who are able to provide accurate tax information, may register as general taxpayers.

III. Annual assessable VAT sales refer to the cumulative assessable VAT sales of a taxpayer during an operating period of not more than 12 consecutive months or four quarters. The operating period refers to the consecutive operating period during the existence of the taxpayer, including the months or quarters in which no sales revenue is obtained.

Sales of intangible assets and transfer of immovable property that happen to be incurred by a taxpayer are not included in the calculation of annual VATable sales.

Sales adjusted by taxpayers due to self-supplementation or correction, wind control verification and audit investigation shall be included in the sales of the corresponding tax period according to the time of occurrence of tax obligation.

IV. Taxpayers shall go through the registration procedures for general taxpayers with the competent tax authorities and truthfully fill in the General VAT Taxpayer Registration Form (Annex 1).

If a taxpayer chooses to pay tax in accordance with small-scale taxpayers, it shall submit to the competent tax authorities the "Situation Statement on Choosing to Pay Tax in accordance with Small-Scale Taxpayers" (Annex 2).

V. Taxpayers shall complete the relevant formalities in accordance with the provisions of Article 4 of this Announcement within the following prescribed period:

(a) Where the annual VATable sales of a taxpayer exceeds the prescribed standard due to the adjustment of sales by the taxpayer's own supplementation or correction, wind control verification and audit check, the taxpayer shall be required to do so within 10 working days from the date of adjustment;

(ii) Other annual VATable sales exceeding the prescribed standard shall be declared within the tax period of the month following the month in which the prescribed standard is exceeded.

VI. Except for the provisions of Article 11 of this Announcement, if the taxpayer's annual assessable VAT sales exceed the prescribed standard, the effective date of the general taxpayer shall be the 1st day of the current period in which the prescribed standard is exceeded.

If the taxpayer's annual assessable VAT sales do not exceed the prescribed standard and the general taxpayer is registered, the effective date of the general taxpayer shall be the 1st day of the current period for which the registration is made.

VII. For general taxpayers who have declared VAT as small-scale taxpayers on the effective date, the taxpayers shall correct the declaration on a period-by-period basis according to the general taxpayers. VAT deduction vouchers that have been obtained but not confirmed for use on the effective date of the general taxpayers shall be confirmed for deduction use on a period-by-period basis.

VIII. If a taxpayer fails to complete the relevant formalities in accordance with the deadline stipulated in Article 5 of this Announcement, the taxpayer shall be managed as a general taxpayer from five working days after the end of the stipulated deadline, and the effective date of the general taxpayer shall be determined in accordance with the provisions of Article 6 of this Announcement.

Nine, taxpayers due to their own conditions or changes in business operations, no longer eligible to choose to pay taxes in accordance with the small-scale taxpayers, should be in the change of the current period to the competent tax authorities to report in writing, from the non-compliance with the provisions of the current period is no longer applicable to choose to pay taxes in accordance with the small-scale taxpayers.

If the competent tax authority finds that the taxpayer does not meet the requirement of choosing to pay tax in accordance with small-scale taxpayers, it will make a Notice of Tax Matters within five working days from the date of discovery, and inform the taxpayer that the choice of paying tax in accordance with small-scale taxpayers is no longer applicable from the period when the taxpayer does not meet the requirement.

X. Taxpayers should keep the relevant information involved in the provisions of this announcement for reference.

XI. The effective date of the general taxpayer shall be January 1, 2026, if the taxpayer handles the VAT declaration for small-scale taxpayers for the fourth quarter of 2025 or the December tax period, and the annual assessable VAT sales exceed the prescribed standard.

The effective date of the general taxpayer shall be no earlier than January 1, 2026, if the annual VATable sales exceed the prescribed standard due to the adjustment of sales for the tax period 2025 and earlier as a result of self-supplementation or correction, wind control verification, and audit and investigation.

The effective date of the general taxpayer is January 1, 2026 for taxpayers who calculate their taxable amount based on sales in accordance with the VAT rate before January 1, 2026 and who are not allowed to deduct input tax.

From January 1, 2026, the implementation of the management of tax counseling period for general VAT payers will be discontinued. General taxpayers who are subject to the management of general taxpayers' tax counseling period and have a balance of prepaid VAT due to the issuance of additional VAT special invoices can use it to offset the VAT or apply for a refund from the competent tax authorities.

XII. This Announcement shall come into force on January 1, 2026. The Announcement of the State Administration of Taxation on Several Matters Concerning the Registration and Management of General Taxpayers for Value-added Tax (No. 6 of 2018) and the Circular of the State Administration of Taxation on the Issuance of Measures for the Administration of the Tax Counseling Period for General Taxpayers for Value-added Tax (Guoshuifa [2010] No. 40) are hereby repealed at the same time.

Notice is hereby given.

Annex: 1.VAT General Taxpayer Registration Form.doc

2. Information note on election to be taxed as a small-scale taxpayer.doc

State Administration of Taxation (SAT)

January 1, 2026

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thailand companies / Vietnam companies / Indonesia / Malaysia Companies and other foreign companies registered in the relevant business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account opening / ODI record / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓ ↓↓↓

02 [Value-added Tax Law] Nine Changes in Concise Vernacular Interpretation

State Administration of Taxation Announcement No. 2 of 2026:

① Maintain the previous rolling 12-month or 4-quarter standard for calculating whether cumulative sales revenue exceeds $5 million.

② The sales adjusted by the taxpayer due to self-supplementation or correction, wind control verification, and audit investigation shall be credited to [sales in the corresponding tax period] according to the time of occurrence of the tax obligation.

(iii) Those exceeding 5 million are required to register as general taxpayers within the next month's tax filing deadline (small-scale taxpayers have to pay attention to their income from time to time, and those exceeding the standard in the middle of the quarter can no longer wait for the quarterly filing before registering).

④ Key point! The effective date for general taxpayers is the 1st day of the period in which the required standard is exceeded (i.e., if the standard is exceeded mid-quarter, the tax is calculated at 13% for the month in which it is exceeded! (No more waiting for quarterly filing before upgrading the general taxpayer).

⑤ If a general taxpayer is registered, the effective date of the general taxpayer is the 1st day of the period in which the registration is made (there is no next-month effective date! Only effective on the 1st of the current month!) The effective date of the general taxpayer registration is the 1st day of the period in which the registration is made (there is no next month effective date!

⑥ If the effective date has been declared as a small-scale taxpayer for VAT, the taxpayer shall correct the declaration on a period-by-period basis according to the general taxpayer (late registration as a general taxpayer? No matter, correct and pay 13% VAT from the month of exceeding as general taxpayer).

(vii) Highlights! Taxpayers for the fourth quarter of 2025 or December tax period small-scale taxpayers VAT declaration, annual VAT sales exceed the prescribed standards, the effective date of the general taxpayer for January 1, 2026 (the last quarter of 25 years exceeded the 5 million, do not worry, but also in accordance with the old method from January 2026 will be recognized as a general taxpayer).

⑧ Highlights! Due to self-supplementation or correction, wind control verification, audit checks and other adjustments to the sales of 2025 and before the tax period, the annual assessable value-added tax sales in excess of the required standard, the effective date of the general taxpayer is not earlier than January 1, 2026 (26 years ago, omitted to declare and has exceeded the 5 million how to do? (Don't worry, the previous corrections are still on a small scale, but those after 2026 will have to pay 13% VAT back as a general taxpayer).

⑨ Cessation of the requirement to manage the counseling period for general taxpayers.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thailand companies / Vietnam companies / Indonesia / Malaysia Companies and other foreign companies registered in the relevant business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account opening / ODI record / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓ ↓↓↓

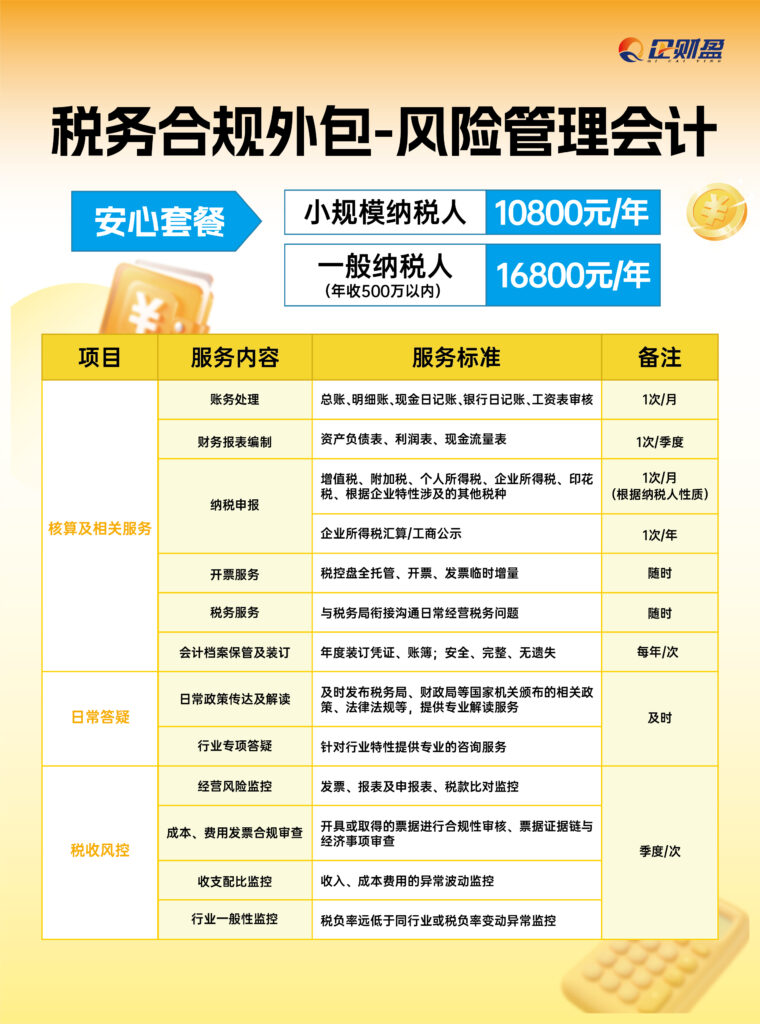

03 What can Enterprise Finance Group offer you?

In the face of the major adjustment of the VAT law, Enterprise Caiying Group, relying on the ability of "tax experts + system support + full-process services", provides the following professional support for the majority of small, medium and micro enterprises:

1) Training on the new tax law and health checkups

A team of senior tax experts will interpret the key points of the new law for enterprises, carry out tax risk assessment and compliance diagnosis, and provide customized optimization suggestions.

2) Contract review and business model optimization

Assisting enterprises in sorting out business contracts, rationally planning transaction structures, and optimizing the application of tax liabilities under the premise of compliance.

3) System upgrade and all-electric invoice adaptation

Provide financial system upgrade support to help enterprises smoothly dock with the all-electric invoice platform and realize a smooth transition to "tax by numbers".

4) Cross-border tax compliance support

Provide tax declaration, information filing and compliance management services under the place of consumption principle for cross-border e-commerce and cross-border service enterprises.

5) Long-term tax planning and consulting services

Accompanying the growth of enterprises, we provide ongoing tax consulting, filing assistance, policy tracking and response strategies.

In the era of the new tax law, compliance is the bottom line and optimization is competitive.

Enterprise Caiying Group is willing to be your tax compliance partner by your side, helping enterprises to cope with changes with ease and grasp development opportunities.

If you need new tax law interpretation, tax health check or system upgrade support, please feel free to contact us at the same phone number as V: 13045886252 for exclusive service package program!

04 Latest version of VAT rate table

Figure from the Internet

05 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Optimization

- Value Added Tax Act

- tax table

- Tax Compliance

- 2026 VAT