Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, but also provides the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / France company / New Zealand company / Japan company / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign companies Registered related business services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

It is reported that recently, according to the Brazilian e-commerce industry report released by Conversion, the structure of Brazilian e-commerce traffic is accelerating to mobile.

As of November 2025, Brazilian e-commerce has seen a cumulative total of 33.9 billion visits over the past 12 months. total visits in a single month in November declined by 1.31 TP3T compared to October, mainly due to a drop in visits via browsers, with web-based traffic slipping by 4.81 TP3T, while app-based traffic increased by 10.61 TP3T year-on-year.

This trend indicates that consumer shopping behavior is accelerating to mobile, while creating market share pressure on platforms that are still predominantly desktop.

The report shows that the Brazilian e-commerce market is highly concentrated, with the top 10 e-commerce platforms accounting for 57.51 TP3T of total visits. among them, Mercado Livre leads the way with a market share of 15.31 TP3T, while Shopee accounts for 11.61 TP3T, Amazon Brasil accounts for 10.41 TP3T, and Shein accounts for 4.41 TP3T.

Mektor is the market leader based on its well-established logistics system and rich product portfolio, while Shopee expands its market influence through its low price strategy and continuous promotions. In the mobile market, Shopee is particularly prominent, with its traffic share in mobile apps reaching 39.2%.

In terms of category-specific performance, sports retail was the brightest performer in November, with overall traffic increasing by 30.11 TP3T. among them, Nike continued to hold the third place in the industry with a 62.41 TP3T increase in visits, while Mizuno moved up to the 10th place. App-based traffic contributed significantly to sports retail, up 29.9% year-on-year, with Netshoes accounting for 40.5% of mobile traffic, or about 5.3 million visits.

Overall, the Brazilian e-commerce market is characterized by a continuous rise in mobile traffic, a high degree of market concentration, and different categories showing differentiated development.

Therefore, today, we are going to share the business environment in Brazil, as well as the benefits of registering a Brazilian company, and the types of Brazilian companies and tax rates, in order to provide professional support for cross-border sellers who plan to register a Brazilian company, or those who already have a Brazilian company.

01 What is the business environment in Brazil?

What are the benefits of Brazil's foreign investment climate for registering a Brazilian company?

In recent years, the Brazilian government has taken a number of measures to improve the business environment and attract the inflow of foreign investment.

The Brazilian Investment Promotion Agency (Apex-Brasil) actively promotes the entry of foreign investors into the Brazilian market with various policy incentives, including tax incentives, simplified approval procedures, and investment subsidies.

However, despite the fact that Brazil shows great potential for investment in a number of areas, there are still a number of potential risks that foreign companies need to deal with when operating in the country.

First, Brazil has a complex tax system. Brazilian taxation involves three levels of federal, state and municipal taxes, and there are significant differences in tax rates and tax requirements between states and municipalities, resulting in higher compliance costs for companies.

Second, Brazil's laws and regulations are lengthy, with more administrative approvals and legal requirements, especially when it comes to environmental protection, labor regulations, and foreign exchange controls.

In addition, the Brazilian economy is highly cyclical, with high inflation and volatile financial markets.

Historically, Brazil's high inflation rate, currency devaluation and high interest rates have posed serious financial risks to foreign companies.

Although the Brazilian government has stabilized the economy to a certain extent in recent years through macroeconomic regulation policies, changes in the global economic situation may still have a greater impact on the Brazilian economy.

Finally, Brazil's infrastructure development, although gradually improving, is still inadequate in some areas. Especially in the interior, roads, ports, airports and other infrastructure are relatively poor, which may affect the efficiency of supply chains and logistics costs for enterprises.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign companies Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓

02 Why incorporate a Brazilian company? What are the benefits?

Let's start with what are the benefits of registering a Brazilian company and why you need to register a local company to sail to Brazil.

1) Product Certification

Brazil has a strict certification system for imported products in order to maintain market order and protect consumer rights, and any uncertified products are at risk of being seized.

So what is the inevitable relationship between a Brazilian local company and product certification? Maybe you don't know, there is a mandatory condition before doing product certification, that is, you need a Brazilian company as a licensee in order to do the certification, so many sellers will be stuck in this step.

(2) Tax self-declaration

Brazil is a country with a complex and varied tax system, which has many types of taxes.

For companies, understanding and mastering tax filing is a key step to successfully entering Brazil.

Currently, Brazilian local companies are adopting the self-declaration model in terms of tax payment, which means that sellers can reduce their operating costs and increase their profit margins by reasonably planning their taxes, otherwise, it may give you a big headache in terms of the amount of tax payment.

3)No need to prove the flow of water in the store and be able to open full

If you are a new seller, only cross-border store, you must provide the relevant mainstream platform (single platform single store) in the past 6 months the average monthly water flow of more than 5000 U.S. dollars to prove in order to be stationed, this is a mandatory condition, otherwise you will not be able to carry out your business blueprint.

Secondly, having a local Brazilian company that can open full warehouses has two major advantages.

Product Flow:After opening the FULL warehouse, the product page will have a "green FULL mark", the traffic and ranking of the product link will be significantly improved, and the weight of the store will be higher. Especially during the promotion activities, FULL warehouse products will get more exposure.

Logistics:The use of FULL warehouse can reduce the tediousness of logistics operations, shipping directly from the official warehouse, and ensure that orders are processed within 24 hours, according to the buyer's address to control the product delivery in 1-3 working days.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign companies Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓

03 BrazilForms of incorporation of companies

Enterprises can choose from the following three forms of registration depending on their situation:

1) Local wholly owned company (simple and fast timeframe)

Registration time: usually about 3-4 weeks;

Registered capital: unlimited capital injection, no need for paid-in capital;

Advantages of registration: local account opening, simple process, speed;

Requirements for registration: Brazilian/permanent resident/blue card holder as legal representative and 100% shareholding.

2) Foreign holding company (compliance holding preferred)

Registration time: 1-3 months;

Advantage of registration: foreign enterprise control, platform entry is more compliant.

Registration Requirements: 99% foreign shareholding + 1% shareholding by Brazilian legal representative / 100% foreign shareholding;

Registered capital: unlimited registered capital, no need for paid-in. (Except for specific industries or the need to apply for import and export quota at a later stage)

3) Investment immigration companies (long-term layout, safe and controllable)

Registration time: about 3-7 months;

Advantage of registration: you can get permanent residence, the legal representative is your own person, compliance and security;

Registered Capital: Paid-up capital is required, with a minimum of R$150,000 paid-up capital (but with 10 registered Brazilian employees) or a one-time investment of more than R$500,000;

Registration requirements: first find a Brazilian to be the company's legal representative to register the company, then Chinese people for investment immigration visa, get the identity of the legal representative of the company changed to Brazil.

How to choose the type of company registration?

If you are initially testing the waters of the Brazilian market, you can choose a local wholly-owned company; if you need foreign control and emphasize compliance, it is recommended that you choose a foreign holding company; if you plan for long-term development and want the legal representative to take control of the company on his or her own, an investment immigration company is more appropriate and safer.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign companies Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓

04 How are Brazilian companies taxed?

How does a Brazilian company choose the method of tax calculation? There are currently three types of tax calculation methods.

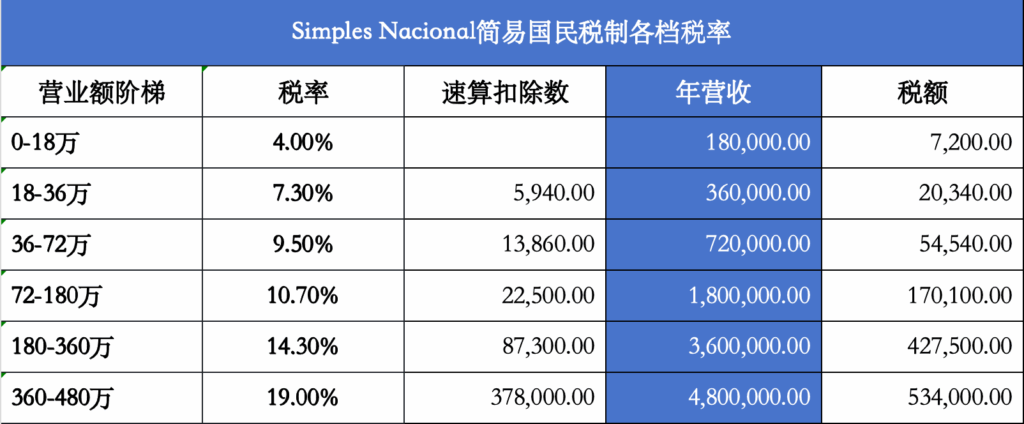

(1) Simples Nacional (Simplified Taxation Act)

Created specifically for small and micro businesses with annual revenues up to $4.8 million, the tax system pays a single tax (DAS) based on the type of business, which includes federal, state and municipal taxes.

The simplified tax method uses a progressive form of taxation, taxed as a percentage of a business's gross receipts, usually between 4% and 19%, and is paid on a monthly basis.

Simplified tax system tax rate table / Image from the Internet

The tax system has certain limitations - it is not available to companies with annual revenues of more than R$4.8 million, to foreign companies, and to some companies belonging to specific industries (finance, transportation, electricity, importers of cars and motorcycles, etc.).

(2) Lucro Presumido (imputed profit method)

The tax system is based on corporate income and estimated profit margins to calculate taxable income, which is then used to calculate the income tax (IRPJ) and the net profit social contribution charge (CSLL).

In estimating profits, taxable income is 81 TP3T of the business's gross receipts from the sale of goods in the case of a business that sells goods, or 321 TP3T of service receipts in the case of a business that provides services.

In addition, companies that choose the imputed profits method of taxation are subject to income tax (PIS rate of 0.651 TP3T and COFINS rate of 31 TP3T), which is calculated on a cumulative basis, and the tax base for this method is gross business income, with no credit against the tax base for the company's related costs and expenses.

The imputed profits method is subject to certain limitations, such as the exclusion of companies with annual revenues exceeding R$78 million and financial institutions from the use of the tax system.

3) Lucro Real Profit Method

The tax regime applies to businesses with annual revenues exceeding R$78 million or those that want to keep precise records of income and expenses, detailed accounting of costs and expenses, and have requirements for completeness and accuracy of financial records.

The Actual Profit Method requires a business to accurately record revenues and expenses to calculate net profit, deduct tax-exempt income through actual profit, and add non-deductible income tax expenses to calculate the business's taxable income.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related corporate services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / French company / New Zealand company / Japanese company / / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign company Registered related business services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce to accompany the operation of the enterprise one-stop service, etc. can be found in the enterprise CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant to communicate with you in detail ↓↓↓↓

05 Services offered by the Enterprise Finance Group

Founded in 2015, Enterprise Caiying has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industrial, commercial, taxation and business services for enterprises and individuals, covering domestic and international industrial and commercial qualifications/tax and equity/overseas identity and asset allocation/cross-border e-commerce, and other core businesses.

Details of the services provided by the Enterprise Finance Group:

Enterprise Caiying Group Strength:

Core strengths of the Enterprise Caiying Group:

The company has nearly 400 employees, and the core team consists of senior lawyers, accountants, tax experts and business consultants. At present, Enterprise Caiying has set up branches in North, Guangzhou and Shenzhen, Hong Kong, Southeast Asia and the United States. So far, it has provided services for 300,000 small and medium-sized enterprises, with more than 50,000 long-term cooperative customers.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company / Vietnam company / Malaysian company and other foreign company registration related business services, the company's annual review / bookkeeping and tax returns / payment of mandatory contributions / change of Information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, etc. can be found in the enterprise Caiying Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax adviser to communicate with you in detail ↓↓↓↓

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Mercado Brazil

- Brazilian company

- Brazilian Company Registration

- Brazilian Corporate Taxation

- Mercado, French supermarket chain