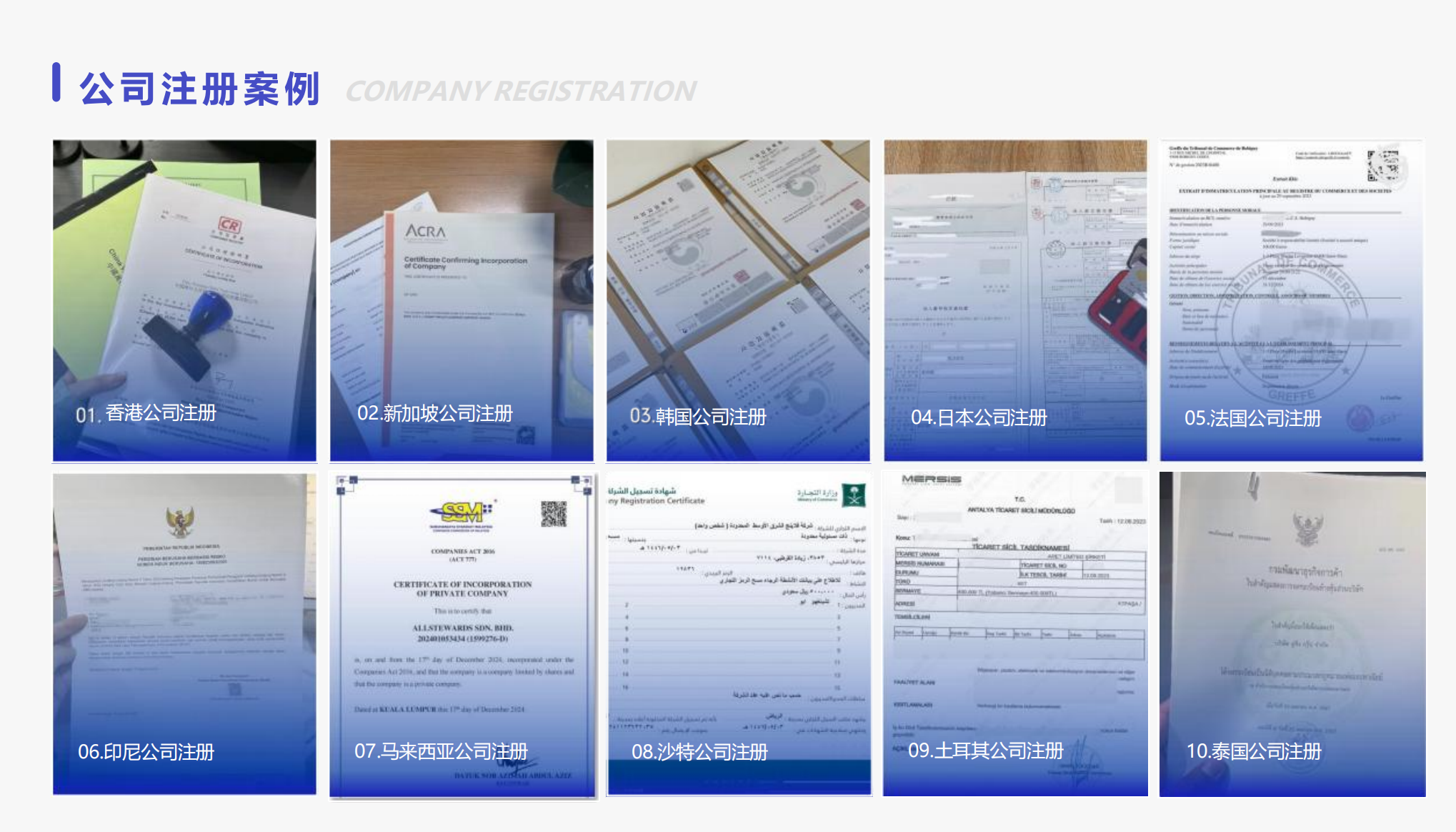

Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, but also to provide the United States company / Canadian company / Mexican company / British company / French company / New Zealand / Singapore company / Thai company / Vietnamese company / Malaysia company and other foreign company registration related business services, the need for Or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

Recently, the French Customs (DGDDI) published an official notice on its website to promote the harmonization of EORI numbers from the SIRET tier to the SIREN tier.

It should be noted in particular that this is not a simple systemic adjustment, but a structural reform implemented by France in line with the overall reorganization of the EU customs system.

If you are currently or planning to clear customs, import or transit through France, this change must be known and the impact assessed in advance.

01 What exactly did France change this time?

The core change, in fact, is just one sentence: EORI France will move from the"Registered by business address (SIRET)"Harmonized to"Registered by corporate body (SIREN)"The

For ease of understanding, let's start with a simple distinction between two concepts:

● SIREN:A French company's corporate identification number (9 digits) is unique to a company.

● SIRET:Business Address/Business Location Identification Number (14 digits), a company can have more than one.

In the past, France allowed companies to apply for an EORI on the basis of a specific business address (SIRET). The core requirement of this reform is that only one EORI number can be assigned to a business entity (SIREN).

02 Impact on Chinese cross-border e-commerce sellers

① First of all, the logic is relatively clear for Chinese sellers who have already registered for a French VAT:

● After registering for French VAT, a SIREN is automatically generated.

:: Apply for a French EORI with the SIREN.

● The EORI obtained is usually expressed as FRCN + 9-digit tax code.

This type of SIREN-based EORI, which is in line with the direction of the current reform, is relatively low-risk.

② And for sellers who have not registered for French VAT, but have historically gotten EORI, it is this category that needs to be focused on:

:: In the past by providing VAT numbers from other EU member States.

● Successfully applied to EORI France.

:: However, the EORI is not associated with SIREN France.

As a matter of fact, French Customs has tightened the EORI application process last year, and non-EU companies that have not registered for the French VAT are usually no longer able to apply for a new French EORI.

However, EORIs that have historically been successfully applied for and not associated with a SIREN are still available at this time.

According to the official disclosure of the French Customs, the objective of this reform is to finalize the full transition of EORI to the SIREN tier starting in 2026.

A specific timetable for the transition will be issued separately by the French Customs, and no definitive "deactivation date" has yet been announced.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Singapore company / Thai company / Vietnamese company / Malaysian company and other foreign company registration of the relevant business services. Company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

03 What are the benefits of registering a French company?

1)Logistics and Warehousing Advantages

Paris Charles de Gaulle Airport is one of the largest cargo airports in Europe and the Port of Marseille is an important hub in the Mediterranean. Setting up a company here allows access to a dense network of railroads and highways, enabling the distribution of goods to major cities in Western Europe within 48 hours.

2)Market access facilitation

Companies legally registered and with an operational address in France automatically gain the right to trade freely in goods and services in the EU-27 without having to set up duplicate legal entities in the member states.

3)Tax optimization

Intra-EU B2B transactions through French companies are subject to EU internal tax-free supply rules, effectively simplifying VAT processing.

4)brand trust

The labeling of French company addresses and logos on legal and financial documents and products quickly builds consumer trust and is particularly empowering for industries such as fashion, beauty, home, wine and high-end electronics.

5)Highly digitized consumer base

France's e-commerce penetration reached 85%, with more than 67 million Internet users, per capita annual online spending of more than 2,800 euros, and rapid growth in mobile shopping.

6)Complete payment and after-sales ecology

Localized companies have seamless access to mainstream local payment systems (e.g. Carte Bancaire) and rely on France's well-established postal (La Poste) and private logistics networks to build a better customer experience.

7)Advanced digital infrastructure

France has Europe's top high-speed fiber and mobile network coverage, providing stable support for new retail models such as e-commerce platforms and live shopping.

8)E-commerce friendly regulations

French law has a clear framework for e-contracts and online consumer protection, and VAT filing systems (such as the "Mini One Stop Service" MOSS) are highly digitized, making it easy for companies to comply.

9)Innovation Incentives and Talent Pools

Paris is one of the world's leading tech startup hubs, with government subsidies and tax breaks for digital projects, as well as a large pool of local professionals skilled in e-commerce, digital marketing and multilingual customer service.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Singapore company / Thai company / Vietnamese company / Malaysian company and other foreign company registration of the relevant business services. Company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

04 expositoryTypes of French company registration

Similar to China where there are numerous types of companies, France also has various types of companies such as SARL, SCI, SNC, SA, SAS, GIE and many others. Three of them are more common:

▎ Limited Liability Company (SARL):

One of the most common types of companies, suitable for small or medium-sized businesses, relatively simple and flexible with few restrictions.

▎ Simplified Association of Shareholders (SAS):

More suitable for small and medium-sized enterprises limited by shares, the need for capital verification, do not recommend e-commerce partners to register.

Ltd. (SA):

Suitable for medium and large-sized enterprises company type, suitable for companies with listing plans to register, higher maintenance costs.

If you are a cross-border seller, it is generally recommended that you register - Limited Liability Company (SARL)

✅ Tax policy: there is a tax-free sales degree of about 500,000 euros a year, and the newly registered company will generally not check the tax within 2-3 years. (However, no non-declaration/zero declaration is allowed to avoid closing the store due to tax problems.)

✅ Save money: registering a SARL company can be done without opening a physical bank account and there is no registered capital limit.

✅ Flexibility: Allows customization of corporate structure, management style and shareholders' equity, which can be selected according to business needs.

✅ Annual review: France delays the annual review of newly established companies for one year, and in the second year, you only need to pay for the address.

In addition, SARL recommends that two shareholders are registered, as shareholders with more than 50% shares are subject to a social contribution (commonly known as boss tax) of approximately €1,300 per year, the amount of which varies from year to year.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Singapore company / Thai company / Vietnamese company / Malaysian company and other foreign company registration of the relevant business services. Company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

05 French company registration process

initial step::Pre-planning and preparation of materials (approximately 12 weeks)

1)Determine the form of the company

SARL::With 1-100 shareholders and a minimum registered capital of 1 Euro (it is recommended to set a reasonable capital to show credibility), the structure is simple and suitable for most e-commerce sellers.

SAS:There is no cap on the number of shareholders, the management structure is flexible and allows the setting of differentiated shareholder rights, which is suitable for companies with venture capital financing or employee share ownership plans.

2)Preparation of the core document

A. Photocopy of passport with shareholders' certified signatures and proof of address for the last three months (French notarized translation required).

B. Provide three alternative company names (subject to a name check in the INPI database).

C. Determination of registered capital and capital verification (capital to be deposited in a frozen account in a designated bank).

D. Preparation of Articles of Incorporation (Statuts), specifying the address of the company, scope of business, distribution of shares, rules of governance, etc.

E. Appointment of legal representatives (certificate of no criminal record required).

secondlya paceOfficial registration and announcements (approximately 23 weeks)

1) Notarization and submission of documents

Documents such as articles of incorporation must be notarized by a French notary or lawyer.

Filing a registration application package with the commercial court (Greffe du Tribunal de Commerce) where the company is located, including a declaration of incorporation (Form M0), a declaration of legal representatives, etc.

2) Statutory Notices

Publication of the incorporation notice in the designated legal notice newspaper (Journal d'Annonces Légales).

3) Obtaining a certificate of registration

Upon review and approval by the court, the company will be awarded:

SIRET number (business identification number)

SIREN number (business registration number)

KBIS business license (company "birth certificate")

thirdlya paceBank, tax and social security registration (about 12 weeks)

1) Opening of a French corporate bank account

With the KBIS certificate and other documents, open a franc/euro account at a French bank and complete the capital release.

2) Tax registration

Declare the opening of your business to the tax office (SIE) and obtain a VAT number (TVA Intracommunautaire) and an accounting code.

3) Social security registration

If you employ staff (including legal representatives), you need to register as an employer with an organization such as URSSAF.

At this point, the company's legal entity is formally established and the whole process takes about 68 weeks (with complete documentation and the assistance of a professional organization).

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Singapore company / Thai company / Vietnamese company / Malaysian company and other foreign company registration of the relevant business services. Company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

06 Attention to the subsequent maintenance of the French company registration

After the registration of a French company, even if the operating data is 0, you should handle the maintenance work of the company's VAT tax filing, annual audit (annual account processing), and the filing of the annual financial report according to the regulations. Understand and comply with the relevant French laws and regulations to ensure the legal validity of the company.

1) Types of French company tax returns

Non-operating companies: These companies are usually only required to file zero returns and annual audits. A zero filing means that the company has not generated any income or expenses, but still needs to report them to the tax authorities.

Companies with operations: These companies are required to submit year-end financial statements and file year-end tax returns in addition to annual audits.

In broad terms, French taxes can be categorized as income tax, excise tax, capital tax and local taxes. The current tax rate is 36.6% on the net profit of a company. Businesses that do not make a profit, or make a loss, are only subject to the basic tax rate.

2) Annual review of French companies

In order to ensure the effective existence of a French company, a local accountant must be appointed from January 1 to May 15 of each year to conduct a company audit report.

The annual review of a French company mainly includes: confirming the company's business information, renewing the company's business license, renewing the company's registered address, and renewing the statutory secretarial services.

3) Filing of annual financial reports

At the end of the fiscal year, a French company must appoint a CPA firm to issue annual financial statements and file the company's VAT and Profit Tax (CIT) returns. However, the completion of the returns does not mean that the maintenance is complete, and the annual financial statements must be submitted to the Commercial Court for registration.

In accordance with French commercial law, the annual financial statements must be filed with the Commercial Court within seven months of their preparation.

Therefore, it is recommended that you engage a professional corporate service provider such as us, Enterprise Finance Group, to fully handle your company's financial, tax and contractual issues to improve efficiency and compliance.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related corporate services, also provides the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Singapore company / Thai company / Vietnamese company / Malaysian company, and other foreign company registration of related corporate services. Company annual review / bookkeeping and tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop services such as can look for enterprises CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant to communicate with you in detail ↓↓↓↓

07 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- EORI, France

- Interpretation of the EORI reform in France

- French company registration

- Types of French Companies

- French company registration process