Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, but also provides the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Japanese company / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign company registration related business services. Corporate services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

New Japanese station rules take effect December 25, 2025

It is reported that the new rules of Japan's Commodity Safety Law, which will officially come into effect on December 25, 2025, all sellers of affected products in the Japanese market must immediately complete compliance, or the goods will be taken off the shelves.

Amazon has now made the announcement. This includes electrical products, baby products, laser pointers, riding helmets, and gas equipment.

Figure from the Internet

01 The New Deal has three main requirements

(1) Clarify the subject of responsibility

For the first time, overseas sellers will be directly included in the Japanese regulatory system, and sellers who sell goods to Japan from overseas will be considered "specific importers" and will be subject to the same legal responsibilities as local Japanese importers.

(2) Compulsory designation of "authorized representatives of Japan"

An administrator with a legal address in Japan must be appointed to receive legal documents, submit compliance documents, and handle security incidents.

3) Product Compliance Requirements

Completion of METI filing, the product must comply with Japanese technical standards and be awarded the PSE/PSC/PSTG/PSLPG certification mark.

Otherwise, the product will be taken off the shelves and will not be able to be sold on the Japanese site, and will even be subject to legal penalties of up to 1 year in prison or a 1 million yen fine.

Note: Some products have a buffer period:

Infant and toddler toys whose importation has been completed by December 25, 2025, may continue to be sold without the need to affix the children's PSC mark;

Infant cribs: until March 24, 2027, products marked only with the traditional diamond-shaped PSC logo may still be sold.

This new regulation will affect these sellers below:

Sellers who sell goods directly to Japanese consumers from overseas;

Overseas sellers who use Amazon Logistics Services (FBA) to deliver affected items;

Sellers who sell goods in the categories of electrical, batteries for mobile devices, toys for infants and children under 36 months of age, and city gas appliances;

In the moment, sellers need to act now:

1) Confirm that the product is within the scope of regulation and check yourself against the list of the four major bills!

(2) Screening of agents in Japan with self-control, signing of a formal consignment agreement, and completion of the METI filing.

3) For product compliance, be sure to meet the new safety standards and obtain the appropriate certificates.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide U.S. companies / Canadian companies / Mexican companies / U.K. companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign company registration of the relevant business services, you can add my WeChat Corporate services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

02 What are the advantages of registering a Japanese company?

1) More internationalized brand image

The identity of "Japanese company" itself comes with trust endorsement, whether it is cross-border e-commerce, brand overseas, or docking supply chain cooperation, the head of a Japanese company, is a sense of professionalism + stability.

2) Cross-border business is more convenient

Japan is one of the economic hubs in Asia. After registering a Japanese company, you can open a local bank account in Japan, which makes it easier to deal with Amazon Japan, Rakuten, Yahoo, Japan B2B and other collection matters, and is more flexible in international settlement.

3) Flexible space for tax savings and financial compliance

The Japanese corporate tax system is well developed and transparent, and relatively friendly to foreign companies. With the assistance of a professional accountant, reasonable planning can also optimize tax expenses and make business operations lighter.

4) Passport to the Japanese market

Many brands want to enter the Japanese market, but without a legal entity status they are restricted from even opening a store, signing a lease, or doing promotions.

Registering a company = Obtaining a legal status for business in Japan, which enables you to apply for visas, leasing, hiring employees, placing advertisements, and other business qualifications.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide U.S. companies / Canadian companies / Mexican companies / U.K. companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign company registration of the relevant business services, you can add my WeChat Corporate services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

03 How to choose the type of Japanese company?

1) Representative Offices

No legal personality to sign contracts or run a business;

There is no need to register a legal entity to open a bank account or hire employees;

It is suitable for the initial research stage when you have not yet decided whether to enter the Japanese market or not;

The office address can be either shared space or co-working, but you need to make sure that the address can meet the inspection requirements of the banks and regulators.

2) Branch Office

It operates in Japan under the name of the parent company and does not have an independent legal personality;

The registration procedure includes notarized documents of the parent company, translations and consular certification;

Registered capital does not need to be separately capitalized, but separate accounts are required for tax and bank purposes;

Suitable for companies that already have an established overseas operation system and are using Japan as a base for expansion.

3) KK Corporation (KK)

The most common type of legal entity in Japan, with a structure similar to that of a Chinese "joint stock company";

Notarized Articles of Incorporation and payment of registration license tax (minimum 150,000 yen) are required;

High external creditworthiness for subsequent financing and compliance filings;

Bank account opening pass rate is relatively higher, and it is highly recognized in business cooperation;

Its governance structure includes a general meeting of shareholders, a board of directors, and representative directors;

For companies that are in business for the long term or planning an IPO.

4) Contract Club (GK)

Similar to a limited liability company, the system is more flexible and less costly;

There is no need to notarize the articles of incorporation, the registration tax exemption is only 60,000 yen, and a single person can set up a business;

There is no shareholders' meeting or board of directors' mandatory requirements, and there is a lot of operational freedom;

Particularly suitable for small operations or holding structures.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide U.S. companies / Canadian companies / Mexican companies / U.K. companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign company registration of the relevant business services, you can add my WeChat Corporate services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

04 Process of registering a Japanese company (for non-Japanese residents)

1)architectural design

:: Determination of the company name (in accordance with the norms of the Japanese Companies Act);

:: Legal representative (whether or not residing in Japan);

:: Registered address (real office address);

:: The percentage of capital contribution and the content of the statute.

For foreign promoters who do not have residency status in Japan, the procedure of notarizing the signature or seal certificate in the country or region where they are located is required for the subsequent application for registration.

2)Charter Certification

KK is required to submit the articles of association to a Japanese notary public for notarization and certification, which is a mandatory part of registration; GK can omit this procedure.

Foreigners are required to submit a "Certificate of Signature" instead of a "Certificate of Seal" for the establishment of a company, while Mainland Chinese are usually required to have their signatures notarized by an attorney and certified by the Japanese Consulate.

3)capital injection

Funds must be paid into a "Temporary Receipt Account" or a Japanese bank account in the sponsor's name, and a certificate of payment must be obtained from the bank.

4)Submit Registration

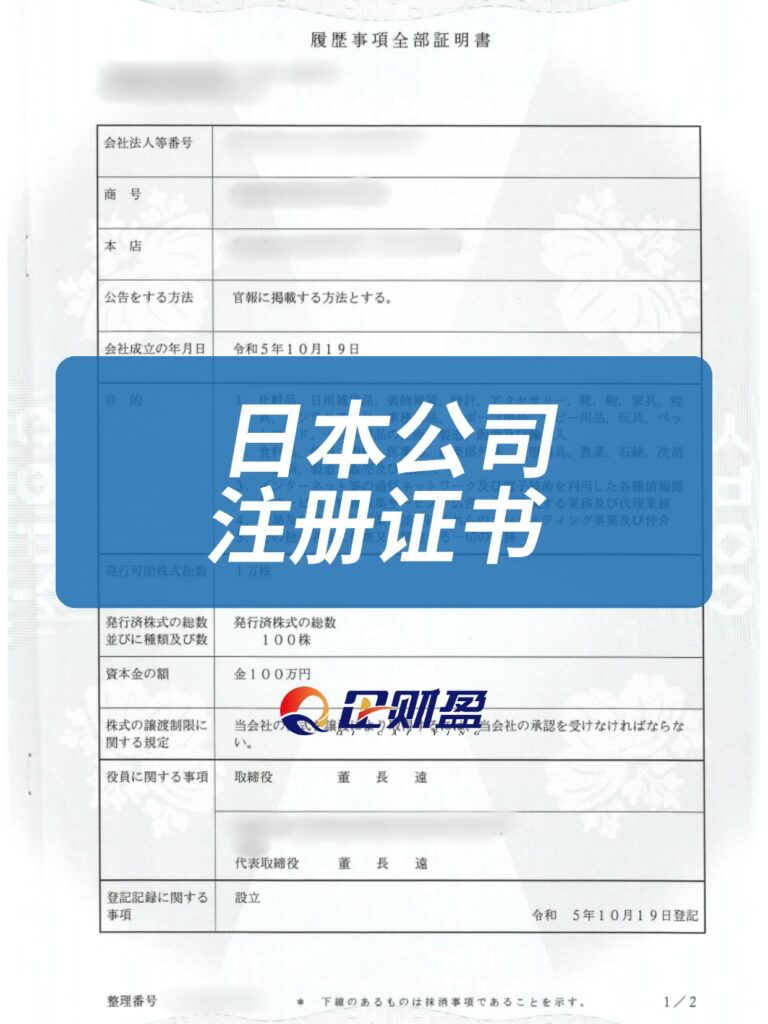

Submit the registration application to the Legal Affairs Bureau and obtain the Certificate of Incorporation and Certificate of Registration of Corporate Seal in about 10-15 working days.

5)Tax Declaration

Within two weeks of the completion of registration, the company must file with the tax office, local tax office, annuity office, etc., submitting information such as the lease contract, establishment prospectus, and representative's identification. Failure to file will be treated as an "unincorporated shell".

6)Bank account opening

It is difficult to open an account, and you need to prepare a complete business plan with proof of office space and other documents in advance.

After registration, you can get a full set of Japanese company information.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business services, but also to provide U.S. companies / Canadian companies / Mexican companies / U.K. companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, and other foreign company registration of the relevant business services, you can add my WeChat Corporate services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓

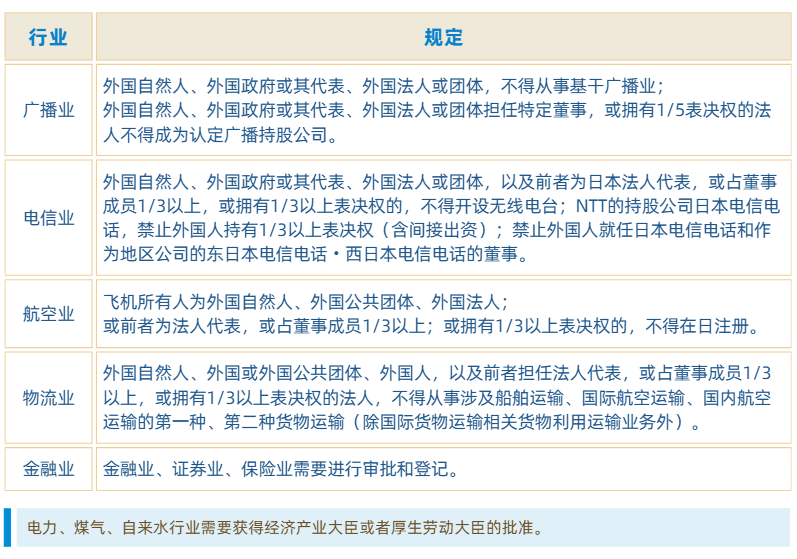

05 FDI Filing Requirements Involving Sensitive Industries

Industries such as telecommunications, logistics, finance, broadcasting, aviation, etc. are required to complete a "pre-registration report" before registration, with a general processing cycle of 30 days. If the business does not involve sensitive areas, it is only necessary to submit an "after-action report" within 30 days after the completion of registration.

Restrictions and review measures on foreign investment by industry in Japan

(Information from the Ministry of Commerce of China, prepared by Hongxin)

JETRO updates the list of sensitive industries from time to time. It is recommended to make FDI classification judgments before establishment to avoid fines or denial of business permits for failure to file, and the relevant requirements should be based on the latest version of the regulations.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexican company / British company / French company / New Zealand company / Japanese company / Singapore company / Thai company / Vietnam company / Malaysia company and other foreign company registration related business services. Corporate services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce to accompany the operation of the enterprise one-stop services such as one-stop services can be found for enterprises, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax adviser to communicate with you in detail ↓↓↓↓

06 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Japanese company

- Japanese Company Registration

- Japan's new rules

- Japan's New Deal

- Types of Japanese company registration

- Advantages of Japanese company registration