In today's accelerated integration of the global industrial chain, more and more enterprises are actively laying out overseas to seek new markets and new opportunities. However, the first step to go overseas - how to comply with the exit of funds? It often becomes the first "compliance threshold" faced by enterprises.

The

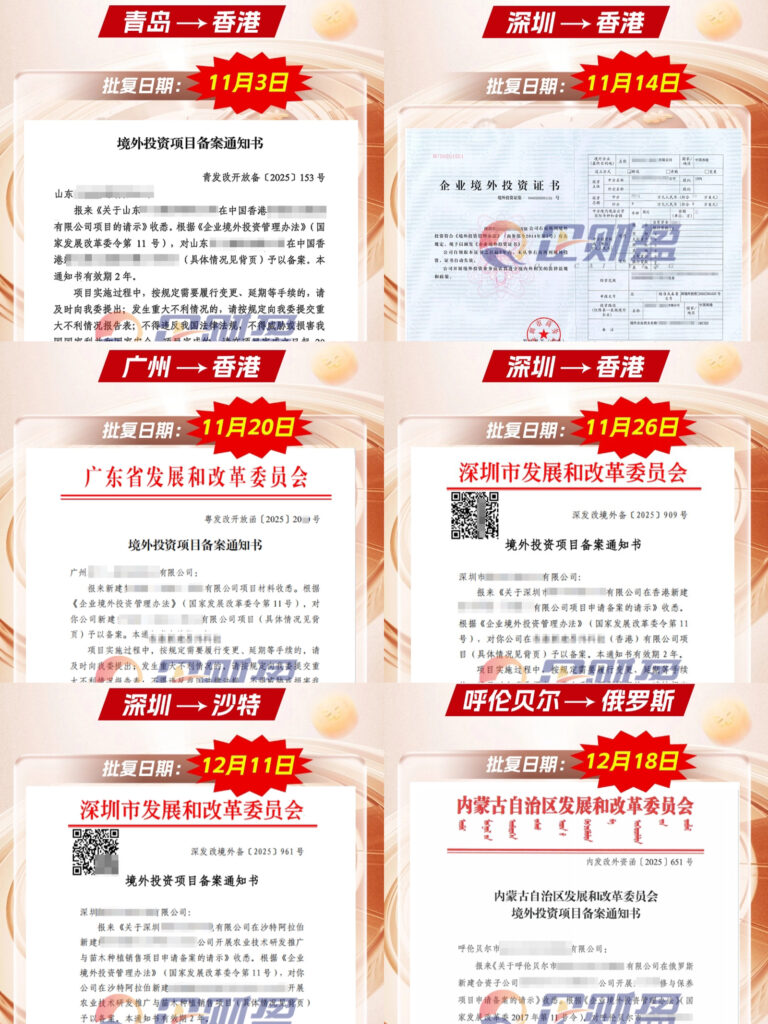

ODI filing is the "official passport" for Chinese enterprises to invest abroad. Without it, the capital can't go out, the project is difficult to land, and the profit is difficult to flow back. Recently, we have assisted a number of enterprises in the fields of science and technology, manufacturing, trade, etc., to efficiently complete the ODI filing and successfully promote the landing of their overseas projects!

🌟 An ODI filing is required whenever your business does one of the following:

✅ New Establishment: the creation or acquisition of a new company abroad and the assumption of control;

✅ M&A participation: Acquisition/participation in a foreign company with effective control;

✅ Establishment of branches: establishment of offices, branches and other business entities outside the country;

✅ Financing support: internal and external loans for overseas subsidiaries, banks require ODI certificates;

✅ Additional investment: capital increase and capital injection in foreign subsidiaries;

✅ Return Investment: Overseas listed companies investing back to their home countries are required to issue ODI filing certificates.

The

What can 📒 Enterprise Finance do for you?

✅ One-stop ODI full-process agency: from policy interpretation, material preparation, to submission to the Ministry of Commerce, Development and Reform Commission (DRC) and the Foreign Affairs Bureau (FAB), the whole process is followed up.

✅ Supporting overseas company registration + bank account opening: fast landing in Hong Kong, Singapore, the United States and many other places.

✅ Structuring and compliance counseling: helping you design the most appropriate investment path to avoid subsequent risks.

✅ Long-term maintenance and reporting support: annual report, change, cancellation and other supporting services are still provided after filing.

The

👍 Why choose Enterprise Finance and Profit?

🔹 Service Scale: 300,000+ enterprise service experience, over 60,000+ long-term cooperative customers.

🔹 Global Network: With branches in Beijing, Guangzhou, Shenzhen and Hangzhou, as well as Hong Kong, the United States and many places in Southeast Asia, we have a global response.

🔹 Licensed and Compliant: Hong Kong Government Certified Secretarial Company, Hong Kong Self-employed Accounting Firm, Vice President of Shenzhen Agency Bookkeeping Association.

🔹 Professional Team: 400 professional team members to provide you with all-round support in cross-border tax, investment and financing, law and so on.

🔹 Rich cases: serving customers covering multiple industries such as finance, trade, e-commerce, technology, manufacturing, catering and so on.

The

⏰ Warm Tip:

Certificates are valid for 2 years, funds can be split out of the country, and there is no limit on the compliant repatriation of offshore earnings!

If you are planning your business to go overseas but stuck at the ODI step, welcome to contact us for professional guidance and customized solutions!

The