Most of the bosses registered Hong Kong company is to open a Hong Kong bank account to receive payments, then in so many Hong Kong local banks, in addition to our common HSBC, Standard Chartered such big banks, Hong Kong Oversea-Chinese Banking Corporation (OCBC) public account is also the choice of many customers. This article we together comprehensive understanding ofAdvantages of OCBC Hong Kong's public account, account opening information, account opening process, account opening related fees, etc!

01.Advantages of opening an account with OCBC Bank Hong Kong

1. Exemption from registration feeBosses with Hong Kong companies are well aware that most banks charge a search fee for opening a public account for a Hong Kong company.Currently through our company, all customers are exempted from the $6,650 registration fee, permanent resident/non-permanent resident/mainlander/foreigner, all are exempted from the registration fee!!!!

2. Free movement of funds

As a local account in Hong Kong, the HKCBC Bank account is not subject to foreign exchange control restrictions, and the funds are free and convenient to enter and exit the bank, which meets the needs of enterprises in cross-border transactions.

3.Multi-currency supportSupports multi-currency operations such as HKD, USD, RMB, AUD, CAD, CHF, EUR, GBP, JPY, NZD and SGD, etc. to meet the diversified currency needs of enterprises.

4. Flexible account operation, easy to use APP

Support a wide range of business mobility services such as bulk payroll, accounting, business loans, business insurance, business debit cards and many more. Use OCBC Velocity and OCBC Business Mobility apps to take care of business anytime, anywhere.

5. Witness account opening service in the Mainland, no need to cross Hong Kong

No need to go to Hong Kong, covering Shanghai, Guangzhou, Shenzhen, Tianjin, Xiamen, Chongqing, Shaoxing, Suzhou, Zhuhai, Foshan, etc.

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

02.Oversea-Chinese Banking Corporation Account Opening Information

- Hong Kong Company Documents

- Domestic company license (if any)

- Main Business Reconciliation Flow (last 3 months)

- Operational documents (2 sets): Purchase contract + Sales contract + Transportation documents + Invoices (VAT invoices) + Receipt and payment water bills

- Director and Shareholder ID + Passport/Hong Kong and Macau Travel Permit + Resume

- KYC Forms

03Hong Kong Overseas Chinese Bank Account Opening Rates

1. Bank account opening feesSearch: hkd6650[My privileged client's single-tier structure search fee of $6,650 is waived]

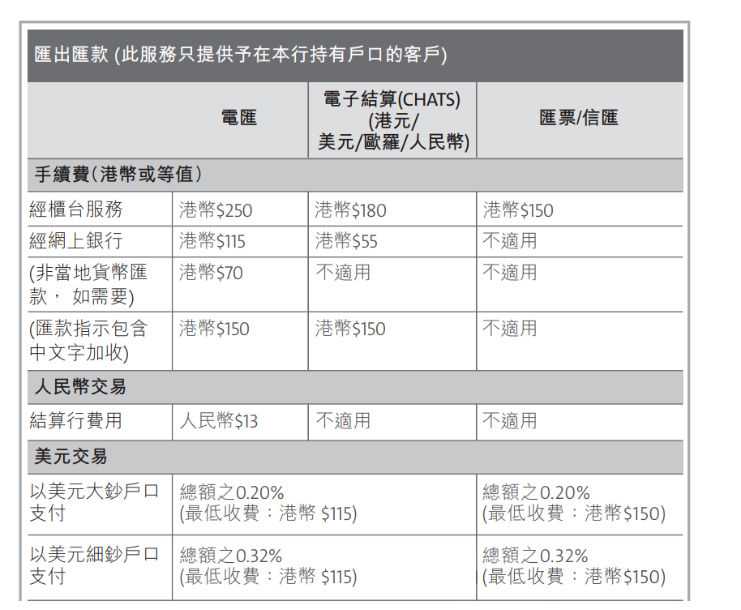

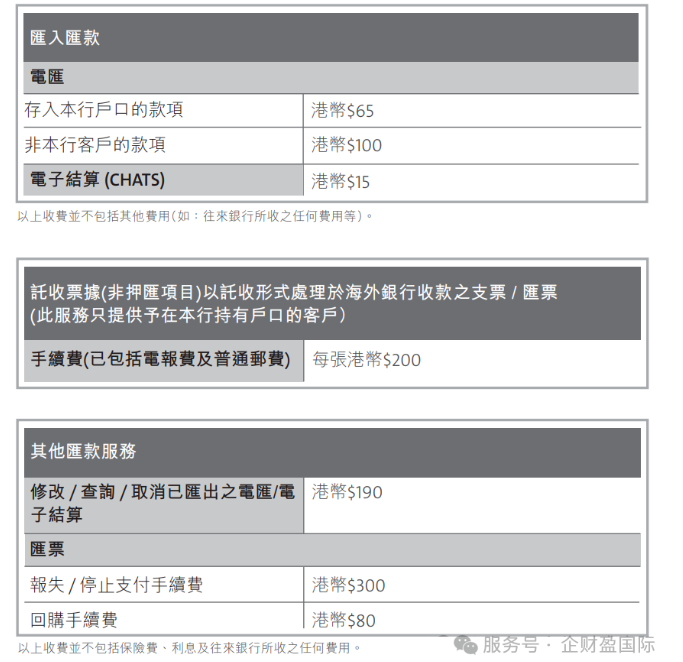

2. Inward and outward remittance chargesManagement Fee: Average daily account balance below 100,000HKD bank will incur 500HKD/month management fee Transfer Limit: 3 millionHKD/day

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

04.Potential benefits of opening a Hong Kong company account for international business

✨ [Benefit 1] Tax Advantages

Low tax rates:The corporate income tax rate in Hong Kong is only 16.51 TP3T, and for enterprises with annual profits not exceeding HK$2 million, the tax rate is even halved to only 8.251 TP3T. In addition, there is no value-added tax (VAT) or sales tax in Hong Kong, and dividend and interest incomes are also subject to a zero tax rate.

Tax planning is flexible:Hong Kong's highly transparent legal and business environment provides enterprises with stable and flexible room for tax planning. For example, profit withholding and tax optimization can be achieved by setting up a company in Hong Kong to engage in re-export trading.

✨ [Benefit 2] Free Flow of Funds

No exchange controls:Hong Kong has no foreign exchange control on enterprises and individuals, and funds can flow in and out freely without restriction. This makes enterprises more efficient in international trade and investment and more flexible in capital operation.

Multi-currency accounts:Hong Kong bank accounts support a wide range of currencies, including Hong Kong Dollar, US Dollar, Euro and Renminbi. Enterprises can easily make multi-currency deposits, withdrawals and exchanges according to their business needs, reducing exchange rate risks and meeting international settlement requirements.

✨ [Benefit 3] Efficient international business settlement

Efficient international remittance systems:Hong Kong banks work closely with major financial institutions around the world, making international remittances fast and efficient. Enterprises can utilize Hong Kong bank accounts to quickly complete cross-border fund settlements, shorten transaction cycles and enhance operational efficiency.

Reduce cross-border transaction costs:Cross-border fund transfers through Hong Kong accounts are relatively convenient and can help companies better manage their funds and reduce transaction costs.✨ [Benefit 4] Investment facilitation

Direct participation in international financial markets:After opening a Hong Kong account, companies can directly participate in trading in the Hong Kong stock market, bonds and other investment products, gaining access to more diversified and internationalized investment opportunities than those in the domestic market, and helping to achieve wealth appreciation.

Convenient overseas investment management:For high net worth individuals and corporations, a Hong Kong account provides a convenient way to store and manage overseas funds, allowing for greater wealth diversification and value preservation and appreciation.

Hong Kong's banks are many, but not every bank is suitable to open a public account, if you choose an inappropriate bank, the risk of being rejected is also relatively large, if they can not control which bank is beneficial to their company, do not know how to match the protection, or want to let the enterprise financial surplus to help customize the program bosses, welcome to scan the code to add our online customer service (micro letter: jxhqcy890 / mobile: 16625410105), arrange the manager to answer questions, provide professional advice and full one-on-one service!

- open an account in Hong Kong

- public account in Hong Kong

- Hong Kong Company Registration