Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / French company / New Zealand company / Japanese company / Singapore company / Thai company / Vietnamese company Indonesia / Malaysia company and other companies. Overseas company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / tax compliance / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, there is a need for or interested in any time drop me (phone and WeChat consulting: 13045886252 ).

Against the backdrop of tightening compliance regulations and normalization of tax audits, many companies are facing common problems such as missing cost tickets, social security non-compliance, and difficulties in handling large sums of money.

Recently, Enterprise Caiying Group has provided in-depth services to clients from different industries, such as automobile marketing, decoration engineering, culture and media, and successfully helped them to build a compliant structure, optimize tax costs and resolve potential risks.

These typical cases reflect our deep insight into the real business scenarios of enterprises and our ability to solve them systematically.

01 Real Customer Cases of Enterprise Caiying Group

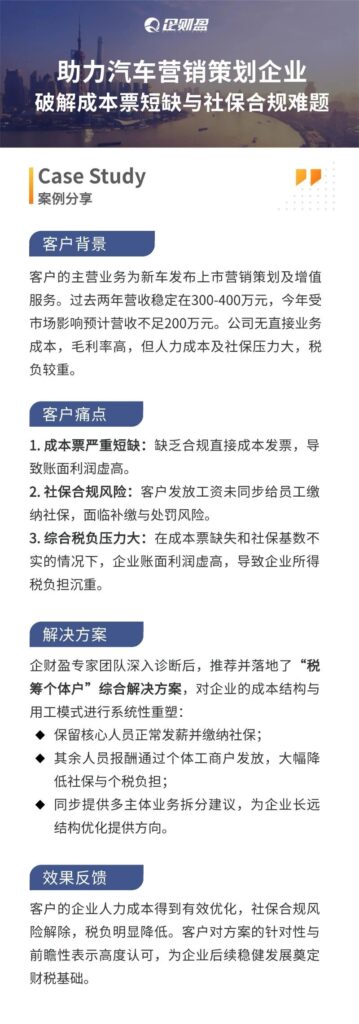

Today we share a [tax compliance] case study from Enterprise Finance Group.

The client's main business is marketing planning and value-added services for new car launches. Revenue has been stable at $3-4 million over the past two years and is expected to be less than $2 million this year due to market impact.

The company has no direct operating costs and high gross margins, but labor costs and social security pressures are high and the tax burden is heavy. Currently it is facing 3 main problems:

1) There is a severe shortage of cost tickets:Lack of compliant direct cost invoicing leads to inflated book profits.

2) Social Security Compliance Risks:Client pays wages without synchronizing social security contributions to employees, exposing them to the risk of retroactive contributions and penalties.

3) The combined tax burden is under pressure:In the absence of cost tickets and inaccurate social security bases, enterprises' book profits are inflated, resulting in a heavy corporate income tax burden.

Solutions provided by the Enterprise Cai Ying team:

After an in-depth understanding, our expert team recommended and implemented a comprehensive solution for "tax-financed self-employed", which systematically reshaped the cost structure and labor model of the enterprise.

(1) Retain core staff on regular payroll and social security contributions.

(2) The rest of the personnel compensation is paid through self-employed businessmen, which significantly reduces the burden of social security and personal tax.

(3) Simultaneously provide multi-principal business splitting suggestions to provide direction for long-term corporate structure optimization.

In the end, this client's enterprise manpower costs were effectively optimized, social security compliance risks were lifted, and the tax burden was significantly reduced. The client highly recognizes the relevance and foresight of this program, which lays a good financial and tax foundation for the subsequent sound development of the enterprise.

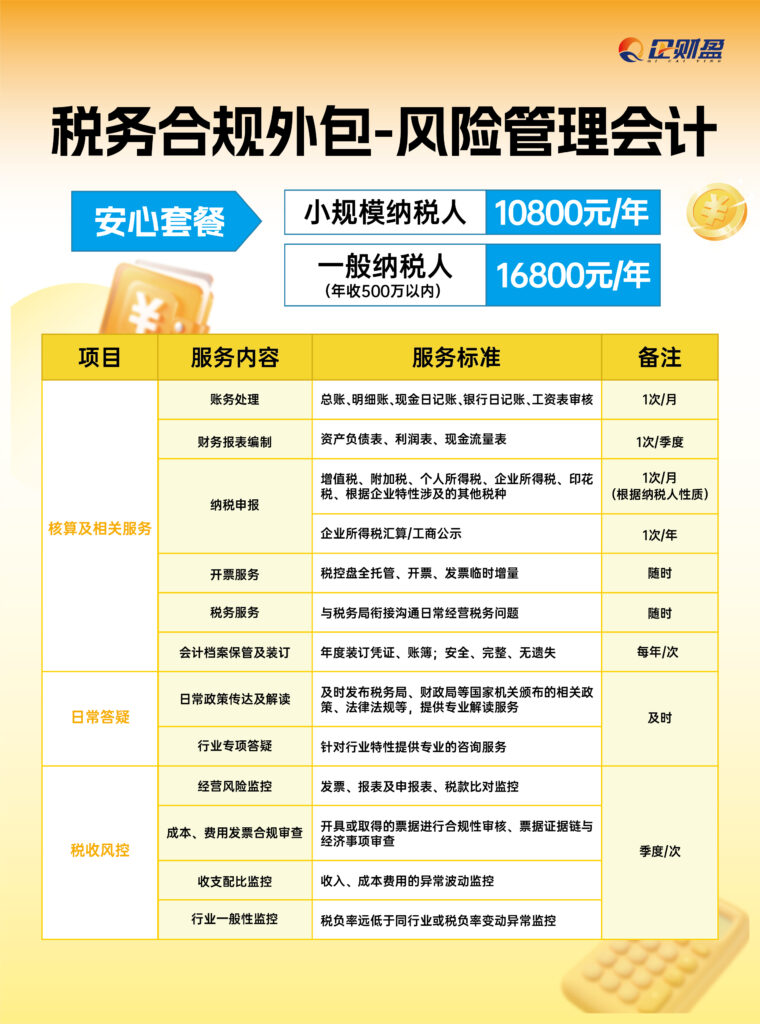

Enterprises CaiYing Group, also successively put forward the [tax compliance] service products 3 packages, the following is a package of service details, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package 1 for solutions.

02 Corporate financial holes may burn more money than rising freight rates

Apart from mainland enterprises, cross-border e-commerce enterprises also have a difficult and long road to compliance.

On January 1, 2026, China's tax system will usher in a historic moment - the official implementation of the Value-Added Tax (VAT) Law, which marks the elevation of VAT from a temporary regulation to a law and a new era in cross-border tax compliance.

"The draft regulations for the implementation of the VAT law have been audited and passed, and the full text is expected to be officially released next week." A senior tax expert close to the policy-making level revealed. For us cross-border e-commerce players, this tax change will directly affect pricing strategies, supply chain costs and profit margins.

What has changed in the VAT law? Three must-know points for cross-border sellers

I. Taxation is more standardized, and there is no more "grey area" in cross-border business.

The new law fixes the mature practices in cross-border e-commerce tax practice in recent years. Sellers who relied on local policy concessions in the past need to pay special attention: tax compliance will become the bottom line of survival.

"The most immediate impact is that all cross-border transactions must have a full VAT chain." The senior consultant for Amazon Global Store noted that "input invoice management, which may have been overlooked before, is now directly related to cash flow and cost control for businesses."

Second, tax retention and refund policy normalization, cross-border sellers ushered in favorable

With the implementation of the new law, the tax credit refund will change from an irregular policy to a statutory system. For cross-border e-commerce companies, this means that VAT paid at the procurement stage can be refunded in a more timely manner, significantly easing capital pressure.

As an example: a cross-border seller of electronic products in Shenzhen, with a monthly procurement cost of 3 million yuan, generates 390,000 yuan of input tax per month at the 13% tax rate. Under the new law, this part of the funds can be returned to the business account more quickly to improve the capital turnover rate.

Third, B2C export tax rebate process optimization, small sellers also benefit

The new law has simplified the process of B2C export tax refund for cross-border e-commerce. The requirement for complete documentation, which used to plague small and medium-sized sellers, has been relaxed, and the degree of electronic filing has been increased. "This is particularly favorable for Shopify independent site sellers." An accountant specializing in cross-border taxation said.

If you need to register a Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic companies registered in the relevant business tax services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / United Kingdom companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies and other foreign companies Company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change of information / bank account / tax compliance / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

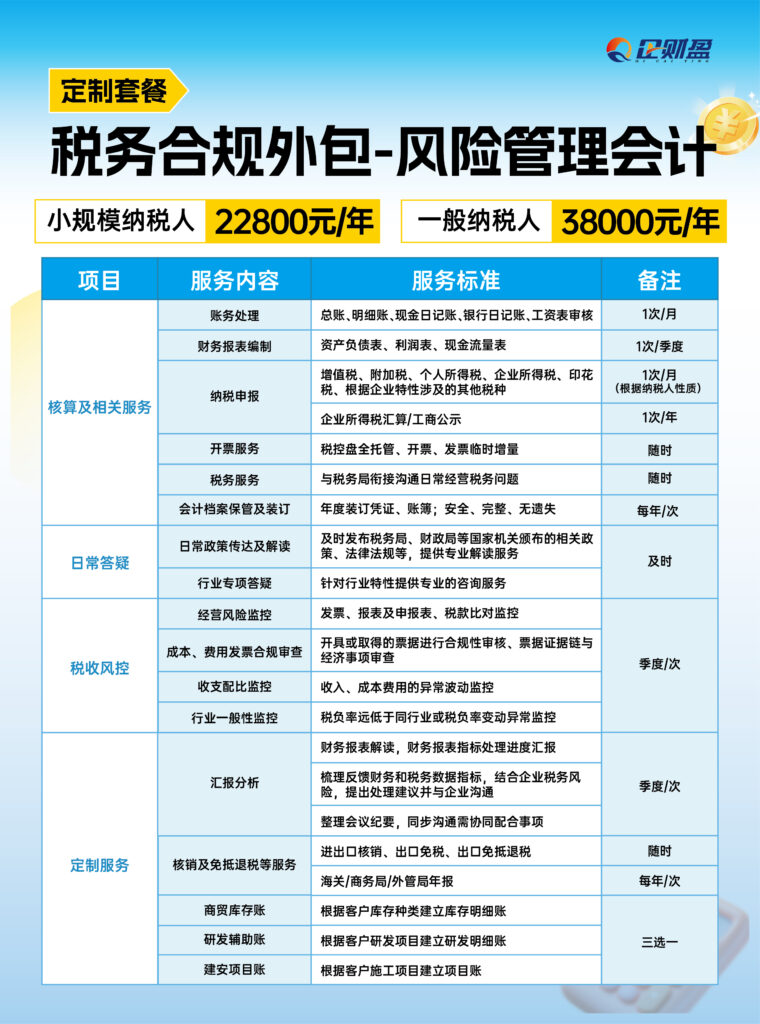

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package II for solutions.

03 Cross-Border Tax Compliance: 2026 Survival Guide for Cross-Border Sellers

1) Supply chain reshaping: from price-oriented to tax-health-oriented

The financial director of a cross-border apparel company in Guangzhou has made a calculation: if you only consider the purchase unit price and ignore the tax compliance of the supplier, you may not be able to obtain a compliant input invoice and pay more VAT, and the actual cost will be higher by 3-5 percentage points.

After 2026, supplier selection criteria will have to be weighted towards "tax compliance". Sellers are advised to initiate supplier screening immediately to ensure that all purchases can be invoiced with VAT compliance.

2) Pricing strategy adjustment: tax costs must be internalized

Hangzhou, a home furnishing category hypermarket has adjusted its pricing model in advance: "We have fully internalized the cost of VAT into our product pricing, which may affect competitiveness in the short term, but avoids tax risks in the long term."

With the new law in place, price wars will have to consider tax compliance costs. Business models that appear to be low-priced but fail to provide tax compliance credentials will be unsustainable.

3) Overseas warehouse tax treatment needs to be clarified to avoid double taxation

Mr. W, a seller on the European site, shared his experience, "We have re-planned our logistic path to ensure that the tax treatment in each step meets the requirements of the new law. Especially the movement of goods in overseas warehouses now requires clearer documentation on tax handling."

There is also a children's clothing e-commerce enterprise that moved to Guangzhou from a mainland city, which is a real customer case of our Enterprise Caiying, selling through Amazon and TIKTOK platforms, with an annual turnover in the order of ten million dollars.

Although the enterprise is profitable, there are hidden problems in fiscal compliance for a long time - the store operates as a domestic individual household, borrowing the name of another person to register, and it is difficult for the actual operator to dock the tax verification, while there is a large number of lack of cost tickets in the business, and the tax risk is increasingly prominent.

Despite the busy business and cross-regional operation, the core decision makers of enterprises have a clear understanding of compliance and tax security. They are eager to systematically avoid risks and control tax burden, and look forward to a professional and efficient team to help cope with all kinds of unexpected financial and tax problems, so they find us to cooperate with Enterprise Caiying.

This cooperation not only solves the momentary needs, but also reflects the deeper needs of cross-border e-commerce enterprises for professional financial and tax accompaniment in the new economic environment - what they need is not only the program, but also the reliable experts and the support that can be landed, which is exactly the value of the service that we, Enterprise Caiyin Group, continue to build.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business tax services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / United Kingdom companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, foreign companies, such as Company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

If you are experiencing compliance issues with your corporate taxes, you can refer to Enterprise Finance Group's Tax Compliance Product Package III for solutions.

04 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Cases

- Corporate Tax Compliance

- tax planning

- taxation services

- Tax Compliance Optimization

- Tax Compliance