At present, enterprises are required to provide the final place of investment when implementing the filing of outward foreign direct investment (ODI). Hong Kong is the only city in the world that combines the advantages of China and the world, with a relaxed tax regime and friendly investment mechanism, possessing natural and unique advantages.It is the preferred destination for most Chinese companies going overseas.

The vast majority of enterprises do not complete their globalization layout in one go. Instead, they use Hong Kong as the first stop for their overseas business for initial planning and investment. When the business has certain growth and investment needs, it is more practical for the enterprise to make foreign investment with a Hong Kong company.

Suffice it to say.Hong Kong is an indispensable link in the OFDI chain

Welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

Common advantages of Hong Kong companies:

1、Hong Kong company business scope is wide

Hong Kong is one of the freer ports in the world for trade and commerce, and there is not much restriction on the scope of business in principle.

2、Hong Kong company tax items less, low tax

Hong Kong company income derived from outside Hong Kong, can apply for tax exemption, the enterprise must be delivered annually only profits tax a tax, the so-called profits tax is in accordance with the enterprise's income, that is, according to the net profit of 16.5% to calculate, the first 2 million tax rate is also as low as 8.25%.

For example, a business has a turnover of $10 million a year, a gross profit of $2 million and a net profit of $1 million. The profits tax payable by this business to the government is 100 X 8.25% = 8.25 lakhs.

There is an additional $10,000 in tax relief available for this year, which means this business is actually due $72.5k.If the company does not operate locally and does not make profit, the company does not need to pay tax. Moreover, a Hong Kong company only needs one annual audit and tax filing a year, which is much simpler and more convenient.

3. Freedom of trade/financial access

Hong Kong is the freest and most prosperous trading port in the world with good infrastructure. Hong Kong has not only free flow of people in and out of the territory, but also free flow of goods in and out of the territory, and free flow of capital in and out of the territory.

- The free flow of people in and out of Hong Kong now has visa-free agreements with more than 100 countries, and the Pearl River Delta will soon launch a visa-free travel scheme;

- Freedom of logistics access is mainly reflected inNo customs duties are levied on the entry or exit of goods;Air, land and sea logistics are handled extremely fast;

- Free flow of funds in and out of the country nowThere is no exchange control in Hong Kong, all kinds of foreign currencies can be exchanged and mobilized at any time, and there is no restriction on the entry and exit of funds.

4. Building an international brand image

Hong Kong is a global financial center, the most competitive city is conducive to enhance the corporate image, the establishment of Hong Kong companies are more worthy of being trusted by customers to develop the global market, but also can register international trademarks, bar codes for international commodity flows.

5、Simple registration and easy maintenance

Registration of Hong Kong companies only need Hong Kong shareholders information, can be quickly registered; Hong Kong company maintenance is very simple, annual audit and a tax return can be done every year, to facilitate the management of the company's operations

6. Flexible corporate structure

Hong Kong allows global investors to set up various types of companies, including private limited liability companies, public limited liability companies, branch offices, joint ventures, etc. to meet different business needs.

7、Apply for Hong Kong Identity

After registering a Hong Kong company, you can realize your Hong Kong permanent resident status by re-employing yourself under the Admission of Mainland Talents and Professionals Scheme.

8. Overseas financing and listing of companies

Hong Kong has a perfect banking and financial system, relaxed financing environment, listing conditions are relatively convenient, registration of Hong Kong companies is conducive to enter the overseas market.

Welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

Advantages of using a Hong Kong company for ODI offshore investments:

I. Domestic and external financial flows

With the accelerated pace of "going out" by Chinese enterprises and the increasing scale of cross-border business, many enterprises have to face the problem of China's foreign exchange control. ODI filing and registration are carried out in accordance with the required compliance procedures. The remittance of funds from China and the repatriation of funds from abroad can be realized smoothly.There is no risk of violations or penalties.

II. Reduced cross-border tax rates

After a domestic company has reinvested in an overseas destination company through a Hong Kong company, there is a problem of paying withholding tax on the profit sharing of the business operations transferred from the overseas destination company to the domestic parent company.

Hong Kong, China and the Mainland have signed a special tax arrangement for the avoidance of double taxation, which has brought great benefits to Chinese enterprises that utilize Hong Kong companies to go global. Under this special tax arrangement, offshore enterprises can pay dividends to Hong Kong companies and enjoy tax relief on dividends to shareholders, with taxes far lower than those of other overseas companies.

Thirdly: easy to open an account with many overseas local companies or other offshore companies

Enterprises do a good job after the record of foreign investment, the first thing is to play the investment funds, offshore banks are mostly admitted to the local registered companies in the local account, of course, there will be on-line banks, will accept some overseas companies to open an account, but also depends on the company's specific circumstances, or there are more additional conditions.

Generally for offshore investment in the enterprise will prefer local banks, rather than online, because there is also need to consider the payer bank to the recipient bank's recognition, the security of funds and other issues. So Hong Kong is the best choice!

Welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

ODI Offshore Investment Application Requirements:

1. Meets the definition of "offshore investment":The act of a domestic enterprise owning a non-financial enterprise or acquiring ownership, control, management and other interests in a non-financial enterprise abroad through new establishment, merger and acquisition and other means.

2. Subject and time of establishment requirements:The subject needs to be an enterprise established in accordance with the law within the territory of China. However, enterprises that have been established for less than one year and are unable to provide complete audited financial statements are generally unable to pass the approval or filing with the approval authorities.

3. Shareholder background, source of funds, investment authenticity requirements:Those who are unable to specify the background of domestic shareholders or partners, the source of funds (e.g., own funds, bank loans, funds obtained in a compliant manner such as fund-raising, etc.), and the authenticity of the offshore investment project can hardly pass the examination.

4. Financial requirements:Audit reports issued by independent third-party accounting firms for the most recent year must not show a loss; return on net assets should preferably be higher than 5%, while gearing should preferably be lower than 70%.

.

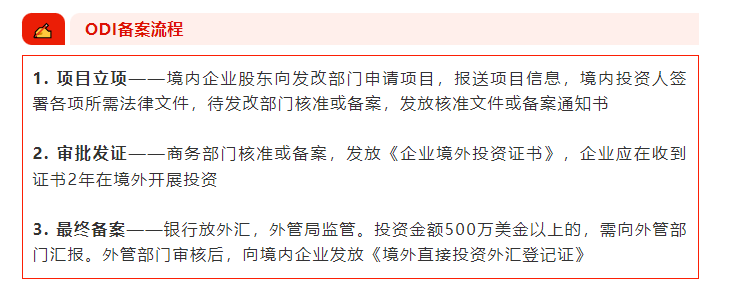

Application process for ODI offshore investments:

The whole process will take 2-3 months, involving complicated documents and processes, if there is no professional guidance to follow up, it is very time-consuming and laborious, and it is likely that due to the information involved in the submission of documents is not compliant, the industry involved in the more sensitive reasons can not pass the audit.

Welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

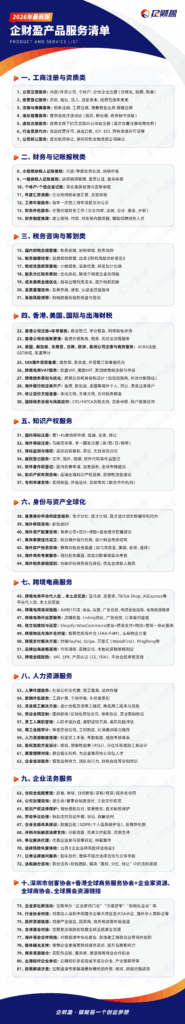

- Hong Kong company registration process

- Enterprises Going Overseas

- ODI Filing

- cross-border e-commerce

- Hong Kong Company Registration