Get Shanghai company registration, read this is enough.

"I want to start a business and open a company in Shanghai, but I heard that the process is complicated, the policy is not understandable, and the address is not good?"

"It is said that Shanghai has a good environment for entrepreneurship, what exactly is good about it? Where should a newbie like me start?"

If you are also struggling with these questions, then congratulations, this article is for you. We've compiled the latest official information and hands-on experience to break down the entire process of registering a company in Shanghai. No more piecing together information, this is a one-stop solution.

I. Why Shanghai? It's not just the charm of the Magic City

As China's economic center and an international metropolis, Shanghai's appeal to entrepreneurs goes far beyond the city's aura.The most novice-friendly core benefitsIs:Extreme process simplification and substantial reduction in start-up costs.

First of all, the process has realized "no need to run a single trip".The entire process is completed online through the Shanghai OneNetOffice platform. Through the Shanghai "One Net One Office" platform, the whole process is completed online, from name verification, submission of materials to electronic signature and receipt of license. You can get the e-business license in three days at the earliest (if the materials are complete and meet the requirements), and it has the same legal effect as the paper version.

This is a complete farewell to the old days when you had to run around from office to office.

Secondly.The greatest gospel is 'Low Cost Park Registered Address's popularization of ...... This means that it is possible to use theVery low costThe company will be able to set up a company in a legally compliant manner, eliminating the pressure of renting a physical office space. This means that for start-ups, e-commerce, consulting, technology services and other businesses that do not require physical office space, it is possible tozero rent, legal and compliant establishment of companies.

If you have a domestic company registration (Shenzhen, Guangzhou, Shanghai, Beijing, Hangzhou, etc.), overseas company registration (Hong Kong / U.S. / U.K. / Thailand / Singapore / Malaysia / Vietnam / Indonesia / Japan / Dubai, etc.) Hong Kong identity applications and renewals, cross-border tax planning, shareholding structure design, compliance and risk control programs and other needs, you can add customer service (WeChat: qcygscszk, cell phone: 18676749275), we will customize your exclusive optimization program to help you comply with the business, save money and increase efficiency!

Second, the key first step: choose the right registration area, is to choose the right starting line

In Shanghai, the focus and intensity of policy support varies significantly from region to region (park).Choosing the right place may directly determine how much dividend you can enjoy initially. No need to be confused, we can make decisions through a virtual dialog:

Entrepreneurs ask, "I'm in cross-border e-commerce, where should I choose?"

Recommendation: Focus on Pudong New Area and Lingang New Area. Pudong's "one network to do everything" is highly efficient and the process of foreign investment is simplified, which is suitable for cross-border business; the new area in Lingang is very important forEligible enterprises in encouraged industriesThe company can enjoy heavy incentives such as reduction of corporate income tax by 15%, facilitation of import and export processes and tariff reductions, which are the strongest policies.

Entrepreneurs ask, "What about the fact that I'm a startup team doing AI R&D with a limited budget?"

Recommendation: Pay attention to Songjiang District and Minhang District. These districts have special support funds for science and technology enterprises, provide free registered addresses, and have concentrated industrial chain resources. Minhang District will also give VAT rebates to small and micro enterprises in science and technology.

Entrepreneurs ask, "I'm just a regular micro and small business and want the most affordable, hassle-free option?"

Recommendation: Prioritize suburban parks such as Fengxian, Jinshan and Chongming. Their common features are "Zero cost of entry + high percentage of tax rebate" . Although geographically remote, this is the most cost-effective option for businesses that register virtually and do not need a physical office.

For businesses that need offline traffic or are particularly focused on their downtown image (e.g., high-end retail, law firms), there is a cost trade-off between choosing toXuhui, Jing'an, Changningand other physical rental addresses in the downtown area.

The core logic of the choice is: matching your industry characteristics, stage of development and cost budget. There is no need to blindly pursue the city center, what is suitable is the best.

If you have a domestic company registration (Shenzhen, Guangzhou, Shanghai, Beijing, Hangzhou, etc.), overseas company registration (Hong Kong / U.S. / U.K. / Thailand / Singapore / Malaysia / Vietnam / Indonesia / Japan / Dubai, etc.) Hong Kong identity applications and renewals, cross-border tax planning, shareholding structure design, compliance and risk control programs and other needs, you can add customer service (WeChat: qcygscszk, cell phone: 18676749275), we will customize your exclusive optimization program to help you comply with the business, save money and increase efficiency!

Third, the start-up preparation: avoid these four common "novice pit"

Taking a moment to confirm these four things before formally submitting your application can prevent the vast majority of unnecessary dismissals and hassles.

Company name: Not what you want to call it. The format must be "Shanghai+Family Name+Industry+Company Limited". Prepare in advance3-5Alternate font size, pre-search through "One Web Office" or third-party tools to ensure that the name has not been registered and does not involve prohibited words.

Scope of business: not the more you write, the better. please providePrimary to secondary businessThe order of the specification is filled in. It is recommended to refer to the National Economic Industry Classification (NEC) or recent registration information of peers. Certain special industries (e.g. education, finance) require prior approval license.

Registered capital: Contributory system is not the same as "just fill in". Currently it is paid-in within five years. Excessive registered capital will bring unnecessary risk of liability of shareholders, and it is recommended that startups take into account the actual situation and fill in the100,000 to 1 millionare common intervals.

Shareholding structure: avoiding the "equalization trap". The most stable structure is to have a clear controlling shareholder (>67% or at least >51%) to ensure efficient decision making. This "share agreement" at the beginning of the business is crucial.

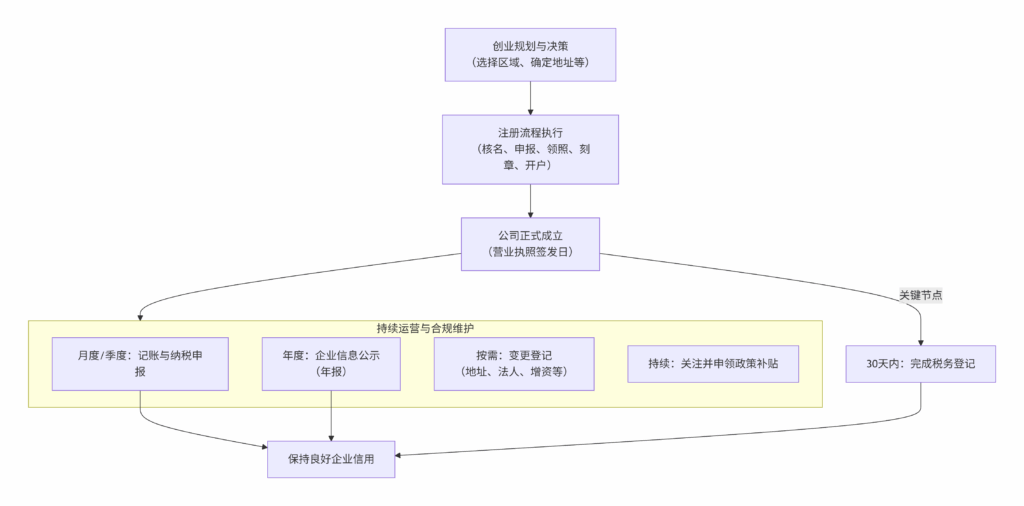

IV. Core seven-step flowchart: from submission to opening

Once you have prepared the above materials, you can follow the diagram and start the formal registration process. The entire core process can be summarized in the following seven steps:

Taking the smooth registration of entrepreneur Xiao Zhang as an example, let's see how these seven steps are efficiently connected. After deciding to choose a free park address in Fengxian, Xiao Zhang submitted three alternative company names online on Monday and was approved on the same day.

On Tuesday, he uploaded all the shareholders' scanned identities, articles of incorporation and address filing certificates provided by the park through the "One Net One Office" platform, and all the members completed the real-name authentication and electronic signature online.

Wednesday afternoon, the system prompted the audit passed. Xiao Zhang immediately in the WeChat "electronic business license" small program brush face, downloaded the company's electronic business license. At the same time, he contacted the public security designated seal engraving point, engraved the official seal, financial seal, invoice seal and corporate seal.

On Thursday, Xiao Zhang, with his business license and seal, went to the bank where he had made an appointment and successfully opened a basic account of the company for future receipt and payment of funds and social security deductions.

After getting a business license for the3Within 0 days, Xiao Zhang logged into the Shanghai Electronic Taxation Bureau to complete the tax registration and approve the tax types. By now, his company has all the qualifications to operate legally.

If you have a domestic company registration (Shenzhen, Guangzhou, Shanghai, Beijing, Hangzhou, etc.), overseas company registration (Hong Kong / U.S. / U.K. / Thailand / Singapore / Malaysia / Vietnam / Indonesia / Japan / Dubai, etc.) Hong Kong identity applications and renewals, cross-border tax planning, shareholding structure design, compliance and risk control programs and other needs, you can add customer service (WeChat: qcygscszk, cell phone: 18676749275), we will customize your exclusive optimization program to help you comply with the business, save money and increase efficiency!

Fifth, get a license: more important than the registration of four "big things"

Many newbies mistakenly think that getting a business license is all that matters, but in fact, this is the starting point for a compliant business. Here are four things, none of which should be overlooked.

First, bookkeeping and tax reporting is the legal bottom line.. According to the Companies Law, after the establishment of a company, regardless of whether or not it has any income and whether or not it is in business, it is required to set up books of accounts and to file tax returns on a monthly or quarterly basis. Even if there is no income, a "zero declaration" must be made. Failure to do so will result in fines and affect corporate credit.

Secondly, the publication of an annual report.The annual report must be submitted through the "National Enterprise Credit Information Publication System" from January 1 to June 30 every year. From January 1 to June 30 every year, the annual report of the previous year must be submitted through the "National Enterprise Credit Information Publicity System" and made public. Failure to do so will result in inclusion in the "Business Abnormal List".

Third, keep your address real and valid. If your company is using a free park address, make sure that you are in contact with the park management and that you are able to receive verification letters from the industry, commerce and tax authorities. Loss of contact with the address will lead to "abnormal operation".

Fourth, proactive attention to and claiming of policy subsidiesThe first-time entrepreneurship subsidy (8,000 yuan) for college graduates in Shanghai and tax rebates and rent subsidies in various parks are examples. For example, Shanghai offers a one-time subsidy (8,000 RMB) for college graduates to start a business for the first time, as well as tax rebates and rent subsidies offered by various parks. These are real cash supports that you need to take the initiative to understand and apply for.

To facilitate your global planning, the diagram below clearly illustrates the life cycle of a company in Shanghai, from its founding to its ongoing operations, as well as the key tasks and compliance obligations that must be adhered to at each stage:

At the heart of this chart is the reminder that successful registration is"one" radical in Chinese characters (Kangxi radical 1)Maintaining compliance is the ray that runs through all the nodes. It is the "seatbelt" of a healthy business.

So, should you do it yourself or get a proxy? For entrepreneurs who are strong learners and have plenty of time, this guide can be completed entirely on their own with a sense of accomplishment. For those who wish toSave effort and improve efficiencyFor entrepreneurs with complex business models (e.g. involving foreign investment, special approvals), it is also wise to appoint a reliable professional agency.

Starting a company in Shanghai has never been as clear and easy as it is today. Whether you are a graduate with a dream or an experienced serial entrepreneur, the city has paved a solid starting line for you. Take the first step bravely and your entrepreneurial story can start with an electronic business license.

- Shanghai Company Registration