Enterprise Caiying Group to provide U.S. companies / Singapore companies / Japanese companies / Thai companies / Malaysian companies / Canadian companies / Mexican companies / Brazilian companies / British companies / French companies / New Zealand companies / Japanese companies / Singapore companies / Vietnamese companies / Indonesian companies / Dubai companies and other foreign companies registered in the relevant business and taxation services, but also to provide the Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic company registration of corporate services, company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, if you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252).

Nowadays, more and more enterprises choose to use Hong Kong companies as a cross-border business platform. However, many Hong Kong companies not only pay more unjust taxes due to non-compliance of accounts, missing documents and other problems, but also face the risks of blocked audits, banks' risk control, and rejection of offshore applications.

This article analyzes in depth the typical Hong Kong company accounting cases of Enterprise Caiyin Group, and helps your Hong Kong company to operate in compliance and save tax accurately.

01 Hong Kong Company Accounting Cases of Enterprise Finance Group

Today I would like to share with you a case study of Hong Kong Company Accounting from Enterprise Cai Ying Group.

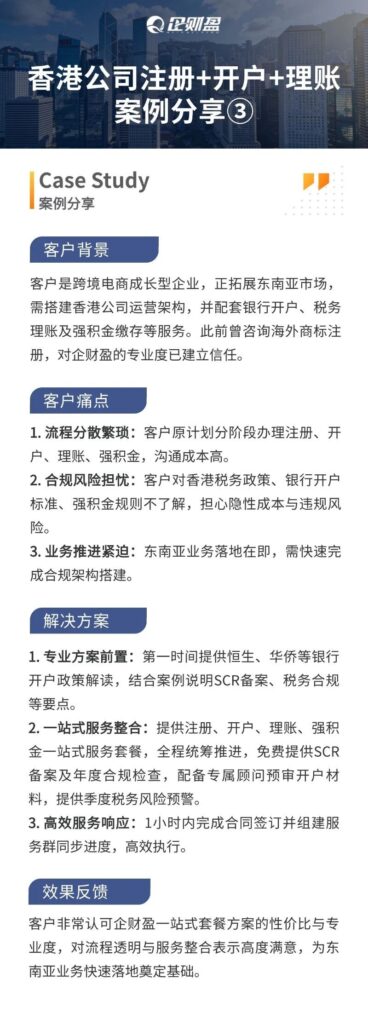

客户是跨境电商成长型企业,正拓展东南亚市场,需搭建香港公司运营架构,并配套银行开户、税务理账及强积金缴存等服务。

此前曾咨询海外商标注册,对企财盈的专业度已建立初步信任。当下该客户面临一些问题,需要与我们企财盈集团合作来解决:

1)流程分散繁琐:客户原计划分阶段办理注册、开户、理账、强积金,沟通成本高。

2)合规风险担忧:客户对香港税务政策、银行开户标准、强积金规则不了解,担心隐性成本与违规风险。

3)业务推进紧迫:东南亚业务落地在即,需快速完成合规架构搭建。

Solutions provided by the Enterprise Cai Ying team:

1)专业方案前置:第一时间提供恒生、华侨等银行开户政策解读,结合案例说明SCR备案、税务合规等要点。

2)一站式服务整合:提供香港公司注册、银行开户、季度理账、强积金一站式服务套餐,全程统筹推进,免费提供SCR备案及年度合规检查,配备专属顾问预审开户材料,提供季度税务风险预警。

3)高效服务响应:1小时内完成合同签订并组建服务群同步进度,高效执行。

最后呢,客户非常认可企财盈一站式套餐方案的性价比与专业度,对流程透明与服务整合表示高度满意,为东南亚业务快速落地奠定良好基础。

如果你的香港公司需要税务合规或者理清季度账目,可以随时咨询(微信同号:13045886252)▼▼▼

02 Why do Hong Kong companies need quarterly accounting?

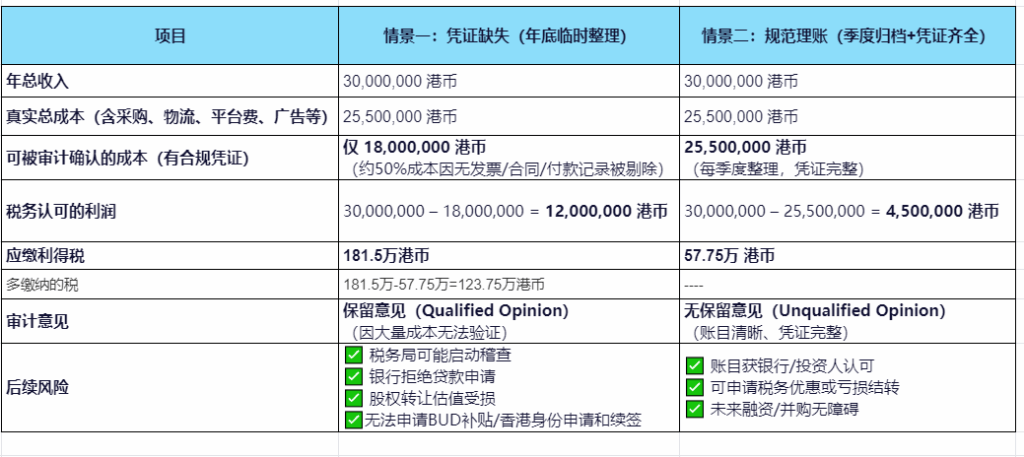

📊 Missing Vouchers vs Regularized Bookkeeping - Look at this Tax Comparison Mockup to see at a glance. (Applicable to Hong Kong Profits Tax)

Applicable objects::Cross-border e-commerce enterprises with annual turnover of HK$30 million (e.g. Amazon, Shopify, Shopee sellers)

Assuming true gross margin: 15% (i.e. true profit ≈ HK$4.5 million)

Hong Kong Profits Tax Rate: 8.25% for the first 2 million, 16.5% after the excess

从上表可见,不是你赚得多,是你“丢票”太多!一年省下 123 万港币税款,足够支付 10 年的香港公司规范理账服务,专业又高效还省心!

如果你的香港公司需要税务合规或者理清季度账目,可以随时咨询(微信同号:13045886252)▼▼▼

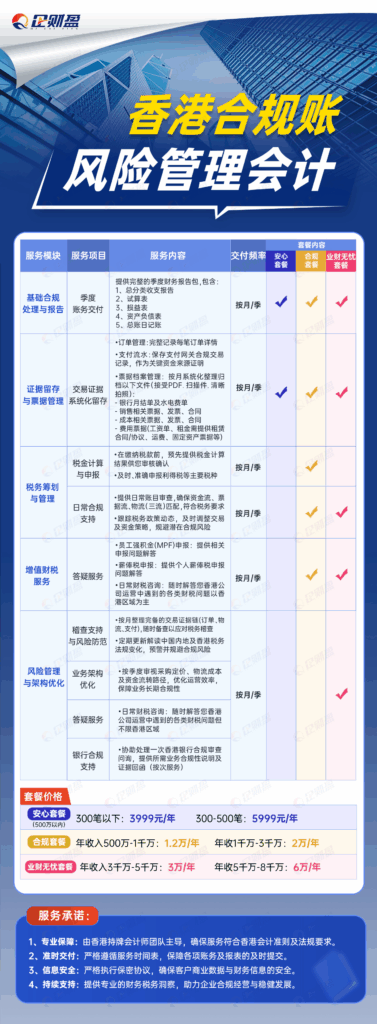

03 Enterprise Finance's Hong Kong Company Accounting Package

Quarterly accounting services for Hong Kong companies - making corporate finance transparent, compliant and efficient!

We provide quarterly financial bookkeeping and compliance management services for companies registered in Hong Kong, covering two packages: basic bookkeeping and high-end compliance, to meet the financial management needs of enterprises of different sizes, and help them avoid tax risks and improve operational efficiency.

Package 1: Basic Accounting Package for Hong Kong Company (suitable for start-ups and small businesses)

Applicable to: Revenue ≤ HK$5 million / quarter

服务内容:● 总分类账● 试算平衡表● 损益表● 资产负债表● 服务标准:每季度交付一次。● 支持300-500笔交易。

Package 2: Compliance Package (for medium to large enterprises)

适用对象:营收 ≥ 500万港币 / 季度

服务内容:所有基础服务(同上)

New "Compliance Services" module:

○Reminders and preparation of tax returns

○ Quarterly cash flow risk review

○Ticket management and retention of evidence

核心点:“我们不只是做账,更是帮您预防税务风险、应对审计检查,让老板睡个安稳觉。”(套餐二,请私信我单独发)。

Package 3: "Bookkeeping + Offshore Exemption = Double Tax Moat"

Many clients think that 'as long as the business is not done in Hong Kong, it is tax free' - but the Inland Revenue now wants a chain of evidence!

If the accounts are in disarray, cost vouchers are missing, and the place where the contract was signed is unknown, the offshore exemption will be denied, even if the profits are truly generated offshore.

Our quarterly bookkeeping service at Enterprise Cai Ying Group builds the books according to the offshore exemption audit standard from day one to ensure that you have 'accounts to rely on, documents to check and signatures to recognize' when you apply at the end of the year.

04 Frequently Asked Questions (FAQ) for three product packages

Q1:Hong Kong company audit is once a year, why do you need to do quarterly auditing? Is it redundant?

A: Very good question! Actually, quarterly bookkeeping ≠ annual audit, but it is the foundation and safeguard for a good annual audit.

We can use the analogy of a "medical check-up": 💡 Annual audit = annual comprehensive medical check-up Quarterly reconciliation of accounts = health monitoring every three months

🔍 Give me a real-life scenario and you'll understand: a Hong Kong company didn't do any accounting for the whole year, and only at the end of the year did they hand over a bunch of invoices to their accountant.

The results revealed that: ● A large number of bills were missing ● Revenue was not accounted for ● Cost vouchers were not in compliance ● Anomalies in fund flow were found.

👉 At this point, the auditor can only truthfully disclose "unable to express an opinion" or "qualified opinion", the tax bureau may therefore start an investigation, the enterprise faces back taxes + penalties!

And if we did quarterly ledgers:● Accounts are cleared every 3 months ● Invoices are consolidated in a timely manner ● Unusual transactions are detected and rectified in advance ● Accounts are clear and complete at the end of the year

✅ When it comes time for an audit, an accountant can produce a report quickly, saving time, effort, money and security!

✅ That's why: quarterly bookkeeping is not a substitute for an audit, but paves the way for an audit and escorts the boss.

It allows you to: Avoid year-end "hand-wringing" ● Reduce audit adjustments ● Improve audit pass rates ● Get a true picture of your company's operations

📣 Just like you wouldn't wait until the end of the year to care about whether your company is making money or not, you wouldn't wait until the day of the audit to start organizing your books, right?

Q2: What exactly is the difference between the quarterly bookkeeping you do, and the annual audit report?

A: 🔹 Quarterly bookkeeping = internal management statement (for the boss)

🔹 Annual Audit Report = Statutory Forensic Document (for IRS, Banks, Investors) Bookkeeping is 'record keeping', Audit is 'certification'.

税务局和银行只认会计师签字的审计报告,不认内部账表。所以,理账让我们‘心里有数’,审计让我们‘合规过关’。”正因为您做了季度理账,我们的审计才能‘轻装上阵’。大部分底稿已经完成,我们只需执行必要程序、签字盖章。

这样,您既能拿到合法有效的审计报告,又能享受我们审计报告的打折优惠。

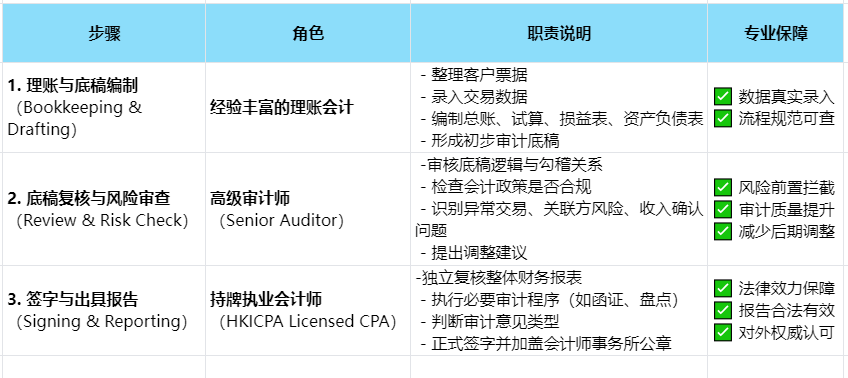

Q3: What is your process for doing an audit report?

Three-Step Process - Closing the Professional Loop

There are some 'low cost audits' in the market, which may be an accountant who does the accounts and directly stamps out the report without review, procedure or separation of responsibilities. Once sampled by the Hong Kong Inland Revenue Department, it is easy to be recognized as 'invalid audit'.

And we adhere to a three-step process to ensure that every report stands up to scrutiny and carries scrutiny.

We are not only professional, but also have a rigorous process. Every audit report, must be gone through:

The bookkeeping accountant makes a draft → the senior auditor reviews it → the licensed accountant signs it.

Three people, three roles, three levels, one without the other.

This is not only our standard procedure, but also a practice requirement of the Hong Kong Institute of Certified Public Accountants (HKICPA).

Q4: I have asked you to do quarterly bookkeeping, how do I charge for the annual audit report?

A: Because we are in the same licensed CPA firm, the process of quarterly bookkeeping is actually preparation for an audit. Every entry, every voucher, every statement has been filed in accordance with audit standards.

At the end of the year, we don't need to 're-do the books', we just need to perform: ● Compliance review ● Audit procedures performed (e.g. correspondence, inventory) ● Formal audit opinion issued So, the audit workload is significantly reduced and naturally, the fees are lower.

Where our accounting firm "quarterly accounting services" for a full year of customers, the annual audit report to enjoy the exclusive preferential price, for more information, please contact: 13045886252!

Q5: What criteria do you use to do your accounts?

A: We strictly follow the Hong Kong Accounting Standards and Hong Kong Inland Revenue Department requirements in our bookkeeping, and all statements comply with auditing and tax filing standards to ensure compliance.

Q6: My company has no employees and I am the only one doing business, do I still need to do the accounting?

A: It must be done! Even if it is a sole proprietorship company, as long as the company is registered and carries out business in Hong Kong, it must do the accounts and tax returns according to the regulations. Otherwise, they may face fines or even revocation of their licenses once they are subject to random checks.

Q7: How do you ensure data security?

A:我们采用加密系统存储客户资料,所有原始票据仅用于账务处理,不会外泄。

合同签署后,我们会签订保密协议,确保信息安全。

Q8: If I already have an accountant, do I still need your services?

A: It works perfectly well together. You can hand over your daily documents to our team to organize and file before submitting them to your accountant for review, which reduces your workload and ensures a standardized process.

Q9: What documents can I get after service delivery?

A: Quarterly, we will deliver the following documents via email or cloud drive: ● General Ledger ● Trial Balance ● Profit and Loss Statement (Income Statement) ● Balance Sheet ● (Compliance Package) List of Bills, Tax Reminder Record, Risk Analysis Report

Q10: Can you help me with my tax return?

A:我们目前提供税务申报提醒与材料协助,但正式报税需由持牌会计师完成。

我们可以协助准备所需资料,确保您按时、合规完成申报。

If your Hong Kong company needs tax compliance or you need to register a Hong Kong company, feel free to consult (WeChat: 13045886252) or scan the QR code below to make an appointment for consultation▼▼▼

05 Why choose Enterprise Caiying Group?

👍 Understand Hong Kong standards, better understand the industry pain points Enterprise Caiying has its own Hong Kong accounting firm, the core team consists of Hong Kong licensed accountants and senior tax experts, well versed in the HKFRS standards and the Inland Revenue Department to review the caliber of the long-term service of the e-commerce, trade, investment and other industries, accurate diagnosis of business vouchers shortcomings and the misuse of standards issues.

👍 Quarterly intervention, preventing problems before they occurWe sort out accounts, file vouchers and alert risks on a quarterly basis, so that you can say goodbye to the passive situation of "end of year surprise, double the amount of tax". Your accounts are always in an "auditable state", ready for review by the bank or the tax office.

👍 Offshore exemption application "zero obstacle" from the first entry into the accounts that is in accordance with the offshore exemption audit standards, to ensure that the contract, capital flow, the operation of the record is complete and traceable, and significantly improve the success rate of offshore applications, and truly realize tax optimization.

👍Audit report "once through" We deliver a complete set of accounts that meets the audit requirements, which are efficiently audited by a licensed accountant, helping enterprises to successfully obtain an unqualified audit report, and safeguarding corporate credit and financing capabilities.

🔗 Service advantage: one-stop full-cycle accompaniment service

🏆We not only help companies solve specific problems, but also work to build a compliant bookkeeping system from the source:

1️⃣ Voucher standardization: mending the cost chain of evidence to avoid inflated profits

2️⃣ Standards Conversion and Audit Interface: Ensuring Hong Kong Standards Compliance in the Accounts Package

3️⃣ Tax planning in tandem: legal deductions, offshore exemptions, tax rate optimization

4️⃣ Full-cycle accompanying services: from company registration, quarterly bookkeeping to annual audit, the whole process of wind control escort

📞 If your Hong Kong company is also facing the following problems:

⚠️ The flow is all electronic records, missing invoices, contracts, bills

⚠️ Accounts handled in accordance with mainland standards, audit not passed, report not available

⚠️ Tried to apply for an offshore exemption, but was denied due to incomplete chain of evidence

⚠️ The bank requires an audit report, but the accounts are a mess Welcome to contact Enterprise Caiying, we will customize a one-stop solution for you, so that every bit of profit is clear and controllable, and every bit of tax burden is legal and compliant.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Hong Kong Company Audit Compliance

- Quarterly Settlement of Accounts for Hong Kong Companies

- Hong Kong Company Client Cases

- Hong Kong company

- Register Hong Kong Company

- Hong Kong Company Registration