Enterprise Caiying Group provides the U.S. company / Singapore company / Japan company / Thailand company / Malaysia company / Canada company / Mexico company / Brazil company / UK company / France company / New Zealand company / Vietnam company / Indonesia company / Dubai company and other foreign companies registered in the relevant business and taxation services, but also to provide Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered corporate services, company annual audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied running Beijing company / Hainan company and other domestic companies registered corporate services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252 ).

日本女性美妆消费新趋势:70%消费者重视成分

据悉,近日eBay日本旗下电商平台Qoo10发布了《2025年日本女性网购行为报告》,系统梳理了 2025 年日本女性在消费决策中的关注重点和行为变化。

该报告基于多项调查数据,主要面向电商平台及相关从业者,总结女性消费者在成分认知、购买渠道、信息获取及美容消费观念等方面的趋势。

调查结果显示,超过70%的女性在购物时会主动查看商品的成分或材质。具体来看,购买服装时关注面料,购买化妆品时关注成分,购买食品时关注产地和添加物。“为了更安心地购买”是最主要的原因,占比达到 41.7%。

整体来看,女性消费者更倾向于在充分理解产品信息的基础上做出购买决定,而非仅凭直觉下单。

在购买预算方面,不同品类和世代之间存在一定差异。化妆品方面,Z 世代的平均预算为 6,541 日元,高于 Y 世代的 5,972 日元;护肤品方面则相反,Z 世代平均预算为 5,330 日元,低于 Y 世代的 6,230 日元;在护发护理产品上,两代人的预算相对接近,Z 世代平均为 3,386 日元,略高于 Y 世代的 3,056 日元。

在购买渠道方面,针对化妆品和护肤品的购买地点调查显示,87.6% 的受访者选择药妆店,位居第一;48.8% 的受访者会选择电商平台,位居第二。

选择通过电商平台购买的原因中,“价格更便宜”占比最高,为 48.1%;其次是“在家就能购买更方便”(45.9%)、“可以参考评论”(43.2%)以及“可以直接配送到家”(41.7%)。

调查结果表明,价格优势和便利性是女性使用电商渠道的重要因素。

在电商平台普遍采用的商品评论功能方面,41.4% 的受访者表示“每次都会查看评论”。当被问及更看重好评还是差评时,受访者的选择几乎各占一半,这表明消费者在决策时既会参考正面评价,也会关注负面意见,以降低购买风险。

报告还关注了近年来逐渐受到关注的“内在美容”趋势。调查显示,在 20 多岁至 60 多岁的各个年龄段的女性中,用于护肤、彩妆和头发护理等“外在美容”的月均支出,普遍比“内在美容”高出约 1000 日元至 2200 日元。

但与此同时,各年龄层女性在营养平衡、生活习惯改善等“内在美容”方面,也保持着一定的持续投入。

调查结果显示,女性消费者在购物时,已不再只是依靠直觉做决定,而是更在意如何降低踩雷风险、确保“买得值、买得对”。

在这种趋势下,电商平台除了要完善站内评价体系,还需要针对不同年龄层采取差异化策略:针对Z世代,重点引入来自社交媒体的真实用户反馈;针对 Y 世代,则提供基于过往经验和信任背书的实用信息,帮助其做出更稳妥的购买决策。

了解了日本女性美妆市场,对于布局日本电商的卖家来说,具有一定的参考价值。如果你需要注册日本公司或者去日本开创跨境事业,可以随时咨询(微信同号:13045886252)▼▼▼

01 Basic Requirements for Japanese Company Registration

To register a company in Japan, it is important to first understand the basic conditions for registering a Japanese company.

1)法定身份要求:在日本注册公司,至少需要一名法定代表人,通常是董事。该法人可以是日本国籍,也可以是外国国籍,但需在日本有一个固定的营业地址。

2)注册资本要求:注册资本并没有固定的金额限制,但一般来说,最低要求为1日元。然而,为了增加公司的信誉度,建议的注册资本通常在100万日元以上。

3)营业地址:申请公司注册时,需要提供一个日本国内的实际营业地址。这一地址将用于法律文件和税务登记。

4)公司名称要求:所注册的公司名称必须是独特的,不得与已注册的公司名称重复。此外,名称应含有“株式会社”或“合同会社”等字样,以明确公司类型。

5)法律规定的业务活动:在注册过程中,需要明确公司的经营范围,确保所选择的业务活动符合日本的法律法规。

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Vietnamese company / Indonesian company / and other foreign companies registered in the relevant business and financial services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

02 Process of registering a Japanese company (for non-Japanese residents)

1) Architecture Design

:: Determination of the company name (in accordance with the norms of the Japanese Companies Act);

:: Legal representative (whether or not residing in Japan);

:: Registered address (real office address);

:: The percentage of capital contribution and the content of the statute.

For foreign promoters who do not have residency status in Japan, the procedure of notarizing the signature or seal certificate in the country or region where they are located is required for the subsequent application for registration.

2) Certification of statutes

KK is required to submit the articles of association to a Japanese notary public for notarization and certification, which is a mandatory part of registration; GK can omit this procedure.

Foreigners are required to submit a "Certificate of Signature" instead of a "Certificate of Seal" for the establishment of a company, while Mainland Chinese are usually required to have their signatures notarized by an attorney and certified by the Japanese Consulate.

3) Injection of funds

Funds must be paid into a "Temporary Receipt Account" or a Japanese bank account in the sponsor's name, and a certificate of payment must be obtained from the bank.

4) Submit Registration

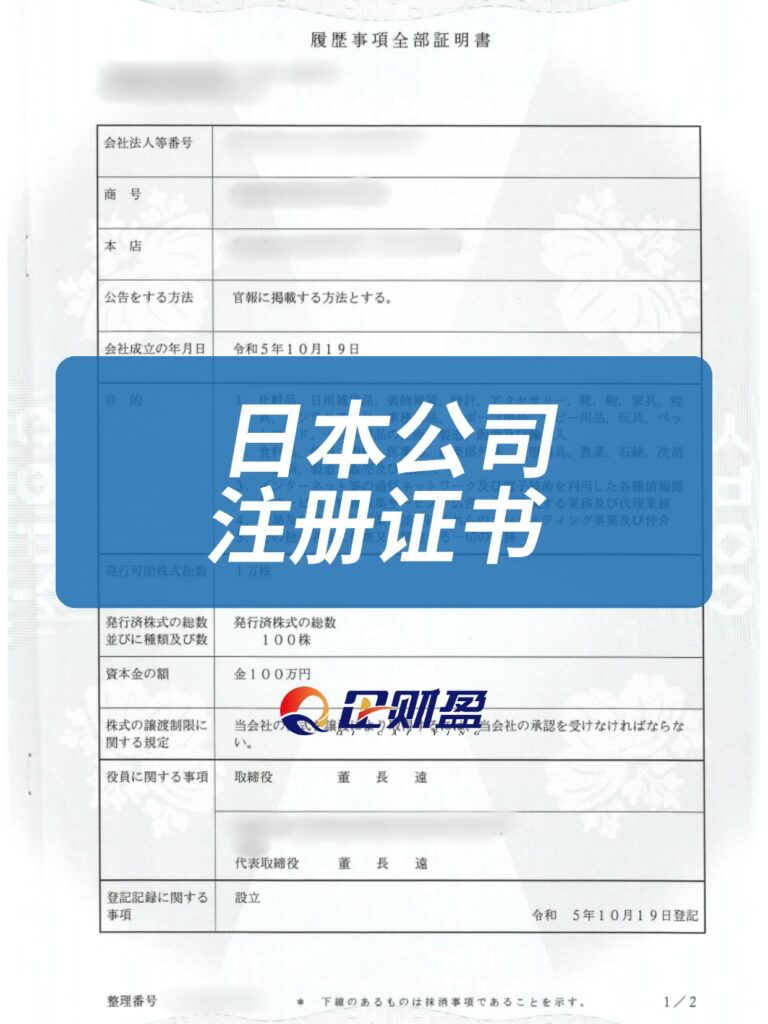

Submit the registration application to the Legal Affairs Bureau and obtain the Certificate of Incorporation and Certificate of Registration of Corporate Seal in about 10-15 working days.

5) Tax Declaration

Within two weeks of the completion of registration, the company must file with the tax office, local tax office, annuity office, etc., submitting information such as the lease contract, establishment prospectus, and representative's identification. Failure to file will be treated as an "unincorporated shell".

6) Bank account opening

It is difficult to open an account, and you need to prepare a complete business plan with proof of office space and other documents in advance.

After registration, you can get a full set of Japanese company information.

If you plan to register a U.S. company/Singapore company/Japanese company/Thailand company/Malaysia company/Canada company/Mexico company/Brazil company/Britain company/France company/New Zealand company/Vietnam company/Indonesia company/UAE company/Dubai company and other foreign company registration related business and finance and tax services, or plan to register a Hong Kong company/Shenzhen company/Guangzhou company/ Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

03 Detailed information required for registration of a Japanese company

The following details must be provided at the time of company registration:

(1) Articles of Incorporation (definitive): the articles of incorporation shall include the name of the company, the purpose of the company, registered capital, shareholder structure and board of directors information.

(2) Proof of identity of the legal representative: Provide a copy of the passport and documents proving the right of abode of the legal representative.

(3) Proof of business address: a copy of the lease contract or real estate property certificate is required as proof of business address.

(4) Proof of funding of registered capital: provide proof of bank deposits, showing the actual deposit of the company's registered capital.

(5) Shareholder and director information: Basic personal information of all shareholders and directors, including name, nationality and address, is required.

6) Company Seal: In Japan, a company must have its own seal (hanko), which is required for the official signing of legal documents.

If you plan to register a U.S. company/Singapore company/Japanese company/Thailand company/Malaysia company/Canada company/Mexico company/Brazil company/Britain company/France company/New Zealand company/Vietnam company/Indonesia company/UAE company/Dubai company and other foreign company registration related business and finance and tax services, or plan to register a Hong Kong company/Shenzhen company/Guangzhou company/ Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

04 Japanese Company Registration Fee Reference

The fee consists of three main components: government fees, professional service fees and additional service fees such as address.

1) Government fees and statutory costs:

Fixed-price certification fee: approximately 50,000-60,000 yen.

Stamp Duty on Registered Capital: Taxes vary depending on the amount of registered capital (e.g., for a capital of 10 million yen, a stamp duty of 40,000 yen).

Registration exemption tax at the Legal Affairs Bureau: 0.7% of capital (minimum 150,000 yen).

(2) Fee for professional agency services:

The service fees for commissioning administrative scribes and representative organizations vary greatly in terms of complexity and service content.

The market price of a standard package for a foreigner setting up a company is about 500,000 yen to 1,000,000 yen (about 25,000 to 50,000 yen).

3) Other necessary/optional costs:

Registered Address Rental: If you do not have a physical address in Japan, you will need to rent a legal business address at an annual fee of approximately 100,000-300,000 yen.

Japanese Representative Director Compensation: If you need to appoint a nominal Japanese representative director to fulfill legal requirements, annual compensation is required, which is a large ongoing expense.

Company seal fee: approximately 20,000-40,000 yen.

Bank account opening assistance fee: At present, Japanese banks are scrutinizing the account opening of new overseas companies strictly, and professional assistance in account opening may incur additional fees.

Total Estimate: For a standard corporation established by foreign natural person shareholders with a one-year address and basic services, the total initial setup costs (excluding registered capital) are usually in the range of 800,000 to 1,500,000 yen (approximately 40,000 to 75,000 RMB), but each case needs to be analyzed on a case-by-case basis, and the costs are not static.

Registering a company in Japan has its own complexities, but as long as you understand the requirements and processes involved, and prepare the necessary documents, you will be able to complete the registration successfully.

If you plan to register a U.S. company/Singapore company/Japanese company/Thailand company/Malaysia company/Canada company/Mexico company/Brazil company/Britain company/France company/New Zealand company/Vietnam company/Indonesia company/UAE company/Dubai company and other foreign company registration related business and finance and tax services, or plan to register a Hong Kong company/Shenzhen company/Guangzhou company/ Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

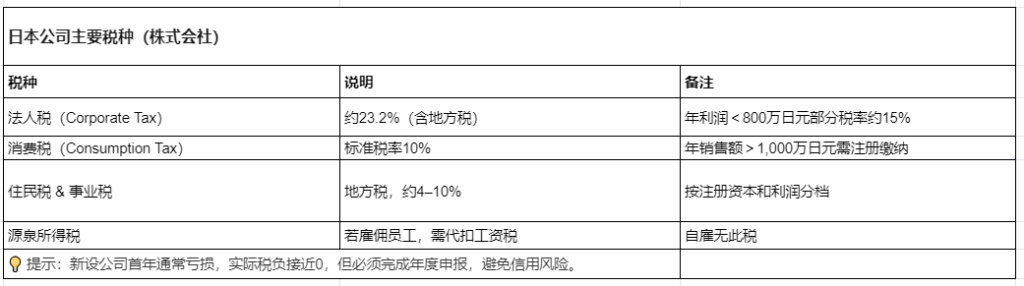

05 日本公司主要税种(株式会社)

06 注册日本公司遇到的常见问题 FAQ

关于注册日本公司的常见问题参考:

Q1: What is the difference between KK Corporation (KK) and GK Corporation (GK)? Which one should I choose?

✅ 株式会社(KK):

● 股东与董事可分离,适合未来融资、引入投资人;

● 社会信用度高,更容易通过银行/平台审核;

● 需设立代表董事(至少1名),可为外国人。

✅ 合同会社(GK):

● 结构简单、设立成本低,利润分配灵活;

● 但对外形象偏“小作坊”,部分银行/平台可能拒接。

📌 Recommendation: If you plan to operate for a long period of time, apply for a business management visa, or interface with B-side customers, prioritize Co.

Q2: I don't have a Japanese address, can I register a Japanese company?

● 可以,但必须使用合规的商业注册地址。

● 我们提供合作的东京/大阪实体办公地址(带租赁合同+房东同意书),符合法务局与银行双重要求;

❌ 不接受住宅地址、虚拟邮箱、朋友住址(2025年起严查空壳公司)。

Q3: I am a Chinese national, can I be a legal representative of a Japanese company?

● 可以,外国人可100%持股并担任代表取缔役,无需日本国籍或永住权。

● 后续如需申请“经营管理签证”,需满足雇员、办公室、营业额等条件。

2、关于海牙认证与翻译

Q4: Why do Chinese documents need to be Hague Certified?

Since both China and Japan are members of the Hague Convention, official documents issued by China (e.g., business licenses, ID cards) must be endorsed by the Ministry of Foreign Affairs before they can be recognized by official agencies (Legal Affairs Bureau, banks, etc.) in Japan.

Q5:How long does it take to get certified by The Hague? Can it be expedited?

● 正常流程:7–12个工作日(省级外办3–5天 + 外交部4–7天);

● 目前无官方加急通道,但我们会优先递交、全程跟踪,避免材料退回延误。

Q6:翻译必须由谁来做?自己找翻译可以吗?

● 法务局要求翻译件需附译者声明+联系方式,且内容准确、格式规范;

● 普通翻译社常因术语错误(如“法定代表人”误译)被退件;

✅ The interpreters we work with at Enterprise Caiying Group have a qualification recognized by the Japan Administrative Scrivener's Office, with a pass rate of 100%.

Q7:Do I need to go to Japan to open a bank account for a Japanese company? Do I need to sign in person?

不需要!全程远程线上开户:

● 提供日本公司注册文件 + 法人身份证明 + KYC问卷;

● 商业计划书与资金来源说明,提升通过率。

Q8: Is it a regular bank? Is it safe?

● 富港(CBI)是新加坡持牌金融机构,受MAS监管,在日本合法展业;

● 账户支持日元、美元、人民币收付,可绑定Amazon JP、Stripe、PayPal等

3、关于成本与时间

Q9: What is the total cost? Are there any hidden charges?

● JEI KAI 4-in-1 (single individual holding): 30,000+ (including registration fee, Hague certification agency, full set of translations, address hosting for the first year, and e-account);

● Japanese company worry-free start-up package (single company holding): 50,000+ (+ e-account opening service);

✅ All-inclusive price, no subsequent mandatory charges (stamp, fixed-price certification, government official fees, ODI, translation are included).

Q10: How long does it take from signing a contract to getting a corporate number?

● 平均 20–30个工作日翻译+海牙认证:5–7个工作日。

日本公司注册:10–15个工作日。

电子账户开通:3–5天(无忧包)。

Q11: Do I need to keep monthly accounts and file tax returns after company registration?

● 即使无收入,也需每年提交法人税申报表;

● 若年销售额超1,000万日元,需注册消费税并按季申报;

07 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Registering a Japanese Company

- Japanese Company Registration Fee

- Japanese company

- Japanese Company Registration

- Types of Japanese company registration

- Advantages of Japanese company registration