企财盈集团提供美国公司/新加坡公司/日本公司/泰国公司/马来西亚公司/加拿大公司/墨西哥公司/巴西公司/英国公司/法国公司/新西兰公司/越南公司/印度尼西亚公司/迪拜公司等国外公司注册的相关工商财税服务,也提供香港公司/深圳公司/广州公司/上海公司/杭州公司/北京公司/海南公司等国内公司注册的企业服务,公司年审审计/记账报税/缴纳强积金/变更信息/银行开户/ODI备案/BVI注册/税务合规/跨境电商陪跑代运营等企业一站式服务,你有需要或感兴趣随时滴滴我(电话and微信咨询:13045886252)。

亚马逊此前二度重发Q3报税信息,但内容仍然不够明晰。而转眼间,第四季度的报税又让人摸不着头脑。

据了解,2026年1月1日至1月20日为第四季度报税的征期时间,但面对复杂的跨境交易情形和尚未完全统一的执行细则,如今许多卖家依然陷在“如何报”的迷茫之中。

一方面,许多卖家反映,即便第三季度已完成申报,还是陆续接到税务局的短信或电话,被告知“报少了”,要求提交情况说明或重新更正数据。这也证实了监管部门正以前所未有的细致度,比对平台报送数据与卖家自行申报数据。

另一方面,各地政策执行的差异更令不少卖家一头雾水。例如,有山西卖家被要求严格按平台提供的数据报税;而与此同时,一位湖南的小规模纳税人卖家则反馈,当地税务局工作人员在辅导时明确表示,在核定其经营情况时“主要关注销售额数据”,即便卖家申明需扣除平台费用。

这种“一地一策”的现象,让试图建立统一合规框架的卖家感到无所适从,也增加了跨区域经营企业的合规难度。为了缓解卖家的普遍焦虑,各大电商平台纷纷跟进,加强了合规支持和服务引导。

例如,亚马逊近日发布了《关于2025年第三季度中国卖家税务信息报送的常见问题说明》,专门澄清了Q3税务报送的疑问。其中提到,季度报告里的“收入(income)”包含了欧洲增值税等海外税费,这份报告更贴近合规信息报送标准,并不是平台帮卖家“算好税”,也不会自动触发额外征税,这也解开了不少卖家“为啥收入数据看着偏高”的疑惑。

此外,亦有平台推出了更为直接的所得税代扣代缴服务,在与卖家的结算环节,直接计算并扣除与出口货物相关的预估所得税款,剩余款项再支付给卖家。尽管困惑依旧,随着第四季度报税,卖家必须在有限时间内做出申报决策。

01 第四季度报税方案参考

根据实际操作,目前卖家主要采取以下四种方案:

第一种是相对保守的“全额申报”,即按平台订单发货日期的全部销售额计算税基。

这种方式看似稳妥,却可能因成本凭证缺失而导致税负(尤其是企业所得税)高企,严重侵蚀利润,不过好处是能满足“离境即退税”等优惠政策的申报条件。

第二种是当前采用人数较多的“折中方案”,即依据亚马逊后台的“收入(Income)”数据进行申报。卖家反馈,该数据虽仍低于税务部门掌握的信息,但差距相对可控,能在一定程度上平衡合规风险与利润保全。

第三种是以实际“回款额”申报的做法。由于回款与平台总销售额存在时间差和金额差(扣除了平台费用、佣金等),这种做法与监管数据差异显著,极易触发税务系统的预警与核查,对年销售额已超过500万元的一般纳税人而言风险极高。

第四种是少数卖家仍抱侥幸心理的“零申报”和“低申报”。不过,在跨境交易数据日益透明的当下,这种做法已被绝大多数卖家视为不可触碰的“高压线”。对跨境卖家而言,合规经营已是大势所趋。

唯有主动拥抱合规,规范账务、留存合规票据、准确申报,方能在监管框架内稳步前行。

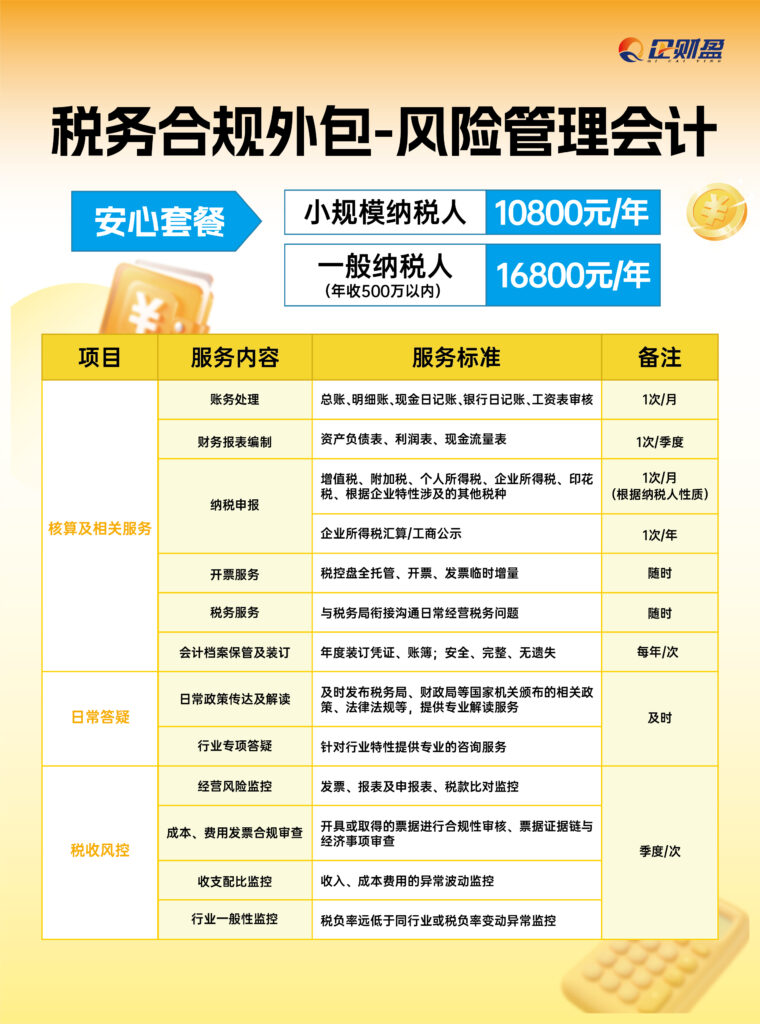

如果你遇到企业税务的合规问题,可以参考企财盈集团的税务合规产品套餐一来解决税务合规或者疑难账务处理等,可以随时咨询(微信同号:13045886252)▼▼▼

02 Which cross-border sellers need special attention?

If you have any of the following, it is important to take it seriously:

✅ Open a store on overseas e-commerce platforms such as Amazon, eBay, Shopee, etc. with sales revenue.

✅ Holding equity in an overseas company and receiving dividends or gains from equity transfers.

✅ Have investment and financial management outside the country and receive interest, dividends and other investment income.

✅ Receiving remuneration for services or labor performed overseas.

✅ Holding overseas properties with rental income or sale proceeds.

✅ Having other business income outside the country.

Self-examination focus: three years of foreign income from 2022-2024 The period of self-examination for which the tax department is clearly reminding is three full years: 2022, 2023 and 2024.

The self-study includes, but is not limited to.

(1) Whether the revenue from sales on offshore e-commerce platforms is fully declared.

(2) Whether or not to declare income from dividends and equity transfers from overseas companies.

(3) Whether or not the income from foreign investments (interest, dividends, property leases, etc.) is declared.

(4) Whether remuneration for overseas labor, royalties, etc. are declared.

5) Whether the credit is correctly taken for foreign taxes paid.

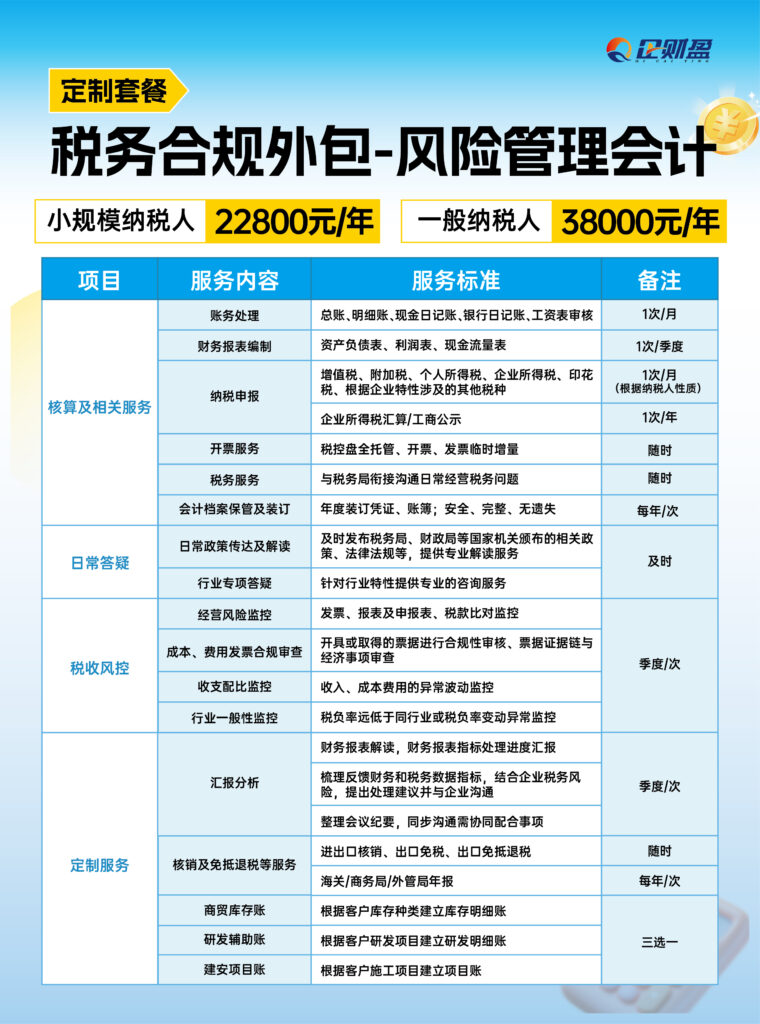

If you encounter more difficult corporate tax compliance issues, you can refer to Enterprise Finance Group's Tax Compliance Product Package II to solve them, and you can consult with us at any time (WeChat same number: 13045886252)▼▼▼

03 How to correctly file a return

The tax authorities have made it clear that taxpayers who find that they have not previously declared their foreign income in accordance with the regulations should make timely corrections to their declarations in accordance with the law.

For your information, here are the proper steps to take to correct your filing:

第一步:梳理境外收入整理2022-2024年所有境外收入明细。收集相关银行流水、平台结算单据。准备境外已纳税的完税凭证。

第二步:计算应纳税额按照个人所得税法规定计算应纳税额。注意境外已缴税款可以抵免(需提供完税证明)。建议咨询专业财税机构企财盈集团,如你有需要,可以随时滴滴我,电话and微信咨询:13045886252,避免计算错误。

第三步:主动补正申报通过个人所得税APP或税务大厅办理。选择”综合所得年度自行申报”或”更正申报”。补缴税款及相应滞纳金。第四步:保存完整凭证保留所有申报记录和缴款凭证。相关资料至少保存5年以上。 境外税收抵免政策要用好 。

很多跨境卖家担心”双重征税”问题。其实中国税法已经考虑到这一点:境外已缴纳的税款可以抵免!具体规则:在境外已经缴纳的个人所得税税额,可以在应纳税额中抵免。抵免限额为该项所得依照中国税法计算的应纳税额。超过抵免限额的部分,可以在以后五个年度内结转抵免。

For example: Suppose you earn $100,000 in income from sales on the Amazon platform in the U.S. and have paid $20,000 in taxes in the U.S.. When you return to your home country to file your return, if you calculate the taxable amount of $25,000 according to the Chinese tax law, then:

(1) Creditable foreign taxes: $20,000

2)实际还需在中国补缴:0.5万美元现在是最佳处理窗口期。从税务部门的表态来看,当前处于”提醒自查”阶段,这是给纳税人的一个宽松处理窗口期。依法纳税是每个公民应尽的义务,与其担心被查,不如主动合规,给自己的跨境事业一个稳固的税务基础。

This formal reminder from the SAT is not a bad thing for the majority of cross-border sellers, but a necessary step for the industry to become standardized and professionalized. Early compliance, early peace of mind, focus on business expansion, rather than worrying about tax risks.

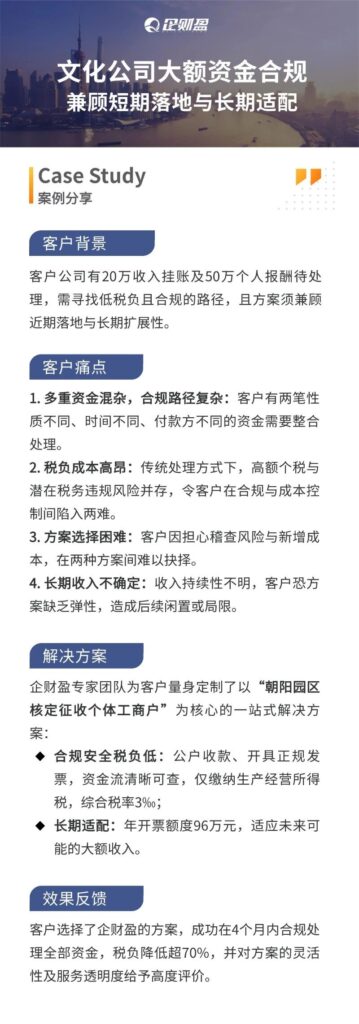

如果你遇到特别难搞的企业税务合规问题,可以参考企财盈集团的税务合规产品套餐三来解决。你的公司需要税务合规或者更多疑难账务处理等,可以随时咨询(微信同号:13045886252)▼▼▼

04 Cross-Border Tax Compliance: 2026 Survival Guide for Cross-Border Sellers

1) Supply chain reshaping: from price-oriented to tax-health-oriented

The financial director of a cross-border apparel company in Guangzhou has made a calculation: if you only consider the purchase unit price and ignore the tax compliance of the supplier, you may not be able to obtain a compliant input invoice and pay more VAT, and the actual cost will be higher by 3-5 percentage points.

After 2026, supplier selection criteria will have to be weighted towards "tax compliance". Sellers are advised to initiate supplier screening immediately to ensure that all purchases can be invoiced with VAT compliance.

2) Pricing strategy adjustment: tax costs must be internalized

Hangzhou, a home furnishing category hypermarket has adjusted its pricing model in advance: "We have fully internalized the cost of VAT into our product pricing, which may affect competitiveness in the short term, but avoids tax risks in the long term."

With the new law in place, price wars will have to consider tax compliance costs. Business models that appear to be low-priced but fail to provide tax compliance credentials will be unsustainable.

3) Overseas warehouse tax treatment needs to be clarified to avoid double taxation

Mr. W, a seller on the European site, shared his experience, "We have re-planned our logistic path to ensure that the tax treatment in each step meets the requirements of the new law. Especially the movement of goods in overseas warehouses now requires clearer documentation on tax handling."

There is also a children's clothing e-commerce enterprise that moved to Guangzhou from a mainland city, which is a real customer case of our Enterprise Caiying, selling through Amazon and TIKTOK platforms, with an annual turnover in the order of ten million dollars.

Although the enterprise is profitable, there are hidden problems in fiscal compliance for a long time - the store operates as a domestic individual household, borrowing the name of another person to register, and it is difficult for the actual operator to dock the tax verification, while there is a large number of lack of cost tickets in the business, and the tax risk is increasingly prominent.

Despite the busy business and cross-regional operations, the core decision makers of the enterprise have a clear understanding of compliance and tax security.

They are eager to systematically avoid risks and control the tax burden, and look forward to a professional and efficient team to help cope with all kinds of unexpected financial and tax problems, so they find us to cooperate with Enterprise Caiying.

This cooperation not only solves the momentary needs, but also reflects the deeper needs of cross-border e-commerce enterprises for professional financial and tax accompaniment in the new economic environment - what they need is not only the program, but also the reliable experts and the support that can be landed, which is exactly the value of the service that we, Enterprise Caiyin Group, continue to build.

If you plan to register a U.S. company/Singapore company/Japanese company/Thailand company/Malaysia company/Canada company/Mexico company/Brazil company/Britain company/France company/New Zealand company/Japanese company/Singapore company/Vietnamese company/Indonesia company/Dubai company and other foreign companies registered in the relevant business and financial services, or plan to register a Hong Kong company/Shenzhen company/ Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓ ↓

05 A real case of tax compliance for the Enterprise Finance Group

06 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Guide

- Tax Compliance Cases

- Corporate Tax Compliance

- tax planning

- taxation services

- Tax Compliance Optimization