Enterprise Caiying Group provides the U.S. company / Singapore company / Japan company / Thailand company / Malaysia company / Canada company / Mexico company / Brazil company / UK company / France company / New Zealand company / Vietnam company / Indonesia company / Dubai company and other foreign companies registered in the relevant business and taxation services, but also to provide Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered corporate services, company annual audit / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied running Beijing company / Hainan company and other domestic companies registered corporate services, company annual audit audit / bookkeeping and tax returns / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, if you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252).

More and more mainland enterprises choose to use Hong Kong companies as a cross-border business platform. However, many Hong Kong companies not only pay more unjust taxes due to non-compliance of accounts and missing vouchers, but also face risks such as blocked audits, banks' risk control, and rejection of offshore applications.

Now, it's time for the annual Hong Kong audit to be processed, and the probability is that many Hong Kong companies will not be able to withstand an audit of their e-commerce accounts in the early part of the year.

Slightly earlier, some cross-border sellers' finances started to make appointments with Hong Kong auditors to go to Hong Kong warehouses for on-site inventory so as to match the authenticity of the inventory data in time.

Of course, there are some just registered Hong Kong companies, seller bosses and financial is not too familiar with the Hong Kong company audit, especially the second half of 2025 began, a lot of cross-border merchants with the main body of the Hong Kong company stationed on the platform, and even for the first time to know that the Hong Kong company also need to audit in order to file tax returns.

Today I'll talk to you about the key to dealing with Hong Kong trade or e-commerce audits in the face of complex auditing rules: thorough understanding of the rules, strict adherence to the process, and avoiding risks in advance. This article deeply analyzes the importance of Hong Kong company audit and helps your Hong Kong company to audit on schedule, operate in compliance and save tax accurately.

01 Hong Kong Company Audit Compliance: Clarifying Audit Core Requirements

Hong Kong has clear legal requirements for company audits and tax returns, and the first task is to understand these basic requirements.

1) The nature of the audit:

A Hong Kong company audit usually refers to the examination of a business's financial statements by an independent third-party accounting firm.

Hong Kong adopts the territorial source principle of taxation, i.e. only profits derived from Hong Kong are taxable in Hong Kong, while profits derived from elsewhere are not subject to profits tax in Hong Kong.

2) Legal obligations:

According to the Hong Kong Companies Ordinance, a Hong Kong company is required to complete its first audit within 18 months after its incorporation and submit a report within 3 months after receiving the tax return issued by the Inland Revenue Department.

After the initial audit, the company is required to conduct an audit and submit an audit report after the end of each fiscal year. An audit report is required even if the company is not operating (e.g., no operating audit report).

3) Core work:

Central to the completion of the annual audit audit:

A. Prepare materials, cooperate with reviews and obtain audit reports.

B. Different types of companies correspond to different audit reports.

4) The main types of audit reports for Hong Kong companies are

No operational audit report available

Applicable circumstances: no business activities have been carried out after registration.

Core points: confirmation of company dormancy, proof of bank statements, etc.

Main risk: need to ensure that there are no operations that are genuine, otherwise they may be found to be underreported.

Audit report on normal operations

Applicable cases: companies with actual business activities.

Core points: need to include full account vouchers, financial statements and auditor's opinion.

Main risk: irregularities in the accounts may lead to the inability to issue an "unqualified opinion", triggering tax audits.

Special purpose audit reports

Applicable scenarios: specific scenarios such as mergers and acquisitions, listing counseling, etc.

Core point: meet additional special verification requirements, such as fairness of connected transactions.

Key Risks: Reporting accuracy directly impacts the valuation and success of a transaction.

If you have not yet registered a Hong Kong company, but have plans to register a Hong Kong company to enter the cross-border e-commerce platform, or your Hong Kong company needs to be audited, you can contact me at any time to efficiently and professionally handle it (WeChat same number: 13045886252)▼▼▼

02 Hong Kong company audit operation process

(1) Pre-preparation: Organize in advance all operating documents during the audit year. This includes monthly bank statements, purchase and sales contract invoices, payroll forms, company registration documents, etc.

(2) Accounts combing and audit entry: The auditor will check the consistency of the vouchers with the running water. If the accounts are in disarray, it is necessary to rectify the situation first. Cross-border e-commerce enterprises should pay particular attention to the handling of "e-commerce accounts", the need to recognize the e-commerce platform revenue, and set up reasonable accounting entries.

(3) Issuance of the report: After the audit is completed, the auditor will issue an audit report. The "auditor's opinion" in the report is crucial, and an "unqualified opinion" is the most desirable result.

03 Subsequent Tax Returns for Hong Kong Companies

After obtaining the audit report, you need to submit it to the Inland Revenue Department of Hong Kong to complete the profits tax return within a few months after the annual closing date of the Hong Kong company, or you may face a high penalty for late submission.

Special Attention: Key Risk Points in Cross-Border E-Commerce Audit The cross-border e-commerce business model is relatively special, and special attention needs to be paid to the following points in the audit:

(1) Revenue Recognition and Accounts Processing: The traditional "water audit" (only provide bank water) is no longer compliant, and should be changed to do accounts according to the real e-commerce business. It is necessary to accurately record the sales revenue of each platform, platform fees, freight, etc.

(2) Information Retention Obligation: Hong Kong law requires a company to keep financial records for at least 7 years for verification (which includes, but is not limited to, information on operation-related authorization agreement documents, etc.).

(3) Connected transactions and transfer pricing: If a Hong Kong company has transactions with its Mainland affiliates, it needs to ensure that they are in compliance with the principle of independent transactions, and prepare transfer pricing documentation to prove their fairness.

How to promote Hong Kong company audit efficiently? (Practical Advice)

1) Choose the right auditor: Priority is given to accounting firms that hold certification from the Hong Kong Institute of Certified Public Accountants (HKICPA) and have rich experience in cross-border e-commerce auditing, such as our Enterprise Caiying Group. When inspecting the Hong Kong secretarial firm, you can pay attention to whether it understands the platform data and whether it can provide suggestions on account rectification.

(2) Plan the timeline: It is recommended that audit preparation be initiated at least three months in advance of the end of the fiscal year in order to deal with contingencies such as replenishment of information and adjustments to accounts.

(3) Emphasize the opinion of the audit report: Ensure that the final "unqualified" report is obtained, which is an important proof of the financial health of Hong Kong enterprises and compliance with the operation, which is conducive to the maintenance of bank accounts and investment and financing.

4) Pay attention to policy developments: Hong Kong's regulatory requirements continue to be updated. For example, the percentage of audit report verification by the Inland Revenue Department (IRD) is being increased and needs to be kept in view.

To ensure successful completion of the audit, you can check yourself against the following checklist:

1) Prior preparation: confirm the financial year end date of the Hong Kong company; contact the auditor 3-6 months in advance; organize all transaction documents according to the list system.

(2) Accounting: If the business is a cross-border e-commerce business, it is necessary to confirm whether the platform income and expenditure have been accurately recorded in accordance with the requirements of the "e-commerce account"; and to verify whether the pricing of the transaction with the related company is fair.

(3) Process cooperation: actively cooperate with the auditor's inquiries and verifications; timely supplementation of required materials.

4) Subsequent compliance: Ensure that audit reports and tax forms are submitted within the legal deadline (within a few months after the year-end date); and that all financial records are properly maintained for at least seven years.

The core of an audit of a Hong Kong e-commerce company:It lies in authenticity, compliance and foresight. Establishing a standardized financial system, choosing a professional partner such as Enterprise Finance Group, and proactively managing compliance processes are the only way to keep your business afloat. and proactively manage compliance processes to keep your business afloat.

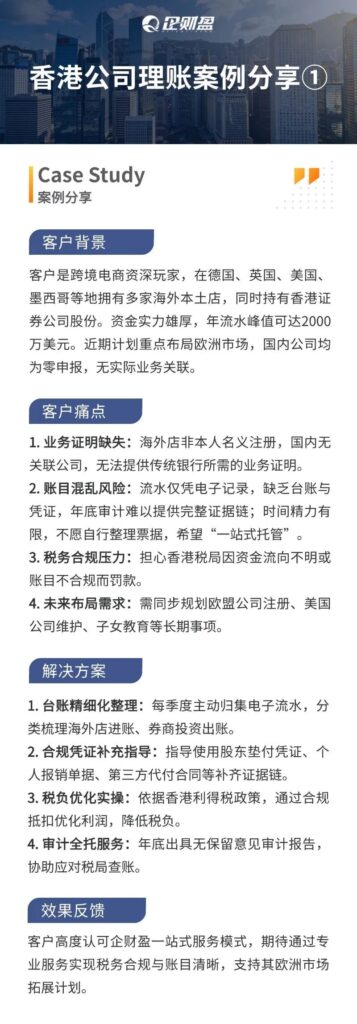

04 Hong Kong Company Accounting Case Reference of Enterprise Finance Group

We share a case study of Enterprise Caiying Group's [Hong Kong Company Accounting] to provide reference advice for your Hong Kong company's audit compliance.

The client is a senior seller of cross-border e-commerce, has a registered Hong Kong company, and owns a number of overseas local stores in Germany, the United Kingdom, the United States, Mexico, etc., as well as holding shares in a Hong Kong securities company.

Its financial strength is strong, with a peak annual flow of up to 20 million dollars.

Recent plans to focus on the layout of the European market, domestic companies are zero declaration, no actual business connection. However, it is currently facing a number of problems that need to be resolved urgently:

1) Proof of business is missing:Overseas stores are not registered in your name, and there are no domestic affiliates to provide the proof of business required by traditional banks.

2) Risk of disorganized accounts:The flow of water is only based on electronic records, the lack of accounts and vouchers, the end of the year audit is difficult to provide a complete chain of evidence; time and energy constraints, unwilling to organize their own bills, hoping that the "one-stop hosting".

3) Tax compliance pressure:Fear of fines from the Hong Kong Inland Revenue Department (IRD) due to unclear flow of funds or non-compliance of accounts.

4) Future layout needs:You need to synchronize the long-term matters such as EU company registration, US company maintenance and children's education.

Solutions provided by the Enterprise Cai Ying team:

1) Fine-tuning of the ledger:Quarterly proactive e-flow collection, categorization and sorting of incoming overseas stores and outgoing brokerage investments.

2) Additional guidance on compliance credentialing:Instruct the use of shareholder advance vouchers, personal reimbursement documents, and third-party payment contracts to complete the chain of evidence.

3) Hands-on tax optimization:Based on Hong Kong's profits tax policy, optimize profits and reduce tax burden through compliance deductions.

4) Audit of full trust services:Issuance of an unqualified audit report at year-end to assist in responding to IRS audits.

Finally, the client highly recognizes the one-stop service model of Enterprise Caiying Group and looks forward to achieving tax compliance and clear accounts through professional services to support its European market expansion plan. As we can see from the above cases, whether it is a headline e-commerce company that has a huge amount of water but no invoices to rely on, a traditional company that is afraid to step forward due to historical risks, or a growing e-commerce company, their common pain points are missing vouchers, misuse of guidelines, and broken chain of evidence. With quarterly bookkeeping as the entry point, combined with the standardization of documents and offshore exemption planning, we can transform bookkeeping from "cost expenditure" to the cornerstone of "tax saving and compliance", and truly guard the profits of enterprises and cross-border development security. If your Hong Kong company needs to comply with tax regulations or clear up quarterly accounts, please feel free to inquire (WeChat: 13045886252)▼▼▼▼

05 Why do Hong Kong companies need quarterly accounting?

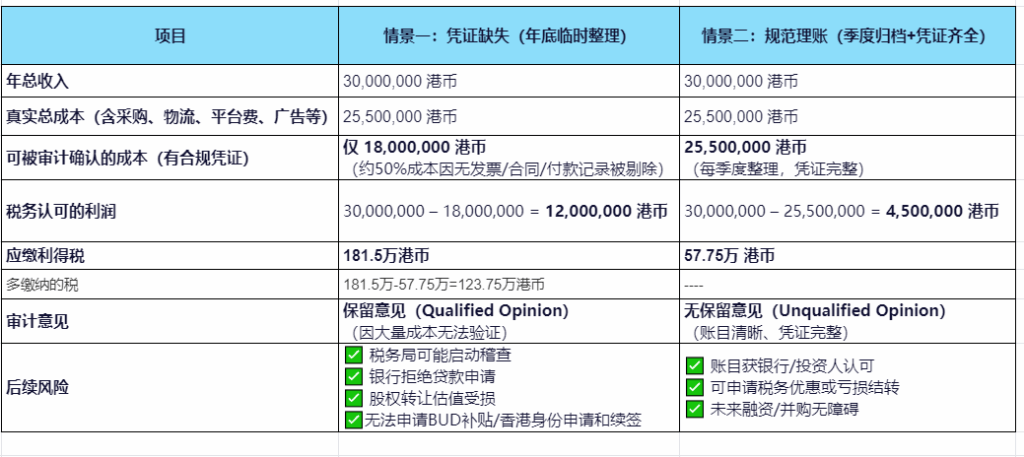

📊 Missing Vouchers vs Regularized Bookkeeping - Look at this Tax Comparison Mockup to see at a glance. (Applicable to Hong Kong Profits Tax)

Applicable objects::Cross-border e-commerce enterprises with annual turnover of HK$30 million (e.g. Amazon, Shopify, Shopee sellers)

Assuming true gross margin: 15% (i.e. true profit ≈ HK$4.5 million)

Hong Kong Profits Tax Rate: 8.25% for the first 2 million, 16.5% after the excess

As seen from the above table, it is not that you earn more, it is that you "lose votes" too much! A year to save 1.23 million Hong Kong dollars in taxes, enough to pay for 10 years of Hong Kong company standardized accounting services, professional and efficient but also worry! If your Hong Kong company needs to comply with tax regulations or clear up its quarterly accounts, please feel free to inquire (WeChat: 13045886252)▼▼▼▼

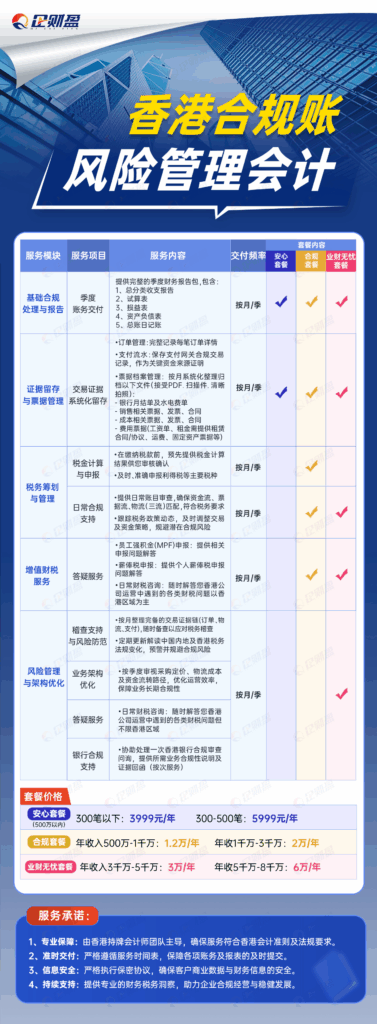

06 Enterprise Finance's Hong Kong Company Accounting Package

Quarterly accounting services for Hong Kong companies - making corporate finance transparent, compliant and efficient!

We provide quarterly financial bookkeeping and compliance management services for companies registered in Hong Kong, covering two packages: basic bookkeeping and high-end compliance, to meet the financial management needs of enterprises of different sizes, and help them avoid tax risks and improve operational efficiency.

Package 1: Basic Accounting Package for Hong Kong Company (suitable for start-ups and small businesses)

Applicable to: Revenue ≤ HK$5 million / quarter

Services: ● General Ledger ● Trial Balance ● Income Statement ● Balance Sheet ● Service Standard: Quarterly delivery. ● Support 300-500 transactions

Package 2: Compliance Package (for medium to large enterprises)

Applicable to: Revenue ≥ HK$5 million / Quarter Service Content: All basic services (same as above)

New "Compliance Services" module:

○Reminders and preparation of tax returns

○ Quarterly cash flow risk review

○Ticket management and retention of evidence

Core key: "We do not just do accounts, but also to help you prevent tax risks, respond to audit checks, so that the boss to sleep soundly." Need to understand the package two, please private WeChat the same number: 13045886252 I privately send you Oh.

Package 3: "Bookkeeping + Offshore Exemption = Double Tax Moat"

Many clients think that 'as long as the business is not done in Hong Kong, it is tax free' - but the Inland Revenue now wants a chain of evidence!

If the accounts are in disarray, cost vouchers are missing, and the place where the contract was signed is unknown, the offshore exemption will be denied, even if the profits are truly generated offshore.

Our quarterly bookkeeping service at Enterprise Cai Ying Group builds the books according to the offshore exemption audit standard from day one to ensure that you have 'accounts to rely on, documents to check and signatures to recognize' when you apply at the end of the year.

07 Frequently Asked Questions (FAQ) for three product packages

Q1:Hong Kong company audit is once a year, why do you need to do quarterly auditing? Is it redundant?

A: Very good question! Actually, quarterly bookkeeping ≠ annual audit, but it is the foundation and safeguard for a good annual audit.

We can use the analogy of a "medical check-up": 💡 Annual audit = annual comprehensive medical check-up Quarterly reconciliation of accounts = health monitoring every three months

🔍 Give me a real-life scenario and you'll understand: a Hong Kong company didn't do any accounting for the whole year, and only at the end of the year did they hand over a bunch of invoices to their accountant.

The results revealed that: ● A large number of bills were missing ● Revenue was not accounted for ● Cost vouchers were not in compliance ● Anomalies in fund flow were found.

👉 At this point, the auditor can only truthfully disclose "unable to express an opinion" or "qualified opinion", the tax bureau may therefore start an investigation, the enterprise faces back taxes + penalties!

And if we did quarterly ledgers:● Accounts are cleared every 3 months ● Invoices are consolidated in a timely manner ● Unusual transactions are detected and rectified in advance ● Accounts are clear and complete at the end of the year

✅ When it comes time for an audit, an accountant can produce a report quickly, saving time, effort, money and security!

✅ That's why: quarterly bookkeeping is not a substitute for an audit, but paves the way for an audit and escorts the boss.

It allows you to: Avoid year-end "hand-wringing" ● Reduce audit adjustments ● Improve audit pass rates ● Get a true picture of your company's operations

📣 Just like you wouldn't wait until the end of the year to care about whether your company is making money or not, you wouldn't wait until the day of the audit to start organizing your books, right?

Q2: What exactly is the difference between the quarterly bookkeeping you do, and the annual audit report?

A: 🔹 Quarterly bookkeeping = internal management statement (for the boss)

🔹 Annual Audit Report = Statutory Forensic Document (for IRS, Banks, Investors) Bookkeeping is 'record keeping', Audit is 'certification'.

The IRS and banks only recognize audit reports signed by accountants, not internal charts of accounts. So, the bookkeeping keeps us 'in the loop' and the audits keep us 'compliant'." It is because you do quarterly bookkeeping that our audits are 'lighter'.

Most of the drafts have already been completed and we only need to perform the necessary procedures, sign and stamp. This way, you get a legal and valid audit report and a discount on our audit reports.

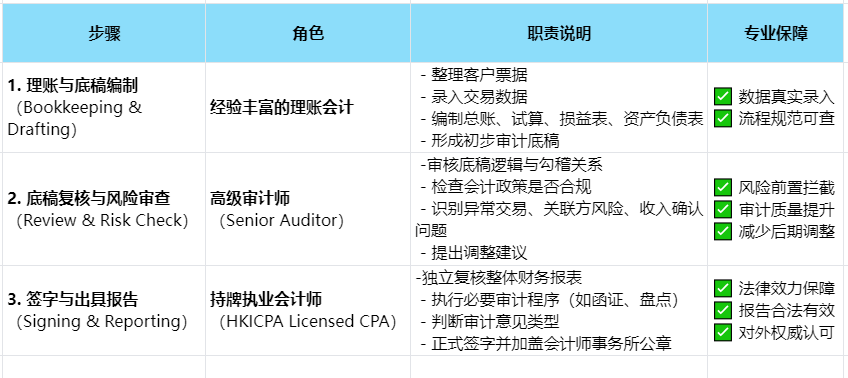

Q3: What is your process for doing an audit report?

Three-Step Process - Closing the Professional Loop

There are some 'low cost audits' in the market, which may be an accountant who does the accounts and directly stamps out the report without review, procedure or separation of responsibilities. Once sampled by the Hong Kong Inland Revenue Department, it is easy to be recognized as 'invalid audit'.

And we adhere to a three-step process to ensure that every report stands up to scrutiny and carries scrutiny.

We are not only professional, but also have a rigorous process. Every audit report, must be gone through:

The bookkeeping accountant makes a draft → the senior auditor reviews it → the licensed accountant signs it.

Three people, three roles, three levels, one without the other.

This is not only our standard procedure, but also a practice requirement of the Hong Kong Institute of Certified Public Accountants (HKICPA).

Q4: I have asked you to do quarterly bookkeeping, how do I charge for the annual audit report?

A: Because we are in the same licensed CPA firm, the process of quarterly bookkeeping is actually preparation for an audit. Every entry, every voucher, every statement has been filed in accordance with audit standards.

At the end of the year, we don't need to 're-do the books', we just need to perform: ● Compliance review ● Audit procedures performed (e.g. correspondence, inventory) ● Formal audit opinion issued So, the audit workload is significantly reduced and naturally, the fees are lower.

Where our accounting firm "quarterly accounting services" for a full year of customers, the annual audit report to enjoy the exclusive preferential price, for more information, please contact: 13045886252!

Q5: What criteria do you use to do your accounts?

A: We strictly follow the Hong Kong Accounting Standards and Hong Kong Inland Revenue Department requirements in our bookkeeping, and all statements comply with auditing and tax filing standards to ensure compliance.

Q6: My company has no employees and I am the only one doing business, do I still need to do the accounting?

A: It must be done! Even if it is a sole proprietorship company, as long as the company is registered and carries out business in Hong Kong, it must do the accounts and tax returns according to the regulations. Otherwise, they may face fines or even revocation of their licenses once they are subject to random checks.

Q7: How do you ensure data security?

A: We use an encryption system to store customer information, and all original bills are used only for account processing and will not be leaked. After the contract is signed, we will sign a confidentiality agreement to ensure information security.

Q8: If I already have an accountant, do I still need your services?

A: It works perfectly well together. You can hand over your daily documents to our team to organize and file before submitting them to your accountant for review, which reduces your workload and ensures a standardized process.

Q9: What documents can I get after service delivery?

A: Quarterly, we will deliver the following documents via email or cloud drive: ● General Ledger ● Trial Balance ● Profit and Loss Statement (Income Statement) ● Balance Sheet ● (Compliance Package) List of Bills, Tax Reminder Record, Risk Analysis Report

Q10: Can you help me with my tax return?

A: We currently offer tax filing reminders and material assistance, but the formal filing of tax returns needs to be completed by a licensed accountant. We can assist in the preparation of the required information to ensure that you complete your filing on time and in compliance. If your Hong Kong company needs tax compliance or you need to register a Hong Kong company, please feel free to inquire (WeChat: 13045886252) or scan the QR code below to make an appointment for consultation▼▼▼▼

08 Why choose Enterprise Caiying Group?

👍 Understand Hong Kong standards, better understand the industry pain points Enterprise Caiying has its own Hong Kong accounting firm, the core team consists of Hong Kong licensed accountants and senior tax experts, well versed in the HKFRS standards and the Inland Revenue Department to review the caliber of the long-term service of the e-commerce, trade, investment and other industries, accurate diagnosis of business vouchers shortcomings and the misuse of standards issues.

👍 Quarterly intervention, preventing problems before they occurWe sort out accounts, file vouchers and alert risks on a quarterly basis, so that you can say goodbye to the passive situation of "end of year surprise, double the amount of tax". Your accounts are always in an "auditable state", ready for review by the bank or the tax office.

👍 Offshore exemption application "zero obstacle" from the first entry into the accounts that is in accordance with the offshore exemption audit standards, to ensure that the contract, capital flow, the operation of the record is complete and traceable, and significantly improve the success rate of offshore applications, and truly realize tax optimization.

👍Audit report "once through" We deliver a complete set of accounts that meets the audit requirements, which are efficiently audited by a licensed accountant, helping enterprises to successfully obtain an unqualified audit report, and safeguarding corporate credit and financing capabilities.

🔗 Service advantage: one-stop full-cycle accompaniment service

🏆We not only help companies solve specific problems, but also work to build a compliant bookkeeping system from the source:

1️⃣ Voucher standardization: mending the cost chain of evidence to avoid inflated profits

2️⃣ Standards Conversion and Audit Interface: Ensuring Hong Kong Standards Compliance in the Accounts Package

3️⃣ Tax planning in tandem: legal deductions, offshore exemptions, tax rate optimization

4️⃣ Full-cycle accompanying services: from company registration, quarterly bookkeeping to annual audit, the whole process of wind control escort

📞 If your Hong Kong company is also facing the following problems:

⚠️ The flow is all electronic records, missing invoices, contracts, bills

⚠️ Accounts handled in accordance with mainland standards, audit not passed, report not available

⚠️ Tried to apply for an offshore exemption, but was denied due to incomplete chain of evidence

⚠️ The bank asked for an audit report, but the books are a mess.

Welcome to contact Enterprise Caiying, we will customize a one-stop solution for you, so that every bit of profit is clear and controllable, and every bit of tax burden is legal and compliant.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Hong Kong Company Audit Compliance

- Hong Kong Company Audit

- Hong Kong company

- Hong Kong Company Registration