Enterprise Caiying Group to provide the United States / Singapore / Japan / Thailand / Malaysia / Canada / Mexico / Brazil / UK / France / New Zealand / Japan / Singapore / Vietnam / Indonesia / Malaysia and other foreign companies registered in the relevant business tax services, but also to provide Hong Kong companies / Shenzhen companies / Guangzhou companies / Shanghai companies / Hangzhou companies / Beijing companies / Hainan companies and other domestic companies registered corporate services, company annual audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / Hainan company Company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic company registration of corporate services, company annual audit audit / bookkeeping and tax returns / payment of MPF / change of information / bank account opening / ODI filing / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you have the need or interested in any time to drop me (phone and WeChat consulting: 13045886252 ).

For the majority of cross-border e-commerce sellers, tax compliance has recently become a difficult and focal point in their operations.

There are several core headaches that people commonly face, including compliance filings for multi-store models, difficult deductions for overseas platform expenses, purchases without invoices, and income tax cost expensing.

Tax compliance policies have progressed

Currently, progress on the core issues of concern to sellers is focused in three main directions:

1) In terms of a compliant way out of a multi-store operation:It is recommended that a "filing system" be adopted. Specifically, the information (such as tax identification numbers and store names) of multiple stores under the same business entity will be filed with the local tax authorities through a filing system, and eventually summarized in a core filing entity.

2) For overseas platform fees:It is recommended to adopt the "positive enumeration" method similar to that of stamp duty to clarify the items and proportion that can be expensed, including what kind of costs can be expensed, what kind of bills can be expensed, and what kind of vouchers can be expensed, etc., so as to help the sellers to make EIT declaration in a more reasonable manner.

3) In process optimization and voucher management:For those who get special invoices, tax refund will be made through intelligent and digital means in the future to speed up the timeliness of tax refund; for those who get ordinary invoices, the focus is to promote the standardization of cost expensing before enterprise income tax; for those who do not have invoices, the core of the business is to promote the sunshine and convenience of the operation of "tax exemption without invoices" and make it legally implementable through the on-line registration and other systematic solutions. The systematic program makes it legal.

Therefore, against the backdrop of tightening compliance regulations and normalization of tax audits, many companies are facing common problems such as missing cost tickets, social security non-compliance, and difficulties in handling large sums of money.

Recently, Enterprise Caiying Group has provided in-depth services to clients from different industries, such as automobile marketing, decoration engineering, culture and media, and successfully helped them to build a compliant structure, optimize tax costs and resolve potential risks.

These typical cases reflect our deep insight into the real business scenarios of enterprises and our ability to solve them systematically.

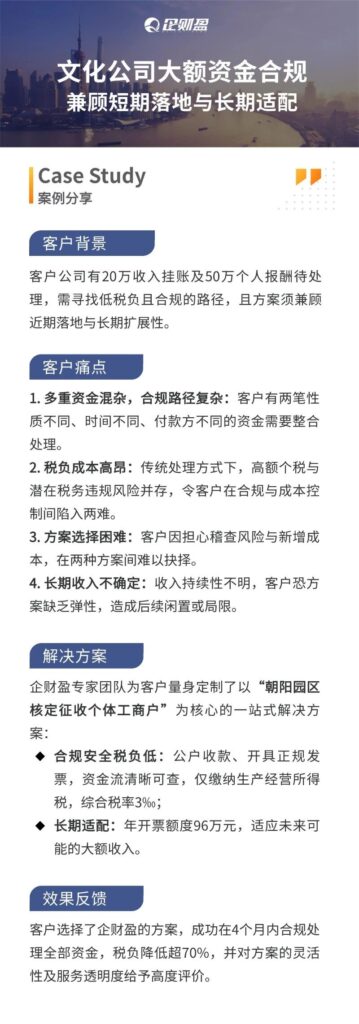

01 Enterprise Finance Group Real Client Case 3

Today, we share a [tax compliance] case study from Enterprise Finance Group3.

The client had $200,000 in pending revenue and $500,000 in personal compensation, and needed to find a low-tax and compliant path that would be scalable for both the near term and the long term. As a result, the client was faced with 4 major challenges:

(1) Multiple funds are mixed, and the compliance path is complex: the customer has two funds of different nature, at different times, and with different payers that need to be consolidated and handled.

(2) High tax cost: Under the traditional treatment, high personal tax coexists with the risk of potential tax violations, which puts clients in a dilemma between compliance and cost control.

(3) Difficulty in choosing a program: Customers are worried about the risk of audit and new costs, and have difficulty in choosing between the two programs.

(4) Uncertainty of long-term revenue: the continuity of revenue is unknown, and clients are afraid that the program will be inflexible, resulting in subsequent inactivity or limitations.

Solutions provided by the Enterprise Cai Ying team:

Our team of experts has customized a one-stop solution for our clients with the core of "Individual Businesses with Approved Levy in Chaoyang Park".

(1) Compliance and security tax burden is low: public account receipts, issuing formal invoices, the flow of funds is clear and traceable, only to pay the income tax of production and operation, the comprehensive tax rate of three thousandths.

2) Long-term fit: $960,000 in annual billing to accommodate potentially large future revenues.

The client chose Enterprise Caiying's solution and successfully disposed of all funds in compliance within 4 months, with a tax liability reduction of over 70%, and spoke highly of the flexibility of the solution and the transparency of the service.

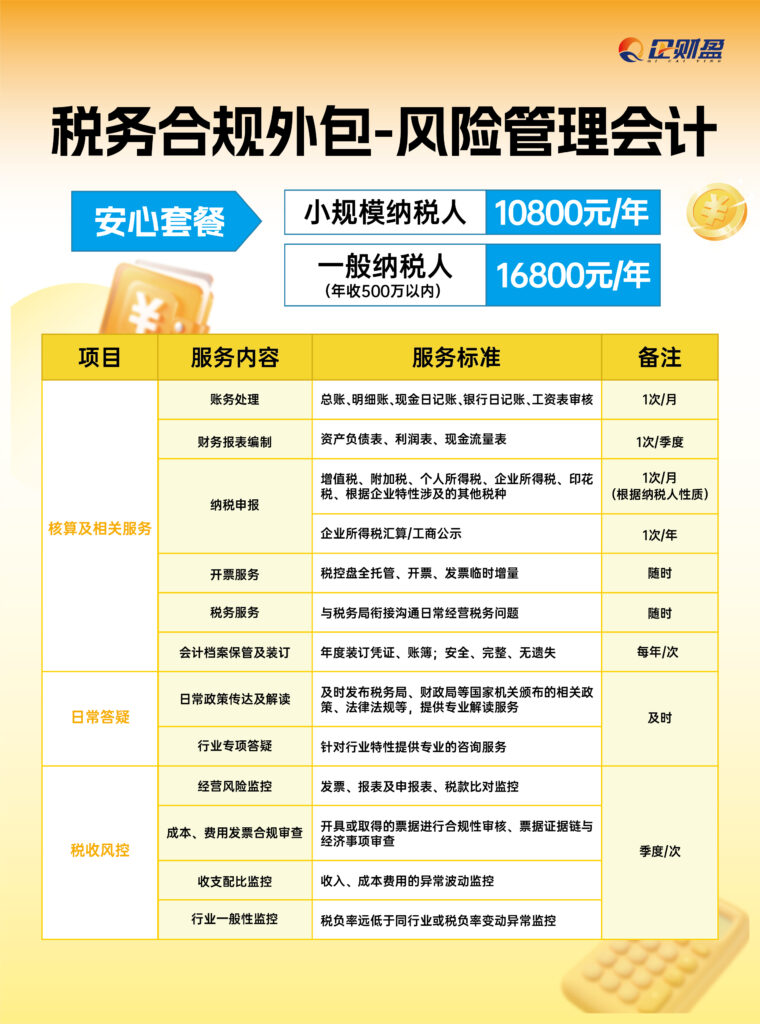

Enterprises CaiYing Group, also successively put forward the [tax compliance] service products 3 packages, the following is a package of service details, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package 1 for solutions.

Apart from Mainland renovation enterprises, many industries such as cross-border e-commerce enterprises also require tax compliance.

02 Three Pain Points in Cross-Border E-Commerce Tax Compliance

Pain point 1: Downstream can't get tickets, costs can't be deducted

This is by far the most prevalent and almost insoluble dilemma.

- status quo::The vast majority of suppliers, small factories and individual sellers are unable to provide compliant invoices, especially VAT invoices. In order to get the goods, e-commerce companies often need to accept "no invoice price".

- dilemma::

- Tax Points: You offer to take on the tax point to allow downstream invoicing, but this amounts to a tax burden shift and the cost is ultimately absorbed by you.

- For individual sellers: If the downstream is an individual, even if you are willing to bear the tax points, the other party can not issue an invoice. Unless the other party specifically goes to register an individual with an authorized levy, but this is usually only possible with a general invoice.Failure to address the core VAT input credit issue. The VAT chain is essentially broken here.

Pain point 2: High advertising and marketing costs, far exceeding pre-tax deduction limits

This is a permanent pain in the heart of platform e-commerce and store group model players.

- realism::In today's high cost of traffic, almost no e-commerce business with a sizable revenue can keep advertising costs (platform promotion, live stream casting, etc.) within 15% of revenue. Especially merchants who rely on the store group model to rush volume, paid traffic is the lifeline to maintain exposure.

- policy contradiction::The tax law stipulates that the advertising and business promotion expenses incurred by general enterprises are allowed to be deducted up to 15% of the sales (business) income of the year; the excess is allowed to be carried forward for deduction in the subsequent tax year. However, for e-commerce companies whose advertising expenses often account for 20%, 30% or even higher, theSignificant excess is not deductible in the current year, which directly pushes up the current taxable incomeThis is equivalent to paying an additional tax for "buying traffic" itself.

Pain point 3: High return rates erode revenue and complicated tax treatment

This is a characteristic challenge for consumer goods e-commerce, especially in industries such as apparel and footwear.

- industry practice: "seven days no reason to return" has become the standard, clothing and other categories of return rate as high as 30%-50% is not uncommon.

- Financial and tax implicationsA high return rate means that a large portion of the recognized revenue will eventually flow back. Although it can be handled by "sales return" in accounting and tax, frequent returns bring huge workload to the practical aspects such as invoicing, offsetting, cost transfer, etc., and if it is not handled in a timely manner or in a standardized manner, it will lead to a loss of revenue.Over-recognition of income and over-payment of tax in prior periodsThe funds are unreasonably tied up.

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Japanese company / Singapore company / Vietnamese company / Indonesian company / Malaysian company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the↓ ↓ ↓

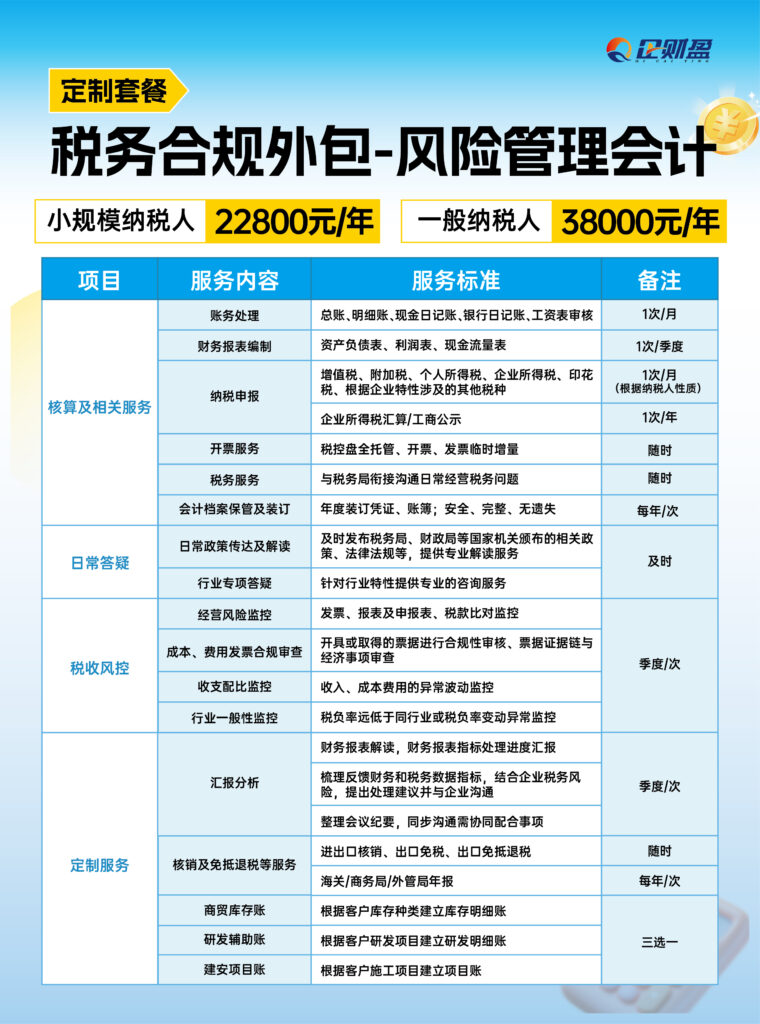

If you are experiencing more difficult tax=compliance issues, you can refer to Enterprise Finance Group's Tax Compliance Product Package II for solutions.

03 Breakthrough Ideas: Finding a Balance Between Compliance and Survival

Since tax-related information reporting is a major trend and the road to compliance must be traveled, the key is:How do you find a solution that meets regulatory requirements while allowing e-commerce businesses to pay taxes and retain profits?

This requires planning and optimization at an integrated level of business model, tax structure and financial management:

1)Business Re-engineering and Supply Chain Sorting::

Revisit the upstream supply chain to find a new balance between price and compliance. Gradually replace key suppliers with partners who can provide compliant tickets, even if the cost of purchasing goes up slightly, but obtaining deductible input tickets can recover from the overall tax burden.

2) Main design and tax planning::

According to the segmentation of business segments (e.g. cross-border platforms, store groups, live streaming with goods, offline sourcing, etc.), rationally utilize the tax policies of different market players (e.g. preferential policies for small and micro enterprises, individual businessmen and women), and carry out a conglomerate or matrix layout. For segments with high non-invoiced expenses such as Darren Carrying Goods, explore modes such as settlement through compliant platforms to convert labor remuneration into purchasing costs that can be invoiced.

3) Accurate accounting and account management::

Establish a financial accounting system that is highly compatible with the e-commerce business. Especially for the characteristic items such as return, promotion fee, platform fee, etc., carry out refined account processing and tax preparation to ensure the data is accurate and avoid overpayment of unjust tax.

4) Policy Research and Compliance Innovation::

Pay close attention to and study tax policies and local financial support policies for new businesses such as e-commerce and live broadcasting. Under the premise of legal compliance, make good use of various tax incentives and approved levies and other tools.

If you plan to register a U.S. company / Singapore company / Japanese company / Thai company / Malaysian company / Canadian company / Mexican company / Brazilian company / British company / French company / New Zealand company / Japanese company / Singapore company / Vietnamese company / Indonesian company / Malaysian company and other foreign companies registered in the relevant business and taxation services, or plan to register a Hong Kong company / Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hainan company and other domestic companies registered business services, the company's annual audit audit / bookkeeping tax / payment of MPF / change of information / bank account opening / ODI record / BVI registration / tax compliance / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the↓ ↓ ↓

If you have encountered difficult corporate tax issues, you can refer to Enterprise Finance Group's Tax Compliance Product Package III to solve them.

04 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Guide

- Tax Compliance Cases

- Corporate Tax Compliance

- taxation services

- Tax Compliance Optimization

- Tax Compliance