Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / French company / New Zealand company / Japanese company / Singapore company / Thai company / Vietnamese company Indonesia / Malaysia company and other companies. Overseas company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / tax compliance / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, there is a need for or interested in any time drop me (phone and WeChat consulting: 13045886252 ).

Against the backdrop of tightening compliance regulations and normalization of tax audits, many companies are facing common problems such as missing cost tickets, social security non-compliance, and difficulties in handling large sums of money.

Recently, Enterprise Caiying Group has provided in-depth services to clients from different industries, such as automobile marketing, decoration engineering, culture and media, and successfully helped them to build a compliant structure, optimize tax costs and resolve potential risks.

These typical cases reflect our deep insight into the real business scenarios of enterprises and our ability to solve them systematically.

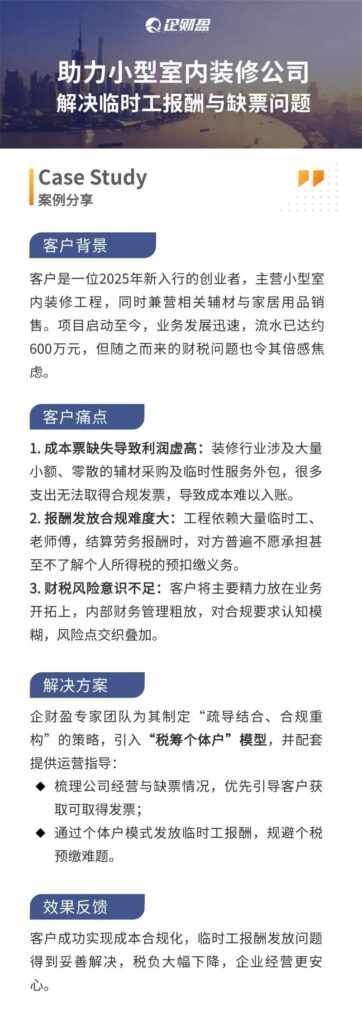

01 Enterprise Finance Group Real Client Case 2

Today, we share a [tax compliance] case study from Enterprise Finance Group2.

The client is a 2025 new entrepreneur who specializes in small interior remodeling projects and also sells related accessories and home furnishings.

Since the start of the project, the business has been developing rapidly, and the water flow has reached about 6 million yuan, but the ensuing financial and tax issues have also caused much anxiety, and the client was facing 3 major problems at that time:

1) Missing cost tickets lead to inflated profits:The decoration industry involves a large number of small and fragmented purchases of auxiliary materials and outsourcing of ad hoc services, and many of the expenditures are unable to obtain compliant invoices, making it difficult to account for the costs.

2) Compensation payments are difficult to comply with:The project relies on a large number of temporary workers and teachers, and when settling the labor compensation, the other party is generally unwilling to undertake or even do not understand the obligation to withhold personal income tax.

(3) Insufficient awareness of fiscal risks:The client focuses mainly on business development, with sloppy internal financial management, fuzzy perception of compliance requirements, and intertwined and overlapping risk points.

Solutions provided by the Enterprise Cai Ying team:

The expert team of Enterprise Caiying formulated the strategy of "combination of guidance and compliance reconstruction", introduced the model of "tax-financed self-employed", and provided supporting operational guidance:

(1) Sort out the company's operation and lack of invoices, and prioritize and guide customers to obtain obtainable invoices.

2) Payment of casual labor compensation through the self-employed model to avoid the challenge of tax prepayment.

The client successfully achieved cost compliance, the issue of payment of compensation for temporary workers was properly resolved, the tax burden was significantly reduced, and the business operated with greater peace of mind.

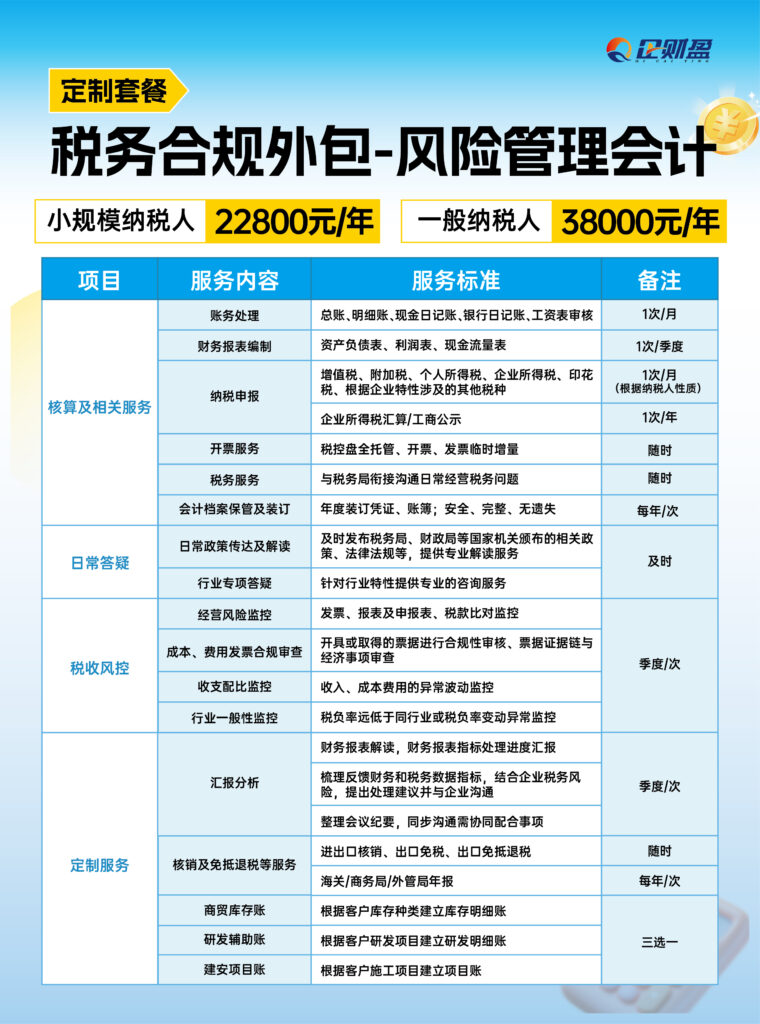

Enterprises CaiYing Group, also successively put forward the [tax compliance] service products 3 packages, the following is a package of service details, you can add my WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package 1 for solutions.

Apart from Mainland renovation enterprises, many industries such as cross-border e-commerce enterprises also require tax compliance.

02 Three Pain Points in Cross-Border E-Commerce Tax Compliance

Pain point 1: Downstream can't get tickets, costs can't be deducted

This is by far the most prevalent and almost insoluble dilemma.

- status quo::The vast majority of suppliers, small factories and individual sellers are unable to provide compliant invoices, especially VAT invoices. In order to get the goods, e-commerce companies often need to accept "no invoice price".

- dilemma::

- Tax Points: You offer to take on the tax point to allow downstream invoicing, but this amounts to a tax burden shift and the cost is ultimately absorbed by you.

- For individual sellers: If the downstream is an individual, even if you are willing to bear the tax points, the other party can not issue an invoice. Unless the other party specifically goes to register an individual with an authorized levy, but this is usually only possible with a general invoice.Failure to address the core VAT input credit issue. The VAT chain is essentially broken here.

Pain point 2: High advertising and marketing costs, far exceeding pre-tax deduction limits

This is a permanent pain in the heart of platform e-commerce and store group model players.

- realism::In today's high cost of traffic, almost no e-commerce business with a sizable revenue can keep advertising costs (platform promotion, live stream casting, etc.) within 15% of revenue. Especially merchants who rely on the store group model to rush volume, paid traffic is the lifeline to maintain exposure.

- policy contradiction::The tax law stipulates that the advertising and business promotion expenses incurred by general enterprises are allowed to be deducted up to 15% of the sales (business) income of the year; the excess is allowed to be carried forward for deduction in the subsequent tax year. However, for e-commerce companies whose advertising expenses often account for 20%, 30% or even higher, theSignificant excess is not deductible in the current year, which directly pushes up the current taxable incomeThis is equivalent to paying an additional tax for "buying traffic" itself.

Pain point 3: High return rates erode revenue and complicated tax treatment

This is a characteristic challenge for consumer goods e-commerce, especially in industries such as apparel and footwear.

- industry practice: "seven days no reason to return" has become the standard, clothing and other categories of return rate as high as 30%-50% is not uncommon.

- Financial and tax implicationsA high return rate means that a large portion of the recognized revenue will eventually flow back. Although it can be handled by "sales return" in accounting and tax, frequent returns bring huge workload to the practical aspects such as invoicing, offsetting, cost transfer, etc., and if it is not handled in a timely manner or in a standardized manner, it will lead to a loss of revenue.Over-recognition of income and over-payment of tax in prior periodsThe funds are unreasonably tied up.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business tax services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / United Kingdom companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, foreign companies, such as Company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

If you are experiencing corporate tax compliance issues, you can refer to the Enterprise Finance Group's Tax Compliance Product Package II for solutions.

03 The Compliance Dilemma: Where are the profits after regulation?

These three pain points stack up to create a harsh reality:Once tax compliance is strictly enforced, many e-commerce companies will have to pay high taxes on the portion of their profits that is "not their true profit".

Let's take an e-commerce company with a pure store model as an example of a short account:

Assume that its merchandise gross margin is only 15% (which is not uncommon in competitive platform e-commerce).

- value-added tax (VAT): At the rate of 13%, if there is a significant shortfall in input votes, VAT will be payable on almost 13% of sales.

- surplus after tax: 15% of gross profit, after deducting 13% of VAT, leaves only 2%.

- corporate income taxThe "gross profit" of $2% has to be deducted from operating expenses (of which a large number of non-billable expenses and over-limit advertising costs are not deductible), and the final book profit may be minimal or even negative, but after tax adjustments, the taxable income may still be very high.

Therefore, e-commerce tax compliance is not as simple as simply making the accounts "beautiful" and importing the water into the bookkeeping software. Rough "standardization" may lead to an embarrassing end: the account is standardized, but the company has lost its ability to survive due to excessive tax burden.

This is particularly fatal for owners of store clusters where margins are already thin and turnover is based on scale.

Corporate High Risks and Response Strategies

1) Three major high-risks (e-commerce / anchor focus on vigilance)

| Type of risk | group of people | Risk consequences |

| split operation | Multi-store enterprise | Consolidated Tax Trigger Exceeded, Back Tax at 13% |

| Replacement of business entities | Cross-border e-commerce, anchor | Tax and penalty costs spike when historical data is combined and exceeded |

| Concealment and misreporting of income | Ticketless income-based e-commerce/anchor | After being audited by Big Data, rehydrated at 13% + fines |

typical exampleAn e-commerce company's sales in April 2026 had exceeded 5 million, but because of the delay in pushing data from the platform (on a quarterly basis), the overrun was only discovered in July: it was necessary to correct the VAT declaration for April-June and pay three months of additional tax at 13% instead of the original small-sized 1%, and the profit margins were seriously compressed.

2) Corporate Response StrategiesCore Portfolio:Internal finance team (focusing on internal bookkeeping) + external year-round tax consultant (professional guidance, regular compliance checks, training for finance staff).Necessity:Under the escalation of levy, it is difficult for a single in-house finance team to cover the full dimensions of compliance needs, and external consultants can make up for the shortcomings of specialization, which is the most economical compliance solution.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of the relevant business tax services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / United Kingdom companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies, foreign companies, such as Company registration related business tax services, company annual review / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓↓↓↓

If you are experiencing compliance issues with your corporate taxes, you can refer to Enterprise Finance Group's Tax Compliance Product Package III for solutions.

04 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Tax Compliance Guide

- Tax Compliance Cases

- Corporate Tax Compliance

- tax planning

- taxation services

- Tax Compliance Optimization

- Tax Compliance