Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic companies registered related business services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / France company / New Zealand company / Japanese company / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign companies Registered related business tax services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

Full Electronic Implementation of U.S. Tariff Refunds Goes Into Effect Feb. 6; Importers Need to Urgently Complete ACE Portal Registration

U.S. Customs and Border Protection (CBP) has recently issued an important announcement clarifying that since February 6, 2026, the full implementation of the electronic issuance mode of customs duty and import duty refunds in lieu of taxes, the traditional paper check refund method will be officially discontinued.

The landing of the policy coincides with the critical eve of the U.S. Supreme Court's final ruling on the Trump administration's tariff case, which is not only recognized by the industry as the core initiative of the U.S. Customs to standardize the management of tariff refunds and enhance the level of trade facilitation, but also puts forward the urgent requirements for the majority of importers to operate in a compliant manner.

The electronic transformation of tariff refunds is an important deployment of the U.S. Customs to deepen regulatory digital reform and optimize the effectiveness of trade services, and its core objective is to shorten the refund cycle through process simplification, enhance the efficiency of capital flow, and fundamentally reduce administrative and operational costs.

According to the details of the announcement, after the new regulation comes into effect, all eligible tariff refund applications must be submitted through the Automated Commercial Environment (ACE) portal in a unified manner; the refund funds that have been audited and approved will be transferred directly to the importer's pre-registered e-account.

This change will completely eliminate the problem of delays, loss and other uncertainties that existed in the previous paper check mailing process, and provide importers with a more efficient and safer channel for tax refunds.

Industry experts analyze and predict that if the Supreme Court rules that the relevant tariff collection behavior is illegal, the U.S. government will face up to 133.5 billion to 150 billion U.S. dollars of huge tax rebate pressure. However, it should be emphasized that such refunds are not automatic, and importers must complete the ACE Portal e-account registration in advance to ensure the smoothness of the subsequent refund channel and avoid losing their legal rights.

Therefore, if you need a tax compliance program or registration of U.S. domestic companies, you can consult the Enterprise Caiying Group efficient and professional processing (phone and WeChat consulting: 13045886252); at the same time, today also share the applicable population of U.S. company registration, as well as how to register U.S. companies, how to pick the right state to register U.S. companies to escort your cross-border business to enter the U.S. market!

In response to the above policy requirements, importers in the U.S. market need to take immediate action to complete the three core operations by February 6, 2026, in order to protect their rights and interests:

For one thing.Be sure to log in to the ACE Portal to complete the electronic account registration and real-name authentication to ensure that the account information is completely consistent with the enterprise information registered with the Customs, so as to avoid the business being blocked due to incompatible information;

Secondly.Bind a valid bank account in a timely manner and verify the compliance and availability of the channel for receiving funds in advance to ensure that the refunded funds can be smoothly accounted for;

Thirdly.Systematically learn and familiarize with the whole process operation specification of e-refund application, and at the same time comprehensively organize and retain the relevant tax payment vouchers, customs declaration documents, trade contracts and other basic information, so as to be well-prepared for the possible arrival of large-amount tax refund application. U.S. Customs has issued a special warning that importers who have not completed the registration of their electronic accounts as required will not be able to receive normal duty refunds. Even if they are eligible for duty refund, they may face the risk of delay in the application process, rejection of information and even loss of rights and benefits.

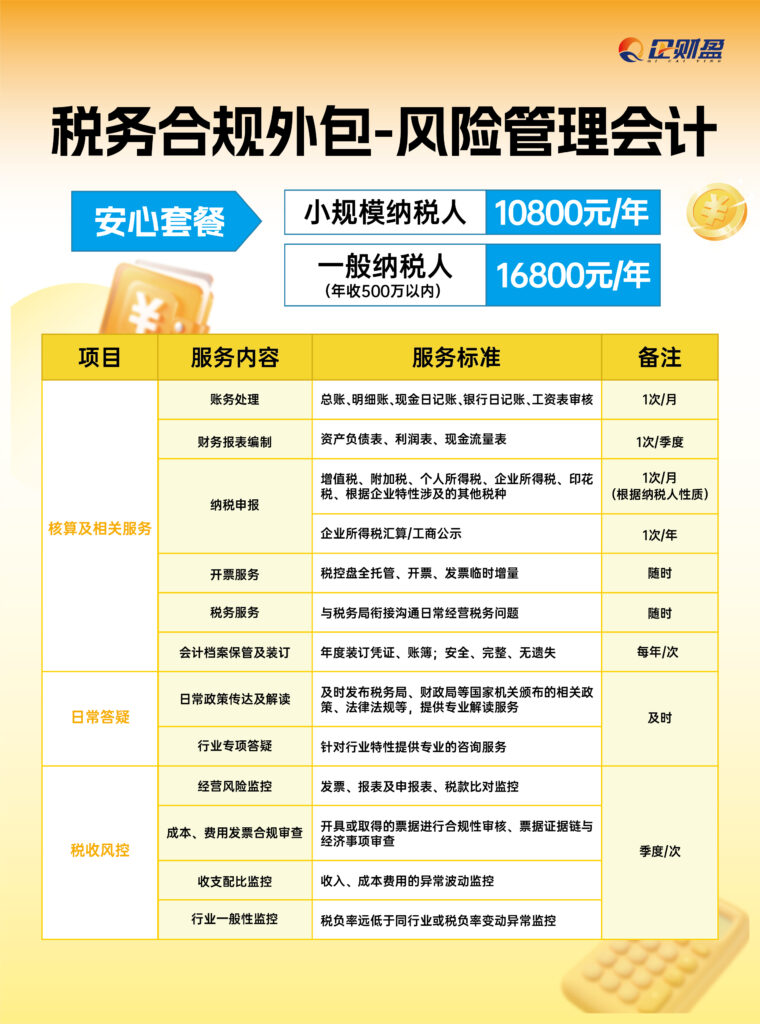

If there is a need for a tax compliance program on your side, Enterprise Caiying has 3 tax package programs for you to choose from.

01 Advantages of registering a U.S. company

1) High international credibility, recognition and legal status

A company registered in the United States has a high degree of international credibility and recognition and can open corporate accounts with banks worldwide. The company's international legal status is also high, protected by the U.S. government, and highly recognized.

2) Flexibility in case of exchange rate fluctuations

In the United States after the registration of the company, there is a public account is not subject to domestic foreign exchange control, foreign exchange freely in and out.

3) Have more avenues for reasonable tax avoidance

We can utilize overseas companies for proper tax arrangements and reasonable and legal tax planning. All foreign companies in our country have a policy of reducing or exempting taxes and utilizing international transfer prices to distribute profits and expenses. If you do not operate your business on U.S. soil, you are exempt from corporate income tax, corporate share tax and personal income tax, and only deliver the normal annual fee.

4) Immigration and Visa Facilities

After registering a U.S. company for 1 year, you can apply for a resident card from the U.S. official by your lawyer for immigration purpose; many Chinese entrepreneurs have also obtained a U.S. green card by opening a branch in the U.S. This is the L1 visa.The L1 visa is an open work visa from the U.S. Immigration Service.

5) Sales Advantage

Company information is available to buyers on many e-commerce platforms, such as Amazon. At the initial stage without a brand, buyers are inclined to choose US-based companies, so US companies are more dominant in terms of sales.

In fact, for cross-border e-commerce, the advantages of registering a U.S. company are even more obvious.

1) Policy Benefits

You can get policy care on local platforms, such as lower commissions, risk of blocking, and category restrictions.

2) Platform on-boarding

Can be stationed in the restrictions only U.S. companies can be stationed in the cross-border e-commerce platform (Walmart, Overstock, Sears, etc.); can be opened to only limit the U.S. companies can apply for services: the American Gift Association ASI and SAGE; ASI and SAGE is also the company's specialty services, has been successfully handled by dozens of people. Do small commodity trade sellers, interested in consulting the Enterprise Caiying Group efficient and professional processing (telephone and WeChat consulting: 13045886252).

3) Lower risk

Audit easy to pass, but also more local consumers trust, low rate of closure, and the U.S. company for the U.S. bank account, the collection of foreign exchange loss is low. Other, the current U.S. company relative to the Amazon global store faster, but also can do some Chinese companies can not do the category (class such as: jewelry, etc.).

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thailand companies / Vietnam companies / Malaysia companies and other foreign companies Registered related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓ ↓↓↓

02 Applicable People of Registered U.S. Corporation

1) Chinese sellers seeking a foothold in the US market:

For Chinese businesses looking to gain a firmer foothold in the U.S. market, having a "local identity" enhances the trust of local consumers and helps them better penetrate and expand into the U.S. market.

2) Merchants who reduce the risk of operating an e-commerce platform:

If business on cross-border e-commerce platforms such as Amazon performs well and orders continue to grow, registering a U.S.-based company can effectively reduce the risk of account blocking and may enjoy various preferential policies and support provided by the platforms for local businesses.

3) Entrepreneurs seeking tax benefits:

Some U.S. states have implemented a variety of tax incentives for local businesses that are designed to promote business activity, innovation, and enterprise development. Therefore, by incorporating in specific regions of the United States, cross-border sellers have the opportunity to take advantage of these financial incentives.

4) Companies that focus on brand image building:

In order to establish a more positive and professional image in the U.S. market, some Chinese companies choose to register their companies in the U.S. in order to obtain an official office address and contact information, thus demonstrating to consumers their identity as a reliable partner, and further enhancing brand recognition and credibility.

5) Businesses that plan to raise capital or go public for expansion:

For Chinese companies that intend to expand through financing, or even seek an IPO, registering an entity in the U.S. often makes it easier to attract the attention of investors.

This is not only because the U.S. has a sophisticated capital markets system, but also because it provides access to a wide range of investment resources.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thailand companies / Vietnam companies / Malaysia companies and other foreign companies Registered related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓ ↓↓↓

03 What information do I need to prepare to register a U.S. corporation?

①English company name and state of incorporation (company name without punctuation as much as possible, before confirming to the verification of the name).

②Corporate registered capital (default 1,000 shares, one share of one U.S. dollar).

③ business scope of the company (not limited to the number of words, business scope is more to provide its main business products or services can be).

④Over 18 years of age shareholder director ID card front and back or passport, if the shareholder is a company, you also need to provide the business license of the shareholder company.

⑤ If the customer's own U.S. address, it is required; if not, it is ignored.

(6) Shareholder and director e-mail and contact number.

⑦ Shareholder director blank A4 paper signature (or group information confirmation is sufficient).

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thailand companies / Vietnam companies / Malaysia companies and other foreign companies Registered related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓ ↓↓↓

04 The process of registering a U.S. company

1) Company name check (the most satisfactory name, preferably several more alternatives).

(2) Submission of power of attorney (completed power of attorney and signing of agreement).

3) Signing the agreement (signing a letter of agreement on mutually agreed terms).

4) Delivery costs.

5) Signing of statutory documents (arranging for a full set of documents to be signed by all shareholders and directors).

6) Government approval process.

7) Company formation is completed U.S. company registration cycle is generally about 20 working days.

Registrations will vary slightly from state to state in the U.S., as will the time required.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thailand companies / Vietnam companies / Malaysia companies and other foreign companies Registered related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓ ↓↓↓

05 U.S. companies are registered, how to maintain later?

1) Annual Audit

An annual review includes confirming or updating the basic business information of the company, such as registered address, agent information, and director information.

The timing and requirements for annual audits vary from state to state; for example, Delaware regular corporations are required to complete an annual audit by March 1, while LLCs are required to do so by June.

Other states, such as New York, have biennial annual audits, while California and Nevada have natural annual audits, i.e., one audit per year.

Failure to keep annual audits on time may result in fines or other legal consequences.

2) Tax Returns

Tax returns for U.S. corporations include both state and federal taxes.

For federal taxes, companies are required to file a tax return at the rate of 21% if there is a business profit, and not if there is no profit.

State taxes vary from state to state; some states such as Nevada, Texas, and Washington do not have a state income tax, while others may have a franchise tax that needs to be paid even if the company does not operate locally, such as California and New York.

When filing taxes, companies are required to file the appropriate tax forms and reports and pay the appropriate taxes based on their type (e.g., C-Corporation or LLC) and operations.

Be careful: even if there are no operations, the company is required to file a zero tax return!

Enterprise Caiying Group, not only can help you to register a U.S. company, but also can register companies in other countries overseas.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / France / New Zealand companies / Japan / / Singapore companies / Thai companies / Vietnamese companies / Malaysian companies and other foreign companies Registered related business tax services, company annual review / bookkeeping and tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop services such as can look for enterprises CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant to communicate with you in detail ↓↓ ↓ ↓

06 Why choose Enterprise Caiying Group?

🏆 Why choose Enterprise Finance? --Professional strength, global trust

Enterprise Caiying Group, since its establishment in 2015, has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industry, commerce, finance and tax and business services for enterprises.

Our bottom line, from the deep precipitation and authoritative certification:

✅ Service Scale Witnesses Reputation: Accumulated services for more than 300,000+ enterprises, long-term cooperation with more than 50,000+ customers.

✅ Global Network Local Support: Branches are set up in Beijing, Guangzhou, Shenzhen, Hong Kong, Southeast Asia, and the United States, with services covering Asia, Europe, and the Americas.

✅ Official certification qualification escort: with 3 Hong Kong government certified licensed secretarial firms, a U.S. branch and a self-employed Hong Kong accounting firm, and at the same time is the vice president of the Shenzhen Agency Bookkeeping Association, etc., to ensure that the service is fully compliant and reliable.

The four core advantages of Enterprise Caiying's overseas company registration service:

🔹 1. A team of experts to guide you throughout the process

Our team of nearly 400 professionals consists of senior lawyers, accountants, tax accountants and cross-border business consultants. They are well versed in international regulations, handle thousands of high-end cases annually, and can provide optimal customized solutions from structural design to on-the-ground implementation.

🔹 2. digitally empowered, smart and efficient

We have spent 20 million RMB to research and develop our own digital system "Echobo", which realizes process standardization and progress visualization. The integration of AI intelligent analysis can provide quick insight into demand and assist in generating solutions, making complex affairs clear, transparent and efficient.

🔹 3. Eco-links, extra value

We connect over 500,000+ entrepreneurs with domestic and international associations. By regularly organizing cross-border salons, tax law seminars and other activities, we not only solve registration problems, but are also committed to linking resources and creating business opportunities for you.

🔹 4. Full-cycle accompaniment for worry-free sailing

Our services go beyond "successful registration". We provide a full life cycle of services from early consultation, mid-term implementation, to late financial and tax declaration, annual audit and maintenance, and compliance consulting, to become your long-term and stable partner for overseas expansion.

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Advantages of U.S. Company Registration

- U.S. Company Registration Process

- Incorporate a U.S. Company

- U.S.A. Inc.

- U.S. Company Registration