Adaptation of new and old companies, support for multiple industries, account opening process + fees are fully disassembled

After registering a Hong Kong company, the counterparty account is the core carrier of cross-border payment collection and fund transfer. Among many banks in Hong Kong, Hang Seng Bank has become a popular choice for foreign trade enterprises and cross-border e-commerce companies by virtue of its "wide adaptability, stable service and efficient cross-border settlement" - no matter whether you are a newly registered new company or an old enterprise with stable water flow, whether it's a trade class or service industry, you can find a suitable account opening program. This article will bring you a comprehensive unlocking of the Hong Kong Hang Seng Bank company account: the advantages of the highlights, account opening information, the process of timeliness, tariffs and standards at once to speak through, to help you take a detour!

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

01 Hong Kong Hang Seng Bank Account Opening Core Advantages: Why Become the First Choice of Enterprises?

Full coverage of old and new companies without industry discrimination

Breaking the pain point of "difficult to open an account for a new company"! Hong Kong companies that have just registered for 1 month, or old companies that have operated for more than 3 years can apply, especially suitable for foreign trade, cross-border e-commerce, service consulting and other industries, no need to worry about being refused accounts due to "cold industry".

Support for account opening without Mainland affiliates

Many start-ups do not have a physical company in the Mainland. Hang Seng Bank has opened an exclusive channel for such cases - as long as you can provide real business evidence (e.g. intentional contracts, procurement documents), you can open an account without an affiliated company, saving the time and cost of setting up an additional entity.

Fast account opening and transparent auditing

After the information is complete, the bank pre-approval takes only 3-5 working days, and the face-to-face signing can be completed in 1 hour, the overall cycle of the account 7-14 days, which is nearly half of the time than HSBC, Standard Chartered Bank, etc., and enterprises in a hurry to use the account can be prioritized.

Efficient cross-border settlement with multi-currency adaptation

It supports 12 mainstream currencies such as USD, EUR, RMB, etc., and the fastest transfer with mainland banks is 1 hour, and there are no barriers to receiving money from Europe, America and Southeast Asia; it supports FPS, CHATS system, and Hong Kong's local transfer is free of commission, which significantly reduces the transaction cost.

High account stability and low risk of closure

As an established local bank in Hong Kong, Hang Seng Bank has a mild risk control policy and rarely closes an account without reason as long as the business is genuine and the current is compliant. For small and medium-sized enterprises (SMEs) with a monthly cash flow of HK$100,000 - HK$5 million, the pressure of account maintenance is low and there is no need to submit supplementary information frequently.

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

02 Hong Kong Hang Seng Bank Corporate Account Opening Information (2026 Latest Version)

(1) Hong Kong company documents (NNC1/NAR1, BR, CI, M&A) Hong Kong companies established more than 1 year need to provide audit reports.

(2) Directors and shareholders (25%) personal documents (ID card + passport/passport).

(3) KYC forms.

(4) Deposits up to $100,000; (average deposit balance of $100,000 every 3 months of personal water records)

(5) Business plan; and

(6) Hong Kong company signed a procurement contract + sales intention contract (1 set) * one and overseas or Hong Kong signed, the other signed with the mainland; (there are provided, the chances of opening an account will be greater)

(7) Relevant information on affiliated companies (if any)

(8) 1-2 years of social security record in the relevant industry of the director or major shareholder (if any)

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

03 Hong Kong Hang Seng Bank account opening process (full transparency, personalized follow-up)

Pre-audit: The customer submits a full set of information, our professional team will do an internal audit to correct the flaws in the documents (such as contract terms are not standardized, address proof is not in line with the requirements), to ensure that it meets the bank's audit standards.

Bank Appointment: After passing the audit, our company will dock with the exclusive manager of Hang Seng Bank to make an appointment for a face-to-face interview in Hong Kong (you can choose the nearest branch in Hong Kong, such as Sheung Wan, Tsim Sha Tsui, etc.).

Interview in Hong Kong: Directors and shareholders bring the original documents to Hong Kong and have an interview with the bank manager (mainly to verify the authenticity of the business and the source of funds), the interview process takes about 1 hour and the details of the account opening are confirmed on the spot.

Account activation: After the face-to-face signing is completed, the bank audit cycle of 7-14 days, through the bank card, Internet banking U shield will be mailed; received after the activation of the account can be normal receipt of payments. Note: Bank policies may be dynamically adjusted, such as account opening thresholds, data requirements, etc., it is recommended to contact our company to obtain the latest policy interpretation before opening an account to avoid delays in the process due to incomplete information.

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

.

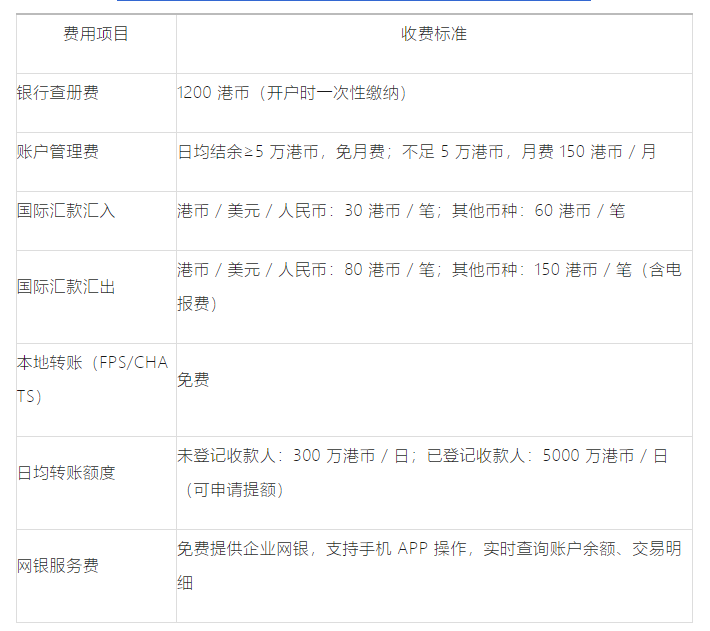

04 Hong Kong Hang Seng Bank account opening fee standard (clear and transparent, no hidden costs)

If you also want to open the Hong Kong company's public account, welcome to sweep the code to add our online customer service (WeChat: jxhqcy890 / cell phone: 16625410105), to arrange for the manager to answer questions, provide professional advice and full one-on-one service!

- Hong Kong Hang Seng Public Accounts

- Advantages of registering a Hong Kong company

- Foreign trade

- cross-border e-commerce

- Register Hong Kong Company

- Hong Kong Company Registration

- Hong Kong Company Account Opening