Enterprise Caiying Group provides Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic companies registered related business services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / United Kingdom company / France company / New Zealand company / Japanese company / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign companies Registered related business tax services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252).

Today, by sharing the case of a customer registering a Hong Kong company & opening an account, and analyzing in depth the difference between mainland tax and Hong Kong tax as well as the tax advantages of Hong Kong, we will provide professional support and tax planning for your business to go overseas.

01 Real Customer Cases of Enterprise Caiying Group

Today, I would like to share a case of Hong Kong company registration + account opening with Enterprise Caiying Group.

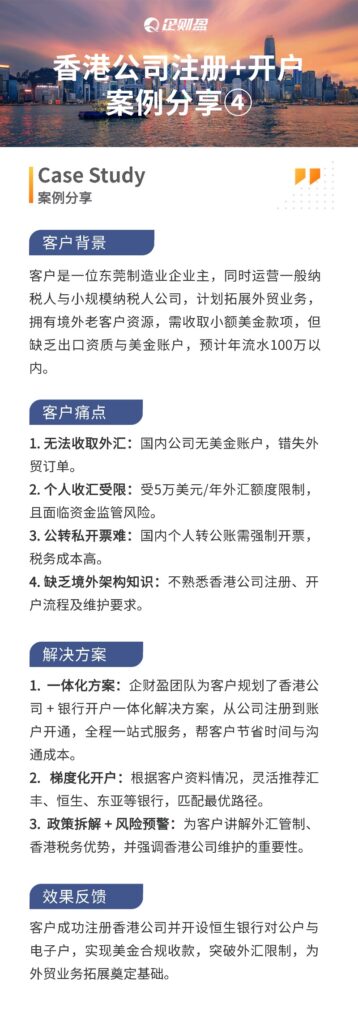

The client is a Dongguan manufacturing enterprise owner, operating both general taxpayer and small-scale taxpayer company, plans to expand foreign trade business, has the resources of the old overseas customers, needs to collect small amount of money in US dollars, but lacks of export qualification and US dollar account, the expected annual flow of less than 1 million.

Before launching, it faces four issues that need to be resolved:

1) Unable to collect foreign exchange:Domestic companies do not have US dollar accounts and miss out on foreign trade orders.

(2) Individuals are restricted from receiving foreign exchange:Subject to $50,000/year foreign exchange limit and exposed to capital regulatory risk.

3) Difficulty in invoicing public-to-private transfers:Domestic personal to public accounts require mandatory invoicing and high tax costs.

4) Lack of knowledge of offshore architecture:Not familiar with Hong Kong company registration, account opening process and maintenance requirements.

Solutions provided by the Enterprise Cai Ying team:

1) Integration programs:Enterprise Caiying team has planned an integrated solution of Hong Kong company + bank account opening for customers, from company registration to account opening, the whole process of one-stop service, to help customers save time and communication costs.

2) Graduated account opening:Flexible recommendation of HSBC, Hang Seng, East Asia and other banks to match the optimal path based on customer profile.

3) Policy dismantling + risk warning:Explain to clients the foreign exchange control, Hong Kong tax advantages and emphasize the importance of Hong Kong company maintenance.

Through the efforts of Enterprise Caiying team's assistance, the customer successfully registered a Hong Kong company and opened Hang Seng Bank's public account and e-accounts, realizing US dollar compliance collection, breaking through the foreign exchange restrictions, and laying the foundation for the expansion of foreign trade business.

If you need to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration of related business services, but also to provide U.S. companies / Canadian companies / Mexican companies / Brazilian companies / U.K. companies / French companies / New Zealand companies / Japanese companies / / Singapore companies / Thailand companies / Vietnam companies / Malaysia companies and other foreign companies Registered related business tax services, company annual review / bookkeeping tax / payment of MPF / change information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, you can add my WeChat (phone with V: 13045886252) at any time to consult the ↓ ↓↓↓

02 Differences in taxation between Hong Kong companies and Mainland companies

Mainland companies cover a wide range of taxes, including personal income tax, corporate income tax, value-added tax, etc., while the main types of corporate tax in Hong Kong include salaries tax, profits tax and property tax, etc. Let's make an in-depth comparison below:

1) Taxation rules for Mainland and Hong Kong enterprises

✅ Mainland Global Taxation

Mainland China's tax policy follows the global taxation model.

This means that as long as you are a holder of a Mainland identity card, you are required to follow the Mainland's tax laws and regulations in filing returns and paying taxes, regardless of where your source of income is.

The core of this policy lies in the identification. The Mainland ID card gives you the status of Mainland tax resident, and this status determines that all your worldwide income needs to be included in the Mainland tax category.

✅ Hong Kong Territorial Taxation

Hong Kong's taxation policy follows the territoriality principle, i.e. the tax liability depends mainly on an individual's residence in Hong Kong.

According to the Inland Revenue Ordinance of Hong Kong, the taxation system of Hong Kong mainly includes profits tax and salaries tax. Among them, salaries tax is targeted at persons employed by Hong Kong employers or working in Hong Kong.

According to the Inland Revenue Department of Hong Kong, you will be considered as a tax resident of Hong Kong if you meet one of the following conditions: ordinarily reside in Hong Kong and have resided in Hong Kong for a cumulative total of more than 180 days in a tax year (from April 1 of each year to March 31 of the following year); or have resided in Hong Kong for a cumulative total of more than 300 days in two consecutive tax years.

(2) Individual Income Tax in the Mainland and Salaries Tax in Hong Kong

✅ Mainland Personal Income Tax

Tax rates:Individual income tax in the Mainland is based on progressive tax rates ranging from 3% to 45%. The exact tax rate depends on the amount of taxable income of an individual.

taxable area::Individual income tax in the Mainland is based on the principle of worldwide taxation, i.e. resident individuals are required to pay tax on their worldwide income. Non-resident individuals are taxed only on their income derived from sources within China.

Deductions::Individual income tax in the Mainland allows for certain deductions, such as basic deductions (RMB 5,000 per month), special deductions (e.g., social security and provident fund), special additional deductions (e.g., for children's education, continuing education, and medical treatment for major illnesses), and other deductions determined in accordance with the law.

✅ Hong Kong Salaries Tax

duty rate::Hong Kong adopts progressive rates for salaries tax, with tax rates ranging from 2% to 17%. In addition, Hong Kong also offers a standard rate (15%) for taxpayers to choose from, with the lower of the two being taken as the effective tax burden lower than the top bracket of 45% in the Mainland.

taxable area::Hong Kong adopts the territorial principle of taxation for salaries tax, i.e. only income arising in or derived from Hong Kong is taxed. This means that if the income is sourced outside Hong Kong, it is not subject to salaries tax.

3) Mainland corporate income tax and Hong Kong profits tax

✅ Mainland Enterprise Income Tax

duty rate::The standard rate of Mainland enterprise income tax is 25%. For small and micro-profit enterprises, the rate is 20%, but the effective tax rate may be lower, depending on the taxable income of the enterprise.

taxable area::Mainland EIT adopts the principle of global taxation, whereby resident enterprises are required to pay tax on their worldwide income. Non-resident enterprises are taxed only on their income derived from sources within China.

Deductions::Deductions allowed under Mainland EIT are more extensive, including costs, expenses, taxes and losses.

✅Hong Kong Corporate Profits Tax

duty rate::The standard rate of Hong Kong profits tax is 16.51 TP3T. For the first HK$2 million assessable profits of the corporation, the rate is 8.251 TP3T.

taxable area::Hong Kong profits tax adopts the territorial principle of taxation, i.e. only profits arising in or derived from Hong Kong are taxed, and no tax is levied on profits generated by Hong Kong companies in non-Hong Kong jurisdictions.

Deductions:Relatively few items are allowed for deduction under Hong Kong profits tax, which mainly include operating costs, expenses, and so on.

4) Mainland VAT and Hong Kong property tax

✅ Mainland VAT

duty rate::Mainland VAT rates are generally 6%-13%, depending on the type of goods or services.

taxable area::Mainland VAT applies to the sale of all taxable goods and services, including imported goods and services.

Deductions::Mainland VAT allows deduction of input tax, i.e. the VAT paid by a business when purchasing goods or services can be deducted against the VAT it is liable to pay.

✅ Hong Kong Property Tax

duty rate::There is no VAT in Hong Kong, but there is a property tax at the rate of 15%.

taxable area::Property tax applies to rental income derived from renting out property in Hong Kong.

Deductions::Allowable deductions for property taxes include repair costs, ground rent, etc.

03 Hong Kong Tax Incentives

✅ Salaries tax:

Basic allowance HK$132,000/year, HK$264,000 for married persons, HK$120,000/person for children and up to HK$75,000/person for dependent elderly.

✅Profits tax:

The tax rate for the first HK$2 million profits of a limited company is 8.25% and the excess 16.5%; for non-limited companies it is a flat rate of 15%. Tax is only levied on profits arising locally in Hong Kong and profits arising outside Hong Kong are exempted from tax.

✅ Deductions are plentiful:

Deductions can be made for MPF contributions (up to HK$18,000), expenses on further education (up to HK$100,000), mortgage interest (up to HK$100,000), etc. to further reduce the tax base.

✅ Avoidance of double taxation:

Hong Kong has an extensive network of international tax treaties and has entered into agreements for the avoidance of double taxation with a number of countries and territories. These agreements facilitate the cross-border investment and business activities of Hong Kong tax residents.

Holding overseas assets through a Hong Kong company to realize rational distribution of profits and avoid taxes in high tax burden areas.

✅ Guangdong, Hong Kong and Macau Personal Tax Allowance:

The part of personal tax exceeding 15% will be subsidized by the finance (exempted from personal tax) for overseas high-end/critical shortage talents working in 9 cities in the Greater Bay Area, including Guangzhou and Shenzhen.

Including Hong Kong permanent residents, those who have obtained their status through the Merit/Professional/Highly Qualified Persons Scheme.

✅ Other regional offers:

Shanghai Lingang new area similar to the policy of the Greater Bay Area, personal tax tax burden difference subsidy; Hainan Free Trade Port direct personal tax exemption over 15% part, without the need to "levy first and then make up".

If you have not yet applied for Hong Kong identity but have plans to do so, you can call or WeChat: 13045886252 to assess whether you can apply for the High Talent Pass Scheme/other talent policies ↓↓↓

04 Services offered by Enterprise Finance Group

Founded in 2015, Enterprise Caiying has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industrial, commercial, taxation and business services for enterprises and individuals, covering domestic and international industrial and commercial qualifications/tax and equity/overseas identity and asset allocation/cross-border e-commerce, and other core businesses.

Details of the services provided by the Enterprise Finance Group:

Enterprise Caiying Group Strength:

Core strengths of the Enterprise Caiying Group:

The company has nearly 400 employees, and the core team consists of senior lawyers, accountants, tax experts and business consultants. At present, Enterprise Caiying has set up branches in North, Guangzhou and Shenzhen, Hong Kong, Southeast Asia and the United States. So far, it has provided services for 300,000 SMEs and over 50,000 long-term cooperative customers. If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company / Hainan company and other domestic company registration related business services, but also to provide the United States company / Canadian company / Mexican company / Brazilian company / the United Kingdom company / French company / New Zealand company / Japanese company / / Singapore company / Thailand company / Vietnam company / Malaysia company and other foreign company registration related business finance and tax services. Registered related business tax services, company annual review / bookkeeping and tax / payment of MPF / change information / bank account / ODI record / cross-border e-commerce run on behalf of the operation of the enterprise one-stop services such as can look for enterprises CaiYing Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax consultant to communicate with you in detail ↓↓ ↓ ↓

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Cases of Hong Kong Company Incorporation

- Hong Kong Tax Advantages

- Register Hong Kong Company

- Hong Kong Company Registration

- Hong Kong Company Account Opening