The Enterprise Caiying Group provides Shenzhen Company/Guangzhou Company/Shanghai Company/Hangzhou Company/Beijing Company/Hangzhou Company.Hong Kong companyDomestic company registration and other related business services, but also to provide the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company / Vietnamese company / Malaysian company and other foreign company registration and related business services, there is a need or interested in dropping me at any time (phone and WeChat consulting: 13045886252 ).

With the deepening of economic globalization, global asset transparency, many mainland business owners will consider registering a company in Hong Kong to achieve the overseas business layout, but also want to get the Hong Kong tax resident status to reduce the tax burden, and the importance of the real operation of the Hong Kong company, not only about whether the business is smooth overseas, whether to comply with the Hong Kong low-tax policy to enjoy, but also about the Hong Kong status can be renewed, turn permanent residence

01 Real Customer Cases of Enterprise Caiying Group

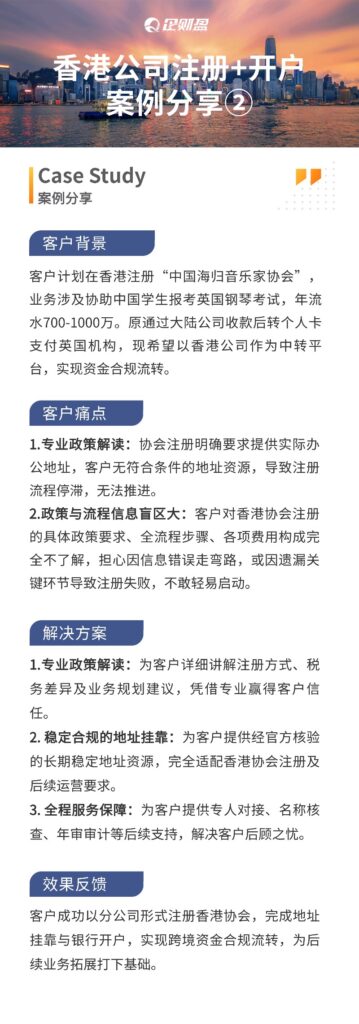

Today I would like to share with you a case of Hong Kong company registration and account opening of Enterprise Caiying Group. The customer plans to register "China Returned Musicians Association" in Hong Kong, the business involves assisting Chinese students to apply for the British piano examination, the annual flow of 7-10 million. Originally, the client received the money through a mainland company and transferred it to a personal card to pay the UK organization, but now he hopes to use a Hong Kong company as a transit platform to realize the flow of funds in compliance, and he needs the professional interpretation of the policy and the whole process of registration services from the enterprise service provider.

Solutions provided by the Enterprise Cai Ying team:

1) Professional policy interpretation:We explain in detail the registration methods, tax differences and business planning suggestions for our clients, and win their trust with our professionalism.

2) Stable and compliant address attachment:Provide customers with officially verified long-term stable address resources, fully adapted to the Hong Kong Association registration and subsequent operational requirements.

(3) Full service guarantee:We provide customers with specialized docking, name verification, annual audit and other follow-up support to solve customers' worries. Through the assistance of the Enterprise Caiying team, the customer not only registered the Hong Kong Association, completed the address attachment and bank account opening, realized the cross-border capital compliance flow, but also laid the foundation for the subsequent business development.

If you need to register a Shenzhen company/Guangzhou company/Shanghai company/Hangzhou company/Beijing company/Hong Kong companyDomestic company registration related business services, but also provides U.S. companies / Canadian companies / Mexican companies / British companies / New Zealand / Singapore companies / Vietnamese companies / Malaysian companies and other foreign companies registered in the relevant business services, the company's annual review / bookkeeping tax / payment of MPF / change of information / bank account / ODI filing / cross-border e-commerce run on behalf of the operation of the enterprise one-stop service, you can add me! WeChat (phone with V: 13045886252) at any time to consult ↓↓↓↓

02 What are the business advantages of Hong Kong as a transit point for offshore business?

Important representative of the Hong Kong Investment Promotion Agency, has elaborated on the advantages of doing business in Hong Kong at the meeting, encouraging mainland enterprises to make good use of the advantages of Hong Kong, make full use of Hong Kong as the first choice of platform for "going global", because Hong Kong's economic freedom is a global leader, the rule of law is excellent, the tax system is simple and competitive, for you to start to talk about Hong Kong's business environment, tax system advantages. We will give you an overview of the advantages of Hong Kong's business environment and tax system.

1) Tax Policy: Cost Advantage of Simple and Low Taxes Hong Kong's tax system is known for its simplicity, transparency and light tax burden, making it one of the most tax-friendly environments in the world.

✅ Tiered profits tax system: the tax rate for the first HK$2 million of corporate profits is only 8.25%, and for the portion exceeding HK$2 million, the tax rate is 16.5%. This is a clear advantage over the Mainland's flat corporate income tax rate of 25%.

✅ Offshore Exemption: If your profits come from overseas (e.g. sales on platforms such as Amazon, TikTok Shop, etc.), you can apply for an offshore exemption from Hong Kong profits tax!

✅ Fewer taxes: Hong Kong has no value-added tax, capital gains tax, dividend tax and inheritance tax, making the tax system simpler and clearer.

✅ Double Taxation Avoidance: Taking advantage of Hong Kong's network of tax treaties is also an important tool for tax optimization. To date, Hong Kong has signed DTAs with over 50 countries and territories.

(2) Free foreign exchange system: capital circulation facilitation Hong Kong, as one of the world's three major financial centers, there is no foreign exchange control, funds can be freely in and out of all parts of the world, for cross-border entrepreneurs, can significantly reduce the cost of capital circulation and exchange losses.

✅Multi-currency support: the account can directly receive foreign currencies such as USD, EUR, GBP, etc., and also have the flexibility to transfer money to global suppliers, or even convert into RMB to remit back to the mainland.

✅ Support multi-platform operation: a Hong Kong company can register multiple platforms (Amazon, eBay, Shopify, etc.), and the mainland body to isolate, reduce the risk of "associated with the seal", coupled with the independence of the Hong Kong director, address, more conducive to compliance management.

3) Operational Convenience: Logistics and Supply Chain Optimization Hong Kong is a globally important free trade port where most goods can enter and exit tariff-free, effectively saving logistics costs and time.

Zero tariff policy:Except for special commodities such as tobacco and alcohol, imported and exported goods are exempted from tariffs, reducing procurement and logistics costs.

Efficient customs clearance:As an international logistics hub, Hong Kong offers easy inbound and outbound cargo flow and shortens the lead time for stock preparation.

International Shipping Center:The port of Hong Kong is one of the busiest ports in the world, and top logistics companies such as DHL and FedEx provide fast and reliable international transportation services.

Great location:Proximity to the Mainland facilitates replenishment from Mainland factories while radiating to global markets (e.g. Southeast Asia, Europe and the United States).

Good storage facilities:Hong Kong has a mature warehousing infrastructure to support the flexible stocking needs of cross-border e-commerce.

(4) Policy Advantage: A number of entrepreneurial policies to support the Hong Kong government to encourage the development of specific industries, to provide R & D expenditures plus deduction, over the BUD special fund, the creation of enterprise tax exemption and other preferential.

✅ Company relocation system: allows overseas companies to directly relocate their place of incorporation to Hong Kong without changing their corporate identity or interrupting their business in order to enjoy the tax benefits and legal protection of Hong Kong, which saves both money and hassle.

✅ Introduction of key enterprises: The Hong Kong Government actively attracts mainland and overseas enterprises to settle in Hong Kong, provides investment and financing support and industrial resource matching, and helps them establish a foothold and further develop in Hong Kong.

✅ Entrepreneurship Support Program: To encourage the development of specific industries, the Hong Kong government provides concessions such as additional deduction for R&D expenditures, special fund for over BUD, and tax exemption for start-ups, etc. The 2025 Policy Address even directly announced 11 favorable measures to support small and medium enterprises (SMEs) to come to Hong Kong to start up their business.

(5) operating policy: simple company registration process Hong Kong company registration process is relatively simple, the registered legal person is not limited to the country, over 18 years of age can apply for registration, the registered capital is not high, only 10,000 Hong Kong dollars, and fewer documents and formalities required, the approval of the speed of fast, in general, within a few working days to complete the company registration, which allows companies to quickly carry out business.

03 How to achieve business overseas and tax compliance by registering a Hong Kong company

Hong Kong companies can directly with overseas customers for business negotiations and cooperation, for enterprise product development and market expansion to provide strong support, the following look at the Hong Kong company and real business how to build? Expand your business to Hong Kong, configure overseas assets through Hong Kong, first need to register a Hong Kong company, the following three steps to build a Hong Kong company and overseas business.

Step 1: Hong Kong Company Structure Setup

Before transferring the business, the enterprise should determine the appropriate company structure and complete the registration of Hong Kong companies. The requirements and process of registering a Hong Kong company are very simple, and it only takes 2-8 days to register. If you have already registered, you need to do a good job in the business registration, open a bank card, conduct an annual review on a regular basis, and do a good job in auditing and filing of tax returns, and other matters.

Obtaining Certificates: After successful registration, you will obtain a Certificate of Incorporation and a Business Registration Certificate. After obtaining the Business Registration Certificate, there is no need to submit a separate "Tax Registration Application" to the tax office. The "Business Registration Number" on the Business Registration Certificate will be synchronized as the company's tax ID number, and the tax office will automatically set up a tax file for the company, so that the company can directly file tax returns with this number. The tax file will be created for the company automatically by the tax office and the company will use this number to file tax returns directly.

Step 2: Make an ODI filing

When mainland enterprises go to Hong Kong to register a company, if the outbound capital is too large, usually should be ODI filing before registering a Hong Kong company, ODI filing process is as follows: the enterprise submits the filing application to the development and reform department of the location, and obtains the "notification of filing of overseas investment projects";

With the documentation of development and reform filing, submit the application to the commerce department to obtain the Certificate of Enterprise Overseas Investment; after completing the above two items, go to the bank to apply for foreign exchange registration and obtain the registration certificate of ODI business.

Step 3: Hong Kong companies need to be continuously compliant

After the registration of a Hong Kong company is completed, if you need to operate in the field, you need to open a bank account, conduct an annual review, audit and tax returns, recruit employees and pay MPF contributions.

Step 4: Building the commercial substance of the Hong Kong company

If you do cross-border e-commerce in Hong Kong, if you want to reasonably enjoy the tax advantages and some tax reduction policies, it is indispensable to tax resident assessment, and enterprises applying for a certificate of Hong Kong tax residency must be required to prove that the company operates substantially in Hong Kong, generally from the judgment of whether or not there is a real business activity, substantial office space, recruitment of local employees in Hong Kong and the payment of MPF contributions, and to make a tax declaration (profits tax, salaries tax), and so on. The company must be able to prove that it has substantial business activities in Hong Kong.

Hong Kong is an important bridge between the Mainland and the international market. Through a compliant structure, reasonable tax planning and sound capital management, Mainland enterprises can not only successfully transfer their business to Hong Kong, but also take this opportunity to move to a broader international market.

And through the opening of a Hong Kong company to do business, can assist in the renewal of Hong Kong status, high flexibility can not be subject to the limitations of the duration of the employer's contract, can fully control the company's operations, can be used to open up / take into account the business of the Mainland to stay in the Mainland on the grounds that do not need to be in Hong Kong for a long period of time, but also to provide a reasonable explanation.

If you have not yet applied for Hong Kong identity but have plans to do so, you can call or WeChat: 13045886252 to assess whether you can apply for the High Talent Pass Scheme/other talent policies ↓↓↓

04 Services offered by Enterprise Finance Group

Founded in 2015, Enterprise Caiying has always been adhering to the mission of "empowering every entrepreneurial dream", focusing on providing one-stop globalized industrial, commercial, taxation and business services for enterprises and individuals, covering domestic and international industrial and commercial qualifications/tax and equity/overseas identity and asset allocation/cross-border e-commerce, and other core businesses.

Details of the services provided by the Enterprise Finance Group:

Enterprise Caiying Group Strength:

Core strengths of the Enterprise Caiying Group:

The company has nearly 400 employees, and the core team consists of senior lawyers, accountants, tax experts and business consultants. At present, Enterprise Caiying has set up branches in North, Guangzhou and Shenzhen, Hong Kong, Southeast Asia and the United States. So far, it has provided services for 300,000 small and medium-sized enterprises, with more than 50,000 long-term cooperative customers.

If you plan to register Shenzhen company / Guangzhou company / Shanghai company / Hangzhou company / Beijing company / Hong Kong company and other domestic company registration related business services, also provides the United States company / Canadian company / Mexican company / British company / New Zealand / Singapore company / Vietnam company / Malaysian company and other foreign company registration related business services, the company's annual review / bookkeeping and tax returns / payment of mandatory contributions / change of Information / bank account / ODI filing / cross-border e-commerce accompanied by running on behalf of the operation of the enterprise one-stop service, etc. can be found in the enterprise Caiying Group for, welcome to consult me (WeChat with the same number: 13045886252), or [Scan the following two-dimensional code] to match your needs, there will be a professional tax adviser to communicate with you in detail ↓↓↓↓

statement denying or limiting responsibility

Image source: some of the image material in this article from the network, such as copyright issues, please contact us to replace the deletion of processing.

Information reference: The content of this article is synthesized from the internal materials of Enterprise Caiying and relevant public network information.

Content Editor: This article was edited and designed by the Operations Department of the Enterprise Caiying Group.

Warm reminder: The relevant policies, conditions, time limits, fees and other information described in this article may be subject to dynamic adjustments, please refer to the latest official announcements or the actual application of the specific circumstances prevail.

- Hong Kong Company Registration Cases

- Hong Kong Compliance Goes Overseas

- Hong Kong Identity

- Hong Kong Bank Account Opening

- Hong Kong Company Registration