On January 1, 2026, the Value-added Tax Law of the People's Republic of China (VAT Law) will be formally implemented, which is a key step for China's value-added tax (VAT) system to move from a "temporary regulation" to a "national law". The new law not only unifies the taxation logic and simplifies the tax items, but also optimizes the tax treatment and cash flow management of enterprises in many aspects.

.

For enterprises, this is both a compliance challenge and an opportunity to optimize tax burden and enhance management efficiency. This article dismantles the core changes of the new policy to help you accurately grasp the direction of the policy and prepare for the response in advance.

.

New VAT Act 2026, what's changed

This adjustment to the VAT law has simplified, optimized and clarified the system in a number of key areas, and the core changes can be summarized as follows:

.

Simplification: formalization of "labour" into "services"

The former "processing, repair and fabrication services" tax item was abolished and unified into "sales services". Since then, taxable transactions have been consolidated into four clear categories: sales of goods, services, intangible assets and real estate. Enterprises are required to synchronize their contracts, invoices and declarations to use the new tax classification codes.

.

Significant reduction in the scope of deemed sales, with emphasis on "material transfers"

This is one of the most direct benefits to business.

Complexity of the old rules: The original regulations provided for as many as eight cases of deemed sales, covering a wide range of behaviors such as sales on behalf of the sales, transfer of goods from one place to another, and provision of services without compensation.

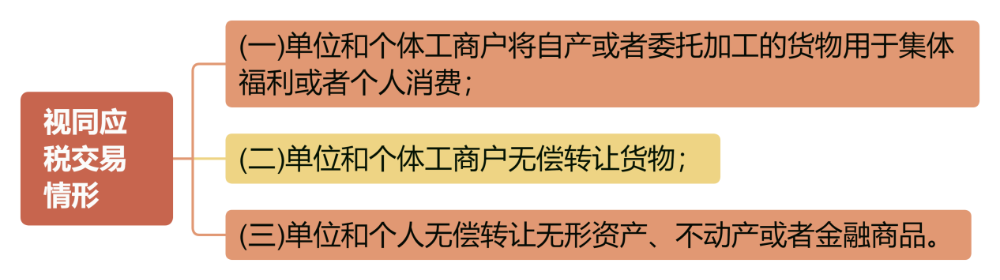

The new law is simplified: it is drastically reduced to a core of 3, focusing mainly on the transfer of ownership or use rights without compensation:

Use of self-produced or commissioned goods for collective welfare or personal consumption;

Transfer of goods without compensation;

Transfer of intangible assets, real estate or financial instruments without compensation.

Important Signal: This means that common behaviors such as transferring goods (without transferring ownership) between subsidiaries within a group, and services provided by enterprises to the society or customers without compensation, will no longer be taxed as sales. This change directly reduces the tax complexity and cost of internal management.

.

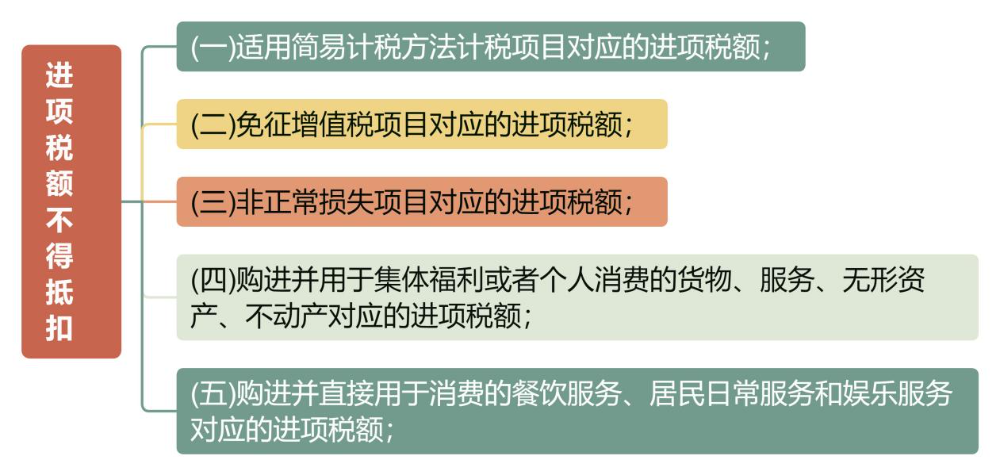

Optimization of the scope of input credits, pointing to "production and business use"

Delete the restriction of "no deduction for loan services" and retain only three non-deductible items, namely, food and beverage, daily residential services, and entertainment services.

This sends a positive signal: such expenditures related to the production and operation of enterprises (e.g., catering for meetings, meal subsidies for overtime work of employees, entertainment services purchased for promotional activities, etc.) are expected to be included in the scope of input tax deduction in the future. Although the specific details are yet to be clarified, the direction is aimed at reducing the actual operating costs of enterprises.

.

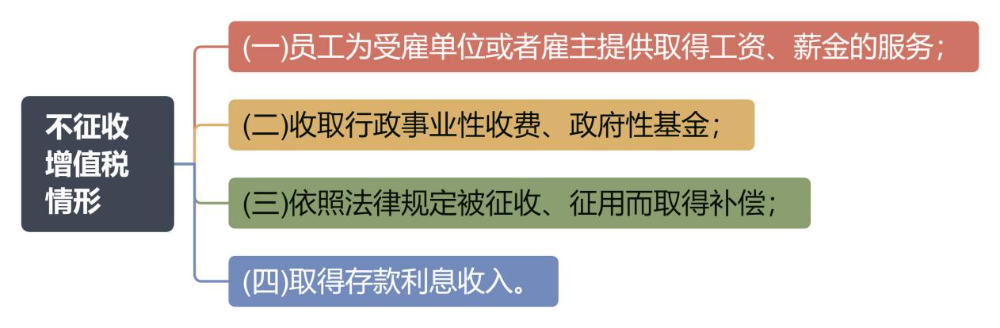

New non-taxable items

Clarify that compensation received for expropriation and services provided by employees to their employers are not taxable.

.

Harmonization of cross-border taxable rules, following the "place of consumption principle"

For cross-border service and intangible asset transactions, the criteria for determining whether tax should be paid in China have been harmonized into a clear "place of consumption principle": as long as the service or intangible asset is consumed within the country, it is a domestic taxable transaction. Enterprises (especially the receiving party) need to strengthen their internal chain of evidence management to prove that the actual place of consumption is outside China to avoid tax risks.

.

New anti-avoidance provisions

New anti-avoidance provisions have been added to the Regulations, of which Article 53 stipulates that if a taxpayer reduces, exempts or postpones the payment of VAT, or refunds the tax in advance, or refunds the tax in excess of the amount due, by implementing an arrangement that does not have a reasonable commercial purpose, the tax authorities may make adjustments in accordance with the relevant provisions.

.

This provision extends the scope of anti-avoidance regulation and demonstrates the importance that regulators place on VAT compliance. With the official implementation of the VAT Law, the Ministry of Finance and the State Administration of Taxation (SAT) have begun to improve the supporting systems, including the formulation of specific operational methods for input tax credits for long-term assets, tax prepayment, and export tax refunds (exemptions). The tax information system will also be upgraded accordingly, providing service channels such as policy guidance, convenient declaration and intelligent calibration. For enterprises, this VAT change has just begun, and every step of future adjustment may affect the final performance of the income statement.

.

What are the practical implications of these changes for businesses?

On the plus side:

Reduction of deemed sales: intra-group transfers and gratuitous provision of services are no longer regarded as sales, which simplifies the process and saves tax.

Deductions may be more flexible: inputs such as catering and conference refreshment breaks related to production and operation are expected to be deducted, directly reducing costs.

Mixed sales are more liberal: companies can rationalize the application of lower tax rates through contract design.

Aspects to focus on:

Adjustment of tax-exempted items: For example, the tax exemption for "contraceptive drugs and appliances" has been abolished, and the relevant enterprises need to re-calculate their tax burden.

Stricter cross-border services: Under the place-of-consumption principle, companies need to strengthen data management for cross-border transactions.

The levy rate may be harmonized: 5% levy rate business may be phased out, and related industries need to pay attention to the subsequent policy.

.

Overall, the new law has released dividends in terms of simplifying tax treatment and reducing tax costs, while also putting forward more refined requirements for compliance management of enterprises.

.

What should transitioning companies be aware of?

1. Overhaul of contracts and business models

Revisit existing contracts, especially clauses on mixed sales, cross-border services, and connected transactions, to ensure compliance with the application of the new tax brackets and rates after 2026.

2. Conducting tax health checks and gap analysis

Check tax exemption items, deemed sales, input credits and other matters item by item against the new law to identify risks and room for optimization.

3. Upgrade of the financial and invoicing system

Adapt to the all-electric invoice rollout and new tax codes to ensure the system supports invoicing, reporting and credit processing under the new regulations.

4. Strengthening internal training and external communication

Training on the new tax law for financial and business personnel, while maintaining communication with tax authorities and partners to clarify the caliber of implementation.

.

What can Enterprise Cai Ying offer you?

In the face of the major adjustment of the VAT law, Enterprise Caiying provides the following support to enterprises relying on the ability of "tax experts + system support + full-process service":

Training on the new tax law and health checkups

A team of senior tax experts will interpret the key points of the new law for enterprises, carry out tax risk assessment and compliance diagnosis, and provide customized optimization suggestions.

Contract review and business model optimization

Assisting enterprises in sorting out business contracts, rationally planning transaction structures, and optimizing the application of tax liabilities under the premise of compliance.

System upgrades and all-electric invoice adaptation

Provide financial system upgrade support to help enterprises smoothly dock with the all-electric invoice platform and realize a smooth transition to "tax by numbers".

Cross-border tax compliance support

Provide tax declaration, information filing and compliance management services under the place of consumption principle for cross-border e-commerce and cross-border service enterprises.

Long-term tax planning and advisory services

Accompanying the growth of enterprises, we provide ongoing tax consulting, filing assistance, policy tracking and response strategies.

.

In the era of new tax law, compliance is the bottom line and optimization is the competitiveness. Enterprise Caiying is willing to be your tax compliance partner, helping enterprises to cope with changes and grasp development opportunities.

For new tax law interpretation, tax health check or system upgrade support, please feel free to contact us for exclusive service solutions!