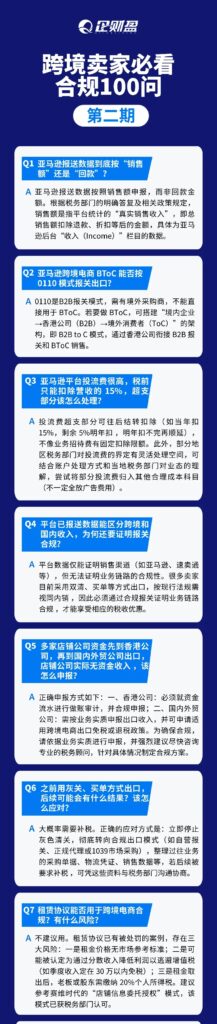

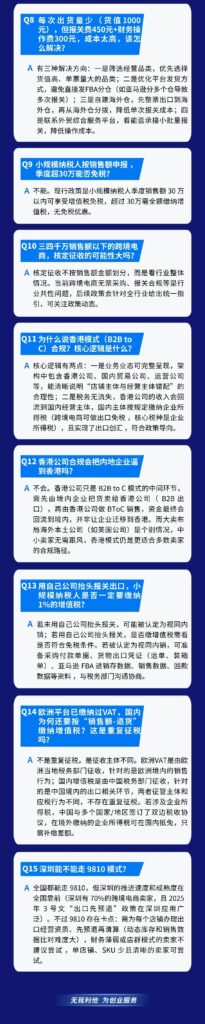

2025 cross-border e-commerce compliance regulation continues to deepen, the tax bureau data comparison, platform audit efforts to double upgrade, theFiling caliber, customs declaration mode, financial flow complianceProblems such as buried in the seller's side of the "invisible minefield". Many sellers have received tax warnings due to "gray customs export" and "data declaration errors", but do not know where to rectify the situation.

The Enterprise Cai Ying GroupAfter the first issue of [100 questions on cross-border e-commerce compliance]Push again.Issue 2: Does Amazon Report Data by "Sales" or "Returns"?It covers core pain points such as Amazon data declaration, customs declaration mode selection, tax deduction, Hong Kong structure, etc., helping you accurately avoid pitfalls and clarify the path of compliance!

Cross-border e-commerce compliance has changed from "optional" to "mandatory", and every fuzzy area may become a breakthrough for auditing. Sellers are advised to check themselves against each of the 15 questions in this issue, and if they are still confused about the details, they can pay attention to the follow-up of the Enterprise Caiying "Compliance 100 Questions" Series!