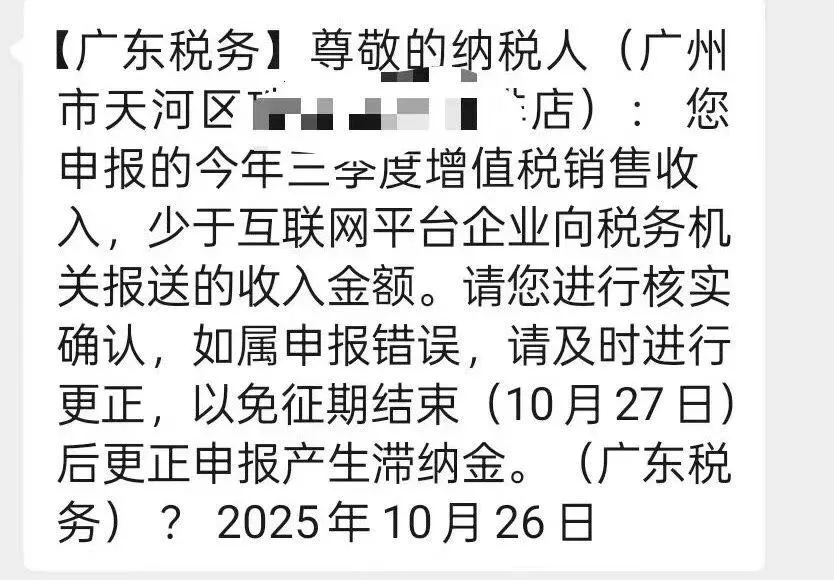

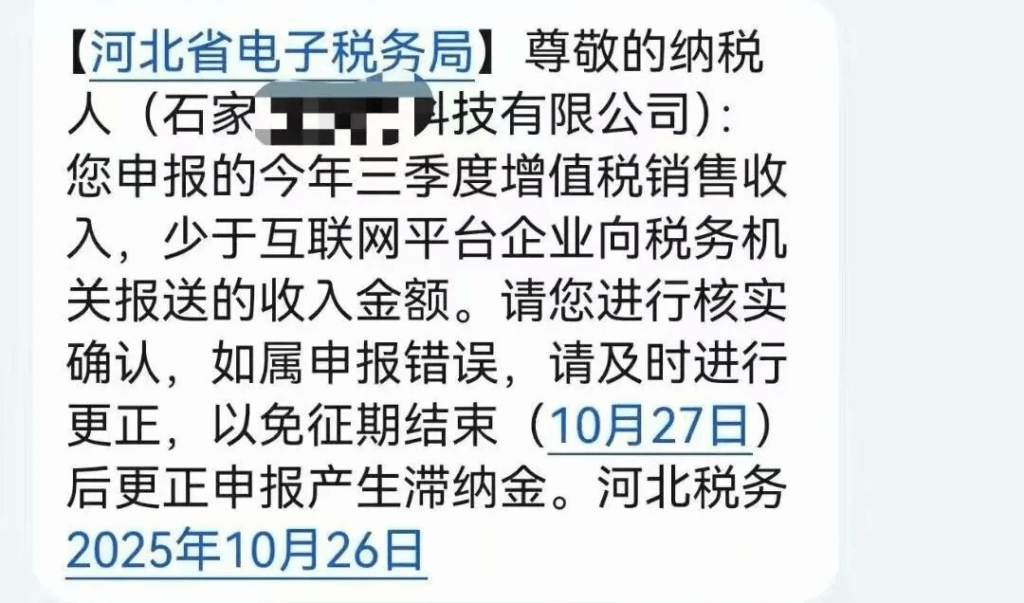

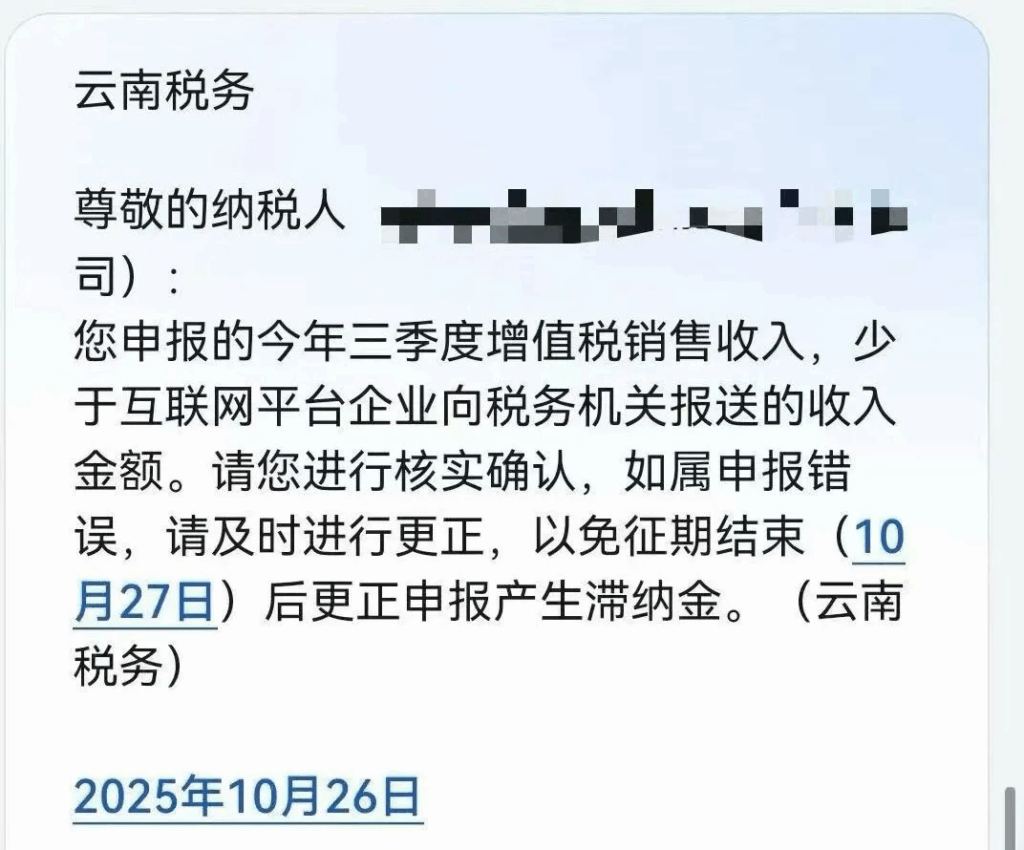

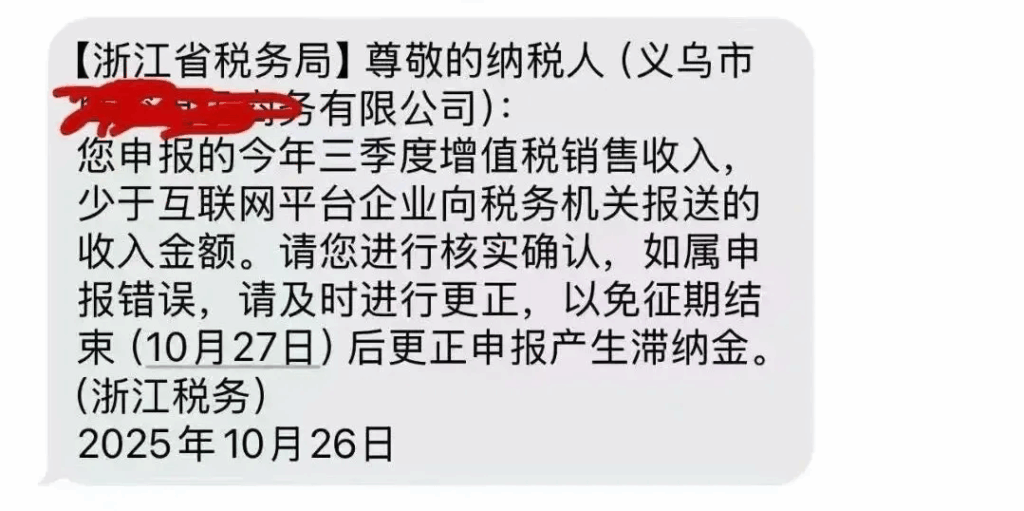

Overnight, the entire e-commerce circle could not sleep! Countless sellers received a [income declaration discrepancy reminder] text message from their local tax office.

Screenshot of some of the text messages (image from the internet)

The text message instantly blew up in seller circles. Back taxes? Fines? Even close the store? All kinds of speculation and panic spread. This is not a "sudden attack" by the tax bureau, but a clear signal: the era of full compliance with e-commerce tax has officially arrived. In the past, the kind of personal bank card receipts, do not keep accounts without tax reporting business model, no longer work.

Why do I get a reminder about "declaration discrepancies"?

Why can the tax office find you so accurately? It all comes from the power of the national "Golden Tax IV" system. Based on the current trend of tax supervision, we have analyzed two core reasons:

Big Data Comparison: "Rule by Numbers" makes income invisible

The core of the "Golden Tax IV" system is "data communication". The Tax Bureau has established data sharing channels with major e-commerce platforms, and every transaction record and every traffic data on the platforms are under the monitoring of the Tax Bureau.

When you declare your income to the tax bureau, and the platform feedback water data there are significant differences, the system will automatically trigger a warning, generate this "declaration does not match" SMS. This is no longer a "spot check", but a comprehensive "system comparison".

Common Filing Mistakes: Sellers' Own "Mines"

Many sellers, especially small and medium-sized sellers and individual sellers, commonly have the following misconceptions when filing, leading to discrepancies:

Misuse of filing policies: Many individual sellers equate the platform income with "remuneration for labor" declaration, but in fact, the continuous, for the purpose of operating the online store income should belong to the "business income", according to the status of the individual industrial and commercial enterprises need to declare tax.

Hiding platform revenue: Only part of the revenue from the platform was declared, or only the revenue from the public accounts was declared, while a large number of goods collected through WeChat and Alipay personal codes were hidden and not reported.

Incorrect filing base: Simply declare the profit after "income - costs", but the correct approach is to first declare the "turnover (gross income)", with costs and expenses as deductions.

What if the seller receives a text message?

Panic and avoidance won't solve the problem; responding correctly is the key. Enterprise Finance recommends that you take the following three steps immediately:

Step 1: Stay calm and self-correct in the first instance (immediate action)

Verify the authenticity of text messages: Firstly, log in the official platform of the e-Taxation Bureau and check whether there is any official notification in the module of "Message Center" or "Tax-related Reminder", and do not click on the links in the SMS directly to avoid fraud.

Reconciliation of data discrepancies: Carefully compare the total amount of income you have declared with the amount of orders and actual receipts in the back office of the e-commerce platform to calculate the exact amount of the difference.

Step 2: Differentiate the situation and seek professional solutions (core key)

Depending on the type of business entity, you will need to choose the most appropriate compliance path:

If you are self-employed or a sole trader:

Check the authorized collection policy: Confirm that the approved levy rate you are entitled to is accurate and that the gross income is declared accordingly.

Establishment of standardized books of accounts: Setting up books of accounts in accordance with regulations and accurately accounting for revenue, costs and profits are the basis of compliance.

If you are an individual seller (no business license):

Immediate registration of market entities:This is the most fundamental solution. You need to register as a sole trader or LLC as soon as possible to transform your personal behavior into a legal business.

Re-open or change as a market entity: Re-contract with the e-commerce platform with a newly registered business license, or change your store's business entity to ensure that the subsequent flow of income is standardized.

Step 3: Use the profession to solve the worries completely (long-term plan)

E-commerce finance and tax is highly specialized, and handling it on your own with a little carelessness may leave hidden dangers. It is the most efficient and safest choice to leave professional things to professionals. Enterprise Caiying's "E-commerce Tax Compliance Solution" is here to protect you:

Accurate diagnosis:Our team of experts helps you analyze the causes of income discrepancies and assess potential risks.

Masterplanning:According to the scale of your business, we will plan the most suitable market entity (self-employed/company) for you and handle the whole registration process on your behalf.

Acting bookkeeper:We provide you with professional bookkeeping and tax preparation services to ensure the accuracy of data and keep away from the risk of filing.

Tax Planning:Tax planning for your legal compliance and tax incentives, subject to compliance.