In 2023, Vietnam attracted foreign direct investment (FDI) totaling about $28 billion, up 13.51 TP3T year-on-year. a total of 62 countries and territories have invested in VietnamThe

Among them, Singapore topped the list, with a total investment of more than 2.55 billion U.S. dollars, a year-on-year increase of 51.3%; Hong Kong, China, ranked second, with an investment of nearly 1.05 billion U.S. dollars, higher than the same period last year, nearly 2.3 times; followed by Japan, mainland China, etc.

In recent years, Vietnam's political stability and rapid economic development, the government's active investment attraction, attracting more and more enterprises to invest in Vietnam!

If you are interested in investing in Vietnam, you should not miss this investment guide! In this article, you will learn more about the requirements for investing in Vietnam, especially the essential ODI (Outward Foreign Direct Investment) filing.

.

01 How is the corporate structure set up for domestic enterprises wanting to invest in Vietnam?

The average company often faces two paths when choosing an offshore investment path:

The first route is for domestic companies to invest directly in Vietnam, i.e. direct investment;

The second way is to use Singapore or Hong Kong as an intermediary layer to set up a Singaporean or Hong Kong company, and then invest in Vietnam through the Singaporean or Hong Kong company, i.e. set up a structure to invest.

So what is the difference between direct investment and structured investment? What are the advantages of structuring intermediate Singapore and Hong Kong companies?

1. Singapore Advantage:

(1) Singapore is one of the world's largest entrepot ports;

(2) A favorable geographical advantage and a stable political situation, which is conducive to investors opening up the Asian market and establishing a business network in Southeast Asia;

(3) Having favorable tax policies;

(4) Easy registration procedure.

(5)Singaporean companies rank first in terms of the number of foreign enterprises investing in Vietnam.

2. Hong Kong Advantage:

(1) Hong Kong is a financial center and free port in Asia;

(2) As a special administrative region of China, Hong Kong has privileged treatment under the CEPA reciprocal agreement with the Mainland of China;

(3) Simple and inexpensive company registration procedures; freedom of name;

(4) Freedom to receive and pay for foreign exchange without being subject to exchange controls;

(5) Hong Kong tax concessions, legal tax avoidance, reduce financial and tax burden;

(6) No need for capital verification, virtual registered capital;

Compared with direct investment, structuring investment can make use of the tax policies and bilateral and multilateral agreements of various countries to obtain greater tax benefits and greatly reduce investment costs, and at the same time, it can also reduce the impact of domestic corporate litigation on overseas capital pools, and it can also be more convenient for overseas reinvestment, which is conducive to the globalization of the enterprises going out to the global layout, and structuring investment is undoubtedly a more advantageous investment path.

The choice of Singapore or Hong Kong as the middle layer of the structure, in fact, each has its own advantages, Hong Kong's geographical advantage determines the domestic enterprises in Hong Kong company registration is more simple and convenient, to enjoy the privileges of the treatment is also more.

Singapore, as the leading country in Southeast Asia, is a crucial springboard for enterprises to layout Southeast Asia. Enterprises choosing to structure the middle tier should give more consideration to the strategy and direction of their future globalization layout, and choose the middle tier countries that are more suitable for their development.

.

02 How do foreign businesses invest in Vietnam?

Foreign investors can generally invest in Vietnam through the following four pathways:

- Establishment of new investment entities in Vietnam

- Acquisition of equity interest in existing Vietnamese companies

- Acquisition of assets of existing Vietnamese companies

- Signing of business cooperation contracts

When foreign investors carry out investment activities in Vietnam in the form of equity mergers and acquisitions, they need to follow the requirements and procedures for equity mergers and acquisitions as stipulated in the laws of Vietnam on investment, enterprise and competition, etc., whereas our domestic enterprises investing abroad.ODI filing is required whenever it involves the direct or indirect acquisition of the ownership, control, or operation of a foreign company.Otherwise, corporate funds cannot exit the country in a compliant manner and profits cannot flow into the country.

ODI Offshore Investment Application Requirements:

1. Meets the definition of "offshore investment":The act of a domestic enterprise owning a non-financial enterprise or acquiring ownership, control, management and other interests in a non-financial enterprise abroad through new establishment, merger and acquisition and other means.

2. Subject and time of establishment requirements:The subject needs to be an enterprise established in accordance with the law within the territory of China. However, enterprises that have been established for less than one year and are unable to provide complete audited financial statements are generally unable to pass the approval or filing with the approval authorities.

3. Shareholder background, source of funds, investment authenticity requirements:Those who are unable to specify the background of domestic shareholders or partners, the source of funds (e.g., own funds, bank loans, funds obtained in a compliant manner such as fund-raising, etc.), and the authenticity of the offshore investment project can hardly pass the examination.

4. Financial requirements:Audit reports issued by independent third-party accounting firms for the most recent year must not show a loss; return on net assets should preferably be higher than 5%, while gearing should preferably be lower than 70%.

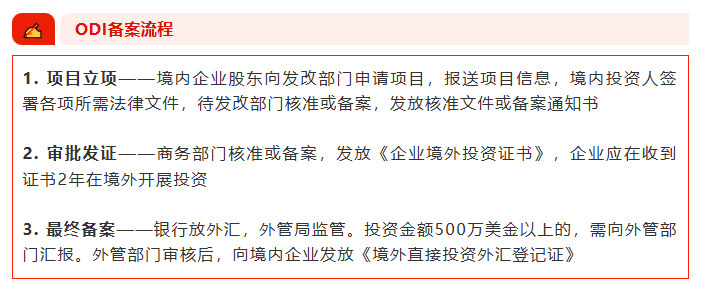

Application process for ODI offshore investments:

The whole process will take 2-3 months, involving complicated documents and processes, if there is no professional guidance to follow up, it is very time-consuming and laborious, and it is likely that due to the information involved in the submission of documents is not compliant, the industry involved in the more sensitive reasons can not pass the audit.

.

03 Vietnam Company Registration Requirements

1. Confirmation of industry and foreign ownership limits

Vietnam allows 100% foreign ownership in most industries. For example, trade, IT, manufacturing, education and other industries.

However, some industries such as telecommunications, advertising, video games, transportation and customs clearance, entertainment, and tourism need Vietnamese joint venture partners.

Foreign Ownership Regulations in Vietnam: In Vietnam, the World Trade Organization (WTO) agreements regulate the foreign ownership limits allowed in different industries. If there is no WTO agreement or local law regulating the foreign ownership limits for the industry, you will need to obtain Vietnamese ministerial approval to set up a company.

2. Minimum registered capital

Generally, there is no minimum capital requirement for registering a Vietnamese business. However, the registered capital should match the industry in which it is engaged. It is usually up to the Ministry of Planning and Investment of Vietnam to approve whether the minimum registered capital meets the actual needs.

As a rule of thumb, the minimum registered capital for the establishment of a service company is approximately US$3,000. For manufacturing industries, the registered capital should be at least sufficient to purchase equipment for production.

3、Enterprise registered address

Typically, businesses focusing on services can register using a virtual office. Businesses that require a physical location to carry out their activities, such as retail or factories, need to have a physical location or address in Vietnam.

4. Resident Director

All companies in Vietnam require at least one resident director. This director can be a foreigner and he/she does not need to have residency status at the time of company incorporation, but they need to have a residential address in Vietnam.

Do not only see the favorable side of the sea investment, many things need to pay attention to, such as taxes, factory location, local laws and other issues need to be clearly understood, so that investors can be more conducive to a firm footing in Vietnam.

.

04 Documents required for registering a company in Vietnam

- English name

- registered address

- scope of business

- Registered capital (capitalization within 90 days of obtaining certificate of incorporation)

- List of directors (no statelessness restriction, expatriates need to obtain local work permit and temporary residence permit)

- List of shareholders, amount of shares and financial proof of shareholders (at least 1 shareholder, no upper limit on the amount of shares)

- List of legal persons (1 is sufficient)

- Scanned passports of all shareholders, directors and legal persons (if the shareholder is a company, please provide the certificate of incorporation).

- Shareholders' identity and financial certificates must be notarized in China and certified by Vietnam's embassy or consulate in China.

.

05 Detailed process of registering a company in Vietnam

1. Selection of company type and name

- Choose the right type of company, such as limited liability company, joint stock company, etc., based on business needs and planning.

- Drawing up the company name and pre-approving the name with the relevant Vietnamese authorities to ensure the uniqueness and compliance of the name.

2. Preparation of registration documents

- Articles of Incorporation: including basic information of the company, shareholder structure, business scope, registered capital, etc.

- Proof of identity of shareholders and directors, copies of passports, proof of address, etc.

- Contract or proof of ownership of leased office space.

- Other documents that may be required, such as a power of attorney.

3. Application for investment registration certificate (IRC)

In the case of foreign investors, an application for an investment project needs to be submitted to the Planning and Investment Department to obtain an investment registration certificate.

4. Application for an Enterprise Registration Certificate (ERC)

Submit the registration application and related documents to the local business registration authority.

After passing the audit, you will receive your business registration certificate.

5. Official seal engraving

Go to the designated seal-engraving organization to engrave the company's official seal with the enterprise registration certificate.

6. Tax registration

Apply for tax registration with the local tax authorities within 10 working days after obtaining the business registration certificate.

7. Bank account opening

Bring the relevant documents to the bank to open a company account.

8. Social security registration (if any employees)

If the company has hired employees, it needs to register with the local social security agency for social security

If you are still not clear about how the company structure should be set up, you can contact our online customer service, senior consultants to arrange a one-on-one detailed answer ↓↓↓

- Vietnam

- Vietnam Company Registration Process

- Advantages of Vietnam Company

- Foreign trade