With the integration of the global economy and the rise of the Southeast Asian market, more and more entrepreneurs are choosing to expand their business to Thailand. As one of the economies in Southeast Asia, Thailand has good market potential and a convenient business environment with low labor and tax costs. This, coupled with Thailand's strategic position in the Asian economy, has led to many well-known and large companies choosing to set up branches in Thailand to capture the market.

Registering a Thai company is a key step in entering the country's market.

01Chinese 100% shareholding registered Thailand company

To register and own a 100% foreign-owned Thai company in Thailand, there are 3 ways to do so

✅ First method: applicationBOIaccreditation

The Board of Investment (BOI) is the Thai government organization responsible for formulating investment incentives and benefits and providing assistance services to investors. Companies that meet the requirements can apply for BOI company certification, which allows them to enjoy a variety of benefits, including allowing 100% foreign ownership. After getting the BOI certification, you can realize a company with full foreign ownership.

application (form etc)BOIThe advantages of certification:

1. Allow foreign 100% shareholding

2. Corporate income tax exemption, import duty exemption for machinery and raw materials, value-added tax (VAT) refund for exported products, tax credit for R&D expenses

3. Allow foreigners to purchase land and hold land and real estate

4. Family members of foreign technicians are allowed to reside and enter the country, and visas and work permits can be obtained for all their family members.

5. Part of the industry enjoys free remittance of currency exchange income and free remittance of foreign currencies.

6. The ratio of Thai and foreign employees employed by Thai companies is 4:1, in contrast to BOI-approved companies, which have no restrictions on the ratio of foreign employees to Thai employees.

✅ Second method: applicationFBLaccreditation

FBL stands for Foreign Business License in Thailand. This method requires an application for a Foreign Business License FBL under the Foreign Business Act and meeting the appropriate capital requirements. It is important to note that not all industries allow 100% foreign ownership. In certain restricted industries, co-investment with a local Thai partner is still required.

application (form etc)FBLThe advantages of certification:

1. Allow foreign 100% shareholding

2. Shareholdings in industries that do not allow 100% shareholdings can also exceed 50%

3、Simple application process and shorter time period compared to BOI

✅ Third method: high registered capitalization

Enterprises can achieve 100% foreign ownership in permitted industries by means of high registered capital. The registered capital needs to be 100 million baht. This method is usually applied to specific industries or large-scale projects.

Application:

Large enterprises with strong capital: suitable for enterprises with large-scale investment and operational needs.

Industry-specific or large-scale projects: e.g., infrastructure development, large-scale manufacturing projects, etc.

02 Registration conditions for setting up a Thai company

There are three general forms of company formation in Thailand, which are:partnerships, limited companies and other types of companies.At present, Chinese enterprises choose to register a private limited company (similar to China's limited liability company) under the classification of limited liability company, the following mainly introduces the relevant requirements for the registration of limited liability company, as well as the information and the registration process~

1. Shareholders:The company must have at least 2 natural persons as promoters and each promoter must have at least 1 share.

2. Directors:At least 1 director is required.

3. Scope of business:No requirements.However, joint ventures (for restricted industries) must be majority-owned by Thais with a share of 51%.

4. Business address:A local business registration address in Thailand is required.

5. Registered capital:Thailand's incorporation law provides for registered capital1 million bahtIt can be registered, and the amount of foreign direct investment should not be less than2 million baht. However, the final registered capital needs to be confirmed according to the actual operation of the company's registered capital.25% of the registered capital is required to be deposited into the company's account within 15 days of incorporation, and the remaining 75% within 3 years of incorporation.

03 Process of Registering a Thai Company

1. Choose the type of Thai company:To register a company in Thailand, you need to choose the type of company based on your business needs and development plans.

2. Company name verification:Applicants are required to provide 3 English company names, which will be transliterated into Thai, and submit them to the Business Development Office (BDO), which will verify the meaning of the Thai characters and whether there are any duplications in the company names, and then wait for a reply on the results of the review.

3. Design official seal:After designing and producing the company seal, the seal will be registered at the same time when submitting the company registration documents to the Office of Business Development, and the seal cannot be altered or replaced at will after the filing, and if it is to be altered, it must be registered and applied for filing with the Office of Business Development again.

4. Drafting of registration documents and submission of documents:Prepare the relevant documents for company registration, signed by directors and shareholders, and submit them to the Department of Business Development (DBD) for registration. The documents include the business scope of the company, minutes of the company's founding meeting, and the distribution of shareholders. Usually, a business license can be obtained after the documents are accepted.

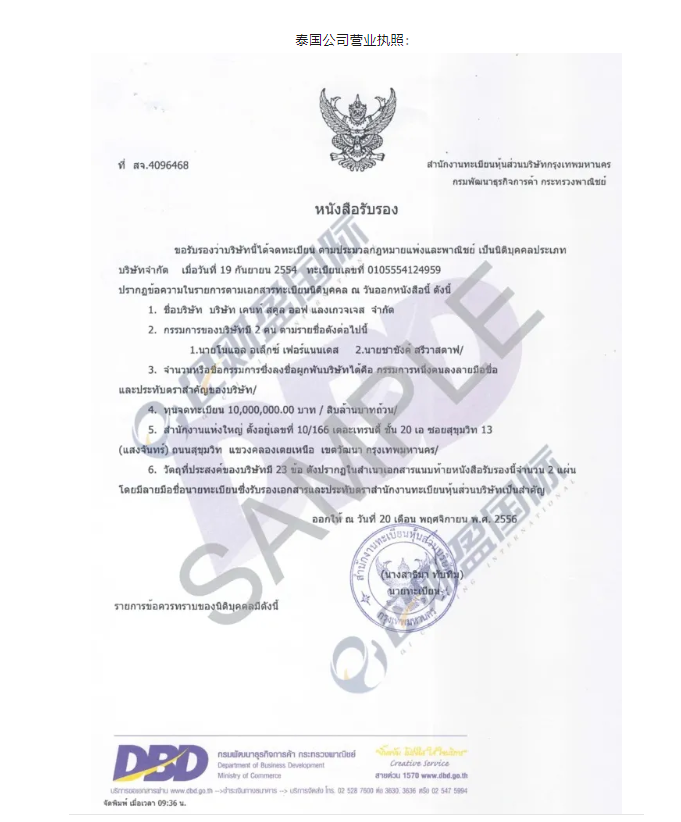

5. Obtain a certificate of registration from Thailand:Once the application for registration is approved, you will receive a Certificate of Registration from the Commercial Registration Office of Thailand, which is an important document for conducting business.

6. Open a bank account:Immediately after incorporation, you can go to the bank to open a company account. When opening a bank account, a director must go to the bank for a face-to-face interview. After the bank accepts the information, the savings account is usually opened on the same day, and internet banking takes 7-20 working days.

7. Tax registration:The Revenue Authority of Thailand (RAT) requires all business activities subject to corporate income tax to apply for a tax registration certificate at the RAT within 60 days of the date of establishment or registration.

04 Common Tax Rates Taxes in Thailand

Value Added Tax (VAT)

The tax rate is7%. AnyIndividuals or organizations with an annual turnover of more than 1.8 million baht(math.) genusSale of goods or provision of services in ThailandAll are subject to VAT in Thailand.

⏰ Tax time:Complete paper filing by the 15th of the month or online filing by the 23rd.

Zero tax rate applies in the following cases:

✔ Selling goods outside the country;

✔ Provision of labor in Thailand for use outside the country (including some or all of it);

✔ Shipping or maritime transport for international transportation;

✔ Sales of goods or provision of services between bonded warehouses, between enterprises in bonded zones, or between bonded warehouses and bonded enterprises;

✔ Sales of goods or services to a government agent or a state enterprise under a foreign subsidy program;

✔ Sales of goods or provision of services to the United Nations or agents of the United Nations Organization, including embassies and consulates;

The Thai government also offers VAT incentives for certain industries, such as tourism and manufacturing. Certain industries or goods may benefit from tax reductions or exemptions, such as in the areas of agricultural products, medical services and education.

corporate income tax

Thailand's tax law provides thatThai or foreign companies with business activities in ThailandAll are subject to corporate income tax. Thailand's corporate income tax is filed twice a year.

✔ No tax on income of 0-300,000 baht.

✔ Income of 300,000-3 million baht pay tax 15%.

✔ Pay tax 20% on income of 3 million baht or more.

⏰ Tax time:Income tax of 50% needs to be estimated and paid by the end of August each year, and the annual summary return needs to be filed within 150 days of the end of the year, with mid-year payments credited against the tax due on the annual return.

withholding tax

Thailand has a withholding tax on financial products and services as well as on export trade.

Withholding tax on transactions between Thai companies and offshore companies Referring to Thailand's tax agreements with various countries, most of them areDividend 10%, Interest 10%- 15%The

⏰ Tax time:Withholding tax needs to be filed every month by the 7th (offline filing) / 15th (online filing) of the following month.

Company incorporation is only the first step to complete the investment in Thailand, the follow-up on the day-to-day operation, annual audit, tax and other issues, for more information, please feel free to contact the Enterprise Caiying online customer service!

- Starting a company in Thailand

- Thailand Company Registration

- Thailand

- Southeast Asia